Miller Industries (NYSE:MLR) might just be the easiest company in the world to understand. The company buys truck chassis manufactured by other companies and puts its own tow truck bodies on them.

The company does not hold a monopoly on the industry, but it is widely accepted to be the biggest player. The company says in its annual report that it is “The World’s Largest Manufacturer of Towing and Recovery Equipment,” and this is probably an accurate statement. The company’s brands include: Century, Vulcan, Chevron, Holmes, Challenger, Champion, Jige, Boniface, Titan, and Eagle.

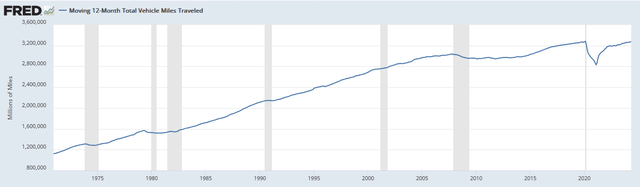

The demand for tow trucks is partly determined by the number of miles driven. As might be expected, the number of miles driven dropped significantly during the pandemic, and probably from the work-from-home culture that came out of that. However, the number of miles driven has almost matched the high number in February 2020.

Federal Reserve Bank of St. Louis

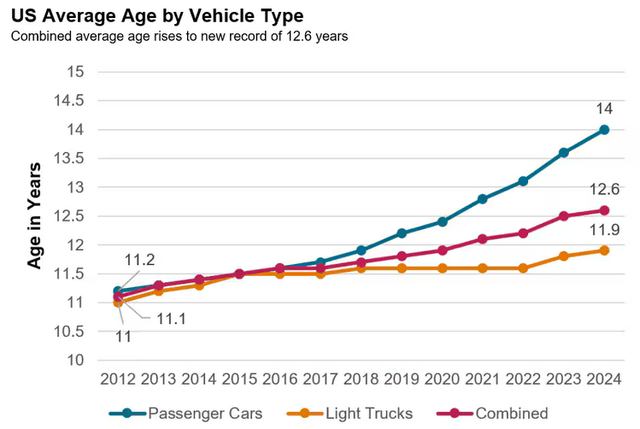

The average age of vehicles on the road also impacts demand for tow trucks. The older a car is, the more likely it will break down, and the more likely it will need to be towed.

S&P Global Mobility recently reported that “The average age of cars and light trucks in the United States has risen again to a new record of 12.6 years in 2024, up by two months over 2023.”

S&P Global

Miller is in a good position to grow with these trends.

A New Focus on Rewarding Investors

Advisory Research invested in Miller in August 2022. Since then, they visited Miller’s facilities and talked with distributors, customers, and employees. They also talked with management. Then they published a public letter in March, basically saying that the stock price was too low and that the board should sell the company:

we are calling on the Board to form an independent committee to conduct a strategic review that will develop a credible long-term plan to be compared to alternative strategies, including a sale of the Company at a meaningful premium to present value. We believe the Company is an attractive target for strategic acquirers in the sector, and that it could fetch a more than 30% premium relative to its current valuation in a transaction.

Miller made a public reply the same day rejecting outright Advisory Research’s letter:

We’re disappointed, but perhaps not surprised that after months of earnest engagement, Advisory Research has concluded that it is not willing to put its thesis to a vote to shareholders, but has instead decided to make a self-serving and short-sighted public complaint, with spurious allegations and no credible path for long-term value creation.

While Advisory Research was shown the door, their efforts appear to have made some impact on Miller’s board.

Weeks before Advisory Research’s letter went public, Miller announced that it was raising its dividend to $0.19 per share, a 5.6% increase. To be fair, Miller has paid a dividend for 53 consecutive straight quarters, right through the pandemic. That was no small feat. Even so, the dividend increase was the first since March 2017.

Less than two weeks after Advisory Researcher’s letter went public, Miller announced a $25M share repurchase program.

Will Miller mentioned these efforts in the latest earnings call. He said, “We… work diligently to invest our capital to maximize shareholder returns through continued investment in the business, quarterly dividends and our share repurchase program.”

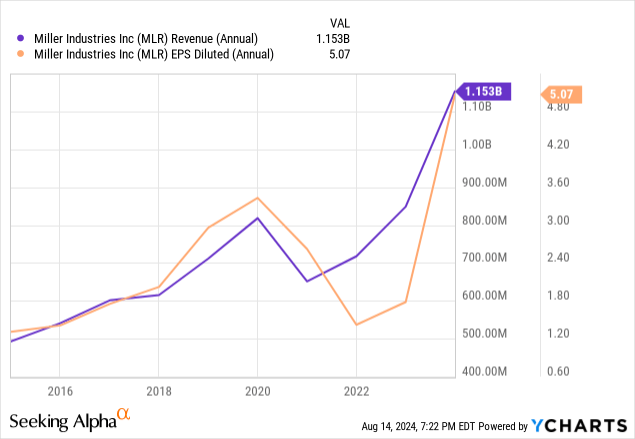

The Numbers are Good

Miller can afford the dividend increase. Revenue and earnings have rebounded since the pandemic, and has been making records:

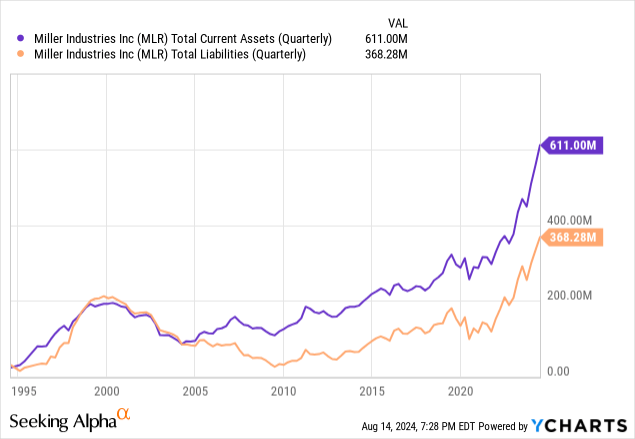

The company has always kept a pristine balance sheet. As CFO Debbie Whitmire put it in the same earnings call, the company is “debt-adverse.” The company typically stays debt-free, and when it does borrow, it typically pays off the debt within a couple of years.

Whitmire did state during the call that the company borrowed $15M to “fund our growth”. CEO Will Miller also mentioned, “production capacity expansion plans, but as normal, details are scarce.

The company has a Quick Ratio of 1.4, a Current Ratio of 2.1, and their Current Assets are significantly greater than their Total Liabilities. Few companies in the automotive industry have such financial discipline. The only other one I am aware of is Gentex (GNTX).

But is it Fairly Valued?

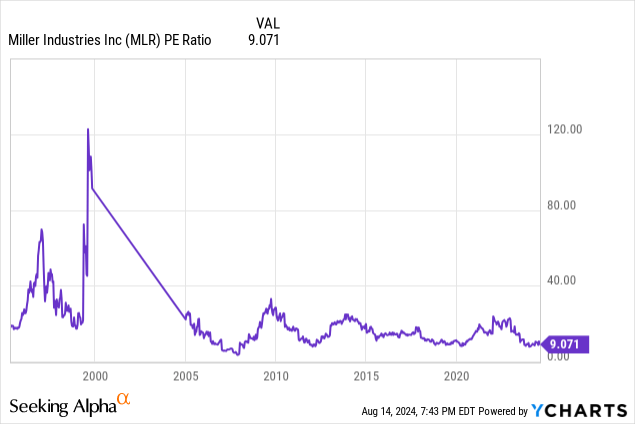

At 9.0, the P/E Ratio is nearly at a ten-year low, and this is only the fourth time in twenty years that the P/E has been this low.

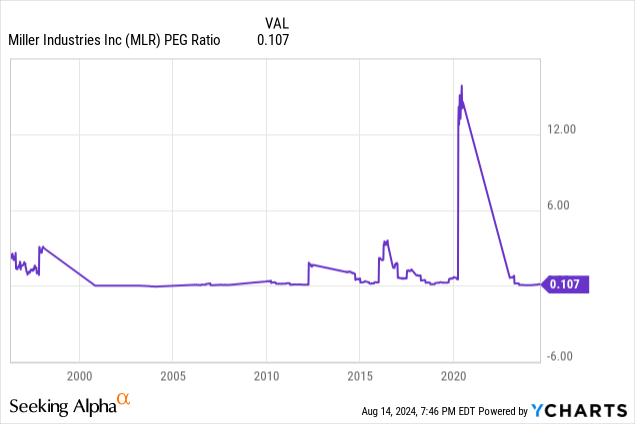

The PEG Ratio spiked during the pandemic, but is now at a very inviting 0.107.

As nice a number as that is, the PEG Ratio can be somewhat erratic, as can be seen above. I myself prefer an old tool from the value hunters’ toolbox called Net Current Asset Value Per Share (NCAVPS). The formula I use is:

- Price / (Current Assets – (Total Liabilities + Preferred Stock) / Shares Outstanding)

Warren Buffett used the approach for what is known as “cigar butt” investing. I decided years ago to use the ratio not for cigar butts, but instead with growing companies that pay a dividend. It was and continues to be a unique way to approach GARP investing that has proved itself.

In 2016, I published my initial article using the approach. I applied it to twelve dividend payers, and Miller was the one that stood out from the crowd. It had a Price/NCAVPS of 1.97 at the time. Since then, I have very rarely seen a quality dividend payer drop below 2.0. Any quality dividend payer with a Price/NCAVPS in single digits catches my attention.

In 2017, I wrote my first article on Miller. Since that time, the company has had a Total Return of 164%.

As of this writing, Miller has a Price/NCAVPS of 3.6. It may shift some before publication, but single digits is a fine ratio for a growing dividend payer.

What Can Go Wrong?

The company is dependent on other companies for components. In particular, they depend on other manufacturers for chassis. This was problematic during the pandemic.

The stock price has nearly tripled in the last two years. There is a possibility that investors will take profits, especially if rates are not cut as quickly as currently anticipated.

Advisory Research aside, management may not have much motivation to grow much more. Years ago they faced antitrust threats from the government, and as long as the Miller family controls the company, they may not want to face that again. There are growth possibilities overseas, but that business has not grown very quickly in the past. If Advisory Research sells out, the company might revert to the status quo.

Conclusion

Having said that, Miller is growing today. The company has a strong balance sheet, and they have started to be more friendly towards investors. The valuation looks good by three different metrics. I rate the stock as a buy.

Read the full article here