Company Description

The Toro Company (NYSE:TTC) is known for its lawn care products and solutions and operates with two segments, professional and residential. Toro has a market cap of approximately $8.5 billion and went public almost 35 years ago. Lastly, the stock has returned nearly 8,500% since inception.

Quality

There are a variety of financial metrics we can use to determine if a company is a high quality business and worthy of being included on the High Quality Dividend Stock Investable Universe. As mentioned in my original article on this list, businesses with increasing revenues, solid margins and above average returns on invested capital should be of high quality, so let’s examine TTC’s financials.

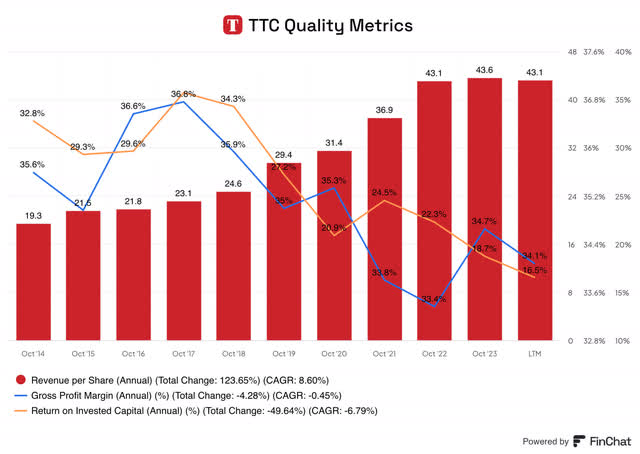

Revenue per share has grown at a respectable 8.6% CAGR over the past ten fiscal years, with especially impressive increases in 2019, 2021 and again in 2022 all above 15%. In fiscal 2023, the company saw only a minor increase in revenue per share, so we will be looking at fiscal 2024 to see if Toro can rebound and continue its growth.

Toro’s gross profit margin has overall fluctuated minimally; however, from 2014 through 2020 the company’s GPM was above 35% and over the last few years it has started to slip before bouncing back close to 35% in 2023. Ideally, TTC will get this metric back above 35% and maintain that level well into the future.

Pre-pandemic Toro’s ROIC was near or above 30%, including a high of 36.8% in 2017. However, since 2020 it has not seen this metric higher than 24.5% and it has continued to decline to 18.7% in 2023. Similar to the revenue per share number, ideally we would prefer to see this metric bounce back to its previous levels above of 30%.

Overall, these metrics are good, however the stagnating revenue and decline in ROIC will be closely monitored moving forward. If more favorable results don’t materialize in the near future Toro may lose its status in this investable universe.

FinChat.io

Dividend

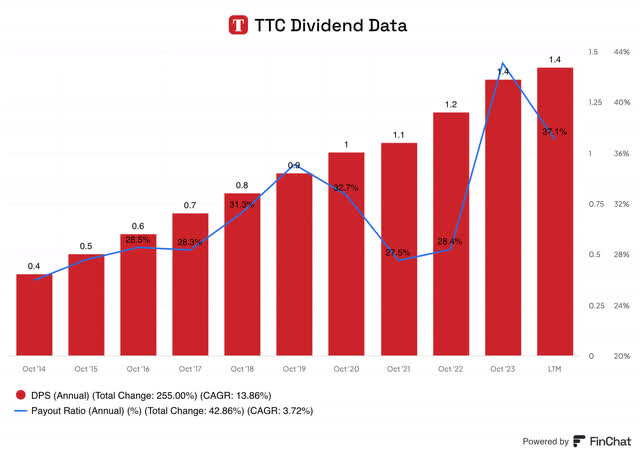

TTC has paid a dividend for more than 30 years and has grown it for more than 20 years. The company currently pays a quarterly dividend of $0.36 equating to a $1.44 annual amount and thus yielding about 1.75%. SA rates TTC’s dividend safety as an A- and is supported by a payout ratio near or below 40% over the last ten years. Additionally, the company’s 3-, 5- and 10- year dividend growth rates all exceed 10% confirming the company’s strong commitment to a consistently growing dividend.

FinChat.io

Past Performance

As previously mentioned, Toro has been a public company for nearly 35 years and has a CAGR of 13.7% since going public. This has resulted in a total return of about 8,480% overall. Additionally, over just the past ten years their stock has appreciated nearly 170%, leading to a CAGR of 10.57%. It is clear, based on past performance, TTC has generated healthy returns for shareholders and its position, in this regard, on the investable universe list is justified.

FinChat.io

Earnings Update

On September 5th, Toro announced third quarter earnings which missed on both the top and bottom line. Revenue for the quarter was $1.16B, a nearly 7% increase from the same quarter a year ago; however, this missed analyst expectations by more than $100M. Additionally, adjusted EPS for the quarter was $1.18, up more than 24% from 2023’s 3rd quarter; however, this was also short analyst estimates as well which were $1.23.

Management revised their adjusted EPS for the year to $4.15-$4.20. Unfortunately, this revision was down from their original estimate of $4.25-$4.35. Additionally, the company is expecting net sales growth of 1% for the fiscal year.

The Toro Company operates as two segments, Professional and Residential. The Professional segment saw a slight decrease of 1.7% in sales to $880.9 million, from $896.3 million a year ago. The main cause was a decline in shipment of winter related products, and lawn care equipment. On a positive note this segment saw increased shipments of golf and ground products along with underground construction equipment.

Further diving into the Professional segment, earnings for this quarter were $165.7M leading to a net profit margin of about 19%. This was a substantial increase from the prior year where the company saw $13M in earnings for the third quarter, as a result of a non-cash impairment which totaled just north of $150M.

The Residential segment was much better off resulting in revenue for the quarter of $267.5M up more than 50% from the same time period last year, this was brought about by higher shipments. Earnings for the Residential segment were $32.6 million or a net profit margin of 12.2%.

As you would expect the mixed results for each segment and the lowering of the adjusted earnings per share for the fiscal year were not well received by the market, resulting in a drop of about 12%. Since that drop on September 5th, Toro shares have recovered nearly 3% to about $83 as of this writing (9/12/24). The full earnings call is available here.

Valuation

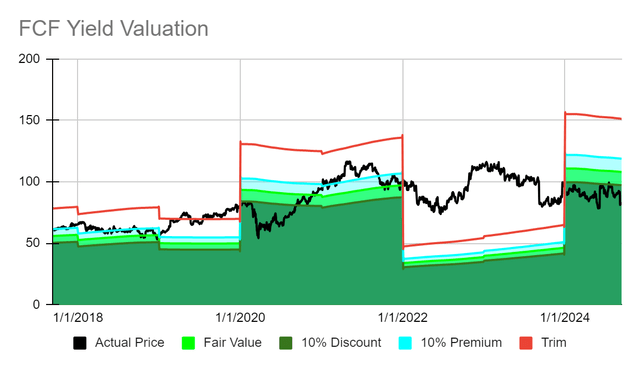

To determine if Toro is potentially attractively valued today let’s take a look at its valuation from a free cash flow perspective.

Created by Author

The valuation model suggests TTC is trading slightly below fair value. Over the past two full years the valuation area was well below its share price. This occurred due to a drop in FCF/share of about 65% from $4.21 to $1.47, from 2021 to 2022. Following that steep decline, 2023 was essentially flat with only a minimal FCF increase of 2.76% to $1.51/share, thus the stock was significantly overvalued. Since the beginning of this year Toro has essentially been trading just below its fair value relative to its FCF, thanks to a significant increase in FCF/share. The company’s recent earnings report and consequential drop in stock price has given potential investors a better margin of safety and the valuation rating for TTC currently rates as a STRONG BUY.

The valuation model suggests TTC’s fair value is $108 and currently the stock is trading at about $83 suggesting a heavy discount to fair value. Given TTC is trading well below $108, this could be a solid entry point that offers investors a significant margin of safety.

The expected rate of return for Toro is one of the highest in the investable universe at just above 16%. The biggest component of this is expected earnings growth which sits just north of 10%, followed by a return to fair value adjustment of 4.23% as well as the current dividend yield of 1.74%. The objective is to attain an expected RoR of 10% or more, Toro is well above this threshold mostly due to the company’s expected earnings growth.

The STRONG BUY rating is a cautious rating given the recent stagnation in TTC’s quality metrics. The valuation model assumes TTC can replicate it’s long-term historical growth trajectory. Consequently, our STRONG BUY rating may not hold if this anticipated growth does not materialize as expected.

Investable Universe Update

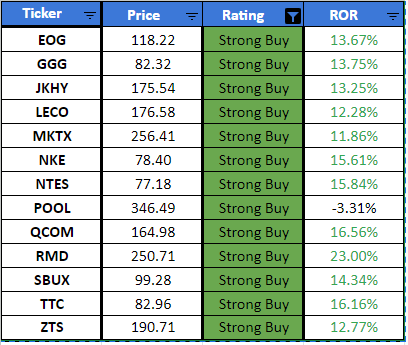

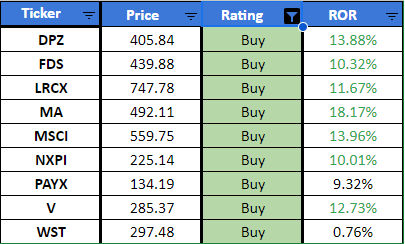

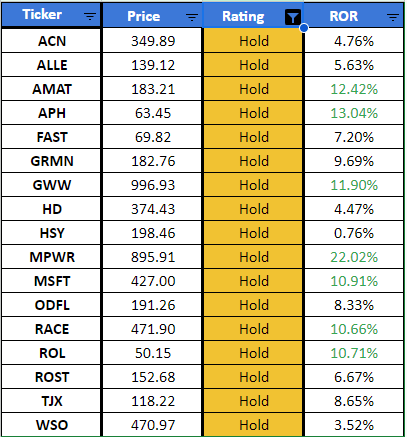

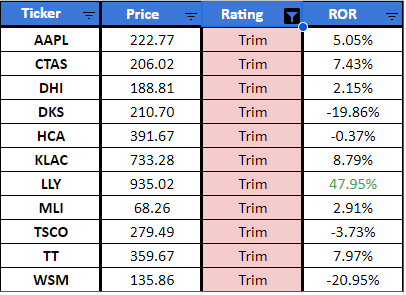

Here are the valuation ratings and expected rate of return for all 50 stocks in the High Quality Dividend Stock Investable Universe. Notable changes are summarized after the chart.

Created by Author

Created by Author

Created by Author

Created by Author

The valuation ratings have not change since our latest updated provided in the coverage of TJX Companies (TJX) that can be found here.

In that update there were 2 rating upgrades.

- EOG Resources (EOG) has moved up from a BUY rating to a STRONG BUY rating primarily due to the share price dropping recently.

- NXP Semiconductors N.V. (NXPI) has moved up from a HOLD to a BUY rating also following the recent share price dip.

As well as 6 downgrades from BUY to HOLD.

- Allegion plc (ALLE)

- Fastenal (FAST)

- Garmin (GRMN)

- W.W. Grainger (GWW)

- Home Depot (HD)

- Monolithic Power Systems (MPWR)

Overall, there is a decent amount of opportunity presented in the investable universe at the moment.

- Strong Buy – 13 stocks (26% of universe)

- Buy – 9 stocks (18% of universe)

- Hold – 17 stocks (34% of universe)

- Trim – 11 stocks (22% of universe)

How to Interpret the Valuation Ratings.

- Strong Buy – the stock is potentially trading for a discount to fair value

- Buy – the stock is reasonably valued at the moment

- Hold – the stock is marginally to moderately overvalued

- Trim – The stock is overvalued or does not present a good long term potential return from its current price.

*A trim recommendation is not to be taken as a firm Sell. The base case methodology for this investable universe is long-term buy-and-hold. A trim recommendation is an option to consider trimming a given position if you would like to free up capital to invest in another opportunity that appears more lucrative.

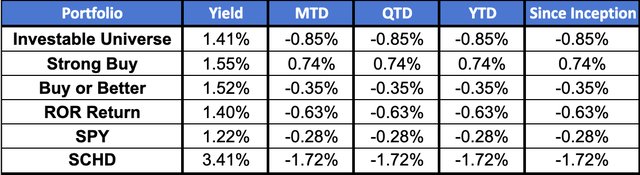

Model Portfolio Performance

In the prior update covering TJX Companies I provided an update on the 4 model portfolios that will be tracked and measured to evaluate the long-term performance of this investable universe and the valuation ratings.

Here is the latest performance update for all model portfolios (partial month returns are price only.) As of mid-day 9/13/24.

Created by Author

We can see that the S&P 500 is continuing its rally to erase the losses it incurred at the start of September, with the index sitting just 28 bps in the red at the moment. The model portfolios are directionally following the same trajectory, with the STRONG BUY portfolio, thus far, seeing the best results, +0.74%. A more in-depth update on each model portfolio will be provided after the close of each calendar month. The updates will detail the holdings within each portfolio, the winners and losers and document the changes.

Read the full article here