BridgeBio Pharma Inc. (NASDAQ:BBIO) is a biopharmaceutical company that focuses on developing innovative therapies for genetic diseases. The company’s research and development platform uses a threefold approach to managing costs and timelines effectively: streamlined discovery, decentralized teams, and efficient development processes. BBIO’s pipeline includes late-stage drug candidates like Acoramidis for transthyretin amyloid cardiomyopathy (ATTR-CM). The company also has other Phase 3 drug candidates such as Infigratinib for Achondroplasia, Encaleret for autosomal dominant hypocalcemia type 1 (ADH1), and BBP-418 indicated for limb-girdle muscular dystrophy type 2I (LGMD2I). However, I have some valuation concerns, and I think there are some caveats regarding the timeline of its potential future revenues. But, despite the inherent biotech uncertainties, I rate the stock a “buy” for investors who understand the embedded risks.

Genetic Diseases: Business Overview

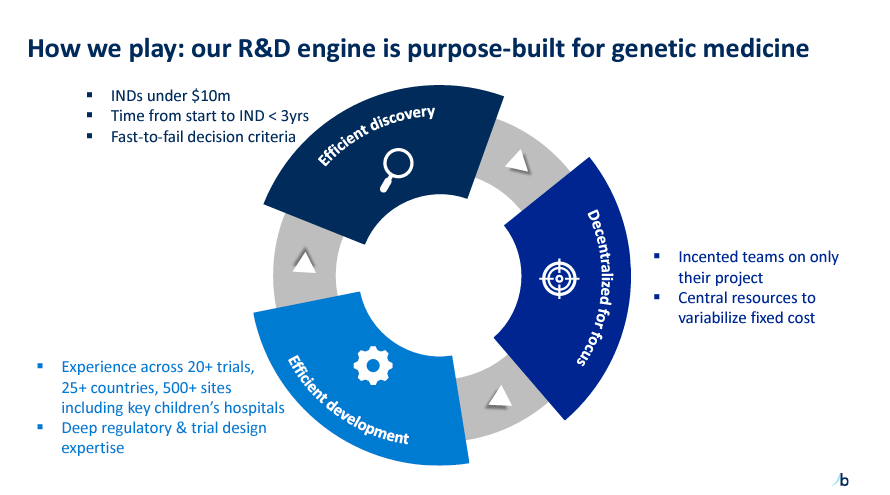

BridgeBio Pharma is a biopharmaceutical company founded in 2015 and headquartered in Palo Alto, California. BBIO develops innovative therapies for genetic diseases using its R&D platform, which has a threefold approach to managing costs and time. Its platform focuses on 1) efficient discovery, 2) decentralized teams, and 3) efficient development. BBIO’s goal is to transition from the preclinical stage to submission as efficiently as possible, with some programs targeting completion in under three years. Thus, it has a decentralized development approach through teams operating independently while leveraging centralized resources. So far, BBIO has accumulated ample clinical trial experience and expertise in regulatory processes in over 25 countries.

Source: Corporate Presentation. March 2024.

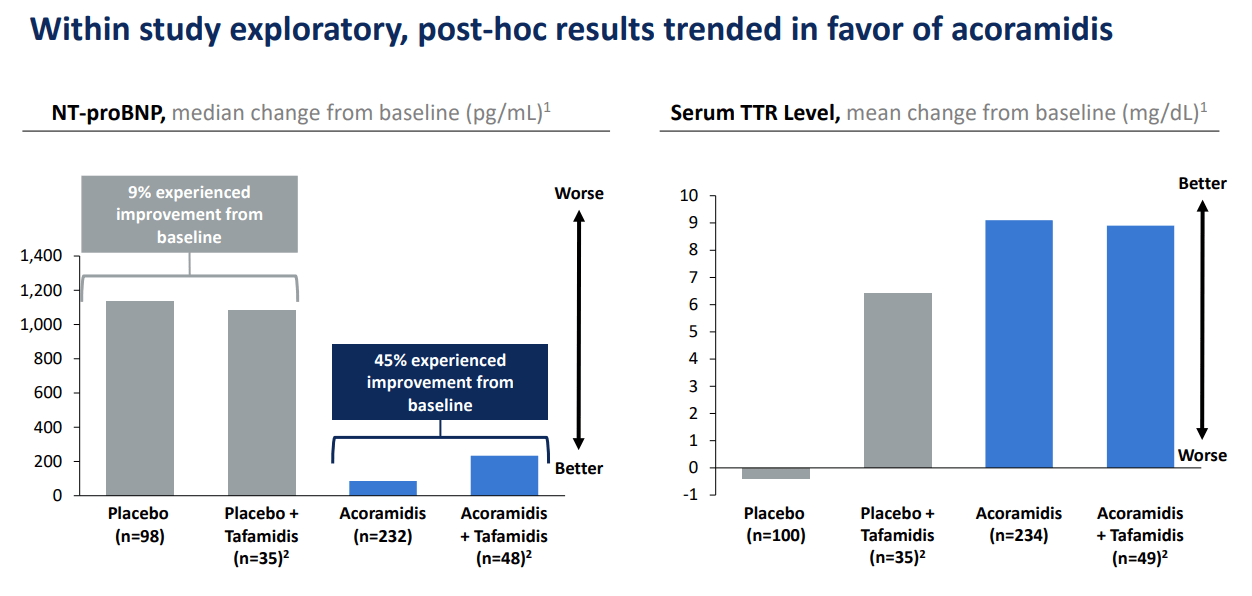

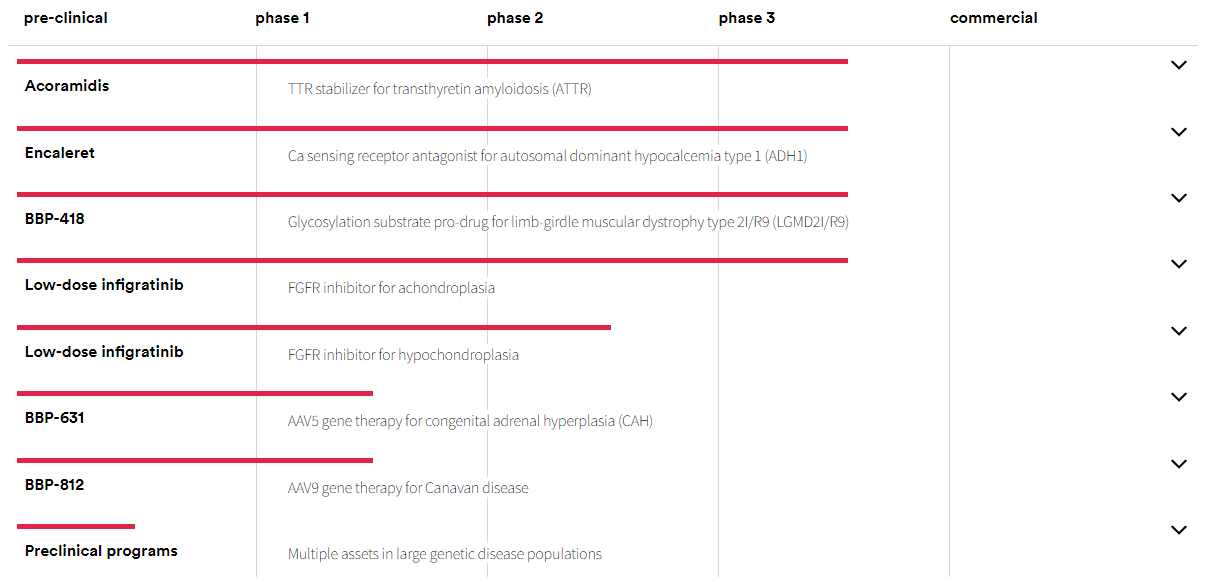

Moreover, the company’s late-stage drug candidate pipeline includes Acoramidis (AG10) for transthyretin amyloid cardiomyopathy (ATTR-CM). Acoramidis was submitted for FDA approval in December 2023, and its PDUFA date is November 29, 2024. It is important to mention that ATTR-CM is caused by deposits of amyloid fibrils formed from misfolded TTR proteins, typically due to genetic causes or aging. Amyloid accumulation damages the heart, leading to cardiomyopathy and heart failure. Therefore, BBIO’s Acoramidis stabilizes the TTR protein, reducing amyloid formation and potentially improving survival outcomes, though comparative survival rates can vary.

Source: Bank of America Merrill Lynch Presentation. May 2024.

Additionally, BBIO’s Phase 3 candidates are 1) Infigratinib for Achondroplasia and potentially for hypochondroplasia, 2) Encaleret for autosomal dominant hypocalcemia type 1 [ADH1], and 3) BBP-418 indicated for limb-girdle muscular dystrophy type 2I [LGMD2I]. BBIO also has BBP-631 in Phase ½ for congenital adrenal hyperplasia [CAH]. The company is also working on more than ten preclinical programs. It’s worth noting that the markets for Achondroplasia, LGMD2I, ADH1, and CAH are each estimated at over $1 billion.

Diverse IP: Product Pipeline

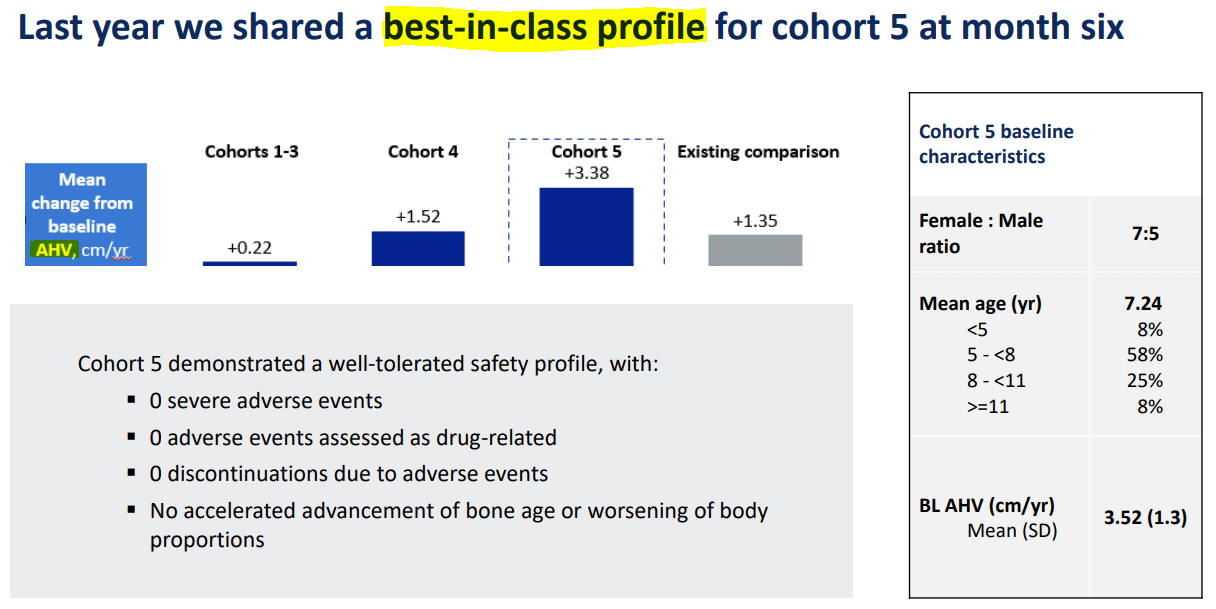

First, Achondroplasia is a genetic disorder caused by mutations in the FGFR3 gene. It causes dwarfism due to abnormal cartilage formation affecting the long bones. The FGFR3 gene mutations also produce hypochondroplasia, which is similar to Achondroplasia. The difference between these conditions is that people with hypochondroplasia don’t show characteristic facial features like individuals with Achondroplasia. Thus, BBIO’s Infigratinib targets FGFR3, blocking its activity. Children treated with Infigratinib show an increase in annual height velocity [AHV], and their body proportionality improves with a favorable safety profile. Currently, Infigratinib has the FDA’s Fast Track and Rare Pediatric Disease Designations.

Source: Bank of America Merrill Lynch Presentation. May 2024.

Secondly, ADH1 is a genetic disease caused by mutations in the CaSR gene. These mutations increase calcium-sensing receptor sensitivity, leading to low blood calcium levels. ADH1 symptoms include muscle cramps, spasms, seizures, and psychiatric conditions. Therefore, BBIO’s Encaleret acts as a small-molecule CaSR antagonist, inhibiting the overactive calcium-sensing receptor. This action mechanism normalizes calcium levels and increases parathyroid hormone [PTH] secretion, balancing blood calcium levels.

Lastly, LGMD2I is a type of muscular dystrophy caused by mutations in the FKRP gene. LGMD2I generates muscle weakness, leading to loss of mobility and respiratory complications. So, BBP-418 is designed to enhance glycosylation of alpha-dystroglycan, a protein critical for muscle cell stability. This could improve muscle function and potentially slow disease progression. It’s worth highlighting that the FDA granted BBP-418 a Rare Pediatric Disease designation, which should expedite its review process, potentially increasing its approval odds.

Source: BBIO’s website.

Those are BBIO’s most advanced research programs. However, as previously noted, BBIO’s BBP-631 is a Phase ½ drug candidate for CAH. This disease occurs due to 21-hydroxylase deficiency (21OHD), a genetic disorder that impacts the adrenal glands, causing insufficient production of cortisol and aldosterone. CAH eventually causes excessive androgen production. Thus, BBIO’s BBP-631 acts as a gene transfer therapy, delivering a working gene copy for encoding 21-hydroxylase. This potentially restores hormone production and reduces the need for hormone replacement therapy. Currently, BBP-631 has an FDA Rare Pediatric Disease Designation.

Research Progress: Updates and Agreements

More recently, in May 2024, BBIO reported positive data for Acoramidis, which I believe is its main product candidate. BBIO’s Acoramidis ATTRibute-CM trial tested its efficacy in ATTR-CM. Results demonstrated increased serum TTR levels by day 28, suggesting that Acoramidis indeed stabilizes the TTR protein and reduces its misfolding and accumulation. BBIO’s ATTRibute-CM trial had fewer cardiovascular-related deaths and fewer hospitalizations. Also, in the 30-month window, Acoramidis showed continued improvements, indicating it has positive long-term effects against ATTR-CM. These key results supported Acoramidis as the potential new standard of care for ATTR-CM, which should translate into significant revenues over the long run. For context, this market was estimated at $1.7 billion in 2023.

Furthermore, in June 2024, BBIO announced Infigratinib’s Phase 2 results for Achondroplasia. Children treated with Infigratinib showed continued height increases at months 12 and 18, indicating it effectively promotes growth. Additionally, body proportionality improved from 2.02 at baseline to 1.88 by month 18. For context, this figure refers to the upper-to-lower body proportion, so a reduction indicates an improvement due to Infigratinib’s effects. Currently, BBIO expects to complete enrollment for its Infigratinib Phase 3 by the end of 2024. BBIO also reported the first child enrolled in its Phase ⅔ ACCEL trial for children with hypochondroplasia.

Source: Corporate Presentation. March 2024.

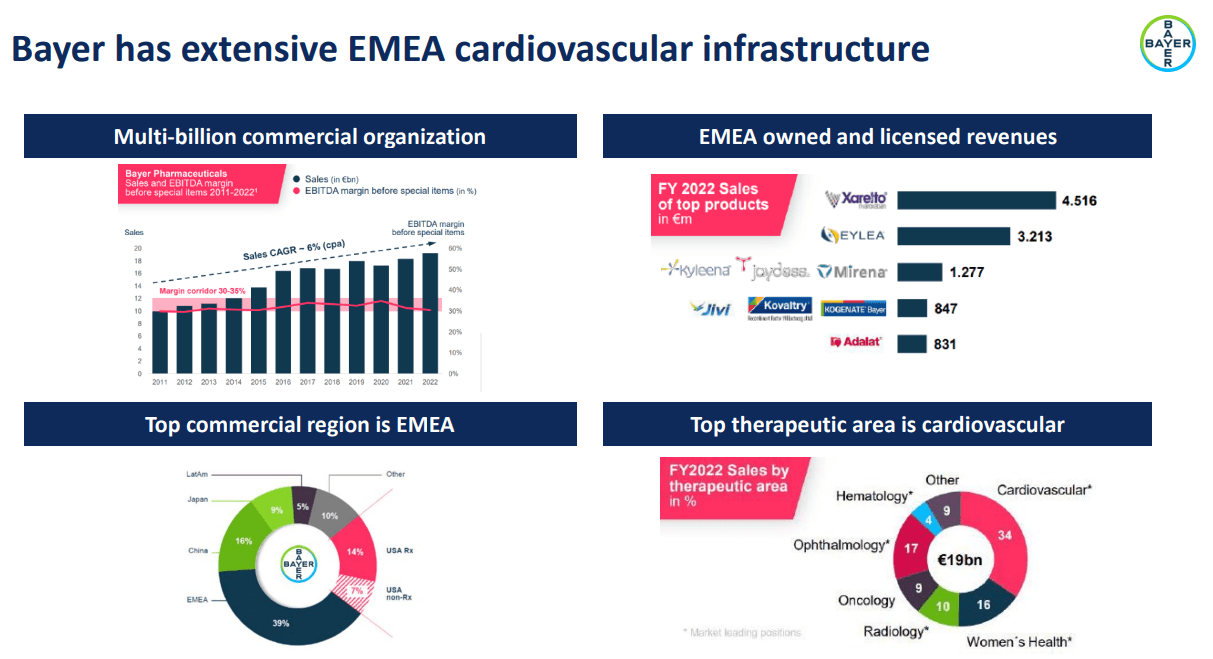

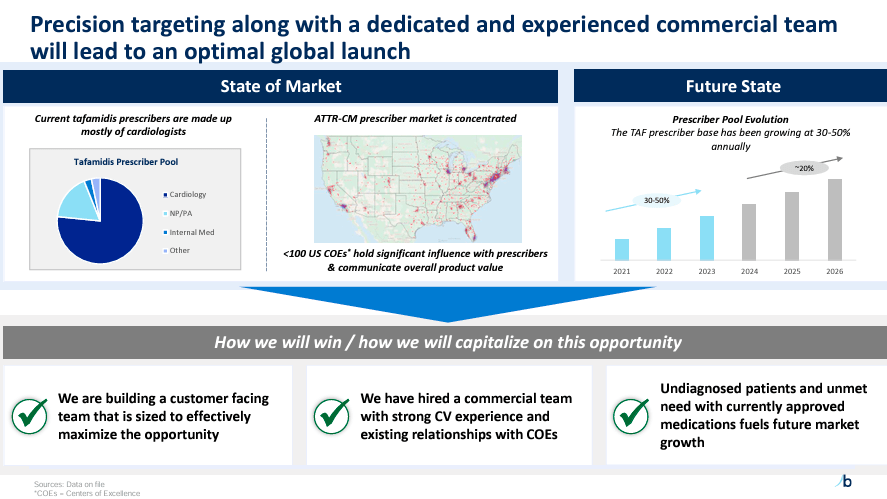

Another notable development was BBIO’s agreement with Bayer (OTCPK:BAYZF) to distribute Acoramidis under an exclusive European license. Bayer will contribute its expertise in cardiovascular treatments and vast commercial infrastructure. BBIO will receive up to $310 million in exchange, contingent on milestones, regulatory approvals, and sales-based royalties. This agreement could supercharge Acoramidis’ market adoption in 2025, also when management anticipates regulatory approval for the European market.

Fair Premium: Valuation Analysis

From a valuation perspective, BBIO trades at a $4.6 billion market cap, making it already a mid-sized biotech company in its sector. Its balance sheet holds $408.0 million in cash and equivalents and $39.8 million in marketable securities. This amounts to $447.8 million in available short-term liquidity against $1.7 billion in financial debt. That debt comes from 2027 and 2029 notes and a term loan. In fact, its financial debt represents 92.1% of its total liabilities as of Q2 2024. Unfortunately, BBIO has a negative book value of about $1.1 billion, limiting our ability to price it through a P/B multiple.

Moreover, the company hasn’t generated any meaningful product sales to date. Ideally, I would add its CFOs and Net CAPEX instead. But BBIO’s Q2 showed a $126.3 million gain in an asset sale, a non-cash item, while reducing its accounts receivable by $234.8 million. These are sizeable and somewhat unusual items for BBIO, which I believe muddles that cash burn approach.

Source: Corporate Presentation. March 2024.

Instead, I estimate BBIO’s quarterly cash burn at roughly $172.6 million through its negative EBIT. Based on that figure, its cash runway would be about 2.6 years, which is healthy for a company nearing multiple approvals by 2025 through 2027. Based on my analysis, there’s a reasonable chance Acoramidis could be approved by late 2024. As for Infigratinib, Encaleret, and BBP-418, these drugs could receive approval by late 2025 or 2026.

Naturally, this optimistic timeline requires no FDA setbacks or unforeseen disappointing trial results, but I believe its current regulatory prospects seem favorable. But, I think BBIO has enough resources until one or more products begin their commercialization stage. At that point, BBIO’s cash burn should decline, extending its runway. This should help its stock price if BBIO requires additional financing after receiving approval.

Source: Corporate Presentation. March 2024.

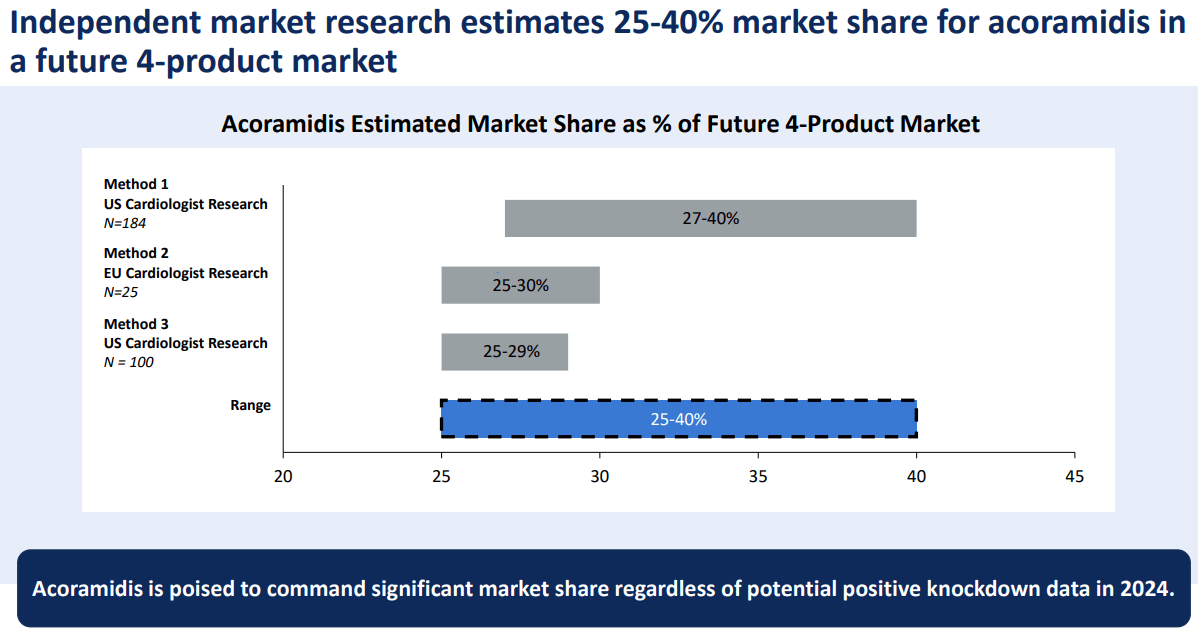

Fortunately, BBIO’s drugs have solid competitive profiles and target several billion-dollar markets. Acoramidis alone would be a major revenue breakthrough for BBIO, as it’s poised to capture a considerable market share. This drug could quickly generate substantial revenues, especially through BBIO’s deal with Bayer.

Thus, an alternative back-of-the-envelope valuation approach could assume that BBIO should be able to generate about $1.0 billion in revenues or more by 2026 or 2027. If that’s the case, BBIO would have a forward P/S multiple of about 4.6. For context, its sector’s median forward P/S ratio is 2.8, so BBIO would still appear somewhat expensive. Hence, I think it’s fair to lean bullish on BBIO, but its valuation limits my rating to just a “buy” for investors who understand the embedded biotech risks.

Investment Caveats: Risk Analysis

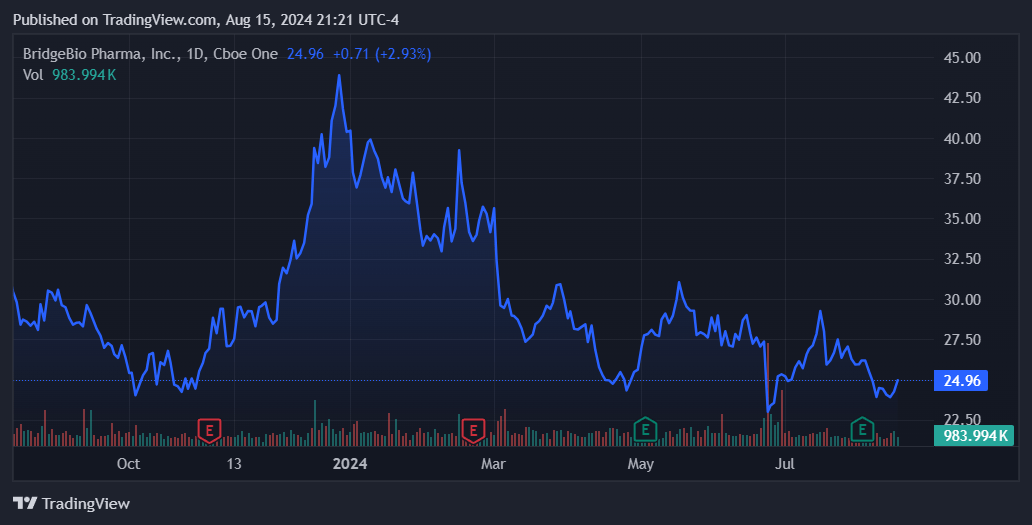

In my view, BBIO’s approval odds for its leading product candidates appear quite favorable. However, the main risk at this point is its cash burn and the timing of its future potential revenues once it receives approvals. This adds a few considerations to my bullish thesis, particularly because if the approval timelines extend, it would likely translate into a lower P/S multiple and lead to headwinds for its stock price. Alternatively, its products are not guaranteed to have swift or significant market acceptance.

Source: TradingView.

While I accept there is a reasonable case for its leading product candidates, the reality is that we won’t know for sure until we start seeing some actual sales numbers across different jurisdictions. Moreover, the commercialization Phase requires additional investment, which could strain BBIO’s cash reserves. However, it’s also difficult to justify a bearish outlook on a company with multiple candidates nearing approval and favorable competitive profiles. On balance, I think it’s fair to rate BBIO a “Buy” but not a “Strong Buy.”

Buy on Dips: Conclusion

BBIO’s main drawback is its relatively expensive valuation. I agree that the stock deserves a premium because it has multiple drug candidates nearing regulatory approval. However, this also caps its investment appeal to some extent. Still, overall the stock still justifies a bullish rating, and it would be a great “buy on dips” if they happen. Thus, despite the inherent biotech uncertainties, I rate the stock a “buy” for investors who understand the embedded risks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here