Introduction

A REIT (Real Estate Investment Trust) is a simplified way to invest in real estate and receive income and potential capital gains as managers monetize property prices, as indicated by pundits. My experience with REITs has been mixed, I have not seen the yield (dividends distribution) more attractive than many bond or structured income funds while the growth or capital appreciation is far less than more mature dividend growth-focused companies. At the same time, REITs are susceptible to macro and rate risk, as seen in the recent past. I analyzed the abrdn Global Premier Property (NYSE:AWP) to see if a global property mix might do better, and it does not.

Performance

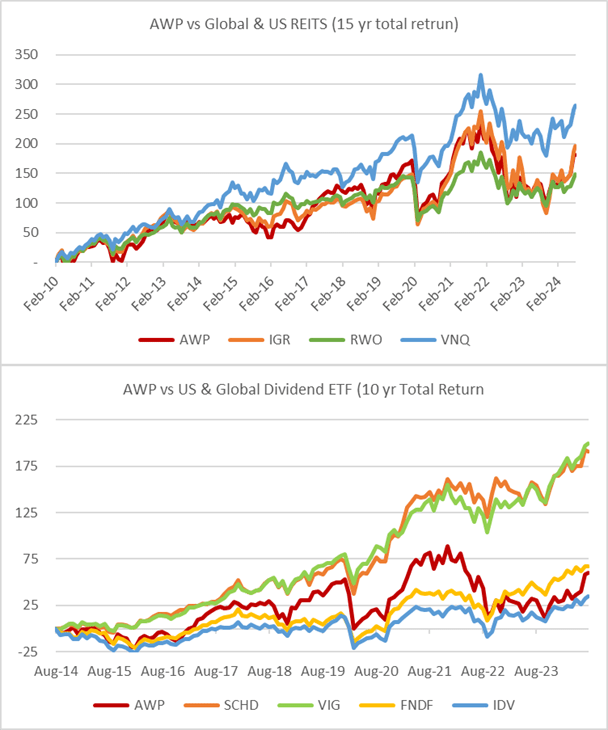

I compared AWP to some larger REIT ETFs as well as Dividend-focused ETFs. I used total return, which incorporates dividend distribution. (Note that AWP is a closed-end fund and may trade at a discount to NAV which may increase reinvestment gains.) I also used a 10-year and 15-year time period to make the comparison and excluded the 2008-2009 time frame, which negatively impacted AWP. As seen in the charts below the fund has performed in line with global REIT ETFs but below US REITs, which may be attributed to USD strength. When compared to dividend-focused ETFs the performance diverges considerably with the US market far above the global dividend portfolios and AWP.

Created by author with data from Capital IQ

Fund Strategy

AWP has several differences from an ETF REIT. It is a closed-end fund that can use leverage, up to 33% of NAV, and while it benchmarks vs the FTSE EPRA Nareit Global Ex US TR USD index it is free to select and weight stock/REITS as it sees fit. In addition, AWP has a managed distribution policy, where it sets a monthly dividend per-share payout that is funded by investment income (dividends from the holding), and capital gains (trading), and if this is not enough to cover the distribution it returns capital or (ROC). Many view ROC as a tax shelter but I view it as NAV destruction and easily abused by funds to lure investors into “high-yielding” instruments.

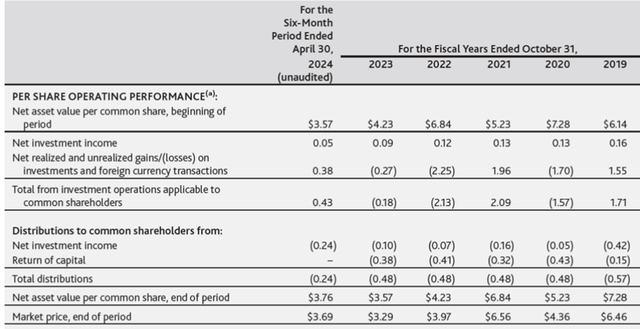

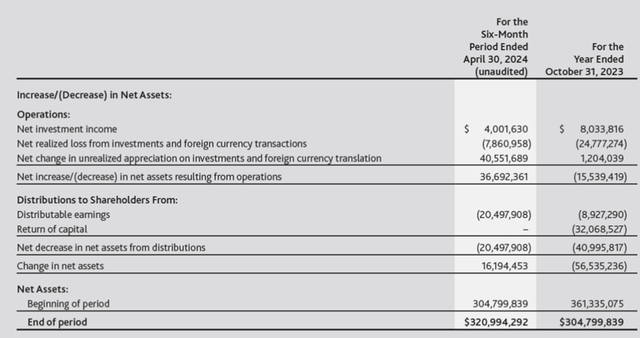

Distribution Detail (abrdn)

Distribution Detail (abrdn)

Portfolio Upside Potential

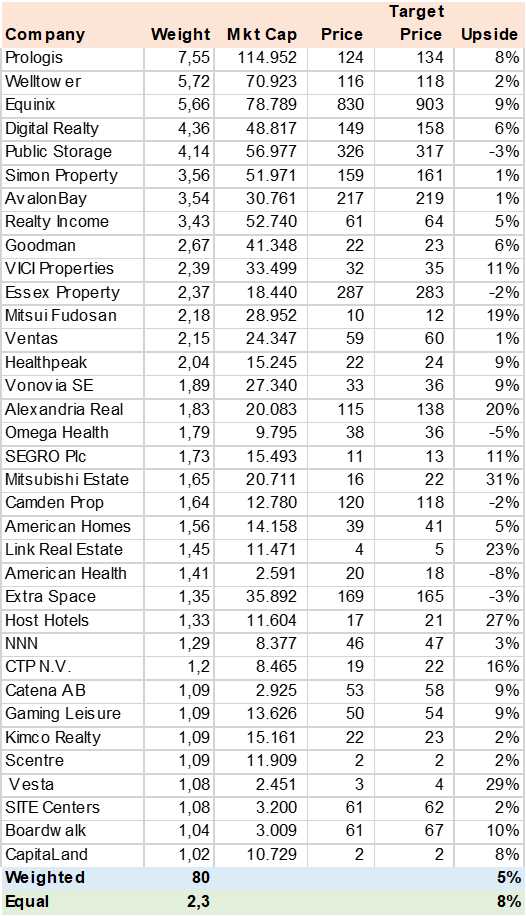

The current portfolio has 65 positions with 64% of AUM in the US flowed by 8% in Japan and 5% in Australia. I gathered consensus estimates for 80% of AUM and calculated the weighted upside potential using analysts’ price targets. The result is less than exciting, with 5% estimated gains in the next 12 months. The top two stocks by upside are Corporación Inmobiliaria Vesta (VTMX) a Mexican Industrial developer that is befitting from nearshoring and Mitsubishi Estate (OTCPK:MITEY) in Japan.

Consensus Upside (Created by author with data from Capital IQ)

Dividend Potential

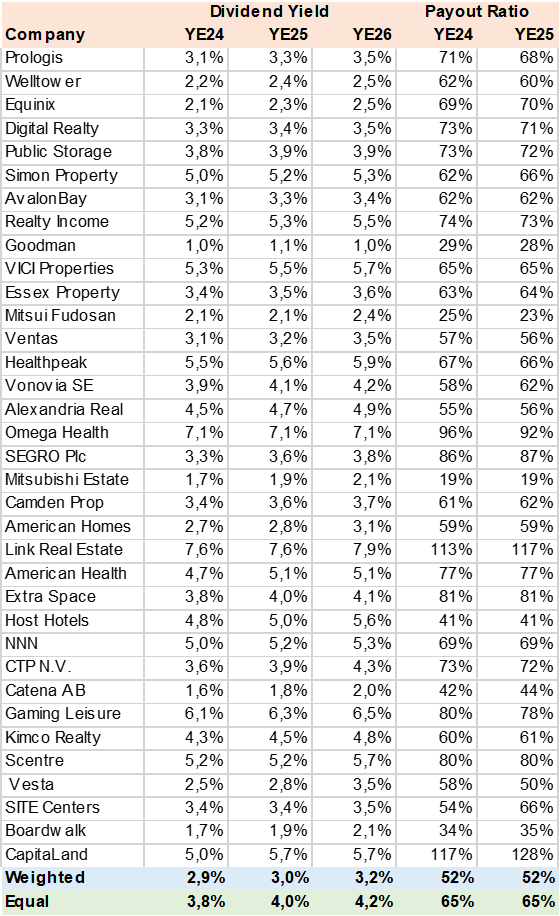

I also used consensus estimates to calculate the portfolio dividend yield, which does not seem compelling at a weighted 3% with very modest growth forecasted in the next two years. On the positive side, the payout from FFO (Funds From Operations) is 52%, which may allow for increased dividends. The investment income of 3%, even when levered by 33%, is not enough to cover the AWP distribution policy and the managers need to trade to generate capital gains or be forced to return capital.

Consensus Dividend Yield (Created by author with data from Capital IQ)

Risk

The fund has extensive risk, not only from real estate operations in the various holdings, but also currency risk given that 36% of AUM is not in USD. It also has interest rate risk, not only from a top-down perspective that may impact REIT valuations but also from the debt cost of the leverage. Fortunately, except for Japan, the world is in a declining rate environment. The greatest risk is not meeting the distribution policy, which forces managers to trade the portfolio for capital gains or reduce NAV with return of capital.

Upside Risk

The main risk to the sell rating is a sharp reduction in interest rates across the world, which would have a positive impact on asset values, especially on real estate and REITS. The other upside risk is if management can effectively trade and generate capital gains above the distribution plan and cushion return on capital risk.

Conclusion

I rate AWP a sell. No real surprise, the REIT industry does not offer compelling total returns and this fund’s distribution policy creates further stress by forcing managers to trade for capital gains or return capital, which is NAV destructive in my view.

Read the full article here