ETF Overview

iShares MSCI Eurozone ETF (BATS:EZU) owns a portfolio of about 230 large and mid-cap stocks from developed market countries that use the Euro as their currency. EZU’s expense ratio of 0.51% is not cheap relative to other peer funds. For example, Vanguard FTSE Europe ETF (VGK) only has an expense ratio of 0.09%. EZU’s net assets of about $7.8 billion is slightly less than one-third of the size of VGK’s net assets of about $26 billion. EZU currently has a trailing 12-month dividend yield of about 2.8%. EZU has steady performance in the past but trailed the S&P 500 index. Earnings growth for stocks in its portfolio is expected to accelerate in 2025 and 2026. In addition, EZU’s valuation is not expensive. Therefore, we think this is a good candidate for investors seeking some diversification in its portfolio.

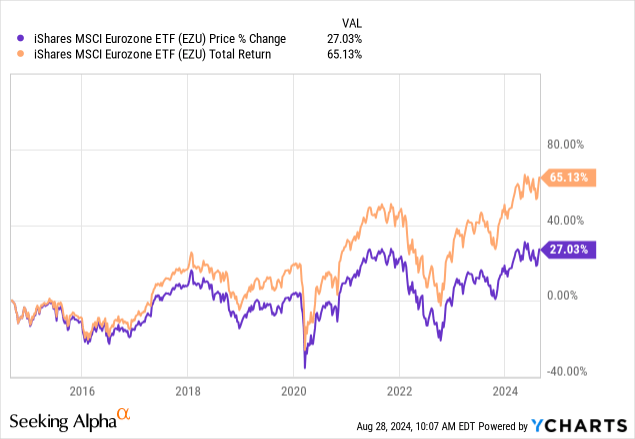

YCharts

Fund Analysis

EZU has steady performance but underperformed the S&P 500

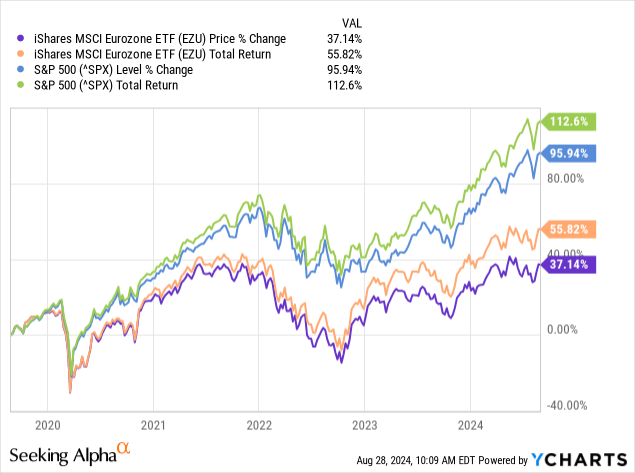

Following a period of decline in 2022, EZU’s fund price has steadily gained ground since October 2022. Earlier this year, EZU has finally surpassed its previous peak reached in mid-2021. As the chart below shows, the fund has delivered a price return of 37.1% and total return of 55.8% in the past 5 years. This return itself is not bad, but still lagged the S&P 500 index. As the chart below also shows, the S&P 500 index delivered a price return of 95.9% and total return of 112.6% in the past 5 years.

YCharts

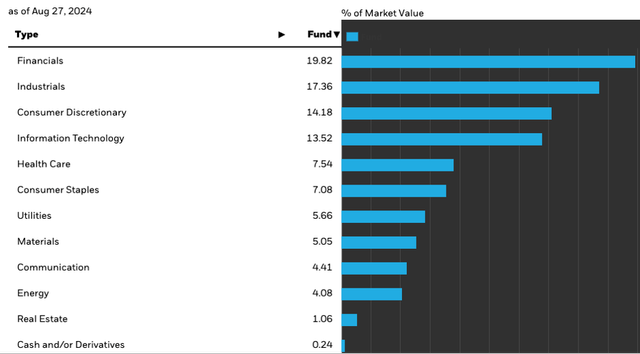

Balanced sector allocation, but not overweight in technology

One of the primary reasons of EZU’s underperformance relative to the S&P 500 index is likely due to its underweight in fast-growing technology sector. Below is a chart that shows EZU’s sector allocation. As can be seen from the chart below, not one single sector represents over 20% of the fund. This is good from a risk-management perspective. However, its exposure to information technology sector is only 13.5%. In contrast, the S&P 500 index’s exposure to information technology is 31.4%. As many investors know, technology sector has been riding on the tailwind of artificial intelligence in the past two years. Therefore, EZU’s low exposure to technology sector is one of the primary reasons why it has underperformed against the S&P 500 index.

iShares

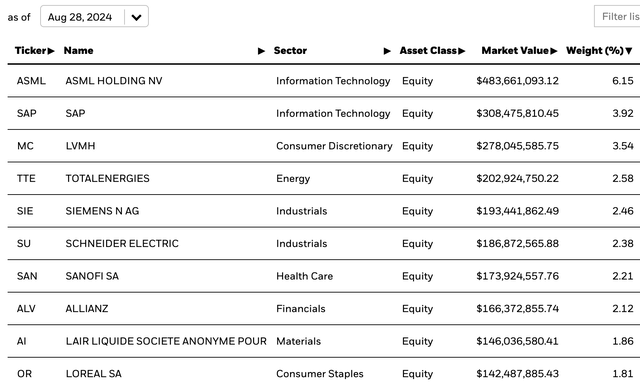

Below is a chart that shows EZU’s top 10 holdings. These top-10 holdings represent about 29% of EZU’s total portfolio. The good news is that not any one single stock represent over 10% of the total portfolio. Therefore, concentration risk is low. Its largest holding, ASML Holdings (ASML) represent about 6.2% of the portfolio. ASML should benefit from the surge of demand for semiconductors as the company is the sole supplier of EUV lithographic system, a crucial semiconductor equipment for advanced manufacturing.

iShares

Earnings growth expected to accelerate in 2025 and 2026

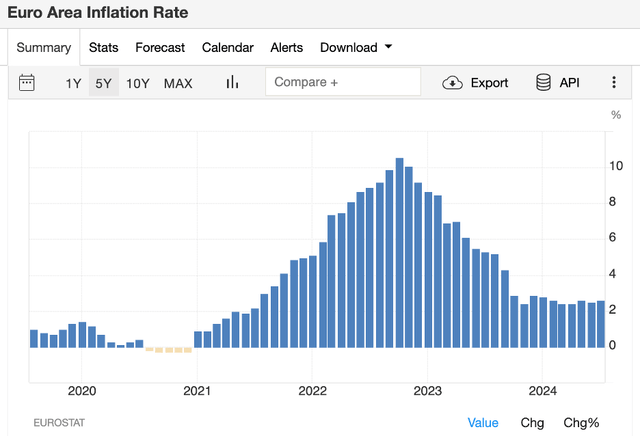

Like many other places in the world, Euro area economy went through the pain of high inflation in 2022 and the first half of 2023. Fortunately, inflation has receded as illustrated in the chart below. Inflation in the Euro area is now down to 2.6% in July 2024. This rate was much lower than the 5.3% inflation rate in July 2023. As inflation receded, European Central Bank now has more room to lower the rate. In fact, the bank has acted quickly to relax its monetary policy and lowered the rate by 25bps in June 2024. As we know, lower interest rate is vital to the strength of Euro area’s economy. Therefore, this is good news from a macroeconomic perspective.

Trading Economics

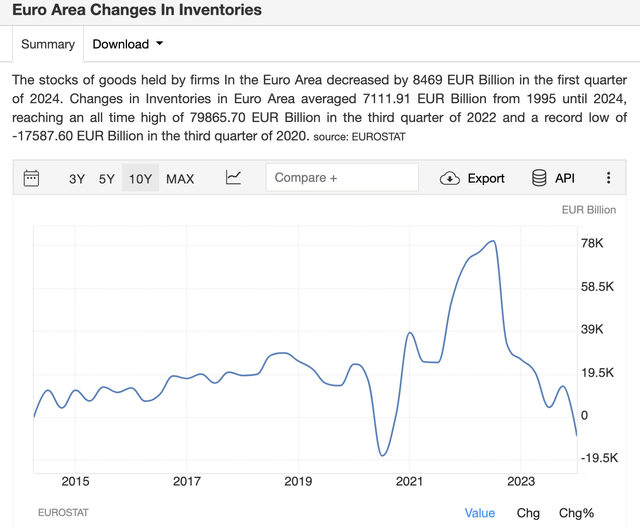

Besides cooling inflation, inventory in the Euro area continued its downward trajectory in 2024. As can be seen from the chart below, inventory in the Euro area continued its declining trajectory in the first half of 2024 from the peak reached in the third quarter of 2022. The inventory level is reaching a level we have not seen since 2020. This means that inventory correction in the Euro area may be overdone. As soon as the inventory adjustment reverses, economic activities will pick up and sectors such as industrials, consumer discretionary, and consumer staples may benefit. Since these three sectors represent about 38.6% of EZU’s total portfolio, we are positive about EZU’s earnings growth potential in the coming few years.

Trading Economics

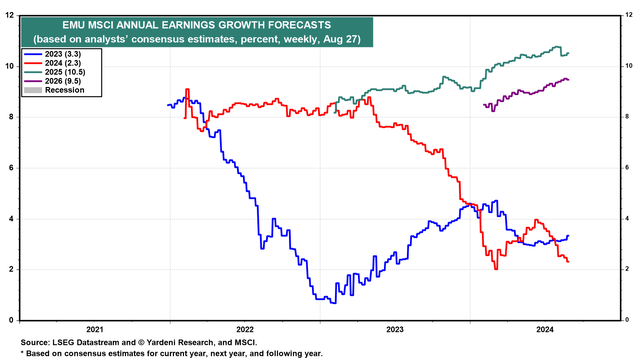

As we have discussed, the macroeconomic environment is turning more positive in the Euro area. As a result, many analysts now think the economy will likely be in better shape in 2025 and 2026 than in the previous few years. Below is a chart that shows the earnings growth forecast for stocks in EZU’s portfolio. As can be seen from the chart, consensus earnings for 230 stocks in EZU’s portfolio is expected to grow by 10.5% annually in 2025 and 9.5% annually in 2026. These double-digits or near double-digits earnings growth rates are much better than the low single-digit earnings growth rate of 3.3% in 2023, and the expected growth rate of 2.3% in 2024. Therefore, good growth potential is certainly there for stocks in EZU’s portfolio in the next two years.

Yardeni Research

Attractive valuation

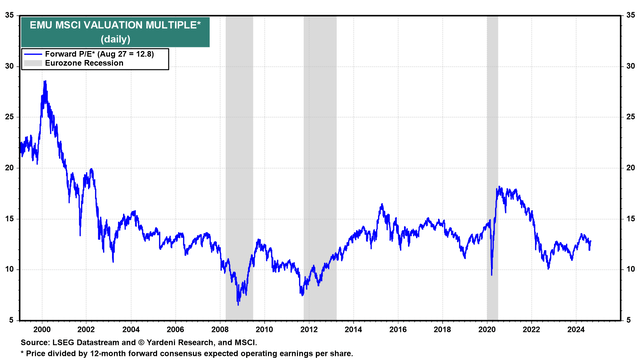

Besides accelerating earnings growth expectations in 2025 and 2026, EZU’s valuation appears to be fair. Below is a chart that shows its forward P/E ratio in the past 25 years. As can be seen, its forward P/E ratio of 12.8x is below the cyclical peak of over 18x in 2021 and also lower than the valuation between 2015 and 2018. Therefore, we do not think EZU as expensive. In fact, it is attractive if we consider its earnings growth prospect in the next two years.

Yardeni Research

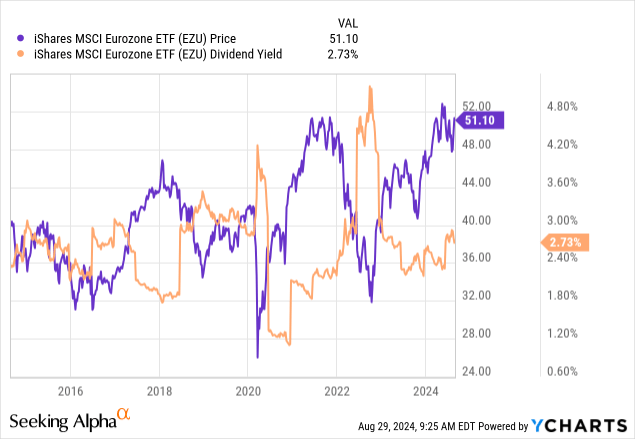

Dividend yield of 2.7%

EZU currently has a 12-month trailing dividend yield of about 2.7%. In the past 10 years, its dividend yield is usually in the range of 2% to 3.5%. Therefore, its dividend yield is in the middle of this yield range. This is better than the S&P 500 index’s dividend yield of 1.3%.

YCharts

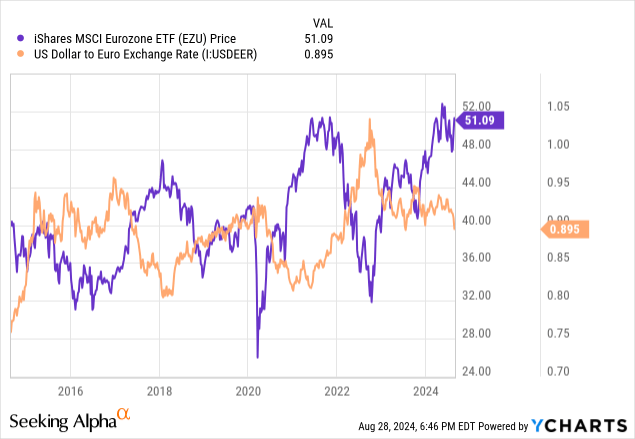

Risk: EZU’s fund price can be impacted by foreign exchange rate

Finally, we think it is important to highlight the risk of foreign exchange rate. Below is a chart that compares EZU’s fund price vs the U.S. dollar to Euro exchange rate. As can be seen from the chart below, EZU’s fund price is inversely correlated to the strength of the US dollar. A strong US dollar relative to the Euro usually results in declining fund price and vice versa. Fortunately, the Federal Reserve may soon begin to lower the rate, and this may result in a further weakening U.S. dollar.

YCharts

Other risks of owning EZU include surging inflation that could derail the positive growth prospect in Europe area, especially if war in the Middle East and Ukraine escalates.

Investor Takeaway

Consider EZU’s earnings growth potential in 2025 and 2026 and its inexpensive valuation, EZU is attractive. Therefore, we think it is a good candidate for investors seeking some diversification in its portfolio.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Read the full article here