Investment thesis

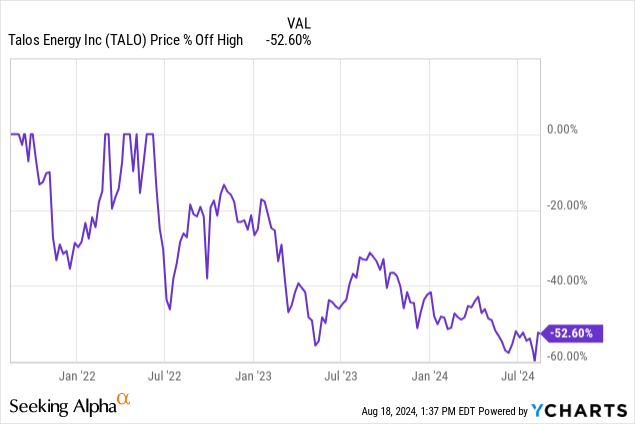

Talos Energy (NYSE:TALO) is a rising oil producer in the Gulf of Mexico that trades at sizable discount to its net asset value (or NAV). I was excited about this stock in 2022-2023 but its performance has been disappointing:

I believe this was largely driven by the negative short-term consequences of management’s long-term growth strategy. Talos management was always clear they were pursuing growth and scale, especially when the acquired assets offered developmental synergies (e.g. tiebacks to existing offshore infrastructure). In that regard, TALO’s acquisitions over the past two years can be seen as the successful implementation of the stated strategy.

Unfortunately, most acquisitions were stock deals and the acquired targets were private operators backed by private equity capital seeking exit liquidity. In the short run these deals created many structural sellers in an otherwise not very liquid stock and that has naturally weighed down on the share price.

What has changed recently?

With each deal, Talos has gotten bigger which brings two benefits. First, as the share count has grown, so has liquidity. Second, future acquisitions should represent a smaller part of the enterprise value. This means they can be financed by fewer shares or even entirely by cash and debt.

A key development has been that Talos managed to attract Mexican tycoon Carlos Slim as a strategic investor. Initially, TALO partially monetized its interest in the Zama field offshore Mexico by selling a stake to an entity affiliated with Slim. However, Slim’s family office has also been adding shares directly and now owns about 20% of Talos. So far Slim seems to buy more when the stock gets oversold and should be a stabilizing factor.

Perhaps most importantly, Talos Energy’s management finally seems a bit frustrated with the stock price and is signaling it is ready to take action to bring it higher. TALO is now free cash flow (or FCF) positive and the company has already started buybacks so management isn’t just engaging in “cheap talk.”

The reality for energy investors has been that generalist capital has shown little appreciation for oil stocks just because their multiples are low. However, the companies that actually started aggressive buybacks have done quite well. Talos seems to be learning this lesson and the string of stock deals was maybe just the necessary evil to reach critical mass.

If asset value mattered, TALO would be $18

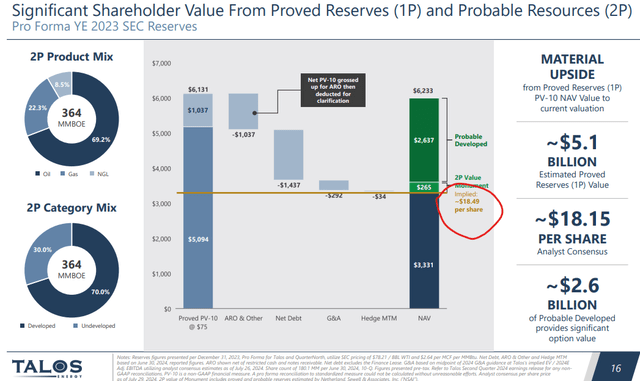

On a NAV basis, TALO should be worth close to $18 which is 50% upside from the current $12:

Talos Energy Presentation

This can also be seen as a conservative calculation because it only attributes value to the so-called “proved reserves.” Oil companies typically get credit too for their 2P or “probable” reserves and factoring these in would imply an even higher fair value for TALO.

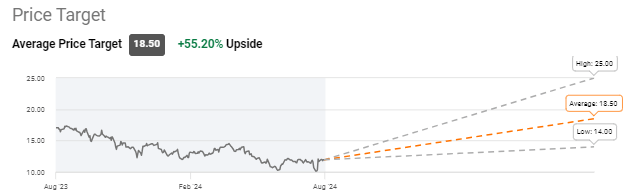

Wall Street analysts have a price target in the same ballpark:

Seeking Alpha

Crucially, the valuation thesis is not about oil prices. The PV-10 asset value measure assumes a $78 oil price, which is pretty much in the middle of the WTI (CL1:COM) trading range last couple years. So the argument is not that if oil prices go up, TALO will go up. If they do, that is indeed a very likely outcome, but that is not the point. Rather, if oil stays in its current range, TALO should still go up as it generates FCF that is converted into buybacks.

Greater liquidity and fewer structural sellers

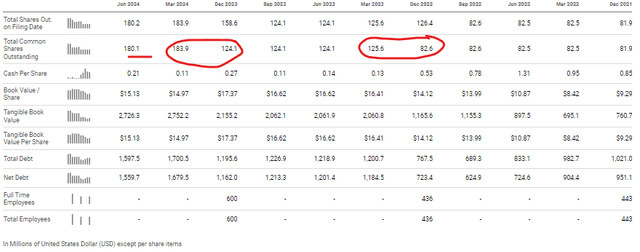

If you look at Talos Energy’s share count over time, you can easily spot the bigger acquisitions:

Seeking Alpha

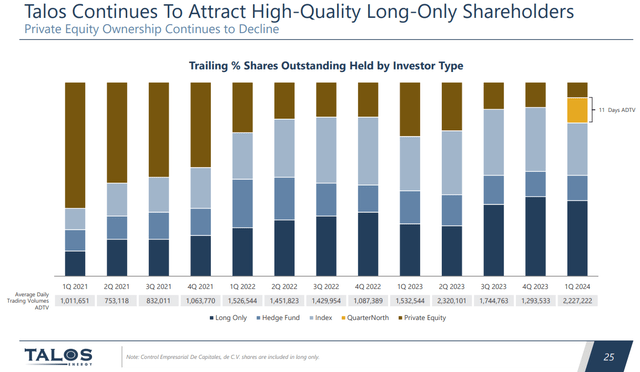

The private equity funds that sold assets to Talos then basically sold their shares, creating sustained selling pressure. TALO itself was also PE backed before it became public, and it took some time to work through this residual ownership. However, PE interest in TALO is now at historical lows:

Talos Energy Presentation

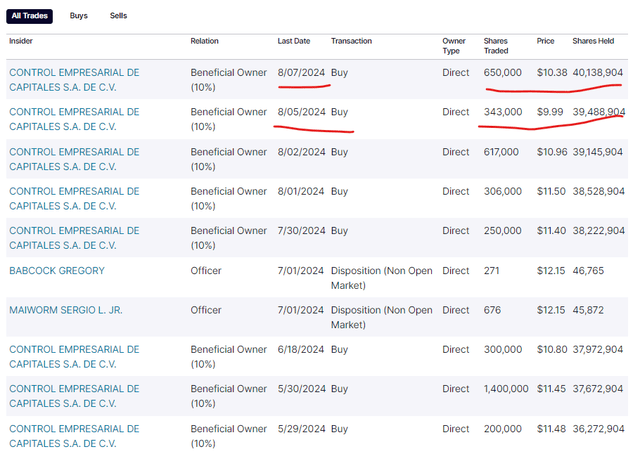

In the meantime, daily trading volumes have more than doubled while Carlos Slim keeps building up his position with the latest buys this August when the share price dipped to $10:

nasdaq.com

In November 2023 Carlos Slim had 13 million shares which have now grown to 40 million. Mr. Slim appears happy to provide exit liquidity to the PE sellers in the low teens, and I don’t think his long-term plan is to lose money.

Management is unhappy with the stock price

Management openly commented on the stock price on the Q2 earnings call:

We do recognize that some folks may think about the discount rate here or the cost capital a little bit higher than the PV-10s and that’s fine. But I think the main focus of that comment was that there is so much value above and beyond PV-10 above and beyond proved reserves, that even if you assume a higher discount rate, there’s so many other avenues that you can get to a much higher stock price or market capitalization than what we currently have, that folks should feel comfortable, even with a higher discount rate, that the stock is actually pretty undervalued compared to the fundamental value of our business, right, even at a slightly higher discount rate.

Management also seems to understand that the only proven method to get the job done is through buybacks:

Now, with that free cash flow, we were able to also continue to pay down our debt. We paid down $100 million of debt, and then opportunistically we used some of the previous buyback authorization to buy 3.8 million shares in the open market. And we increased that authorization for another $150 million that we talked about in our earnings release.

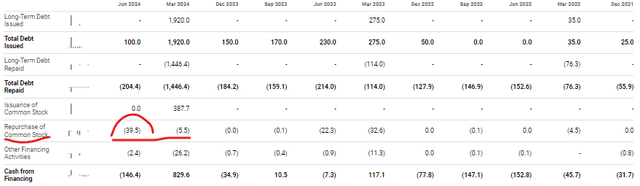

Q2 saw a fairly sizable $40 million repurchase that retired 3.8 million shares:

Seeking Alpha

The FCF has inflected

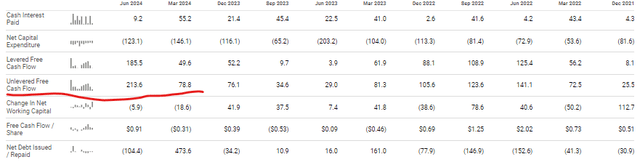

Management not only wants to see the stock price higher, but has tools to make this happen. The company now excepts $400 million in FCF for 2024:

Seeking Alpha

That is a 20% yield on the market cap and a bit above 10% on the enterprise value. Analyst estimates for 2025 are even higher.

Additional considerations

It is worth noting that TALO also sold its carbon capture business to TotalEnergies (TTE) for $148 million and used the proceeds to repay debt. I think that was a good decision. Despite the generous government carbon capture credits, the business requires capital and is better positioned in the hands of a major rather than an independent.

TALO also probably got the most it could out of Zama. As a reminder, the company was forced by the Mexican government to merge its prolific discovery with the adjacent Pemex block and cede the operator role on the combined block to Pemex. Talos sold half of its Mexican interest to Carlos Slim, and having a powerful local partner will probably help smoothen out potential future issues with Pemex. In addition, as noted, Mr. Slim has taken a long-term interest in TALO beyond the Mexican asset.

Takeaway

Talos Energy’s shareholders have had a rough ride the past couple years, but the company had to do what was necessary to gain scale. Now, with FCF inflecting and Mr. Slim’s backing, it seems the moon and stars may be finally aligning.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here