Performance

|

Net Returns as of September 30, 2024 |

|||||||

|

Current Quarter |

Year to Date |

One Year |

Three Year |

Five Year |

Ten Year |

Since Inception |

|

|

Institutional Shares (RLSIX) |

0.66% |

11.25% |

28.77% |

-11.15% |

3.98% |

5.11% |

6.12% |

|

Retail Shares (RLSFX) |

0.60% |

11.12% |

28.50% |

-11.30% |

3.77% |

4.90% |

5.95% |

|

Morningstar L/S Equity Category |

3.56% |

11.37% |

18.03% |

5.49% |

6.74% |

4.54% |

4.46% |

|

S&P 500 Total Return Index |

5.89% |

22.08% |

36.35% |

11.91% |

15.98% |

13.38% |

14.13% |

|

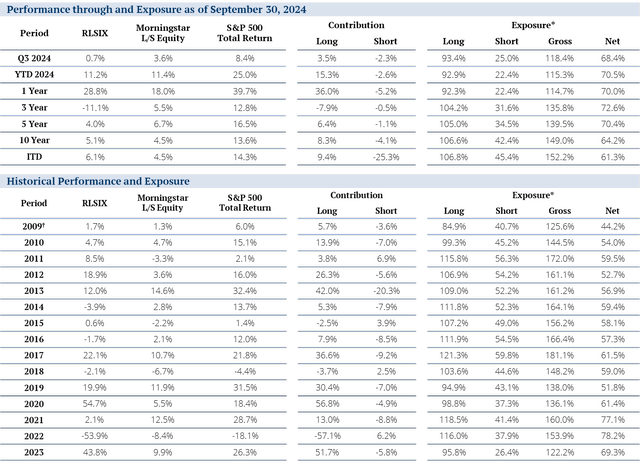

Annualized performance since inception of the Mutual Fund (3/30/2012) was 4.55% for RLSIX and 4.35% for RLSFX. The performance quoted for periods prior to March 30, 2012 is that of RiverPark Opportunity Fund, LLC (the “Predecessor Fund”). The inception date of the Predecessor Fund was September 30, 2009. The performance of the Predecessor Fund includes the deduction of actual fees and expenses, which were higher than the fees and expenses charged to the Fund. Although the Fund is managed in a materially equivalent manner to its predecessor, the Predecessor Fund was not a registered mutual fund and was not subject to the same investment and tax restrictions as the Fund. Performance shown for periods greater than one year are annualized. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged and one cannot invest directly in an Index. Morningstar L/S Equity Category Returns sourced from Morningstar Principia. The performance quoted herein represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost, and current performance may be higher or lower than the performance quoted. For performance data current to the most recent month end, please call 888.564.4517. Expense Ratio: Institutional: 1.89% gross and 1.85% net, Retail: 2.14% gross and 2.00% net as of the most recent prospectus, dated January 26, 2024. Gross Expense Ratio does not reflect the ability of the adviser to recover all or a portion of prior waivers, which would result in higher expenses for the investor. Please reference the prospectus for additional information. |

The RiverPark Long/Short Opportunity Fund (the “Fund”) returned 0.66% in the third quarter, versus the S&P 500 Total Return Index, which returned 5.89%.

The quarter got off to a shaky start with the RLG declining 8.8% from the end of June through the fifth of August, driven by a weaker-than-expected jobs report, which led to concerns of a coming recession. Those losses quickly reversed as the Fed kicked off its rate cutting cycle with a 0.50% cut to a target of 4.75%-5.00%, and China passed a massive stimulus package. Bonds also rallied as yields fell and the treasury yield curve, which had been inverted since mid-2022 and perceived by many to be an indicator of a coming recession, turned positive. Growth stocks performed well in the quarter but were outperformed by Value and Small Cap stocks. Despite the increased volatility, we continue to think that risks in the macro-economic environment remain balanced, and we are optimistic about the growth prospects and valuations of our portfolio companies.

Overall, our longs contributed 3.46% and our shorts hurt us by 2.31%. In addition to the SPDR S&P Homebuilders ETF (XHB), which we discuss below, the Industrial Select ETF (XLI) short and an individual short in DoorDash (DASH) were our worst performing shorts in the quarter.

In the short book, we continue to focus on businesses that we believe are losing competitive market share, that have business models we believe are flawed or are facing cyclical headwinds (including unprofitable technology, subscale internet media, residential real estate, cyclical industrial and consumer lending). In addition, we use select ETFs from time to time to manage exposure.

We started the third quarter 94.25% long, 18.13% short, and 76.11% net. We ended the quarter with more gross exposure and less net exposure at 93.70% long, 26.55% short, and 67.15% net.

Below we describe some of our top and bottom performers.

Portfolio Review

Top Contributors

|

Top Contributors to Performance for the Quarter Ended September 30, 2024 |

Percent Impact |

||

|

Shopify Inc. (SHOP, long) |

0.65% |

||

|

Meta Platforms, Inc. (META, long) |

0.61% |

||

|

Blackstone Inc. (BX, long) |

0.60% |

||

| Portfolio Attribution is produced by RiverPark Advisors, LLC (RiverPark), the Fund’s adviser. Although RiverPark believes that its attribution methodology adheres to generally accepted standards in the industry, attribution analysis is not an exact science and different methodologies may produce different results. Performance Attribution is shown gross of fees. Holdings are subject to change. |

Shopify: Shopify was our biggest contributor in the third quarter following a strong second quarter earnings report that included better than expected revenue growth and substantial margin expansion. Gross merchandise value (the value of all items sold on the platform) growth of 22% was three percentage points above investor estimates, revenue of $2.0 billion was $50 million better and free cash flow of $333 million was $80 million better. A combination of new merchants to the company’s platform, increased adoption of SHOP’s offerings by existing merchants, and e-commerce market share gains are driving this revenue growth and profitability.

Last year, 10% of US retail e-commerce sales flowed through SHOP, second only to Amazon, and the company is still enjoying significant tailwinds as retail merchants of all sizes adopt SHOP’s software tools to display, manage and sell their products across a dozen different sales channels. We believe that the overall growth of e-commerce, combined with the development of new products and services, such as its digital wallet Shop Pay, should continue to drive revenue growth of more than 20% per year over the next several years, accompanied by re-acceleration of operating margin growth and FCF generation.

Meta: Meta was a top performer in the third quarter after reporting a strong second quarter, including revenue of $39 billion (+22% y/y) and EPS of $5.16 (+73% y/y), both ahead of consensus expectations. Better than expected advertising revenue was driven by strength in key verticals including E-Commerce, Gaming and Entertainment, and Media. The company gave revenue guidance for Q3 that was ahead of investor expectations, driven by continued growth from Reels and Messaging (WhatsApp US users reached 100m+).

META owns multiple social media platforms, each with more than one billion users, has an 81% gross margin, and generated $44 billion of FCF in 2023. Both its Facebook and its Instagram franchises have more than 2 billion Daily Active Users and generate the bulk of the company’s revenue. Recently, the company’s short form video offering, Reels, and public text-sharing app, Threads, achieved mass user engagement and growing advertiser adoption, which have helped return the company to strong revenue and free cash flow growth. Even after this year’s 62% stock price appreciation, META shares trade at 23.5x Wall Street’s consensus estimates for 2025 EPS, estimates that we think could prove to be too low.

Blackstone: Alternative asset manager Blackstone was a top contributor in the third quarter following a relatively weak second quarter earnings report but accompanied by an optimistic outlook. BX delivered Distributable Earnings (‘DE’) of $0.96 per share, dividends of $0.82 per share, and Fee Related Earnings (‘FRE’) of $0.91 per share, all slightly below investor expectations of $0.98, $0.83, and $0.90 respectively. Fee-related performance revenues (‘FRPR’) of $177mn were also below investor expectations of $221 million. Management anticipates a material step-up in Q4 FRE, driven by Corporate PE and Energy flagships. In terms of net realizations, management expects a lag between improving markets and a pickup in these revenues.

Whatever the near-term brings for realizations, we continue to view Blackstone as offering an attractive risk/reward profile given its below-market valuation and consistent double-digit AUM growth driving recurring fee revenue growth, plus strong and consistent investment performance. Most of Blackstone’s capital is long-dated or even permanent, most of its fees (which are highmargin and recurring) are not sensitive to market fluctuations, and the company has billions of dollars of uninvested capital available to put to work. BX’s recurring fees provide a base of consistent earnings, while its opportunistic investing and harvesting add the ability to maximize investment returns, providing a strong foundation for long-term stock performance. Additionally, BX provides a 2% dividend yield at the current share price.

Top Detractors

|

Top Detractors From Performance for the Quarter Ended September 30, 2024 |

Percent Impact |

|||

|

Alphabet Inc. (GOOG,GOOGL, long) |

-0.61% |

|||

|

Pinterest, Inc. (PINS, long) |

-0.54% |

|||

|

SPDR S&P Homebuilders ETF (short) |

-0.49% |

|||

|

Portfolio Attribution is produced by RiverPark Advisors, LLC (RiverPark), the Fund’s adviser. Although RiverPark believes that its attribution methodology adheres to generally accepted standards in the industry, attribution analysis is not an exact science and different methodologies may produce different results. Performance Attribution is shown gross of fees. Holdings are subject to change. |

Alphabet: Google was our top detractor in the third quarter despite reporting second quarter results that were generally in line with expectations. The company reported slightly better revenue growth in Search, which grew 14% and continues to be resilient in the face of AI challengers, and Google Cloud, which grew 29% in the quarter. Service operating income margins of 40% and Cloud operating income margins of 11% were also both ahead of investors’ expectations as management’s cost-efficiency efforts drove operating leverage. YouTube revenue growth was slightly below expectations (+13% v. +16%) driven by tougher year-overyear comparisons and some general weakness in the Brand Advertising vertical. Finally, Cap Ex in the quarter of $13.2 billion was more than expected and likely the driver of the weakness in the stock as investors grapple with how much infrastructure investment will be required to achieve Google’s AI goals.

With its high margin business model (44% EBITDA margins last quarter), continued strength across its core Search and YouTube franchises, and continued growth and expanding profitability in its still relatively small Cloud business, we continue to view Alphabet as among the best-positioned secular growth franchises in the market. Additionally, GOOG shares trade at a compelling 19.5x the Street’s 2025 EPS estimate, a discount to the Russell 1000 Growth Index.

Pinterest: Similar to GOOG, PINS was a top detractor in the third quarter despite reporting solid second quarter results and giving guidance that, it seemed to us, fell within the growth framework issued at the September 2023 Investor Day. Specifically, second quarter Monthly Active Users (MAUs) were 522 million, up 12% year-over-year and 2 million better than estimates, Revenue was $854 million, $5 million better than estimates, and EBITDA was $180 million, $4 million better than estimates. Revenue guidance for the third quarter of $885-900 million (+17% growth) was slightly below expectations and seemed to be what drove the stock down despite being squarely within the company’s 3-5-year guidance of mid-to high teens percentage revenue growth.

We believe Pinterest to be an extremely well-positioned internet advertising platform. Users are increasingly coming to Pinterest to get inspiration for their home, their style, or upcoming travel, which often means they are actively looking for products and services to buy. The company currently has 522 million MAU’s, 2/3 of whom are female (who continue to control the lion’s share of household purchasing budgets) 1, which positions the company well to continue to take share of future ad dollar allocations. Continued growth of MAU’s and ARPU (grew 8% in the quarter), and the ramp of third-party relationships with Amazon and Google, should return the company to revenue growth rates approaching 20% for the coming years. In addition, strong cost controls should drive EBITDA margins back to the 2021 peak (40% v the current 21%), leading to strong growth in earnings and cash flow in the years to come.

SPDR S&P Homebuilders ETF: The XHB short, a US homebuilder index, was also a top detractor this quarter. The underlying stocks in the index, which were down sharply in 2022 due to higher mortgage rates, were volatile throughout the quarter but ultimately reacted positively to tame inflation readings, which have led to hopes of stabilizing or declining interest rates. Although we agree with this view on rates, we believe the spike in rates in 2022 led to lower inventory as homeowners were unwilling to sell a home with a low mortgage rate and buy one with a much higher cost of borrowing. As interest rates and therefore mortgage rates ease, we expect pent up inventory to come to market depressing prices and increasing competition for homebuilders. If this happens in conjunction with any kind of economic slowdown, we expect greater price declines and reduced home sale volumes.

Top Ten Long Holdings

Below is a list of our top ten long holdings as of the end of the quarter:

|

Holdings |

Percent of Net Assets |

|

|

Microsoft Corp. (MSFT) |

6.7% |

|

|

NVIDIA Corp. (NVDA) |

6.4% |

|

|

Apple Inc. (AAPL) |

5.8% |

|

|

Alphabet Inc. (GOOG),(GOOGL) |

5.0% |

|

|

Amazon.com, Inc. (AMZN) |

4.4% |

|

|

Meta Platforms, Inc. (META) |

4.3% |

|

|

Uber Technologies, Inc. (UBER) |

3.3% |

|

|

Shopify Inc. (SHOP) |

3.0% |

|

|

Netflix, Inc. (NFLX) |

3.0% |

|

|

The Walt Disney Co. (DIS) |

2.9% |

|

|

Holdings subject to change. |

45.0% |

|

Below is a list of the key secular themes represented on both sides of our portfolio as of the end of the quarter.

|

|

| This is a representative (non-exhaustive) list of our largest current long and short themes. Holdings subject to change. |

Summary

We continue to believe that our secular-themed long/short portfolio is well positioned to generate strong absolute and relative performance in the years to come. We will continue to keep you apprised of our process and portfolio holdings in these letters each quarter. As always, please do not hesitate to contact us if you have any questions or comments about anything we have written or about any of our funds.

We thank you for your interest in the RiverPark Long/Short Opportunity Fund.

Sincerely,

Conrad van Tienhoven | Portfolio Manager

† Inception date of the Fund was September 30, 2009. Annualized performance since inception of the Mutual Fund (3/30/12) was 4.4% for RLSIX. The performance quoted herein represents past performance. Past performance does not guarantee future results. The performance quoted for periods prior to March 30, 2012 is that of RiverPark Opportunity Fund, LLC (the “Predecessor Fund”). The inception date of the Predecessor Fund was September 30, 2009. The performance of the Predecessor Fund includes the deduction of actual fees and expenses, which were higher than the fees and expenses charged to the Fund. Although the Fund is managed in a materially equivalent manner to its predecessor, the Predecessor Fund was not a registered mutual fund and was not subject to the same investment and tax restrictions as the Fund. Performance shown for periods greater than one year are annualized. The Contribution numbers set forth above are produced by RiverPark Advisors, LLC, the Fund’s adviser, in accordance with generally accepted standards in the industry. Contribution is shown gross of management fees and expenses and is geometrically linked on a monthly basis. Contribution is not an exact science and different methodologies may produce different results. * Where applicable, the exposures are delta-adjusted and are computed by averaging the exposures of each month-end within each period. To determine if the Fund is an appropriate investment for you, carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information may be found in the Fund’s summary or full prospectus, which may be obtained by calling 888.564.4517, or by visiting the website at RiverPark Funds. Please read the prospectus carefully before investing. Mutual fund investing involves risk including possible loss of principal. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. The use of leverage may accelerate the velocity of potential losses. Furthermore, the risk of loss from a short sale is unlimited because the Fund must purchase the shorted security at a higher price to complete the transaction and there is no upper limit for the security price. The use of options, swaps and derivatives by the Fund has the potential to increase significantly the Fund’s volatility. There can be no assurance that the Fund will achieve its stated objectives. This material represents the portfolio manager’s opinion and is an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular. Standard and Poor’s 500 Total Return Index is a capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Morningstar Long/Short Equity Category portfolios hold sizeable stakes in both long and short positions in equities and related derivatives. Some funds that fall into this category will shift their exposure to long and short positions depending on their macro outlook or the opportunities they uncover through bottom up research. Some funds may simply hedge long stock positions through exchange-traded funds or derivatives. The Russell 1000 Growth Total Return Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The S&P 500 Total Return Index is an unmanaged capitalization-weighted index generally representative of large companies in the U.S. stock market and based on price changes and reinvested dividends. Morningstar Large Growth portfolios invest primarily in big U.S. companies that are projected to grow faster than other large-cap stocks. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged and one cannot invest directly in an Index. The RiverPark funds are distributed by SEI Investments Distribution Co., One Freedom Valley Drive, Oaks, PA 19456 which is not affiliated with RiverPark Advisors, LLC or their affiliates. 1 Source: Sabrina Chueh Ellis, Pinterest’s Chief Product Officer, at analyst day September 19th, 2023. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here