MarketAxess: Global Credit Trading Platform, But Valuation Appears Fair Given Recent Market Share Trends

MarketAxess (NASDAQ:MKTX) operates a global credit trading platform and also offers rates trading, data and post-trade solutions to its clients. MKTX has benefited from the electronification of global credit markets. However, in recent years, its market share growth has come under pressure. The company continues to be at the center of this cyclical shift in the markets but given the recent share loss trends, I rate MKTX as HOLD until I see a meaningful shift in market share gains.

Company Overview: The Premier Global Electronic Credit Trading Platform

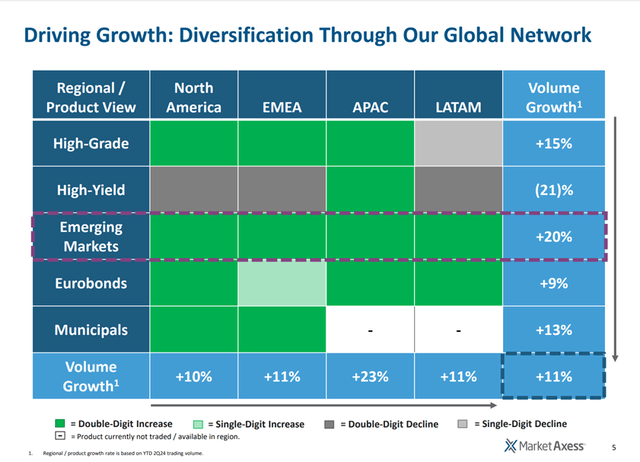

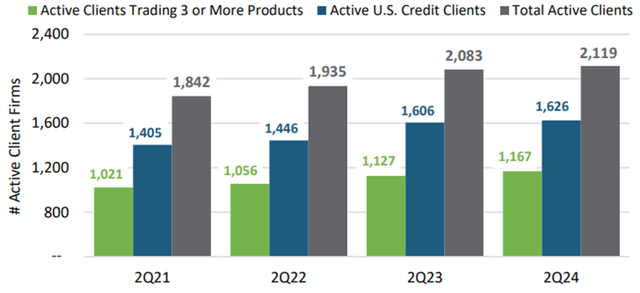

“MarketAxess operates a global, electronic fixed income trading platform that offers trading efficiency, a diverse liquidity pool and cost savings to institutional investors and broker-dealers” (MKTX 2023 10k). MKTX’s platform offers trading across two main fixed income categories 1) Credit – which includes U.S. High Grade and High Yield credit, Emerging Markets credit, Eurobonds, Municipal Bonds and Other Credit products and 2) Rates – which includes U.S. Government Bonds and Agency and Other Bonds. MarketAxess’ clients are spread across four key geographic segments which include North America, EMEA, APAC and LATAM. As of 2Q24, MKTX had 2,119 active client firms on the platform, including 1,626 active U.S. credit client firms,1,076 international active client firms and 1,167 active client firms trading three or more products on the platform. In addition to its trading platform, MKTX offers data products, a range of post-trade services and, more recently, technology services to its customers.

MKTX 2Q24 Earnings Presentation MKTX 2Q24 Earnings Presentation

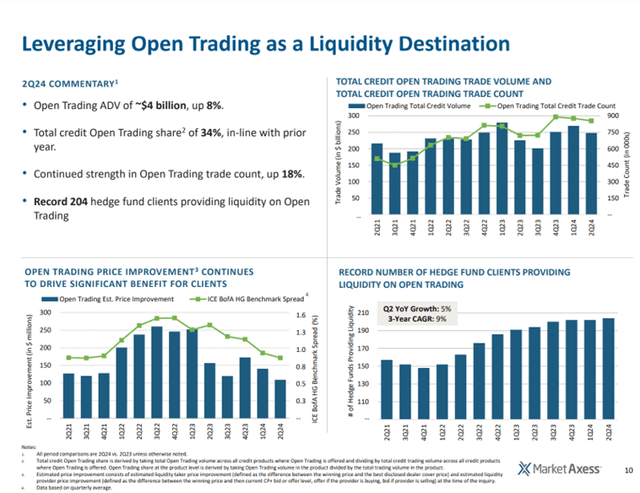

MKTX’s trading solutions offer unique trading protocols to its clients, the two largest of which are Disclosed Request for Quote (60% of all credit volume on the MKTX platform in 2023 was executed via this protocol) and Open Trading (35% of all credit volume on the MKTX platform in 2023 was executed via this protocol). The Disclosed Request for Quote protocol allows institutional investors to request competing, executable bids or offers from a list of over 140 dealers and execute trades with the dealer of their choice, and MKTX does not act as a counterparty on any of these trades. Disclosed Request for Quote also allows clients to trade lists of up to 60 bonds simultaneously, offers portfolio trading for baskets of bonds, and offers swap trading. The Open Trading protocol is MKTX’s all-to-all trading solution in which institutional investors and dealers can transact anonymously between other institutional investors or other dealers, which greatly increases the number of counterparties available to trade with. Under this trading protocol, MKTX transacts between the buyer and seller on a matched principal basis by acting as a counterparty to both seller and buyer. The Open Trading solution also offers several sub-protocols to meet MKTX’s clients’ specific needs.

MKTX 2Q24 Earnings Presentation

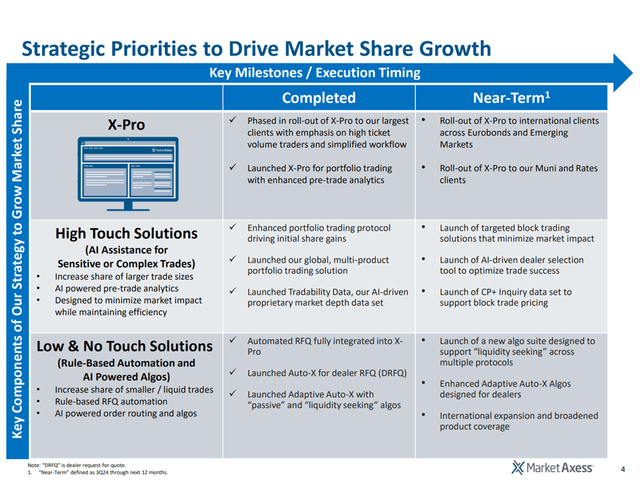

In addition to these two trading protocols, MKTX offers clients Automated and Algorithmic Trading Solutions, Order and Execution Workflows, and recently launched its new X-Pro platform. The X-Pro platform combines MKTX’s workflows with its proprietary data and pre-trade analytics to provide superior low and high-touch trading workflows to clients. MKTX views the X-Pro platform as the key to unlocking future market share growth, as it combines the best of MKTX’s trading protocols and data solutions into one platform.

MKTX 2Q24 Earnings Presentation

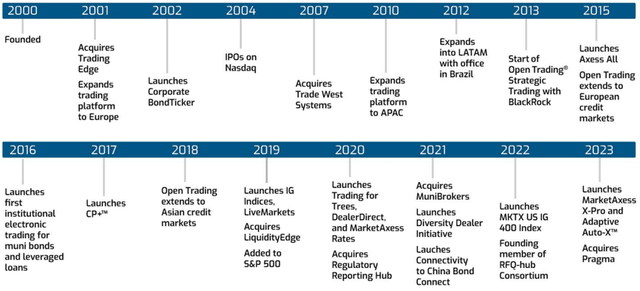

Acquisitions Have Helped Diversify MKTX into Adjacent Asset Classes and Revenue Streams

MKTX has made a handful of acquisitions over the years which have helped diversify its product suite. The first notable acquisition closed in November 2019 when MKTX acquired LiquidityEdge for $150 million. LiquidityEdge began as a trading system connecting dealers, market-makers and institutional investors in the U.S. Treasuries (rates) market and allowed MKTX to offer rates trading to its clients in conjunction with its already established credit trading capabilities. The next notable acquisition closed in April 2021 when MKTX acquired MuniBrokers which substantially expanded MKTX’s presence in the Municipal Bond space. Most recently, in October 2023, MKTX completed its acquisition of Pragma, a quantitative trading technology provider to the equities, FX and fixed-income markets. The Pragma acquisition effectively introduced a new revenue line for MKTX (Technology Services) and came about as a way for MKTX and Pragma to accelerate development of execution algorithms and analytics across fixed-income products.

MKTX 2023 10K

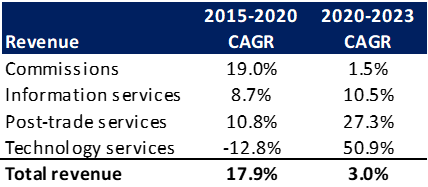

Revenue Growth Has Slowed in Recent Years, Primarily Due to Slowdown in Commissions Revenue Growth, But the Mix has Shifted Slightly

Between 2020 and 2023, MKTX’s revenue grew at a CAGR of 3%, this is down from the torrid pace of revenue growth between 2015 and 2020 (CAGR of 18%). Much of the slowdown in revenue growth has come from a decline in commissions revenues growth, which grew at a CAGR of 19% between 2015 and 2020 but fell to a CAGR of 1.5% between 2020 and 2023. Meanwhile, MKTX’s non-commission revenue growth has remained strong through this more recent time period (admittedly partly due to acquisition activity) as the CAGR for Information Services revenue from 2020-2023 was 11%, up from 9% from 2015-2020 and the CAGR for Post-trade Services revenue from 2020-2023 was 27%, up from 11% from 2015-2020. Admittedly, MKTX has its work cut out for it if it wants to return to the outsized revenue growth rates experienced in the past, but management has pointed to the roll-out of its X-Pro product as the key to unlocking future market share growth, which should translate into future revenue growth as well.

MKTX 2020, 2021, 2022, 2023 10Ks

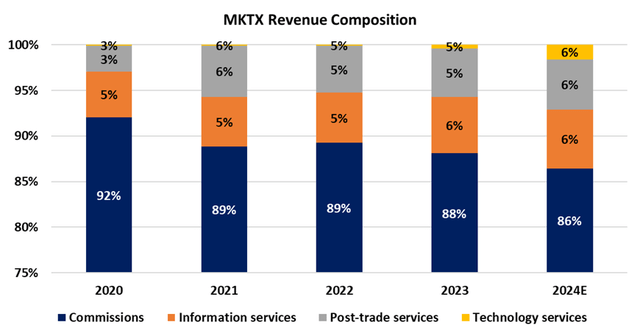

Due to this shift in growth rates, MKTX’s revenue has become slightly more diversified over that time. Between 2015 and 2020, MKTX’s revenue comprised 90% (on average) commissions related revenues. From 2020 to 2023 commissions revenues have fallen to 88% of total revenues and are expected to fall further to 86% in 2024.

MKTX 2020, 2021, 2022, 2023 10Ks and Analyst Estimates

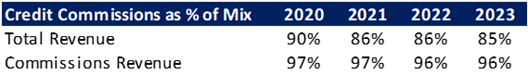

Commissions Revenue and Mix, Highly Levered to Credit Trading

MKTX’s commissions revenues are made up of two main components, variable transaction fees and fixed distribution fees, across three broad asset classes, Credit, Rates and Other. Fixed distribution fees set at a fixed rate and are billed to broker dealer clients on a monthly basis whereas variable transaction fees are calculated as a “percentage of the notional dollar volume of bonds traded and vary based on the type, size, yield and maturity of the bond” (MKTX 2023 10K). Roughly 80% of total commissions are based on variable transaction fees. The vast majority of commissions revenue (both variable transaction fees and fixed distribution fees) is related to credit trading, as credit trading comprises >90% of total commissions, rates trading makes up 3% and other makes up 3% (up from 0 a couple of years ago).

MKTX 2020, 2021, 2022, 2023 10Ks

Expense Growth Has Remained Elevated Despite Revenue Headwinds, Leading to Margin Compression

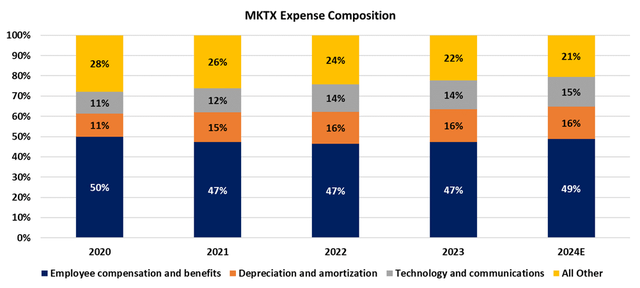

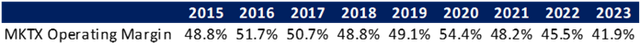

MKTX’s expenses have seen a pretty consistent split over the years, as MKTX is heavily weighted towards compensation expense (~50% of the mix) followed by depreciation and amortization (~16% of the mix), then technology and communications expense (~15% of the mix) and then all other expenses, which includes a number of line items (21% of the mix).

MKTX 2020, 2021, 2022, 2023 10Ks

Despite the recent headwinds facing the revenue side of the picture, MKTX’s expense growth has remained elevated in recent years, growing at a CAGR of 12% between 2020 and 2023. This compares to a CAGR during the 2015-2020 time period of 15%. This has lead to margin compression in recent years, as MKTX’s operating margin has fallen from a high of 54% in 2020 to 42% in 2023.

MKTX 2020, 2021, 2022, 2023

And the results have been reflected in MKTX’s multiple, which has compressed from a high of nearly 76x NTM earnings in 2020 to the current nearly 32x NTM earnings.

Seeking Alpha

Historical Volume and Market Share in Select Products

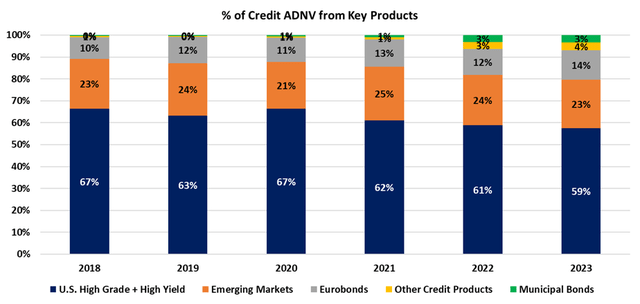

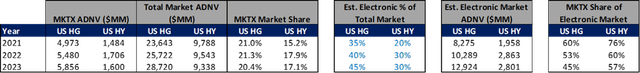

As mentioned previously, >80% of MarketAxess’ revenue comes from commissions revenue related to its Credit products, the bulk of which are U.S. High Grade and U.S. High Yield credit (59% of 2023 Credit ADNV was made up of U.S. High Grade and U.S. High Yield credit). As such, these two products have an outsized influence on MKTX’s financial performance, thus, monthly volume and market share updates typically dictate how the stock trades over the coming days/weeks. Since 2018, U.S. High Grade and U.S. High Yields ADNV have grown impressively (9% and 18% CAGR, respectively). However, the bulk of this growth in recent years has come on the back of strong overall market growth as MKTX’s U.S. High Grade market share declined from an annual high of 21.6% in 2020 to 20.4% in 2023 and U.S. High Yield Market share declined from a high of 17.9% in 2022 to 17.1% in 2023. Further, market share in U.S. High Grade has slipped further in 2024-to-date to 19.0% and U.S. High Yield market share has slipped to 13.1%. MKTX has pointed to the low level of credit spread volatility as drivers of lower market share YTD (particularly as it relates to High Yield market share) as well as a greater focus on the new issuance calendar by MKTX’s long only clients, which typically pressures share as early trading in new issues occurs directly between dealers and institutions.

MKTX Monthly Volume Reports

Despite these near-term market share headwinds, MKTX sits in the middle of a structural shift in the credit markets. According to MKTX’s 2023 10K, an estimated 45% of the U.S. High Grade and 30% of the U.S. High Yield market is traded electronically today, which compares to 40% for U.S. High Grade and 30% for U.S. High Yield in 2022 and 35% for U.S. High Grade and 20% for U.S. High Yield in 2021. These figures compare to the U.S. equity, U.S. options and FX markets which are currently ~90% electronic and the U.S. Treasury market at around 65% (per MKTX 2022 10K). As the market continues to further adopt electronic trading, MKTX stands to benefit as the premier electronic trading platform in the space. As a caveat here, it does appear that MKTX has lost share to other electronic trading platforms in recent years as MKTX’s share of U.S. High Grade electronic trading in 2023 was an estimated 45%, down from 60% in 2021 and MKTX’s share of U.S. High Yield electronic trading in 2023 was an estimated 57%, down from 76% in 2021 (MKTX’s primary competitors in the electronic credit space include Bloomberg, Intercontinental Exchange and Trumid). That being said, the shift towards more electronic trading stands to benefit all players in the market, including MKTX.

MKTX Volume Reports and MKTX 10Ks for 2021, 2022, 2023

2Q24 Earnings Review and 2024 Guidance Updates

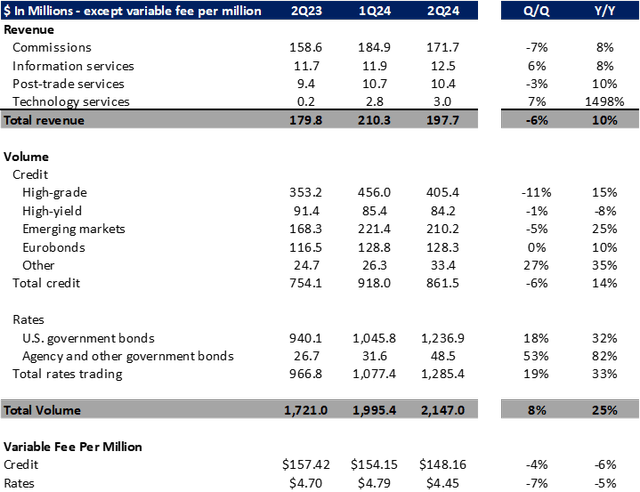

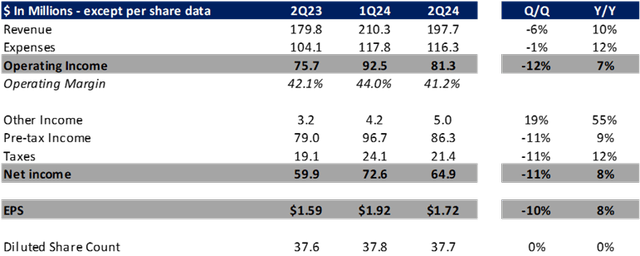

MKTX reported mixed earnings results in 2Q24 on August 6. EPS came in at $1.72, up 8% Y/Y (down 10% Q/Q – note MKTX results tend to be very seasonal, with 1Q historically very strong). Revenue was up 10% Y/Y (to $197.7 million) on 8% growth in Commissions revenue, 8% growth in Information Services revenue, 11% Growth in Post-trade Services revenue and the addition of Technology Services revenue from the Pragma acquisition (which closed in 4Q23 so MKTX has not fully lapped the timing of that yet). Variable transaction fees were up 12% Y/Y on 8% growth in Credit, 26% growth in Rates, plus the impact of the Pragma acquisition in the Other line, which amounted to $5.1 million in the quarter. Fixed distribution fees were down 6% Y/Y on a 6% decline in Credit, which MKTX attributed to the consolidation of two dealers on the platform plus the migration of some dealers to the variable fee plans, and a 2% increase in Rates. Credit volume was up 14% in the quarter, which helped drive the 12% growth in variable transaction fees; however, this was offset by a 6% decline in credit variable transaction fee per million dollars traded, which MKTX attributed to lower High Yield trading (USHY credit ADV was down 8% Y/Y), a protocol mix shift and higher portfolio trading activity (which caries a lower fee per million).

MKTX 2Q24 Earnings Release

On the expense side, expenses were up 12% Y/Y to $116.3 million (partly due to the Pragma acquisition). This lead to operating income of $81.3 million (up 7% Y/Y) and an operating margin of 41.2%, down from 42.1% in the prior year period. On the capital return side, MKTX paid out a $0.74 dividend in the quarter, and used $33.5 million to repurchase 164k shares. Notably, MKTX also announced an increase to its repurchase authorization to $250 million and noted on the earnings call that this showed the company’s willingness to be more opportunistic with share repurchases going forward and potentially repurchase shares beyond just offsetting employee stock-based compensation dilution. In terms of guidance updates, MKTX noted that its total operating expenses for the year would be slightly below the low end of its original guidance range of $480-500 million, which I view as a positive as I think management understands that it needs to get a handle on expense growth given the slowdown in ADNV and market share growth we have seen of late.

MKTX 2Q24 Earnings Release

Other Recent News – Announces Connection with ICE Bonds

On August 5, MKTX announced plans to connect its liquidity network with that of ICE Bonds (Intercontinental Exchange) to bring efficiency and a greater pool of liquidity to the fixed income market. On its 2Q24 earnings call, MKTX noted that the two companies have a long history of buying and selling data to each other and that the relationship between the two companies was very good. Additionally, MKTX noted that the smaller retail sized trades that are typically found on ICE’s TMC platform were going to be a benefit to MKTX’s more institutional clients by way of unlocking the ability to make odd lot trades. I view this announcement as a modest positive as it should allow MKTX’s clients to access smaller sized trades if they are trying to break up a larger block of bonds and not impact the market with a large purchase or sale.

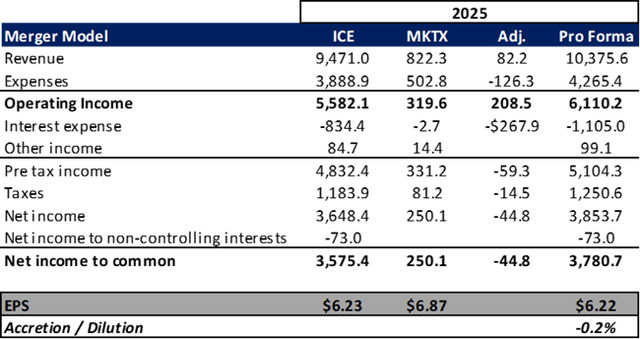

Could the ICE News Potentially Lay the Groundwork for MKTX to Be Acquired Down the Line? – It Could Be Possible

Given the ICE partnership announcement, I think it could be possible that this could set MKTX up to be an acquisition target during the medium term. First, MKTX’s current CEO, Chris Concannon, has a history of M&A activity. As CEO of Bats Global Markets, he helped sell the company to CBOE in 2017. Second, MKTX’s platform would fit well with ICE’s suite of products as a global exchange operating, fixed income data provider, and more recently, electronic mortgage platform. Third, based on ICE’s expectations and my assumptions for ICE’s earnings over the next year and a half, I believe ICE will exit 2025 with a gross leverage ratio around 3.0x, which is ICE’s stated goal following its acquisition of Black Knight. Finally, ICE has been a serial acquirer over the years, with a history of adding adjacent businesses to build out a truly global network of products (as laid out in my ICE initiation). I think the two companies could mesh well together and there could be significant synergies by combining the two firms, both on the expense side as well as the revenue side. Assuming 10% revenue synergies (of MKTX’s estimated 2025 revenue) in a potential transaction, 25% expense synergies (of MKTX’s estimated 2025 expenses) and a 50/50 cash (in newly issued debt) stock split in a potential transaction, I estimate a potential deal between the two would be essentially neutral to ICE’s estimated 2025 EPS. However, there is potential that the revenue synergies could exceed my expectations in a transaction, which could add upside to my estimates.

Analyst Estimates

Valuation & Rating

MKTX currently trades at a relatively depressed multiple vs. its historical level (32x NTM earnings vs. levels prior to 2021 of around 60x). Given the pressure lately on MKTX’s market share, I believe this multiple contraction is warranted, as MKTX has not seen the 100+ bps of market share expansion Y/Y as it did in the past. While 35x NTM earnings is still a decent premium to other stocks in the space (CBOE, CME, ICE, NDAQ all between 19x and 23x), I think this is warranted given the aforementioned cyclical trend of migration of credit markets to becoming more electronic, which MKTX continues to benefit from. Additionally, as discussed, I think MKTX deserves at least some premium for the potential to be an acquisition target down the road. While I like the company and believe in the long-term value and strength of the business, the recent results have been underwhelming relative to MKTX’s history. Given this, I rate MKTX HOLD currently. I want to become more constructive on the stock, but I am waiting to see a meaningful turn in the market share and revenue trends before I can rate this stock as a buy.

Risks To The Thesis

Key risks to my thesis include 1) market share trends – this could play out in two ways, either market share continues to come under pressure, which would further depress MKTX’s multiple, or market share could rebound, driving multiple expansion, 2) if management does not continue to manage expenses well, this could lead to further pressure on margins down the line, 3) if the longer-term trends of electronification of the fixed income markets falter, that would lead to lower benefit from the industry tailwinds MKTX has benefitted from over the years.

Conclusion

MKTX is a strong player in the electronic credit trading space. The business has produced solid results over the longer term, but the recent slowdown gives me pause at present. I do believe there is potential for MKTX to be acquired down the line, which should warrant a multiple premium. I think the longer-term trends in the industry remain solid, but I am waiting for a turn in market share trends to become more constructive on the name.

Read the full article here