Since I last covered the Kraneshares China Internet And Covered Call Strategy ETF (NYSEARCA:KLIP) in January, it has posted steady returns of around 7%, in line with the underlying KraneShares CSI China Internet ETF (KWEB). It has done so, however, with far less volatility owing to its strategy of forgoing capital gains in exchange for monthly call option income, which is currently running at a rate of 60% annually. The KLIP is ideal for investors looking to benefit from undervalued China tech stocks while generating high income. The ETF has managed to generate decent returns since its inception even as Chinese tech stocks have fallen, and we should see annual returns in excess of 10% as China tech bear market comes to an end.

The Case For The KWEB

As 96% of the KLIP’s holdings are the KWEB, the performance of Chinese tech stocks will be the main driver of the ETF and its outlook is increasingly positive. Valuations have fallen spectacularly amid the 67% market decline from the market’s peak in early 2021. The forward PE ratio is now below 10x, while the EV/EBITDA ratio is just 7.5x. As the table below shows, the majority of the index’s top holdings trade with single digit PE ratios.

| INDEX WEIGHTING | FORWARD PE RATIO | |

| TENCENT | 10.4 | 14.5 |

| ALIBABA | 10.1 | 9.0 |

| PDD | 7.8 | 7.6 |

| MEITUAN | 7.3 | 15.4 |

| JD.COM | 5.8 | 6.9 |

| NETEASE | 4.4 | 11.1 |

| TENCENT MUSIC | 4.3 | 14.9 |

| BAIDU | 4.0 | 8.0 |

| KE HOLDINGS | 3.9 | 16.1 |

| VIPSHOP | 3.8 | 5.2 |

Such low earnings multiples often reflect high levels of debt that raises the risk premium for holding the stock, but in the case of Chinese tech, almost all the index leaders have positive net cash positions. Many companies are swimming in cash and are generating enormous amounts of free cash flow, yet concerns about future growth are keeping valuations depressed. Companies have responded to high cash levels and low stock multiples by increasing buybacks and there is significant potential for further purchases which should help put a floor under KWEB.

The Case For The KLIP’s Covered Call Strategy

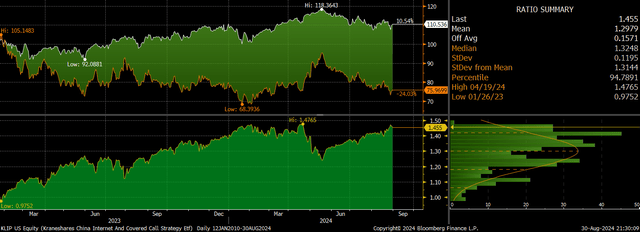

The buywrite strategy employed by the KLIP has been very successful since the ETF’s inception in January 2023. It has outperformed the KWEB by an impressive 46%, rising by 11% compared to the KWEB’s 24% decline. The KLIP has also enjoyed very little volatility when compared to the KWEB, suffering a maximum peak to trough decline of just 10% versus the underlying’s 31%.

KLIP Vs KWEB Total Return (Bloomberg)

For the ETF to record high single digit returns amid a decline in the KWEB is impressive, and suggests we would need to see significant market declines from already discounted valuations in order for this not to continue. As I expect the KWEB to rise over the coming months and years, I expect the KLIP to post at least 10% annualised total returns. Although I actually expect the KWEB itself to post stronger returns as Chinese tech stocks revalue, the KLIP’s guaranteed income and lower volatility make it preferable to more risk-averse investors. Indeed, during the KWEB’s 40% rally that occurred in the first half of this year the KLIP still managed to return 18%, so there is still potential for significant capital gains in the ETF.

Risks And Drawbacks

The main drawback of the ETF is its high expense ratio of 0.93%. Another is that the ETF has exposure to a market crash but significantly less exposure to a strong rally. This means there is potential for the fund to lose money even if the KWEB moved higher, if it does so in a particularly volatile manor with large pullbacks. However, such a scenario is highly unlikely and investors should expect strong risk-adjusted returns over the coming months and years.

Read the full article here