Investment Thesis

2024 has proven to be a tough year for the consumer services industry. With input prices remaining so high, many companies have found it difficult to fully capitalize on the post-pandemic demand resurgence. As such, most of these companies have missed on their earnings’ targets and many stocks have been performing poorly in comparison to the major indexes. This is exactly the case for Walgreens Boots Alliance (NASDAQ:WBA), which has seen a 55% YTD decrease in its share price. However, I expect WBA’s downtrend to continue due to a continuation of these tough market conditions, adverse effects from poor C-suite decision-making, and an impending maturity wall that the company will struggle to deal with. My base case valuation for WBA is $8.35, which is a 30% discount from the current price.

Industry Overview

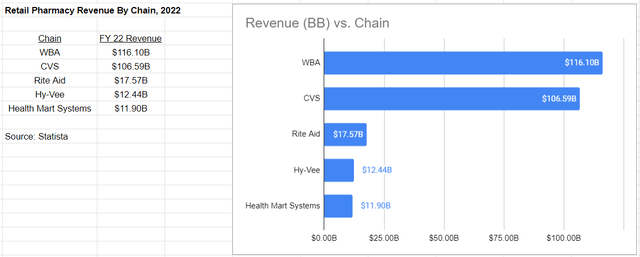

In the drugstore industry, it is incredibly hard to establish a competitive edge. This is because in every drugstore around the country, the products being sold are almost (if not entirely) identical, with only minor differences beyond the active ingredients in each drug. There are opportunities to do sales promotions or marketing stunts to try to accentuate differences, but because of this underlying fact, it is not really feasible for drugstores to splurge on advertising. Instead, I would argue that a drugstore’s edge is reliant on its image of consistency and safety – after all, the bottom line is that whatever the price is, no one would buy drugs from a person or store they do not trust. It is therefore no surprise that the US retail pharmacy market is a duopoly, with Walgreens and CVS being the two main competitors, as these two chains have the strongest brand names in the country. In 2023, both CVS and WBA did roughly $110B in domestic retail pharmacy sales, while the third-largest chain, Rite Aid, only did $17B for the year. The more generic discount and supermarket chains – Walmart, Kroger, and the like – do take some of the market share, mostly through in-house pharmacies and common OTC products like Tylenol and Benadryl. At the moment, their revenue share pales in comparison to CVS and WBA; however, this is a changing trend, which I will discuss in further detail.

2022 Retail Pharmacy Revenue by Chain (Statista)

A quick look at US retail sales shows a decent picture for the overall industry. The July 16th report showed a 0.0% change, which was a beat on the estimate of -0.3%. Furthermore, for the past few months, numbers have remained within a 1% month-over-month change, showing predictability in the US consumer market. This is also indicative of a much more stable consumer base, the exact opposite of the volatility we saw in the months immediately after the pandemic. Even as the industry still faces some challenges, especially around inflation and systematic break-ins, these numbers show that the market conditions could be much worse than they are now.

Company Overview

Walgreens was established in 1901 in Chicago as a pharmacy chain, and the headquarters is still in the Chicago suburb of Deerfield. It is currently the second-largest retail pharmacy chain in the US – as mentioned, CVS is the other major chain in the market. The company merged at the end of 2014 with Alliance Boots to form Walgreens Boots Alliance; it previously bought 45% of the company in 2012 and bought the rest by 2014. Walgreens is WBA’s US operating arm, while Alliance Boots covers the international side. Retail pharmacy is the core of the business, but Walgreens also has a healthcare arm via a majority acquisition of VillageMD in 2021. Globally, Boots operates retail pharmacies in the UK, Thailand, Ireland, and Mexico under the Benavides brand, as well as the drug wholesale brand GEHE AG in Germany.

There are two recent developments that I would like to mention at the outset, as they are not strictly related to valuation, unlike the points I will mention later. Firstly, their CEO Tim Wentworth has only been in the role since October 2023. He previously worked for Express Scripts and later Cigna’s Evernorth Health Services, in the pharmacy benefit management space (essentially back-office work for pharmacies) and healthcare space respectively. With intimate knowledge of both spaces and with both being core parts of WBA’s business model, it made sense for the company to appoint him as CEO nine months ago. Secondly, Walgreens has been embroiled in lawsuits surrounding opioids, having been accused (among other companies) of substantially contributing to the current opioid crisis. Walgreens settled most of the lawsuits in 2022, agreeing to pay out $5.7 billion over 15 years to several states. On the 2023 company income statement, this showed up as a one-time $7.5B expense regarding legal and regulatory accruals and settlements.

Key Drivers/Investment Catalysts

Continued Headwinds

To start, there are signs that the headwinds that WBA had to face in 2022-2023 will clearly continue from here.

Market Share Problems

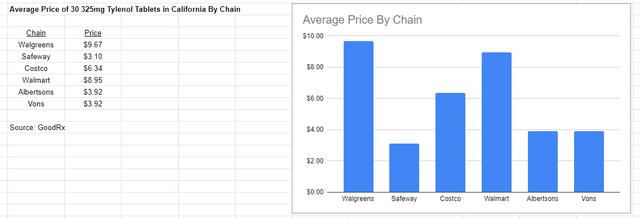

For the past few years, competitors have been eating away at Walgreens’ market share. It has become far easier for people to do things at home – online shopping is becoming the new norm, and there is no shortage of online pharmacies that ship medicine directly. At the same time, discount stores like Walmart and Target have been selling common OTC medicine themselves. Besides making themselves a “one-stop shop” for consumers, the prices for medicine are often cheaper at these discount stores due to economies of scale. Attached is a graph showing the average California prices of a 30-pack of 325mg Tylenol tablets at Walgreens as well as several discount store chains, proving the validity of this idea.

CA Average Price of Tylenol By Chain (GoodRx)

Walgreens is trying to refashion themselves as a pseudo-discount store by selling non-pharmacy items and starting delivery, but this has failed as the connotation with stores like Walgreens and CVS is to drive in for pickup or purchase. The pandemic was the exception to this as consumers went out to drugstores directly in emergencies (because they were the only stores that were not closed), and then usually bought other things while there – this is one thing that WBA greatly benefited from in 2021, as it did not see the same revenue slump as most companies during that year. However, now that the pandemic has ended, Walgreens is starting to feel the pain because this drive-in connotation has remained.

In-Store Experience

Additionally, the in-store experience for these chains has been quite poor. With systematic break-in crimes on the rise in many cities, Walgreens has had to find the balance between making it too easy for criminals to steal things and making it too hard for customers to buy things. Customers just do not like this new reality, and stores are seeing a 10-25% reduction in sales due to frustration over locked products.

International Segment

There is one caveat in all of this, namely that WBA’s international segment has been performing quite well. However, the issue is that the US dollar has been moving up on most foreign currencies worldwide, including the euro and Mexican peso. As such, once international profit is converted into USD, it is not even that great for the company. WBA’s international sales segment saw a 6.7% constant currency sales gain from 2022 to 2023, but once this exchange rate change is factored in, the sales gain goes down to just 1.7%.

Simply put, there are many reasons why customers are choosing not to spend their money at Walgreens, and the customers who do go are having worse experiences, and All of this is having a poor showing at Walgreens stores themselves – the Yelp average rating of 77,000 total Walgreens reviews is 2.2 stars, far from the quality of service one would expect at a typical retail store. This poor performance also extends to the C-suite, as the company is looking to close as much as 25% of its unprofitable stores over the next three years. This central idea is the most important takeaway for my bearish outlook on WBA stock.

Maturity Wall

Secondly, WBA is currently facing a looming debt problem. The company has $9B in total debt, and $4B of that is due in 2026. For some companies, this would not be a problem. However, the company only made $344 million in the last quarter, and has only paid down $100 million of its debt in that time span, per the 3Q earnings report. Creditors have realized this; WBA was recently given junk ratings from S&P and Moody’s, with a negative outlook for the future. Even as refinancing will help the company with deferring payment, these ratings will make it hard – if not impossible – for Walgreens to get a good interest rate. Furthermore, any refinancing will not do anything to improve WBA’s underlying position. As discussed, the cash flow problems that have been plaguing WBA will stick around for the foreseeable future, and even if the company can get rid of the 2026 maturity wall, it can only do so by increasing its debt payment later, amplifying WBA’s cash flow problems even more. Because of this, it seems to me that refinancing would simply kick the can down the road.

Adverse Repercussions of Decisions

Finally, the repercussions of several C-suite decisions in the past few years are starting to really hurt the company. Although these decisions might have been made in good faith, they have only caused the company to struggle more. The VillageMD majority acquisition is a good example of this. WBA acquired it in 2021, but the holding has still failed to break even after 3 years of operations. This segment was supposed to break even by the end of this fiscal year per 4Q 2023 guidance, but because it has lost $151 million YTD in 2024, it is highly unlikely that this will occur. The store sell-leaseback policy is another example of this – the company was able to harvest the tax benefits and come up with some extra cash, but there are only so many stores that can be leased back. Walgreens only owns 5% of its stores at this point, while its lease payments are only growing larger as a result. Finally, it can be argued that the major opioid settlement is another of these repercussions – although this cannot easily be pinned on the decisions of a few people, it has nevertheless a bit back on the company.

Note on Further Opioid Lawsuits

Even as the large settlement made headlines, there are still plenty of legal actions taking place today against the company, and Walgreens is still dealing with opioid lawsuits right now. Most of the outstanding cases have been collected into a multidistrict lawsuit in the Northern District of Ohio, of which Walgreens is one of the named defendants. A judge there already found for the plaintiffs in the 2022 bellwether case County of Lake, Ohio v. Purdue Pharma et al. Separately, Walgreens is one of the named defendants in two other cases in Maryland and Florida, which are both in their respective state courts. Both cases were settled as part of the 2020 Purdue Pharma settlement (this is not the same settlement outlined in the company overview), but are moving through the trial process again after the Supreme Court struck that down earlier this year. The verdicts on these cases are years out. However, if the ruling in the bellwether case holds true for all of these cases, Walgreens will probably be ordered to shell out more abatement payments.

To conclude, all of these effects might have been relatively meaningless in a different world – for example, if a company had a strong enough profit margin to easily pay off a large legal settlement, it would be akin to a speed bump whereby the company’s operations might be impacted momentarily, but in the long run it does not mean too much. However, Walgreens is different because the market conditions right now are so tough. Once the headwinds are factored in, the additional effect of these decisions has caused WBA’s position to deteriorate significantly, and its stock price has declined as a result – 55% year-to-date and 60% in the last 12 months at the time of writing. Furthermore, because of the continued effects of these decisions, I do not expect this price decline to slow down anytime soon.

Valuation

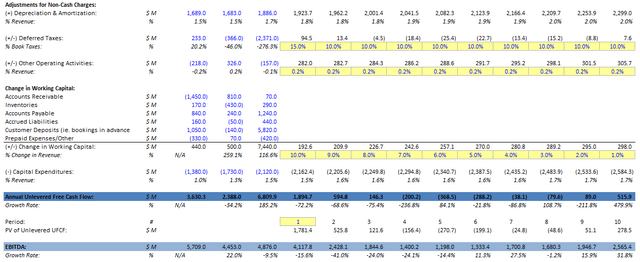

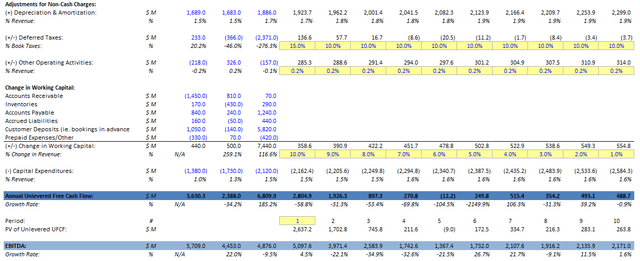

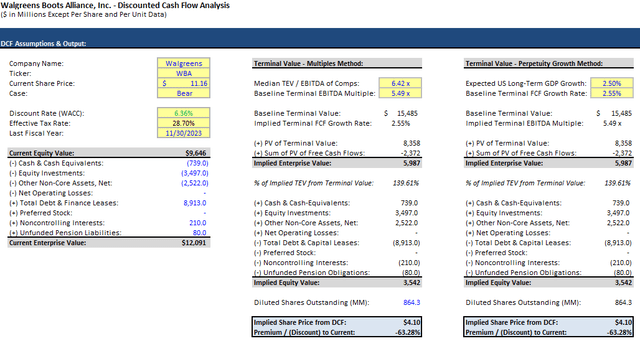

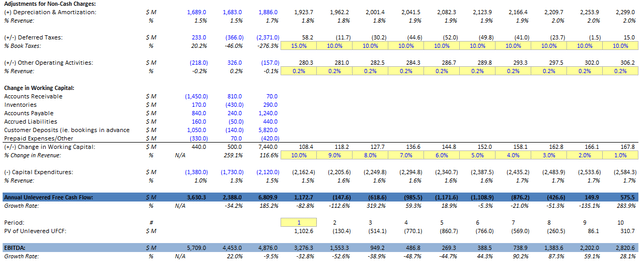

Assumptions

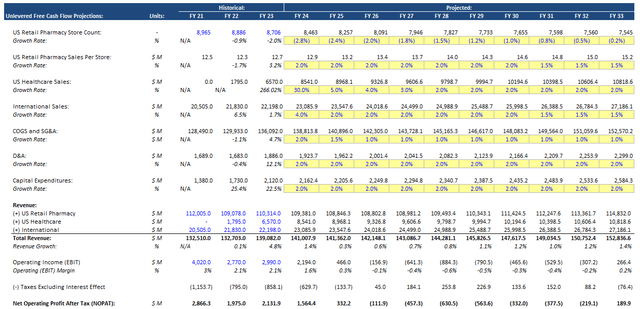

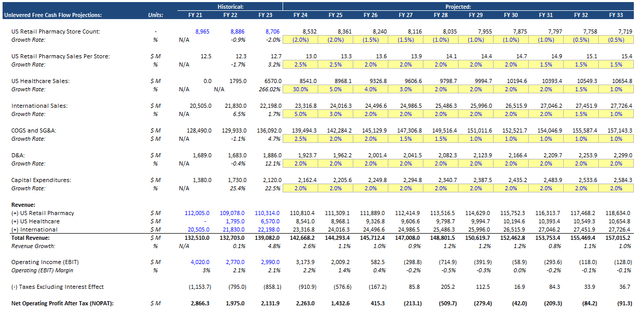

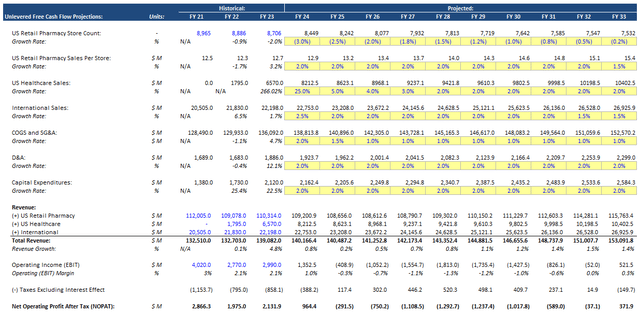

Before I discuss my model, I need to talk about its assumptions. Assumptions for the DCF are rooted in management projections, either by taking exact guidance or matching the general trend. For example, the 30% healthcare revenue increase matches company guidance of $8.5B for the 2024 fiscal year, and this is a reasonable prediction regardless as this segment has done $6.2B in the first three quarters of the year. This is applicable for most of the model – however, there are some items I would like to mention separately.

The US retail pharmacy segment is modeled on a per-store basis. However, this is not done for the other revenue segments because it would be very hard to consolidate estimates of different countries’ growth trajectories, and these revenue segments make up much less of the business anyways. Expenses like COGS and SG&A are assumed as a single number for the whole company because the company does not report these numbers by revenue segment.

The tax rate of 28% is taken from pre-COVID as recent years are quite strange with taxes – the tax rate for FY 2023 was negative (i.e. a tax benefit) due to WBA reducing its valuation allowance to offset capital gains for the year, as well as “internal legal entity restructuring and one-off tax benefits related to a measurement change in prior year tax positions.” I thought it’s best to use numbers from a more normal period.

Finally, I have not accounted for unusual expenses in the model because they are quite simply unpredictable. I think there is a possibility that some of these expenses may occur, especially since there are still several opioid-related suits that WBA is involved with, as discussed previously; however, it just does not make sense to try to predict these events. Regardless, if these unusual expenses do happen, then it will drag down WBA’s net income like what happened in 2023 – this will only be beneficial to a short position.

Base Case

Author’s Calculation Author’s Calculation Author’s Calculation Author’s Calculation

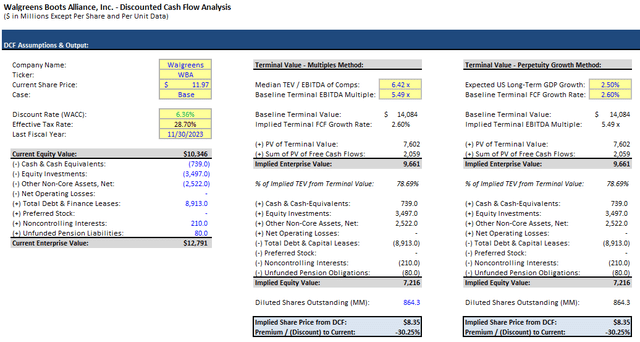

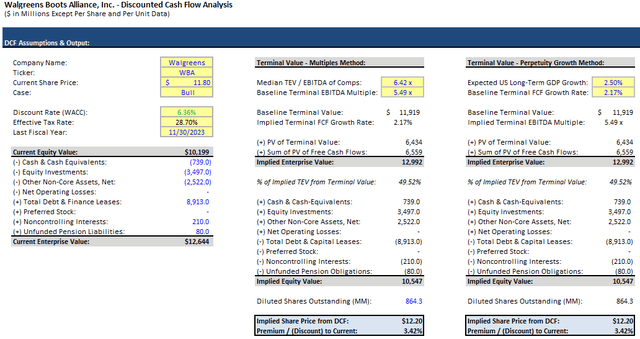

On to the base case itself. In this scenario, the numbers play out essentially as management expects. Over time, the company closes unprofitable stores before reaching a sort of steady-state after 10 years. At the same time, expenses remain just as high, significantly cutting into WBA’s profits like they are doing right now. Revenue per store growth rate remains high initially to cover the customers going to different stores, but eventually tapers as customers run out of Walgreens stores close to them. The healthcare and international segments both see strong growth overall, but it does not matter too much due to the retail segment’s struggles. With this set of assumptions, I have the company reaching negative EBIT by 2026, which happens to coincide with the $4B maturity wall discussed previously.

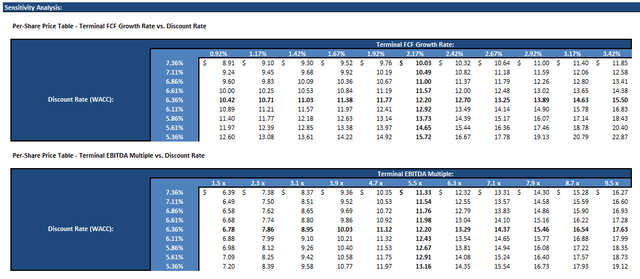

Given the discount rate of 6.36%, I have estimated the fair value of WBA shares to be $8.35, which implies a 30% downside from the current price. Furthermore, due to the assumptions outlined above, I feel that I have given the WBA quite a lot of slack numbers-wise, so this base case is very reasonable in my book.

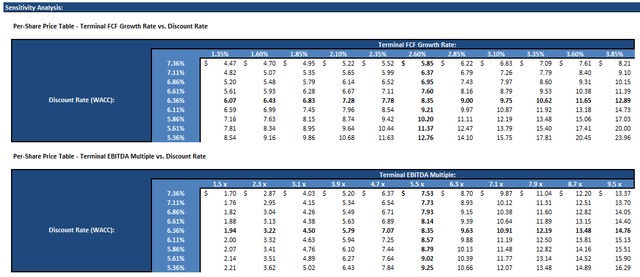

Bull Case

Author’s Calculation Author’s Calculation Author’s Calculation Author’s Calculation

Next is my bull case. In this scenario, the company can capitalize on lower costs and increased revenues driven by more consumer spending and better market conditions – as such, far fewer stores are closed down, and the company is able to start finding its footing again. Furthermore, the other revenue segments do better than expected, even as they do taper into the future as usual. Although the company will still see problems with positive EBIT, the difference is that in this bullish case, WBA’s cash flow base is much stronger because it retains much more retail infrastructure to drive sales or raise cash by liquidating some of these assets. Company management can then use this stronger position as a sort of foundation to start planning around the debt burden, and WBA has a much higher probability of post-2026 recovery as a result.

In this case, WBA shares are valued at $12.20 per share, implying a 10% upside potential. If this increased demand sort of scenario were to actually play out, I think this is a reasonable valuation, especially given that the main cause for the Q3 earnings slide was revenue weakness. However, as discussed previously, I do not think this is likely for the WBA.

Bear Case

Author’s Calculation Author’s Calculation Author’s Calculation Author’s Calculation

Lastly, I will discuss my bear case – this is essentially the worst-case scenario for the company. In this scenario, more stores are closed than in the base case, but the revenue growth per store remains the same as customers choose competing chains instead. At the same time, other revenue segments drastically miss their targets while costs stay high due to higher-for-longer inflation. My valuation of WBA in this case is $4.10, implying a 60% downside. This is clearly a very extreme case, but a more moderate version of this is well within reach for WBA if the conditions are right and if there is another unusual expense for the company to deal with. By the same token, some of the sensitivity analysis per-share values are in the negatives, which is theoretically impossible; to me, this simply signifies a bankruptcy event and a near-zero share value, which would theoretically be the best-case scenario for a short. A watershed model and associated distress pitch would be needed for valuations and such later on, but since WBA’s liquidity is still stable right now, I do not want to touch on this topic yet.

Risks And Mitigants

One risk of note is that of a viral drug that could cause retail sales to skyrocket. A recent example of this is Ozempic, which went viral last year as a weight-loss drug. However, I do not think this will impact WBA as much because of how it was – and still is – far easier for a consumer to buy the drug online. It also simply makes sense that in order for a consumer to buy the same drug at Walgreens, they would have to do a substantial amount of extra work compared to simply buying it online or via a phone call. I think that if there ever was another Ozempic, a similar scenario would eventuate, and WBA would not see much benefit.

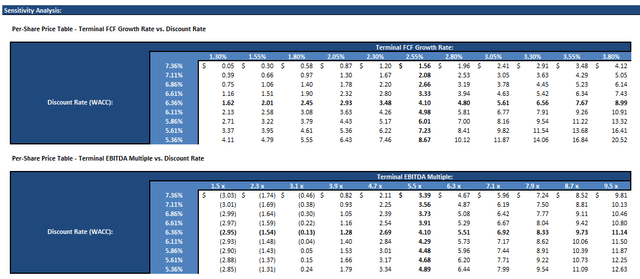

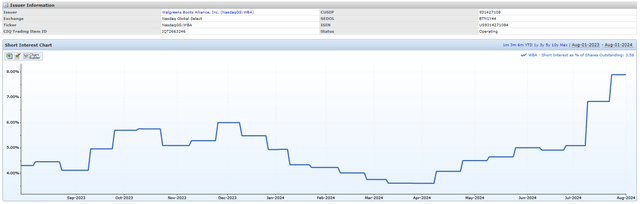

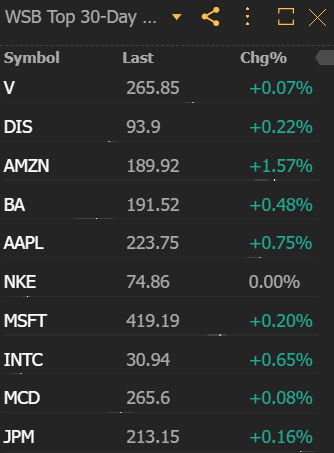

Another risk is that of a meme stock-style short squeeze. Short interest in WBA has been on the rise over the past few months (shown below), and WBA does have parallels with GME, AMC, and so on – all of these are struggling companies with somewhat outdated business models and ample debt, with rising short interest to boot. There is a possibility that another 2021 GME-type of rally could happen with WBA. However, this is not a stock that is on many retail traders’ watchlists. Attached is a chart detailing the number of times WBA was mentioned on r/wallstreetbets – after being mentioned 58 times on the day of the Q3 earnings report, WBA has had almost no mentions on the subreddit. Also attached is a watchlist detailing the top stocks in the 30 days before the time of writing; it is clear r/wallstreetbets has been much more concerned about these other companies, none of which have anything to do with the drug or medical industry. As such, companies like WBA have been skipped by most of these squeeze-oriented retail traders, and I do not see how there will be enough volume to actually execute a squeeze on WBA stock.

1Y WBA Short Interest (S&P Capital IQ)

WBA WSB Mentions History (TrendSpider) WSB Top 30-Day Mentions (TrendSpider)

Finally, there is a risk that as the economy continues to recover and the Fed cuts rates, the positive effects will extend to WBA, causing its sales to increase and its costs to remain stable in the short term. This would allow the company to stabilize by stopping store closures, while also giving it a base to begin paying down its 2026 maturity wall. However, I do not think these developments will affect WBA as much, seeing as the underlying business will still face headwinds into next year as discussed. Even if the broader economy becomes better for consumers, I do not expect it to significantly affect sales because a drugstore is probably the last place that a consumer will choose to spend their money. Furthermore, even if the Fed’s rate cuts will help WBA with their debt burden, it will not improve WBA’s underlying position and will only increase their cash flow stress later on, as discussed. Since the business will have a hard time getting to positive EPS anyways, rate cuts will not help WBA as much as a company with a clear way to pay. (My previous article on Carnival Corp is a good example of this sort of company.)

Conclusion

To conclude, I expect WBA to be in a tough position by the end of the year due to market conditions, repercussions of past decisions, and with a sizable debt burden. As such, I am recommending a sell on WBA with a target of $8.35. There are risks surrounding one-off “virality” events and broad economic strength, but these are not likely to affect WBA all too much, making this an attractive company for investors to short.

Read the full article here