I thought Wendy’s (NASDAQ:WEN) looked cheap enough when I opened on it with a ‘Buy’ rating late last year. Sure, there is a lot that is so-so here, including unit economics and growth prospects, but these shares were offering up a 5% dividend yield back then, and that really didn’t require too much supplemental growth from the business in order to work for investors.

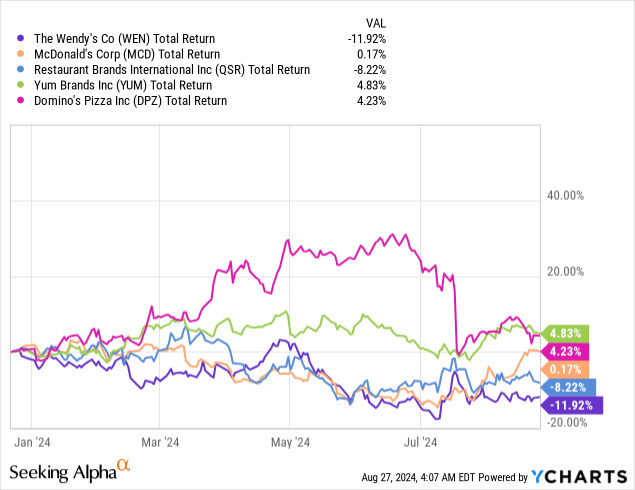

The stock has definitely disappointed in that time. This isn’t an easy period for quick-service restaurant players, but a circa negative 11% total return still lands Wendy’s near the bottom of the pack versus peers.

The bad news is that Wendy’s is definitely going through a soft patch. The good news, if you can call it that, is that this does look cyclically driven rather than anything company-specific. How long this persists is obviously a legitimate concern, especially for those sensitive to shorter-term returns. That said, the dividend yield is now closing in on 6%, and that looks like a good deal for those prepared to hold through the cycle.

Working Through Cyclical Softness

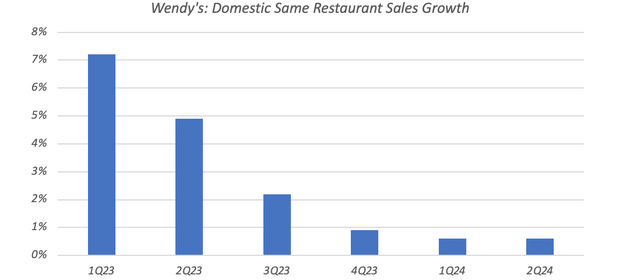

Wendy’s has released three sets of quarterly figures since my opening piece, and business is definitely slowing. Domestic same-store sales growth landed at just 0.6% last quarter, flat versus Q1 but down from mid-single digit growth in the year-ago period. The trend at this point looks pretty clear, with domestic comps heading lower for some time now. Globally, year-to-date same-restaurant growth was just 0.9% through Q2.

Data source: Wendy’s quarterly results releases

Comps are obviously weak, especially since management initially guided for 3-4% global same-store growth this year. That said, I don’t think this is a Wendy’s-specific issue. In fact, Q2 comps were actually a little stronger here than at burger-related peers. McDonald’s (MCD), for example, posted a 0.7% decline in domestic comparable sales last quarter, worse than the modest growth that Wendy’s carved out. Burger King, owned by Restaurant Brands (QSR), likewise posted pretty weak figures, with domestic comps growth clocking in at just 0.1% last quarter. So, while growth is grinding to a crawl, I’m inclined to buy the idea that this is just a broader slowdown – and that’s not exactly farfetched given where we are in the interest rate cycle.

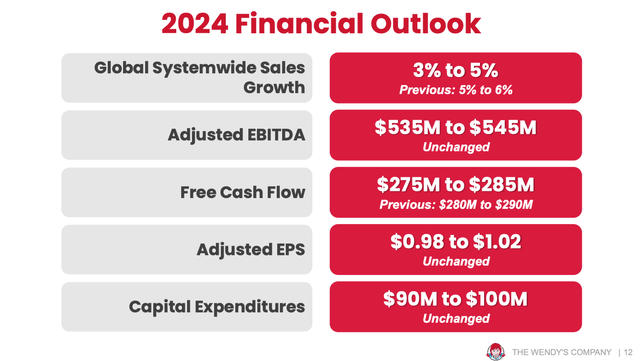

Even so, weak performance year-to-date has forced management into downgrading full-year guidance, with same-store sales growth now seen up 1-3% (versus 3-4% previously) and system sales growth seen at 3-5% (versus 5-6% before).

Source: Wendy’s Q2 2024 Results Release

Unit-level economics are also a little mixed. Wendy’s posted a 16.5% restaurant-level EBITDA margin last quarter, down around 80bps year-on-year. Year-to-date performance through Q2 was about flat on 2023, clocking in at a shade under 16%. Management also downgraded guidance a touch here, with the range for the full-year margin expanding at the low-end to 15-17% versus 16-17% initially. Looking back, mid-point guidance for this year is roughly in line with 2018-2019 levels (i.e. pre-COVID and COVID-driven inflation etc.).

This is important for two reasons. One, Wendy’s obviously operates some restaurants itself (~6% of the total to be precise), so there’s a direct link to its P/L statement. More importantly, this line drives longer-term growth in high margin royalty fees, as franchisees making good store-level returns will be incentivized to expand. Digging a little deeper on this, franchisees pay a mid-single-digit percentage of sales in royalties, so their EBITDA margins are likely somewhere in the low double-digits versus ~16% for company-operated outlets. Last year, franchised units averaged around $2 million in sales, so as a rough guess I would say average franchisee EBITDA per outlet is around the $240,000 mark. Costs to open up a Wendy’s seem to land around $2 million or so, implying unlevered cash-on-cash returns of around 12% on average. That isn’t amazing, but it’s not very bad either.

A quicker way to view franchisee returns is simply to check if the restaurant estate is actually growing. If it is, franchisees are probably making a reasonable return on their money. This is where the picture is a little bit more positive for Wendy’s. This isn’t a great environment for opening up new units, with consumer finances and store-level economics weakening; plus, interest rates are obviously still quite high, making financing tougher. Even so, Wendy’s continues to report modest estate growth, with total global units up to 7,261 from 7,166 last time.

Wendy’s also has some decent same-restaurant sales growth drivers. Breakfast sales, for example, were somewhere in the $4,000 per store per week area last year, implying a roughly 10% share of total restaurant-level sales. In contrast, breakfast accounts for around a quarter of business over at McDonald’s. Management wants to increase that dollar amount by 50% over the next few years, which would go some way to closing that gap.

This comes with two benefits. Firstly, there is a correlation between sales and store-level margins, as restaurants come with a lot of fixed costs. Scaling up breakfast would therefore boost unit sales and, by extension, economics (with the added benefits that bring). Secondly, breakfast is typically the most profitable daypart, so store-level economics could see an ever bigger boost by increasing its share of total sales.

Valuation

Wendy’s is more of a U.S. player compared to many of its peers, so I expect its long-term growth prospects to be slightly more pedestrian. That said, I think investors can afford to be quite sanguine about this. Growth is important insofar as it is needed to justify a given valuation, and at $16.85 as I type, Wendy’s stock is only trading for around 16x 2025 consensus EPS.

Investors don’t need exceptional growth to make that work. Driving incremental growth in earnings doesn’t require much investment here, as franchised store-derived earnings are very capital light. Indeed, Wendy’s currently pays out all of its earnings by way of its dividend.

That dividend is currently yielding almost 6%. A couple of points of growth on top from both same-restaurant sales and net unit growth would get investors to ~10% annual returns from there, and Wendy’s is likely able to leverage system sales growth into a much higher rate of earnings growth. The bad news is that this isn’t a near-term story, with 2024 consensus EBITDA of around $535 million essentially pointing to a flat year here.

Summing It Up

Wendy’s has definitely hit a soft patch since my opening piece, with comps slowing and restaurant-level margins weakening a touch. While this is likely to result in a subdued year for the firm, these shares now offer a dividend yield that is approaching the 6% mark. Longer term, that can work out just fine, even with fairly modest contributions from same-restaurant sales and net unit growth. For investors happy to hold through the cycle, Wendy’s stock might be worth another look at this point.

Read the full article here