Introduction

Per my May article, Brookfield Corporation (NYSE:BN) allocates capital shrewdly. Since then, a July 17 Bloomberg article discussed management changes. The 2Q24 letter to shareholders also talked about the evolution of management. My thesis is that Brookfield is preserving their culture while slowly and carefully making management transitions.

Management Development And Culture

Brookfield has a collaborative culture and this was laid out in the 2Q20 earnings call when CEO Bruce Flatt stressed the importance of people working together in person:

Simply stated, our view is that companies use their offices to foster culture, collaboration and development of talent. This cannot be replicated from a home office.

Part of Brookfield’s collaborative culture with a philosophy of promoting from within is seen in the way they make management changes. Executives tend to be groomed for a long time and sudden changes are eschewed. Currently, Flatt is CEO of both Brookfield Corporation and Brookfield Asset Management (BAM). CEO Flatt was identified as the next CEO in 1999, but he didn’t assume the role until 2002. Succession planning for CEO Flatt has been taking place for several years, and expectations are especially high for BAM President Connor Teskey.

A July 17 Bloomberg article notes it was BAM President Connor Teskey who brought about the successful Oaktree Capital Management acquisition which helped Brookfield expand into credit. The article revealed the next management development step for President Teskey (emphasis added):

But taking over from Flatt may be a touch more gradual. He has run Brookfield’s collection of entities for more than two decades and has promised succession will be an evolution, not a revolution. In the next major step, Teskey would probably rise to CEO of Brookfield Asset Management. If Flatt copies the playbook for his own ascent at age 36 under the wing of his predecessor, Jack Cockwell, he would stick around as chairman for years.

CEO Flatt confirmed President Teskey’s rise in the 2Q24 letter (emphasis added):

In 2019, a next-generation review and planning process was undertaken with senior Partners and Brookfield’s Board members, looking ahead to the next 20 years. This process culminated in 2023 with a new group of younger Partners being identified to assume more senior roles over the coming years. Connor Teskey was identified as the next CEO of Brookfield Asset Management at that time – and this change will happen when we feel the time is right for all our stakeholders. In addition to Connor’s many exceptional skills and talents, he has the advantage of being 36 years old today, which gives him the opportunity to lead the organization for 20 plus years through the next phase of our growth. Anuj Ranjan, Sachin Shah, Nick Goodman and others have also been assigned very senior “CEO” roles across Brookfield and will continue to have crucial responsibilities as the organization evolves further over time.

Valuation

The 2Q24 letter says management estimates shares are worth $84 each, and it says repurchasing shares is not a method to boost the share price (emphasis added):

The Value of our business based on our estimates is currently $84 per share, and this Value does not take into account the franchise we have, which generates transactions year in and year out by allocating capital effectively. For example, it does not take into account any Value for new businesses we are building, or the option we have to repurchase further shares at a discount to their intrinsic value, thereby adding further Value to each share.

The 2Q24 letter goes on to explain how the $800 million spent on buybacks this year has been very beneficial to existing long-term shareholders:

In simple terms, we acquired 20 million shares this year, and the Value of those shares was $1.68 billion. Due to market trading conditions, we were able to acquire them for $800 million. This means that the selling shareholders left behind $880 million of excess Value. Said another way, for the ability to get liquidity of $800 million, the selling shareholders turned over $1.68 billion of Value to the remaining shareholders, reallocating $880 million of Value to the remaining shareholders.

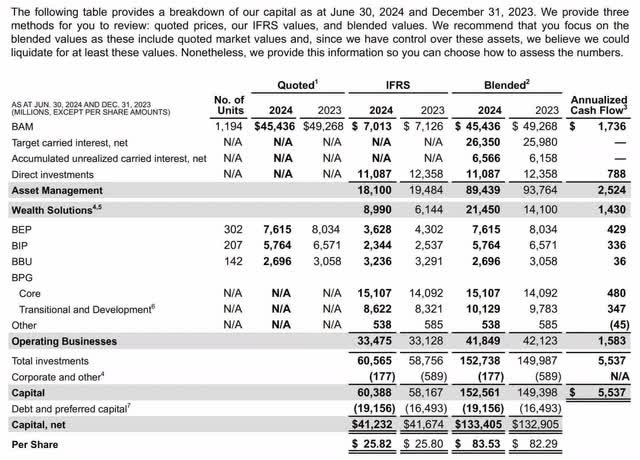

The 2Q24 supplemental breaks down the $83.53 per-share valuation in the “Blended” column below:

Brookfield valuation (2Q24 supplemental)

The largest part of the above valuation comes from the $45.4 billion worth of BAM shares, and these are publicly traded, so this part of management’s valuation shouldn’t be questioned. The Brookfield Property Group (“BPG”) real estate valuation can and should be questioned and management says the core portion is worth $15.1 billion while the transitional/development portion is worth $10.1 billion. These optimistic BPG numbers may be valid when viewed through a long-term lens, but I’m guessing their liquidation value would be much lower. Another large valuation piece which can be questioned is the $26.4 billion in net target carried interest. Liquidation risk is low, but we live in an unpredictable world and there is always a small chance management could be forced to sell parts of the company at distressed prices. Another risk is what could happen if interest rates aren’t cut as expected later this year.

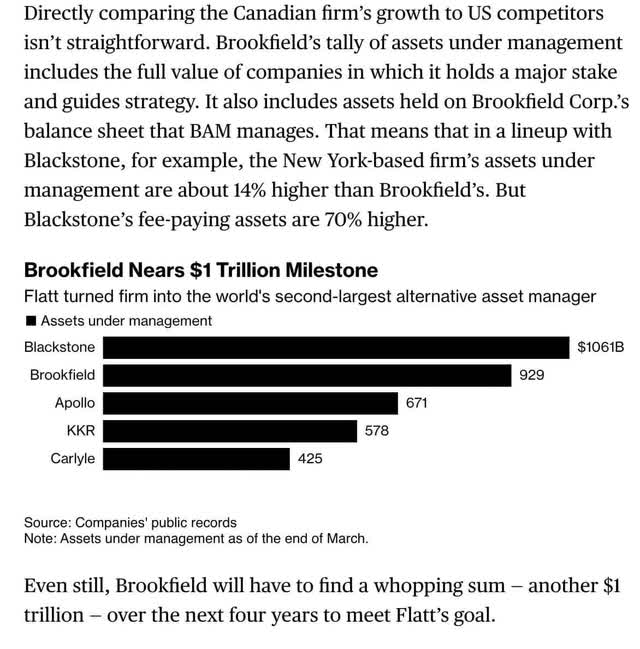

Part of the reason management values the company highly is because they have a proven track record of accumulating assets. Per the above Bloomberg article, it is hard to compare them with competitors because of varying tracking considerations:

Brookfield assets under management (July 17 Bloomberg article)

Management’s $84 per-share valuation above is the high end of my valuation range. Other investors say management might be too optimistic with some of the retail and office real estate holdings. I wouldn’t argue with other investors who have a short-term liquidation valuation which is discounted by up to one-third from the optimistic long-term number used by management. As such, my valuation range is $56 to $84 per share. The $50.28 share price from August 30 is below my valuation range, and I think the stock is a buy.

Forward-looking investors should keep tabs on developments from the Investor Day on September 10th in New York.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Read the full article here