Introduction

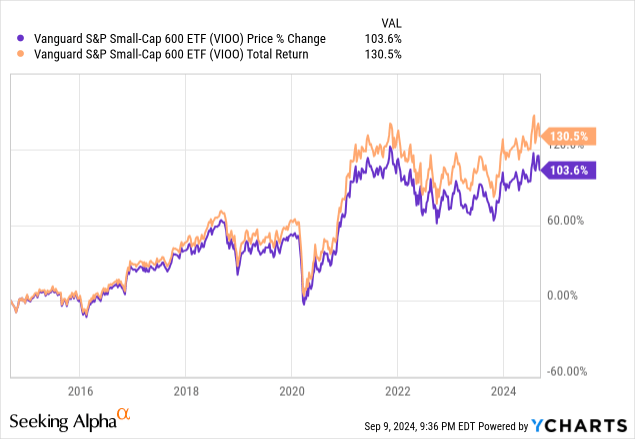

We last covered Vanguard S&P Small-Cap 600 ETF (NYSEARCA:VIOO) in October 2023. At that time, we noted VIOO’s attractive valuation, but we cautioned VIOO’s higher volatility and downside risk, especially in a high rate environment. Now that it has been about a year and the macroeconomic environment is very different than before. Therefore, it is time for us to review VIOO and provide our insights and recommendations.

ETF Overview

VIOO invests in a portfolio of U.S. small-cap stocks. The fund tracks the S&P 600 index, which consists of about 600 U.S. small-cap stocks. The fund has an expense ratio of 0.1%. While VIOO underperformed the S&P 500 and S&P 400 indices in the past year, earnings growth for stocks in its portfolio is expected to improve significantly in the next few years. In addition, we see more rooms for VIOO’s share price to move higher. Hence, we have a buy rating on this fund and think investors should take advantage of its attractive valuation, and accumulate more shares.

YCharts

Fund Analysis

VIOO underperformed the mid-cap and large-cap peers in the past year

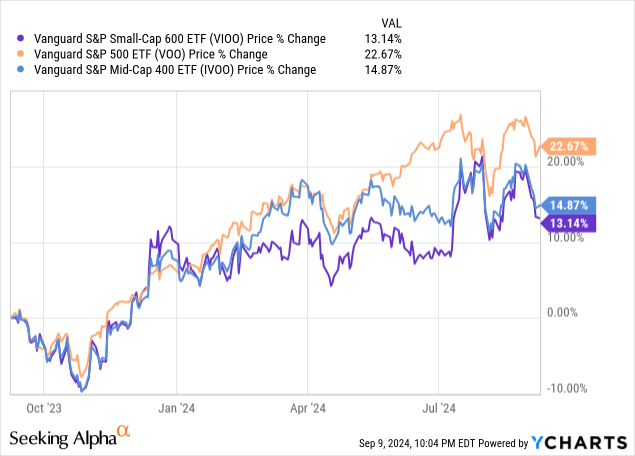

Let us first review how VIOO has performed in the past year. As can be seen from the chart below, VIOO delivered a price return of about 13.1% in the past year. This performance is not bad, but still lower than the 22.7% and 14.9% returns of the S&P 500 and the S&P 400 indices respectively. The S&P 500 index has clearly outperformed VIOO.

YCharts

VIOO’s underperformance to the S&P 500 index is not difficult to understand. As we know, VIOO’s portfolio includes small-cap stocks. In the past year, the elevated rate environment clearly favored large-cap stocks such as stocks in the S&P 500 index. This is because large-cap stocks tend to have better balance sheet and generate consistent (and often growing) cash flow. Therefore, they are less impacted in an elevated rate environment. On the other hand, small-cap stocks such as stocks in VIOO’s portfolio have inferior balance sheets and less stable business models than large-cap stocks. Therefore, they tend to face stronger headwinds in this elevated rate environment and was much more difficult to achieve growth.

We see significant growth opportunity in lower inflation environment

Fortunately, this environment is about to change. As inflation gradually recedes, the Federal Reserve now has the room to adjust its rate policy. In fact, several representatives from the Federal Reserve have indicated in the past few months that it is about time to begin a new rate cut cycle. We think lower rate environment will be very beneficial to small-cap stocks such as stocks in VIOO’s portfolio. As the rate moves lower, stocks in VIOO’s portfolio will benefit from lower refinancing costs and lower interest expenses. Lower inflation and rate environment will also stimulate consumer and business activities and benefiting the broader economy.

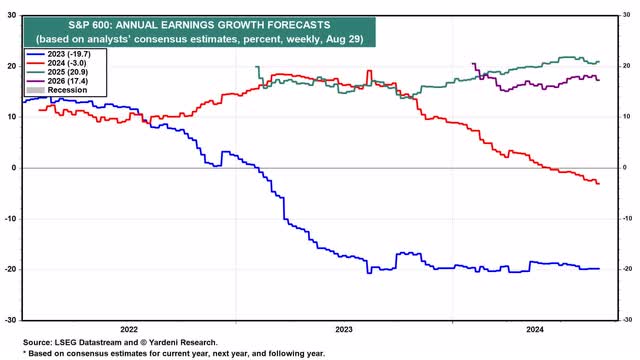

In this environment, earnings growth is expected to improve. In fact, we are seeing better growth trends ahead. Unlike the negative 19.7% earnings growth rate experienced in 2023, and the expected earnings growth rate of negative 3% in 2024, earnings growth forecasts are looking very good in each of the next two years. As can be seen from the chart below, VIOO’s earnings growth are expected to be in the low twenties (20.9%) in 2025 and high teens (17.4%) in 2026.

Yardeni Research

As the table below shows, VIOO’s expected earnings growth rates of 20.9% in 2025 and 17.4% in 2026 are much better than the average expected earnings growth rates of stocks in the S&P 400 and the S&P 500 indices.

|

VIOO |

S&P 400 (Mid-cap) |

S&P 500 (Large-cap) |

|

|

2023 |

-19.7% |

-8.3% |

2.5% |

|

2024 |

-3.0% |

-0.3% |

10.0% |

|

2025 |

20.9% |

17.1% |

15.3% |

|

2026 |

17.4% |

14.8% |

12.8% |

Source: Yardeni Research, Organized by author

It is still not too late to join the party

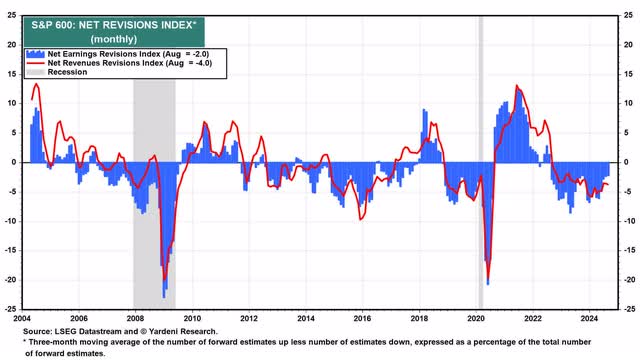

While some may wonder whether it is too late to join the party, we think there is still more room for VIOO to trend higher. Below is a chart that shows the net earnings and revenues revisions of the S&P 600 index in the past 20 years. As we know, the previous cyclical high of VIOO was reached in November 2021, a few months after earnings and revenues revision reached its peak in August 2021. The same pattern also held true in the prior price peak of VIOO which reached in July/August 2018. As can be seen from the chart below, net earnings and revenues revision reached the peak between March and June 2018.

Yardeni Research

So, what will happen in this current cycle? Since net earnings and revenues revision have yet to turn positive, we think there is still a lot of room for VIOO to trend higher. In other words, it is still not late to join the party.

Valuation is inexpensive

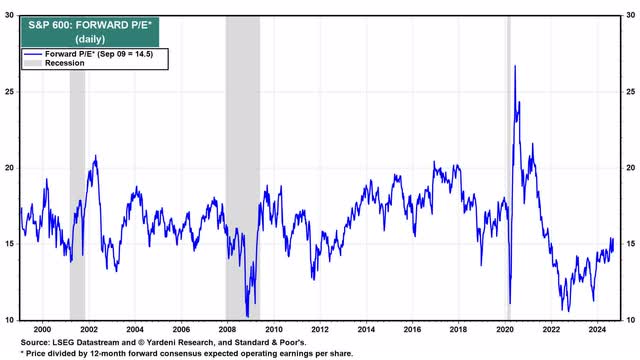

Below is a chart that shows VIOO’s average forward P/E ratio. As can be seen from the chart, VIOO has typically traded in the range of 14x and 20x in the past 25 years. Its current forward P/E ratio of 14.5x is towards the lower end of this valuation range. Therefore, we think VIOO is trading at an attractive valuation right now.

Yardeni Research

Risk: an economic recession may cause VIOO to underperform

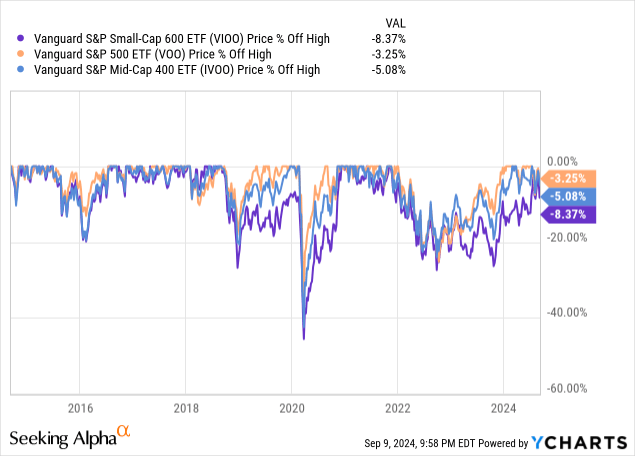

Although VIOO appears to have a better future ahead, investors should keep in mind that VIOO’s portfolio of small-cap stocks can be quite volatile in economic turmoil. As the chart below shows, the fund has typically declined slightly more than its mid-cap and large-cap peers, Vanguard S&P Mid-Cap 400 ETF (IVOO) and Vanguard S&P 500 ETF (VOO), in economic recession in 2020 and in stock market correction in early 2019.

YCharts

Investor Takeaway

As our analysis shows, stocks in VIOO’s portfolio should experience better earnings growth rates in the next few years. In addition, there is still likely more room for VIOO’s fund price to move up as net earnings and revenues revision has yet to turn positive. As such, we think investors should take advantage of VIOO’s attractive valuation.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Read the full article here