Key takeaways

- The fund outperformed its benchmark

- Strong stock selection in pharmaceuticals, health care equipment and biotechnology contributed the most to relative performance during the quarter, along with an underweight in health care services.

- The health care sector underperformed the overall US stock market.

- Health care lagged technology and communication services but outperformed materials and industrials. Health care equipment, life science tools & services and health care services were the most notable underperformers during the quarter.

- Our outlook for health care is neutral but we see signs of improving trends.

- Health care utilization levels and procedure activity have been higher and the biopharma research funding environment has been improving. GLP-1 obesity drug headlines appear less of a headwind for companies that treat obesity-related diseases.

Manager perspective and outlook

The US equity market advanced during the second quarter as investors appeared to continue processing the possibility of a US Federal Reserve pivot to easier monetary policy in 2024.

The health care sector underperformed the overall US stock market during the second quarter. Health care lagged technology and communication services the most while outperforming materials and industrials.

We still have a neutral outlook for the health care sector but have continued to see signs of improving growth trends. We have been observing higher levels of health care utilization and procedure activity, which are a tailwind for health care equipment, distributors and facilities, but a headwind for managed care. We have seen an improving environment for biopharma research funding, which is positive for life science tools & services. Headlines about GLP-1 obesity drugs have continued to be positive for biopharma companies and now appear to be less negative for equipment and services companies that treat obesity-related diseases and diabetes.

The fund invests in premier health care companies that we believe are positioned to compound multi-year growth. We combine in-depth health care experience with bottom-up fundamental analysis to evaluate company management, identify growth prospects and manage risk.

Portfolio positioning

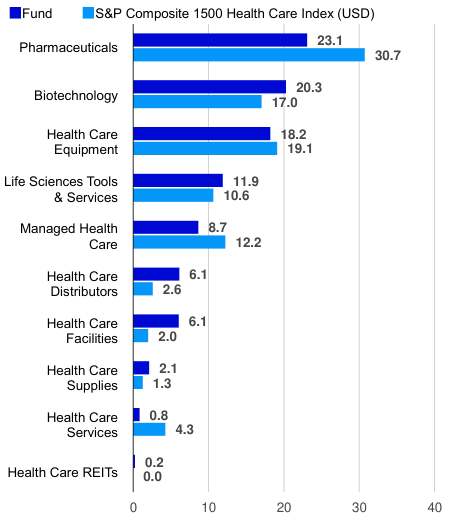

The fund’s largest absolute industry weights are in pharmaceuticals, biotechnology and health care equipment. At quarter end, the fund’s largest overweights relative to its benchmark were in health care facilities, distributors and biotechnology. The fund was underweight in pharmaceuticals, managed care, health care services and equipment. During the quarter, the fund’s positions in pharmaceuticals, biotechnology, health care supplies and facilities increased. Positions in distributors, managed care, health care equipment, health care technology and life science tools & services decreased.

Within biotechnology, we added Alnylam Pharmaceuticals (ALNY), Merus (MRUS) and ADMA Biologics (ADMA) and sold Legend Biotech (LEGN), Ionis Pharmaceuticals (IONS), Kyverna Therapeutics (KYTX) and Scholar Rock (SRRK). In health care equipment, we added Insulet (PODD) and sold Shockwave Medical (SWAV), Steris (STE) and Treace Medical Concepts (TMCI). In life science tools & services we added Bio-Techne (TECH) and sold West Pharmaceutical Services (WST). In managed care, we sold Molina Healthcare (MOH), Progyny (PGNY) and Humana (HUM). In distributors, we sold Cardinal Health (CAH). In facilities, we added Select Medical (SEM) and Brookdale Senior Living (BKD) and sold Surgery Partners (SGRY). We added ConvaTec (OTCPK:CNVVF) in supplies and sold Veeva (VEEV) and Evolent Health (EVH) in health care technology.

Second quarter 2024 additions to the fund:

Alnylam Pharmaceuticals makes Ribonucleic Acid (RNA) interference therapeutics to treat rare cardio-metabolic, infectious, central nervous system and ocular diseases.

Merus is an early-stage biotechnology company that makes antibody therapeutics to treat head and neck cancer.

ADMA Biologics makes immuno-technology plasma-derived therapeutics to treat infectious diseases and manage immune compromised patients.

Insulet is a medical device company that makes insulin pumps to treat diabetes.

Bio-Techne provides reagents, instruments, manufacturing services and testing services for the biopharma, academic and diagnostics end markets.

Select Medical operates hospitals that provide recovery, inpatient rehabilitation and outpatient rehabilitation for critical illness and injury.

Brookdale Senior Living provides assisted living, independent living, memory care, skilled nursing, continuing care retirement communities and at home care.

Convatec supplies medical products used to manage chronic conditions, such as advanced wound care, ostomy care, continence care and infusion care.

Top issuers (% of total net assets)

|

Fund |

Index |

|

|

Eli Lilly & Co (LLY) |

9.82 |

12.59 |

|

Boston Scientific Corp (BSX) |

6.05 |

1.97 |

|

UnitedHealth Group Inc (UNH) |

4.62 |

8.16 |

|

McKesson Corp (MCK) |

4.36 |

1.32 |

|

AstraZeneca PLC (AZN) |

4.09 |

0.00 |

|

Merck & Co Inc (MRK) |

4.07 |

5.46 |

|

Intuitive Surgical Inc (INTU) |

4.06 |

2.75 |

|

Vertex Pharmaceuticals Inc (VRTX) |

3.68 |

2.11 |

|

Danaher Corp (DHR) |

3.63 |

2.87 |

|

Regeneron Pharmaceuticals Inc (REGN) |

3.47 |

1.94 |

|

As of 06/30/24. Holdings are subject to change and are not buy/sell recommendations. |

||

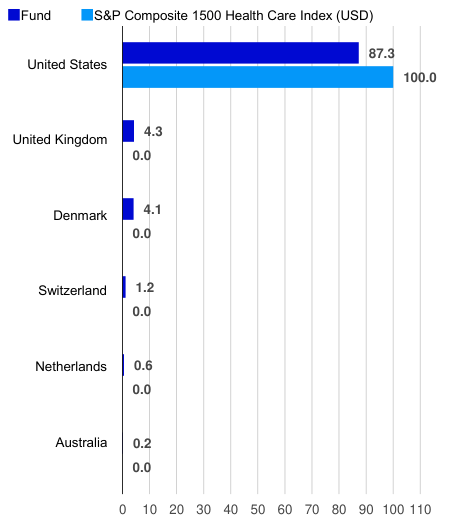

Top countries (% of total net assets)

Top industries (% of total net assets)

Performance highlights

Strong stock selection in pharmaceuticals, health care equipment and biotechnology added most to relative performance during the quarter. An underweight in health care services was also advantageous. These positive results were partially offset by stock selection in managed care and life science tools & services.

Contributors to performance

Eli Lilly is a large-cap pharmaceutical company that makes drugs to treat Alzheimer’s, cancer, diabetes, obesity, pain and autoimmune diseases. The company posted better-than-expected earnings and raised 2024 guidance due to continued success and expansion in its obesity treatments.

Boston Scientific makes surgical devices and medical equipment to treat cardiovascular, gastrointestinal and pulmonological conditions. The company reported better-than-expected organic growth driven by strength in cardiovascular, endoscopy and urology devices. The company also reported a strong launch for its pulsed field ablation system, Farapulse.

AstraZeneca is a large-cap pharmaceutical company that makes drugs to treat oncology, cardiovascular, renal, metabolism and respiratory diseases. The company delivered better-than-expected revenue and earnings, driven by success across its product categories.

Detractors from performance

DexCom makes wearable continuous glucose monitoring (CGM) devices used to monitor and treat diabetes. The company delivered strong organic growth, added new patients, had better-than-expected profit margins and provided higher revenue guidance. However, investor sentiment appeared to slip due to a combination of inventory destocking, health care plan switching and disruption of customer Medicaid claims due to a cyber-attack at a vendor.

Molina Healthcare provides managed health care services under the Medicaid and Medicare programs and through the state insurance Marketplace. The stock declined during the quarter, hampered by apparent concerns about higher-than-expected Medicaid claims.

Bruker makes instruments, microscopes and imaging technology used in biopharma research, development and diagnostics. The stock declined during the quarter amid lower- than-expected organic growth in the company’s mass spectrometry CALID segment due to shipment timing and tough earnings comparisons to prior quarters.

Top contributors (%)

|

Issuer |

Return |

Contrib. to return |

|

Eli Lilly and Company |

16.57 |

1.47 |

|

Boston Scientific Corporation |

12.44 |

0.71 |

|

AstraZeneca |

15.18 |

0.49 |

|

Tenet Healthcare Corporation (THC) |

26.56 |

0.43 |

|

Novo Nordisk A/S (NVO) |

13.26 |

0.41 |

Top detractors (%)

|

Issuer |

Return |

Contrib. to return |

|

DexCom, Inc. (DXCM) |

-18.26 |

-0.40 |

|

Molina Healthcare, Inc. (MOH) |

-25.90 |

-0.35 |

|

Bruker Corporation (BRKR) |

-32.02 |

-0.31 |

|

Repligen Corporation (RGEN) |

-31.46 |

-0.25 |

|

Cencora, Inc. (COR) |

-7.07 |

-0.24 |

Standardized performance (%) as of June 30, 2024

|

Quarter |

YTD |

1 Year |

3 Years |

5 Years |

10 Years |

Since inception |

||

|

Class A shares (MUTF:GGHCX) inception: 08/07/89 |

NAV |

2.25 |

12.84 |

13.12 |

2.43 |

8.14 |

7.04 |

10.27 |

|

Max. Load 5.5% |

-3.37 |

6.62 |

6.90 |

0.52 |

6.92 |

6.44 |

10.09 |

|

|

Class R6 shares (MUTF:GGHSX) inception: 04/04/17 |

NAV |

2.32 |

12.99 |

13.51 |

2.78 |

8.49 |

7.29 |

– |

|

Class Y shares (MUTF:GGHYX) inception: 10/03/08 |

NAV |

2.33 |

12.95 |

13.41 |

2.70 |

8.41 |

7.31 |

10.10 |

|

S&P Composite 1500 Health Care Index (‘USD’) |

-1.07 |

7.48 |

10.85 |

5.75 |

11.05 |

11.04 |

– |

|

|

Total return ranking vs. Morningstar Health category (Class A shares at NAV) |

– |

– |

16% (45 of 176) |

32% (65 of 161) |

46% (84 of 139) |

71% (89 of 114) |

– |

|

|

Expense ratios per the current prospectus: Class A: Net: 1.06%, Total: 1.06%; Class R6: Net: 0.71%, Total: 0.71%; Class Y: Net: 0.81%, Total: 0.81%. Performance quoted is past performance and cannot guarantee comparable future results; current performance may be lower or higher. Visit Country Splash for the most recent month-end performance. Performance figures reflect reinvested distributions and changes in net asset value (NAV). Investment return and principal value will vary so that you may have a gain or a loss when you sell shares. Returns less than one year are cumulative; all others are annualized. Performance shown prior to the inception date of Class R6 shares is that of Class A shares and includes the 12b-1 fees applicable to Class A shares. Index source: RIMES Technologies Corp. Had fees not been waived and/or expenses reimbursed in the past, returns would have been lower. Performance shown at NAV does not include the applicable front-end sales charge, which would have reduced the performance. Class Y and R6 shares have no sales charge; therefore performance is at NAV. Class Y shares are available only to certain investors. Class R6 shares are closed to most investors. Please see the prospectus for more details. For more information, including prospectus and factsheet, please visit Invesco.com/GGHCX Not a Deposit Not FDIC Insured Not Guaranteed by the Bank May Lose Value Not Insured by any Federal Government Agency |

Read the full article here