At the beginning of the month, Hercules Capital’s (NYSE:HTGC) valuation plummeted from more than $21 to $17 on concerns that the U.S. economy would go into a recession and that the Federal Reserve was set to lower the federal fund rate. Falling interest rates are universally recognized as a challenge to BDCs that invest in variable rate debt. However, Hercules Capital’s second-quarter earnings were robust, with the investment firm supporting its dividend with net investment income by a very decent margin. With shares now trading at a more reasonable P/NAV ratio, I believe the risk profile has improved greatly on the drop, and I am upgrading shares to buy again.

Previous rating

Although the BDC reported strong net investment income results in the last several quarters, I adopted a more neutral stance on Hercules Capital in February due to valuation concerns: Wait For A Drop Before Buying This 10% Yield. I also pointed to a potential overvaluation of HTGC in my work in May. I am upgrading shares again to buy as the BDC’s valuation and risk profile improved considerably this month and because Hercules Capital continued to submit a strong Q2’24 earnings sheet, showing high-single digit growth in its net investment income.

Favorable investment trends

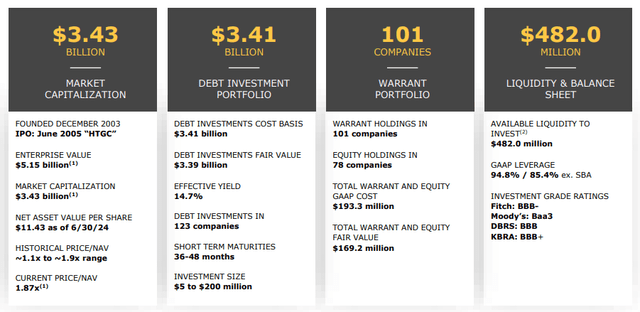

Hercules Capital is focused on a small number of industries including technology, life sciences and sustainable/renewable technology. The BDC is chiefly investing in venture-backed companies and prioritizes debt investments, but it is also known for taking equity positions in its portfolio companies. The debt portfolio was valued at $3.41B at the end of the June quarter compared to $3.38B in the previous quarter.

Hercules Capital

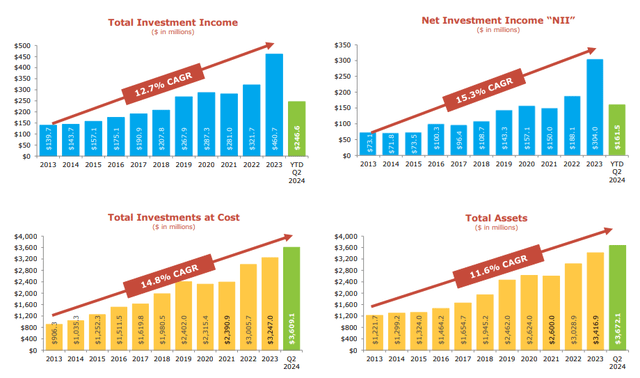

Hercules Capital is seeing strong portfolio growth and total investment income trends in its portfolio. In the last decade, Hercules Capital achieved 13% annual growth in total investment income while its total assets increased a CAGR of 12%. This consistent growth, paired with a low non-accrual percentage (high asset quality) and considerable excess dividend coverage, has led shares to trade at a massive premium to net asset value over time.

Hercules Capital

In the second quarter, Hercules Capital’s asset quality deteriorated quarter-over-quarter, but remained below 1.0%. The non-accrual percentage, which measures the amount of impaired loan in a BDC’s debt investment portfolio, increased from 0.1% in Q1’24 to 0.9% (based off of fair value) in Q2’24.

|

$M |

Q2’23 |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

|

Total Investments |

$3,114.1 |

$3,308.9 |

$3,247.0 |

$3,575.0 |

$3,609.1 |

|

Non-Accrual (at FV) |

0.0% |

0.8% |

0.0% |

0.1% |

0.9% |

|

Non-Accrual (at cost) |

0.4% |

2.7% |

1.0% |

1.2% |

2.5% |

(Source: Author)

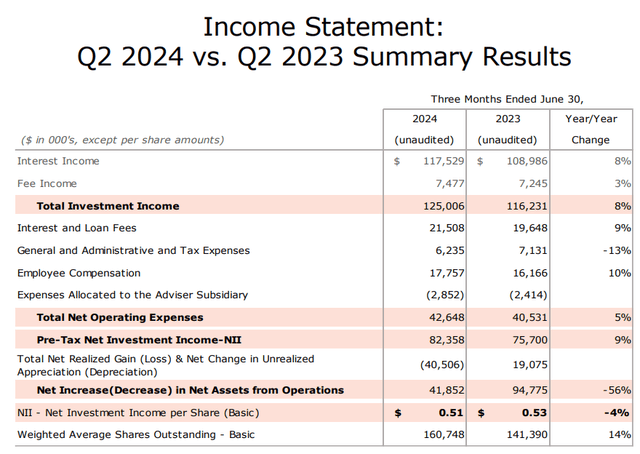

Hercules Capital benefited from high-single digit growth in its key income item, interest income in the second-quarter: the investment firm generated 8% year-over-year growth and achieved $117.5M in interest income in Q2’24. This resulted in a 9% boost to the company’s net investment income, which forms the basis for the calculation of my distribution coverage ratios below. Growth in interest income has been related to Hercules Capital mainly structuring a rate-sensitive debt portfolio: approximately 97.4% of investments were made in variable rate debt at the end of the June quarter.

Hercules Capital

The business development company covered its $0.40/share regular dividend with net investment income easily: the BDC generated 1.28X distribution coverage with regard to the regular distribution compared to a distribution coverage ratio of 1.25X in the previous quarter. It should be understood that Hercules Capital is paying supplemental dividends of $0.08/share each quarter at the moment which complements the regular dividend income investors receive. As a result, the current, annualized distribution (regular + irregular) amounts to $1.92/share which calculates to a dividend yield 10.4%.

Hercules Capital’s valuation

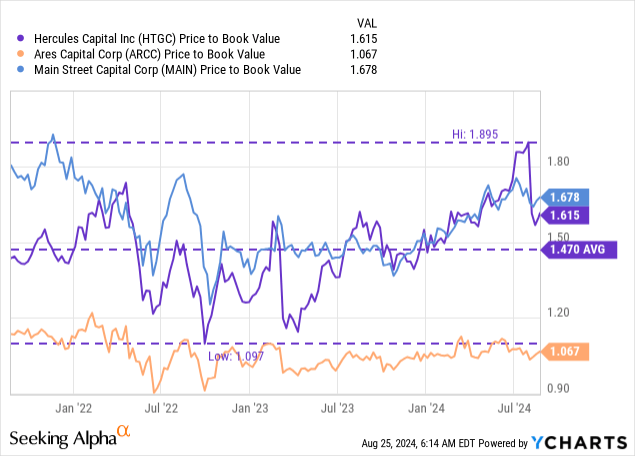

The share price drop at the beginning of the month has made shares of Hercules Capital quite a bit cheaper which is why I see an engagement opportunity here with the BDC. However, income investors still pay a considerable premium to net asset value as Hercules Capital remains one of the most expensive investment firms in the BDC industry.

Shares of Hercules Capital are currently trading at a price-to-NAV ratio of 1.62X which is still above the company’s longer term P/NAV ratio of 1.47X. Investors have been willing to pay a very high premium for Hercules Capital’s dividend, in large part because the company has had strong asset quality and a record of achieving considerable excess dividend coverage. In terms of valuation, only Main Street Capital (MAIN) is in the same valuation category with a P/NAV ratio of 1.68X.

The price investors pay here is still high with a P/NAV ratio of 1.62X, but the valuation is nowhere near where it was just one month ago, at 1.90X NAV. I do expect Hercules Capital to keep trading at a considerable premium to net asset value going forward, however, as investors value the BDC’s well-supported 10% yield as well as the supplemental dividends.

Risks with Hercules Capital

Hercules Capital is a tech-focused BDC that has made a name for itself in a narrowly defined niche. Hercules Capital mostly invests in companies in the technology, life sciences and sustainable/renewable technology industries, which gives the investment firm a limited, yet lucrative target market. A down-turn in these industries or decreasing risk appetite in the IPO/M&A markets may prevent the company from exiting its investments at lucrative multiples, which is one major risk that I see, especially with investors seemingly worrying more about a recession now. Further, Hercules Capital is chiefly invested in variable rate loans, which have driven interest income gains for the BDC in the last several quarters.

Final thoughts

Investors that want to buy a high-quality business development company with good balance sheet quality and a solid distribution coverage profile, should consider buying Hercules Capital on the drop: they can now secure a 10% yield that is highly sustainable, in my opinion. Although Hercules Capital is not cheap (in comparison to other BDCs), the investment firm’s shares are much cheaper today than just one month ago. While the BDC’s asset quality slightly deteriorated in the last quarter, Hercules Capital is a high-quality BDC investment for income investors, in my opinion, and the drop represents an attractive engagement opportunity for income investors.

Read the full article here