Investment thesis

In my previous article covering Global Blue (NYSE:GB), I assigned a Buy rating on the stock as I found its valuation very attractive given the company’s dominant market position as well as its solid growth outlook and improving margins. Its latest earnings results prove that my original thesis remains on track, as the business is starting to demonstrate strong operating leverage, which is resulting in its FCF growing substantially, which in turn accelerates the company’s deleveraging process. Although I was initially skeptical about the acquisitions made by management to expand the product suite, these have now begun to positively impact the company’s bottom line. Valuation remains undemanding at an EV/ adjusted EBITDA multiple of 8.4, and I have highlighted why I think there is further upside from the current share price. Consequently, I maintain my Buy rating on GB stock.

Key takeaways from Q1 25 earnings

Global Blue reported a 25% year-over-year rise in revenue for Q1 ending on June 30, 2024. This strong growth was mainly attributable to the APAC region where revenue grew 109% year over year, with Japan contributing 67% of the revenue from the region, growing at 172%. A key factor driving this growth has been the weakening of the Japanese Yen versus currencies such as the Chinese Yuan, thus making it a more attractive travel destination. Meanwhile, growth in Europe was up a steady 19% year over year, with notable weakness in France owing to the Olympics. Commenting on this, the company’s CEO stated:

And you can see that the main element in Europe in July versus Q1 was the weak performance of France at minus 2% versus 10% growth in Q1 which is really explained by the pre-Olympics negative impact in Paris, basically for almost 10 days Paris was totally empty before Olympics. Clearly the Olympics has been positive, but we will see this impact in August.

In Q2, I expect growth in Japan to moderate given the recent strengthening of the Yen. Nevertheless, growth in France should pick up starting in August, which should help sustain overall growth.

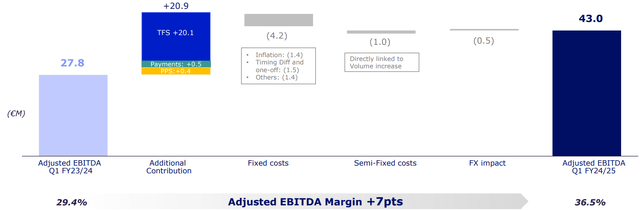

Q1 Earnings Presentation

As shown in the image above, adjusted EBITDA grew to €43 million, at a margin of 36.5%, as the business shows strong operating leverage with 65% of incremental revenue flowing through to the bottom line. Notably, the company’s newer Post Purchase Solutions (PPS) also contributed positively to adjusted EBITDA. Despite posting strong adjusted EBITDA, FCF this quarter was negatively impacted by higher interest rate expenses following the repricing of the company’s debt at the end of last year. As shown in the image below, the interest rates on its Senior Debt and Revolving Credit Facility (RCF) are now considerably higher versus the year ago period. However, annual interest expenses are expected to be €45 million versus €50 million last year as interest costs should gradually fall in upcoming quarters as management allocates FCF generated by the business towards deleveraging.

Thoughts on valuation

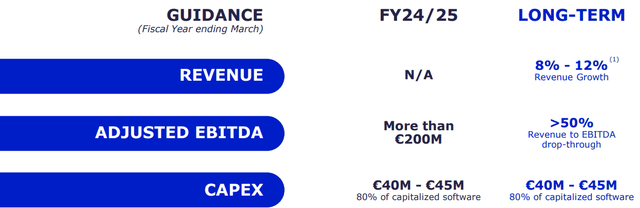

Q1 Earnings presentation

Management’s guidance for FY25 calls for adjusted EBITDA to be above €200 million, as shown above. Given that the company’s TTM adjusted EBITDA is already at €205 million, I expect adjusted EBITDA for FY25 to end up closer to €210 million. This translates to around $231 million, assuming an FX rate of 1€=$1.1. With interest expenses and capex expected to approximately total €90 million (or $99 million), FCF is likely to be around $132 million.

At the current share price of $5.6, the company has a market cap of $1.4 billion. Given its net debt position of $550 million, its enterprise value stands at $1.95 billion. Shares are therefore currently trading at EV/ adjusted EBITDA and EV/FCF multiples of 8.4 and 14.7 respectively. I find that the valuation looks optically more expensive due to the company’s high debt load and the associated interest costs. As the company continues to deleverage through FCF generation, I expect its valuation multiples to sharply contract. For instance, when stripping out its cash interest payments, FCF will be closer to $181 million, which translates to a Price/FCF multiple of just 7.7.

Being a payments processing company, Global Blue has incremental margins close to 50%, which implies that FCF growth should be significantly higher than revenue growth. Peers, such as Edenred (OTC:EDNMF) and WEX (WEX), typically trade at high double-digit FCF multiples despite growing slower than Global Blue.

Why I’m remaining bullish on GB stock

As I previously described, I continue to see room for further upside through significant FCF growth as well as multiple expansion. Besides valuation, there are other reasons for my bullishness. Management continues to prioritize debt repayment using the FCF generated from the business. This will gradually lower the company’s interest costs and improve the company’s overall financial strength. More importantly, this means management is unlikely to deploy cash towards acquisitions, which I had highlighted as a potential risk in my previous article. Additionally, management has now approved a $10 million share repurchase program, which I consider a prudent move given where shares are trading.

Monthly Tax Free Shopping provided by the company for the months of July and August has continued to show a strong trend in Sales in Store growth, particularly in Asia. Therefore, it is likely that the company’s Q2 earnings will continue the momentum from Q1, making me confident that full-year earnings will comfortably meet my expectations. However, given the macroeconomic backdrop where luxury brands like LVMH (OTCPK:LVMHF) are reporting declining year over year sales, I maintain a degree of cautiousness.

Risks to consider

The company is sensitive to global travel demand and luxury shopping spend. A deteriorating macroeconomic environment could impact the outlook for growth and profitability, while also impacting the timeline for its deleveraging. Given that its debt maturities are only in 2030, I do not consider this a significant risk to the financial health of the company.

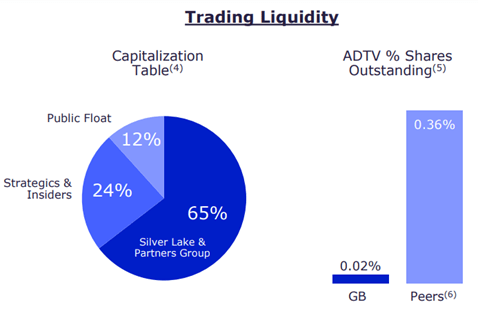

Latest Investor Presentation

Though it isn’t a risk to the business, the low liquidity in its shares is something that investors should be aware of. As shown above, public float represents only around 12% of the shares outstanding, which has led to low trading volumes and high volatility in its share price. The company’s buyback program should offer more stability and downside support, especially taking into account the company’s latest announcement regarding the potential sale of shares from private shareholders.

Conclusion

I remain confident that my original thesis on this investment is playing out nicely as the company demonstrates solid growth while generating strong FCF that is vital to continue to reduce its debt level. Despite the recent rise in its share price, I still see further upside as the business benefits from strong operating leverage that should drive investor returns through higher earnings as well as margin expansion. I therefore maintain by Buy rating.

Read the full article here