A Hold Rating for Shares of AngloGold Ashanti plc

This analysis reiterates the Hold rating for shares of AngloGold Ashanti plc (NYSE:AU), a Greenwood, Colorado-based mining company that mines gold deposits in West and East Africa, Western Australia, Brazil, and Argentina. The same rating was assigned in the previous analysis, dated June 6, 2024.

AngloGold Ashanti’s Performance Since Last Rating

Since the last analysis, AngloGold Ashanti shares are up 20.53% (or +21.41% including the payment of the semi-annual dividend of $0.19/share on March 28 and the next dividend of $0.22/share on September 13), which is better than the US stock market represented by the S&P 500 positive change of 3.03%. As predicted in the previous analysis, investors flocked to the safe haven of gold amid risks and uncertainties, and AngloGold Ashanti’s operating conditions improved. To the point that the company reported positive net income for Q2 2024, further reinforcing the upward trend. But, as previously forecast, thanks to the good liquidity of shares available in the market, now reflected in the average (“3-month”) volume of 1.63 million, both capital gains and market beat would likely have been more generous had investors bought on a dip around June 10, when gold prices experienced their “sharpest sell-off in 3.5 years“. Arundhati Sarkar, news editor at Seeking Alpha, reported on June 10, 2024, that sentiment around the yellow metal suddenly soured as China’s central bank slowed the pace of its gold purchases, while markets prepared for the much-anticipated meeting of the US Federal Reserve but widely expected to keep its policy rate unchanged on the back of strong US jobs numbers.

On average, the gold price per ounce in the second quarter of 2024 increased to $2,292/ounce (up 18.3% year-on-year) on 581,000 ounces sold by subsidiaries of AngloGold Ashanti and to $2,336/ounce (up 18.5% year-on-year) on 81,000 ounces sold by joint ventures of AngloGold Ashanti group. This sharp increase in the selling price per ounce was supported by the bullish sentiment that saw two major culminations for the yellow metal’s market price, which hit its fifth straight weekly gain as Middle East risks rising on April 19 and scored a spot on the podium at the Olympics of Metals on 21 May in the wild game of raw materials. The precious metal’s market price was driven by geopolitical risks and strong demand for safe-haven assets, particularly from Chinese traders, and hedges against macroeconomic headwinds and fears of a pick-up in inflation also took a hit. Rising hopes for a Fed rate cut at its September meeting and a weaker US dollar also helped push gold prices per ounce higher.

AngloGold Ashanti Gold Deposit in Operation: Production, Costs, and Projects

The following operating tailwinds captured the benefit of bullish sentiment on gold prices: production of 648,000 ounces of attributable gold in the second quarter of 2024, a pleasant improvement from 634,000 ounces in the prior year quarter with subsidiaries’ output (up 4.3% year-on-year to 581,000 ounces on a consolidated basis), which more than offset the decline in joint ventures (down 6.8% year-on-year to 82,000 ounces on a consolidated basis).

The entire portfolio of gold complexes is yielding effective ounces of gold, but the turning point for positive earnings and cash flow has come from a step change in operating performance in Brazil. Brazil, which is currently proving to be the flagship of the business in the Americas region, is benefiting in terms of ounce production from last year’s restructuring efforts, which, with a particular focus on core and high-margin assets, consisted essentially of the following measures in 2023: AGA Mineração‘s uneconomic Córrego do Sítio asset was placed under care and maintenance, and measures were taken to offset the headwinds of lower grade metal ores by processing larger volumes of mine material at Serra Grande. These initiatives to improve the efficiency of the Brazilian business regional segment have laid a robust foundation, suggested AngloGold Ashanti CEO Alberto Calderon, to continue to deliver in the future. The Americas regional segment is completed by the Cerro Vanguardia mine in Argentina, which contributes positively with its greater consistency in ore processed and gold recovery rates. The overall improvement in gold production was also helped by Australian assets back to normal after the flooding towards the end of the first quarter of 2024. This allows the segment to focus on two key aspects: 1) The expected improvement in mining yield from Sunrise Dam, as the feasibility study aims for increased underground ore tonnage combined with a higher metallurgical recovery rate of the mill facility. 2) A turnaround in metal grades and tonnage of ore processed at the Tropicana, as well as tailwinds from efforts to enhance the efficiency of Havana’s underground gold resources through infrastructure upgrade. Tropicana makes a major, strategically important contribution to AngloGold Ashanti’s growth profile, also due to the high expectations of its decarbonisation project and its politically and socially positive impact on local communities: the Tropicana Renewable Project aims to reduce greenhouse gas emissions by 30% within 2030 and achieve net zero emissions in 2050 (compared to a base year in 2021). AngloGold Ashanti is building a positive local image, no less than Chinese competitors who are heavily active in the region. In the Republic of Guinea, the Siguiri mine has been dealing with metallurgical recovery challenges after first quarter results were hit hard, but the issue has now been resolved. However, with recovery rates indicated as a kind of “trump card” for Siguiri, since the solution of another issue, a “carbon problem in the leach tank”, occurred earlier, unless further technical problems arise, this mine should move forward further after that “second quarter gold production was up 67% quarter-on-quarter”. Across the remainder of the portfolio, improved second-quarter gold production contributions were recorded at: A) the large gold-producing Kibali mine in the Democratic Republic of Congo boosted by good ore tonnages and gold grades. B) Geita in northwest Tanzania – the largest contributor to AngloGold Ashanti’s total production – is improving the tonnage of ore processed as well as the grade of the yellow metal extracted. And like its Australian counterpart Tropicana, as we have already mentioned, Geita is also working on a decarbonisation program to boost the green profile of its activities and focus more on taking care of the interests and wishes of local communities, where the increasing footprint of Chinese competitors fiercely seeking natural resources worldwide is raising alarm bells for Western companies in Tanzania as well.

C) Furthermore, despite stable quarter-on-quarter production of 54,000 ounces in the second quarter of 2024, the Obuasi mine in Ghana appears to be on track to deliver 300,000 ounces of gold annually. It may not happen this year but supported by a new mining method that promotes safe working conditions and frees up additional processing capacity, the mine is slowly but surely on track to deliver 400,000 ounces annually in the future, which currently represents approximately 15% of the company’s total production. D) Gold production at the Iduapriem mine in Ghana still appears to have potential in terms of favorable metal grades and the expanded facilities that can welcome more gold ore, making a positive contribution to AngloGold Ashanti’s overall production.

Healthier metal mineral activities across the entire portfolio had a positive impact on costs: Total cash costs per ounce for the Group fell 1.6% year-on-year to $1,137/oz in Q2-2024 from $1,155/oz in the same period last year. While All-In Costs per Ounce (“AISC”) for the Group increased slightly by 2.2% to $1,560/ounce in the second quarter of 2024, compared to $1,527/ounce in the same quarter last year. However, the deterioration was primarily due to higher sustaining capital expenditure, which was, among other things, planned, and the expenditure was actually required merely across the joint ventures, which represent a smaller proportion of AngloGold Ashanti’s total production than the segment of the company’s subsidiaries. The higher costs and expenses did not preclude positive earnings from joint ventures, and this serves as a hallmark of robust operations that AngloGold Ashanti boasts across its entire portfolio of gold mineral activities.

Rising Earnings and Cash Flows Are Drivers of Share Prices. Financial Condition Is Improving

Higher gold prices, increased production and lower costs and expenses resulted in an impetus given to the following stock price drivers: A) Net income was $253 million in Q2-2024 swinging from a loss of $83 million in the prior year quarter. B) The Adjusted EBITDA nearly doubled to $684 million in Q2-2024 from $356 million in Q2-2023. C) The Free Cash Flow recovered to $183 million in Q2-2024 from negative $44 million in Q2-2023, boosting Free Cash Flow for H1-2024 which was $206 million versus negative $205 million in the corresponding period of 2023.

AngloGold Ashanti ended the second quarter of 2024 with a financially strong balance sheet: $998 million in total cash and ST investments, up from $964 million at the end of 2023, and total gold reserves of $774 million as of June 30, 2024. Due to gold price, operating cost and production solid premises, the liquidity available to the company is well positioned. Currently, the balance sheet is burdened with debt of $2,314 million, and more debt may be incurred in the future to finance the acquisition or upgrade of fixed assets. From an economic viability standpoint, as the company has no problem carrying this burden, facilitated by the looming easing of credit conditions as a result of the Fed’s interest rate pivot, the company’s creditworthiness paves a path without significant bumps to get more loans if needed. As an indicator of the financial solvency of AngloGold Ashanti’s balance sheet, the Interest Coverage Ratio has a reading of 6.21x (= trailing 12-month operating income of $863 million divided by trailing 12-month interest expense of $139 million), enabling AngloGold Ashanti to walk proudly high in the industry, as investors start from 1.5 to 2x to rate any company as worthy of financial trust.

The Outlook: Several Upside Catalysts of Gold Prices, Production, and Costs

The bullish gold price and the improvement in the company’s operations currently define a fertile context for the hope that AngloGold Ashanti share prices can flourish. However, AngloGold Ashanti’s share price is cyclical, and the current levels are such that, let’s say, they are not the best the cycle could present from the point of view of a potential acquirer. But the wheel will turn in the direction of more attractive share price levels which, if exploited, will make it possible to maximize the appreciation opportunities arising from a positive underlying trend. Therefore, for the time being, it would be a good idea for investors to moderate their inclination to strengthen their investments and wait for the share price to return to more attractive levels. In any case, the general consensus remains very bullish on the price of gold, which trend AngloGold Ashanti appears to be strongly associated with, judging by the positive correlation between the share price and the price of the metal.

The Hold rating means that investors should keep their position in AngloGold Ashanti to continue to benefit from the rise in the price of gold, which has been driven by two main factors over the last 12 months or so: 1) Expectations of an interest rate cut implemented by the Federal Reserve. The idea that interest rates will fall as a result of monetary easing by the Fed acts as a stimulus for gold, as the metal, which pays no income, increases its attractiveness compared to US Treasuries, which instead provide interest income based on a fixed rate. 2) The risk to global economic growth as a result of an aggressive interest rate policy by the world’s leading monetary authorities to curb rising inflation, as well as an unstable global environment burdened by wars and geopolitical tensions. In such a situation, investors seek traditional properties of gold as a safe haven investment that acts as a portfolio shield against macroeconomic and geopolitical headwinds.

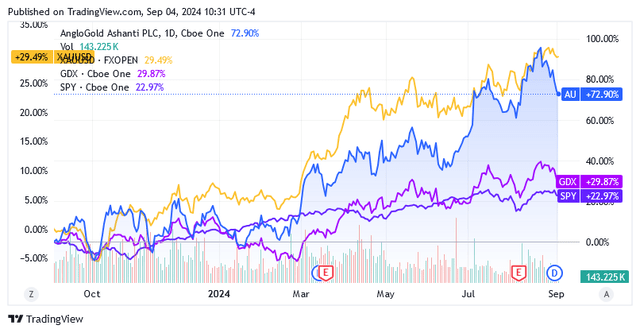

Due to these upside factors, the Gold Spot Price (XAUUSD:CUR), trading at $2,491.55/oz at the time of writing, is up 28.6% over the past 12 months, pushing AngloGold Ashanti shares to a gain of 72.90%, outperforming the VanEck Gold Miners ETF (GDX)+29.87% and the SPDR S&P 500 ETF Trust (SPY)+22.97%.

Source: Seeking Alpha

Driven by strong central bank buying and strong investor interest in the safe-haven asset gold amid macroeconomic uncertainty and ongoing geopolitical risks, gold’s uptrend is still in full swing, and further gains are likely over the next few years, Joni Teves, precious metals strategist at UBS Group AG (UBS), wrote in a note according to Dow Jones, Seeking Alpha news editor Carl Surran reported on September 3, 2024.

In addition, The Goldman Sachs Group, Inc. (GS) analysts in a note to the market agreed on gold as the “preferred hedge” among investors “against geopolitical and financial risks,” and although with the highest upside potential in the short term, the bank has initiated what, Arundhati Sarkar, Seeking Alpha News Editor reports on September 3 as opening a long gold trade recommendation. The Goldman note also foresees Western capital returning to the gold market as soon as the Fed cuts interest rates, providing another strong upside factor for demand, “a component largely absent from the sharp gold rally observed in the past two years,” the bank added. Goldman predicts a $2,700 target price for the gold ounce as early as 2025, reflecting 8.4% growth from the current level. Trading Economics analysts support views of a near-term rise in gold prices, forecasting a gold price of $2,532.66 per ounce by the end of this quarter and an even higher price of $2,623.27 per ounce in 12 months.

As well, Bank of America Corporation (BAC) is bullish on the price of gold, raising the price targets for publicly traded gold companies such as Barrick Gold (GOLD), IAMGOLD (IAG) and Wheaton Precious Metals (WPM), also backed by strong Q2-2024 results, but AngloGold Ashanti’s Q2-2024 results were also strong, as this analysis shows a bit later.

The price per ounce of gold remains very supportive, continued operational improvements give the company confidence that gold production across the portfolio is consistent with annual guidance, while costs are on the downside. This is a mix of favourable components for market-focused profitability metrics such as net income, adjusted EBITDA and free cash flow, effective share price drivers that, as a result, appear to be strongly positioned today to trade further up.

Due to the positive trends in operating metrics highlighted earlier in this analysis, AngloGold Ashanti maintains its full-year production guidance of 2.59 to 2.79 million ounces of gold including subsidiaries and joint ventures. This implies higher volumes for the second half of 2024, as the Group produced 1.254 million ounces in the first half of 2024, an increase of 1.8% year-on-year.

“Given strong gold prices and improved cost performance, AngloGold (AU) expects free cash flow to exceed $400 million in the second half,” nearly double the $206 million generated in the first half of 2024, as reported on August 6 by Carl Surran, news editor at Seeking Alpha, suggesting a strong outlook for other share price drivers such as earnings and adjusted EBITDA.

The Stock: A Lower Share Price Is Possible

The share price has a rosy outlook, but it still appears not to be trading at the most compelling levels, so investors should continue with a Hold rating for the time being.

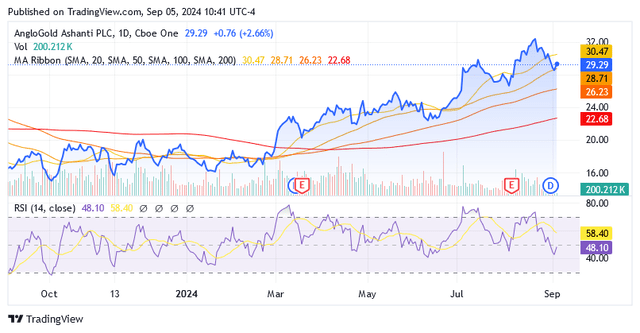

At the time of writing, AU shares are trading at $29.29 apiece on the US NYSE, giving it a market cap of $11.91 billion and a dividend yield (“FWD”) of 1.54%.

Source: Seeking Alpha

Shares are still trading too much above the MA Ribbon and are currently well above the $23.74/share midpoint of the 52-week range of $14.91-32.57/share.

Also, looking at the 14-day Relative Strength Indicator of 48.10, shares have room underneath to consume a healthy pullback from current levels, provided the wind blows and creates downward pressure. From there, with the stock price having more room to rise again, investors may decide to increase their position.

Based on summer trends, AU shares traded lower around June 10, 2024, as market sentiment towards gold became sour amid widespread expectations that the US Federal Reserve would keep its benchmark interest rate unchanged due to strong US jobs numbers and in the first week of August 2024, when global equity markets experienced chaotic and massive sell-offs.

The Fed’s next move on interest rates expected from its September 18 meeting could create downward pressure and cause stock prices to fall well below current levels. Consistent with the dovish signal sent by its Chairman Jerome Powell in his speech at the Jackson Hole Symposium on Friday, August 23, the Fed is likely to pivot course on September 18. At the time of writing, interest rate traders believe that a 25-basis point cut from the current target rate of 5.25-5.50 to 5.00-5.25 has a 61% probability of occurring. But there is uplifting speculation about a significant 50 basis point cut by the Fed this month as there has been a new wave of doubts about the resilience of the US economy to higher interest rates since yesterday, September 4:

JOLTS data yesterday “revealed a much larger-than-expected drop in job openings”, which “unexpectedly fell to a more than three-year low in July”, “combined with the ISM PMI’s sharp decline in US factory activity”, said Trading Economics.

Judging by the evolution of the probability of the next Fed rate cut, interest rate traders do not seem to be particularly keen on speculation about a 50-basis point rate cut, with their forecast probability falling over the past 24 hours from 44% a day ago to 39% at the time of writing.

The economy does not appear to be flash-freezing as disinflation progresses: Consumer spending continues to bare its teeth, providing strong resistance to the benefit of the cycle despite the Fed’s most restrictive interest rate policy since the 2008 financial crisis. Household demand for goods and services lifted the Conference Board’s consumer confidence index in August, which rose to 103.9. And it is largely thanks to resilient consumers that annual US GDP growth was pushed up to +3% from +1.4% in the first quarter. In addition, the US service sector, which accounts for the largest share of US GDP, is showing signs of expansion rather than contraction. Disinflation is underway because the Fed’s policy of increased interest rates for several quarters is necessary to contain the highest inflation in more than 40 years. But the economy handles this burden well without complaining too much. So, despite recent speculation attempts, the correct stance versus the current situation is, according to this analysis, that there is no reason for the Fed to cut the key interest rate so sharply.

If the Fed cuts interest rates, but by 25bps and not by 50bps, the subsequent consequences for gold sentiment will not be pleasant, as the metal will undoubtedly prefer as low interest rates as possible from the Fed’s next decision, due to its battle against US Treasuries to convince more investors to join turn to gold lovers. Then, should the market be disappointed if the Fed cuts rates by 25bps and not by 50bps, AU shares could be sent down significantly based on the positive correlation with gold prices.

The “soft landing” scenario for the economy, which Investopedia defines as

“a cyclical slowdown in economic growth that ends without a period of outright recession,”

remains popular among analysts. But that doesn’t rule out a new wave of recession fears shaking up U.S. stocks. The latter could also temporarily create negative wind for AngloGold Ashanti shares, and the following two indices continue to signal an impending downturn in the US economic cycle: Economist Claudia Sahm predicted the US economy in a recession sometime between late 2024 and early 2025. Claudia Sahm is the compiler of the Sahm Rule, an indicator that, performed on the last nine US recessions since 1970, has convinced most in the market of its ability to predict a subsequent one. Duke University professor and Canadian economist Campbell Harvey also predicts an economic recession or, more correctly, its inverted yield curve predicts a recession. The inverted yield curve (three-month US Treasury yields are currently higher than ten-year US Treasury yields: 5.084% vs. 3.755%) signals that a recession may only be a matter of time for the US economy. Since World War II, this index has reliably predicted a recession 8 out of 8 times.

Recession fears – a small spark could be enough to fuel concern – could have depressing consequences for AngloGold Ashanti shares, in line with a 24M beta of 1.15. The market is not missing an opportunity at the moment, and the commodity markets, especially the gold market, are very prone to rely on any change in sentiment, as shown by the large and often erratic price swings.

Conclusion

AngloGold Ashanti is a senior gold miner with production in Latin America, Africa, and Australia, currently experiencing improved operating activity, with production in line with plans and costs on the downward path.

Improving production and costs will create tailwinds that will capture the formidable outlook for gold prices, as the metal is sought by investors as a safe-haven against risks to global growth and uncertainty due to geopolitical tensions and conflicts. The Fed’s interest rate pivot, which is likely to take place at the September 18 meeting and continue to ease thereafter, will also boost gold, as in such a scenario there will be a decrease in the opportunity cost of investing in no-income yielding gold instead of interest income paying US Treasuries.

This mix will result in higher earnings and cash flows for AngloGold Ashanti, effective drivers of the share price.

Share prices are not currently at their most attractive levels, and there are strong reasons to believe they could trade significantly lower than current levels. Investors should therefore be patient for now and stick with the Hold rating. AngloGold Ashanti offers a viable alternative to investing directly in physical gold, now that the time is ripe to do so for a broader group of investors. Direct investments in physical gold, on the other hand, are only feasible and affordable for large investors, such as institutional investors and banks.

Read the full article here