Oil prices have struggled on Tuesday morning as US markets return from the Labor Day holiday. Brent is trading 3% down at the time of writing, flirting with the psychological $75 a barrel mark.

The slide may be attributed to Chinese PMI data released over the weekend, which has renewed demand concerns moving forward. The halt in production from Libya has taken a backseat it appears, however Libya and the tensions in the Middle East are likely to prevent an extended selloff in oil prices.

Export orders from China fell for the first time in 8 months in July, while new home prices rose at their weakest pace in 2024. A sign that housing demand is waning, which does not bode well for demands of raw materials as well as oil. The knock-on effect has been broad with declines across a host of commodities as well.

The situation in Libya is notably complex, with recent reports indicating that around 70% of oil production has halted and exports from ports have stopped. Despite this, the impact on oil prices has been minimal due to uncertainty over how long these issues will persist. If more information becomes available regarding the duration of the disruptions, we could see a more significant effect on oil prices.

Another factor which could be exerting downward pressure on oil prices is OPEC+ and the increase in supply planned for October. There were concerns for a while that given waning demand and lower oil prices that OPEC+ may plan to delay the supply increases. However, rumors surfaced at the back end of last week, with industry sources confirming the plan is likely to go ahead.

The planned increases from OPEC+ could be seen as a counter to the Libya uncertainty; however, this is still a month away at best. I remain skeptical regarding the OPEC+ increases especially if oil prices remain below the $75 a barrel as many OPEC+ members require prices above a certain level to keep the books in balance and realize a profit. All in all, an interesting time ahead for oil prices.

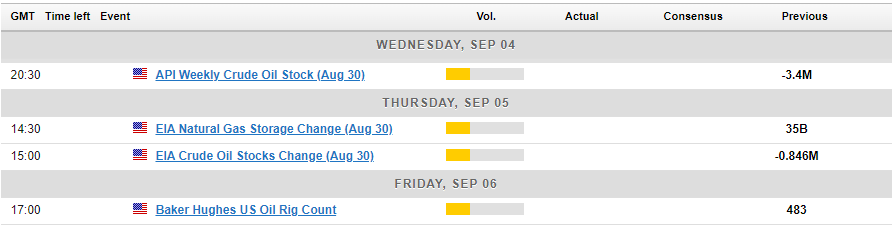

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

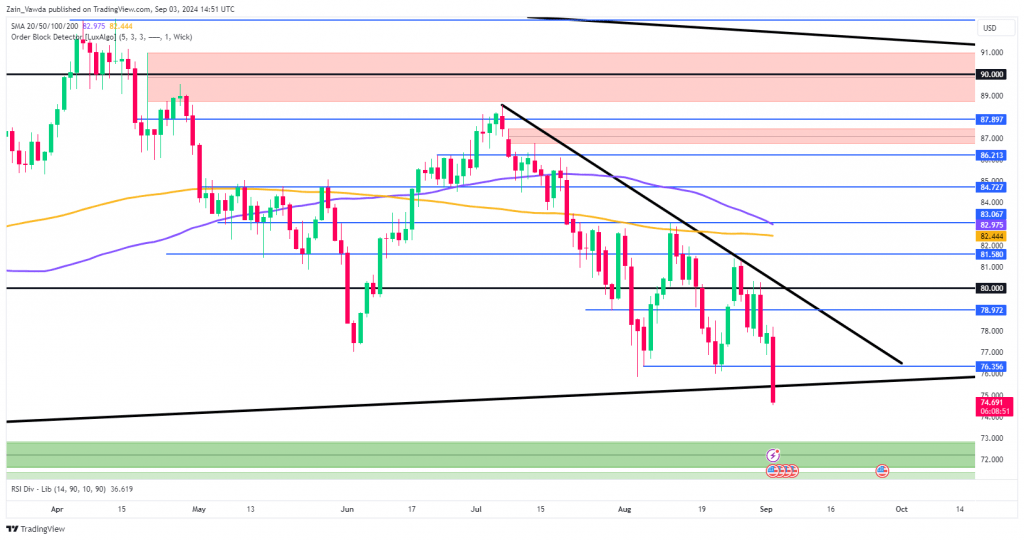

Technical Analysis

From a technical perspective, oil recently formed a lower high, suggesting a potential retest of the descending trendline. However, today’s price movement has disrupted this pattern, with the daily candlestick appearing particularly concerning at the moment.

If the daily candle closes below the long-term ascending trendline, it could signal trouble for oil prices, as this trendline has been a support level since March 2023. Nonetheless, the fundamentals, including geopolitical tensions in the Middle East and production challenges in Libya, might limit further declines in the near future.

Currently, the price is trading within a crucial support zone on the H4 timeframe, around the 74.00 mark. A break below this level could shift focus to the 73.00 support, with a confluence area just beneath it, making it a critical level to watch.

Brent Crude Oil Daily Chart, September 3, 2024

Source: TradingView

Support

- 74.00

- 73.00

- 72.50 (key area of confluence)

Resistance

Original Post

Read the full article here