Introduction

Samsara (NYSE:IOT) is a SaaS company that provides tailored IoT (internet of things) solutions for transportation and logistics companies. This is a subsector of the market that is relatively untapped and is poised for explosive growth as artificial intelligence improves over the coming years. IOT is at the forefront of innovation in this sphere with their cutting edge technology making them an extremely compelling investment opportunity at current share price levels.

While the SaaS sector has been out of favor recently due to relatively mediocre earnings, IOT has been an outlier posting a double beat in their most recent quarter. This is more of the same as they have managed to beat both top and bottom line expectations over each of the past three years.

In this article I will explore IOTs current business model, some new product offerings, the competitive landscape, and finally review a discounted cash flow model I built to assess the current valuation of this firm. I currently rate IOT a buy heading into their next earnings call.

Samsara Business Model

Samsara’s business model is relatively straight forward, yet their product offerings are complex and diverse. On the home page of their website they state that “We help the most complex organizations empower their people with a single, secure operations platform.” Some of their solutions include video-based safety, vehicle telematics, and equipment monitoring.

The video-based safety technology product suite includes two main product offerings: the AI dash cam and site visibility cameras. The AI dash cam uses real-time AI programs to detect unsafe driving, road hazards, and allows for “in-cab coaching.” On their website, IOT claims that they have helped prevent over 200k crashes for customers using these cameras. This clearly offers a tangible benefit for large trucking operations considering the average cost of large truck accidents is $91k.

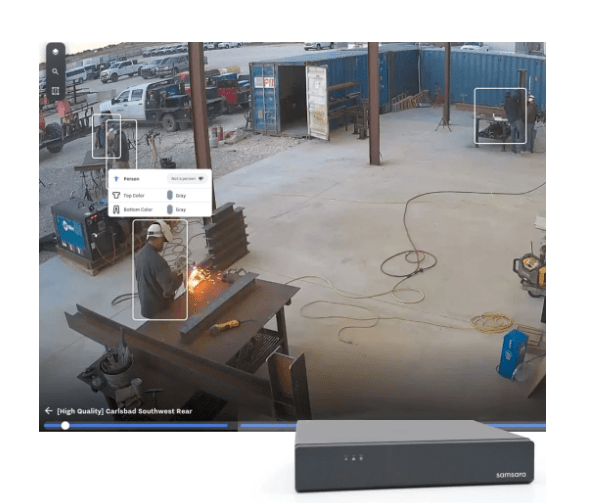

The site visibility cameras are cloud-connected and offer insight into onsite activities. There are AI-driven search tools built into Samsara’s cloud platform that significantly reduce the amount of time it takes to investigate safety incidents that happen on worksites. Additionally, IOT allows customers to use their existing camera infrastructure to deploy their video-based safety technology. This is a fantastic approach as it eliminates the headache of having to overhaul an entire site monitoring system. Rather, IOT allows customers to integrate their software seamlessly and for a relatively low cost. This should prompt more hesitant enterprise customers to consider onboarding with Samsara going forward.

Site Visibility (Samsara)

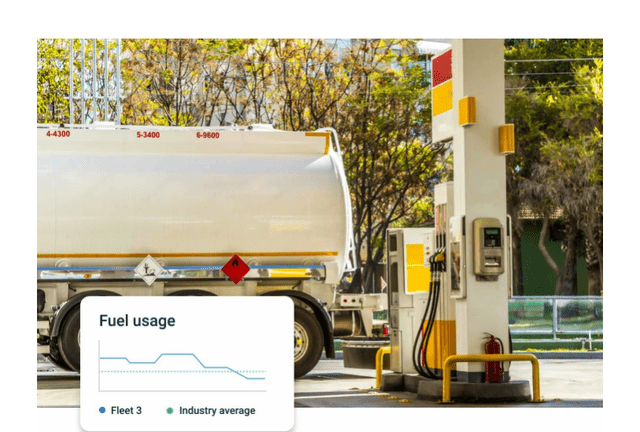

The vehicle telematics segment offers firms GPS fleet-tracking and vehicle diagnostics to improve both efficiency and safety. Some of the neat features they offer include route optimization technology which analyzes individual drivers routes and driving trends and provides personalized feedback to improve efficiency and reduce overhead costs. Additionally, the vehicle diagnostics feature helps organizations to preemptively spot issues in their fleet and provide support to drivers to avoid trucks breaking down in-route.

The vehicle telematics segment also provides enterprises with filing mileage and fuel purchase reports which reduces the amount of man hours spent on these tasks.

Vehicle Telematics (Samsara)

The equipment monitoring technology is incredibly cool as it gives companies an automated utilization report for each piece of equipment they choose to track. This will help management reallocate equipment based on what is being underutilized between different sites and allow them to save on the costs of purchasing more unnecessary tools.

New Products

IOT recently released a new enterprise grade asset tag which is described as “first of its kind.” This product is designed to give enterprises visibility into valuable assets that do not contain serial numbers and therefore are extremely difficult to track. This product uses Bluetooth Low Energy technology which allows the asset tag to communicate with the rest of a firm’s network. The Samsara cloud platform will analyze the data relayed from the asset tags in order to effectively communicate the locations of these assets.

I do not pretend to be an expert in technology, therefore my first question when learning about this new product offering was “Ok, what’s the difference between this and an apple air tag?” First of all, these tags will support large-scale operations, which is IOTs target customer segment. These tags work with a broad network of gateways that allows the enterprise to view the location of thousands of assets simultaneously. The asset tag product is also designed to fit seamlessly within the Samsara cloud offerings, which includes inventory management and tracking systems. This reduces the manual labor required to track these valuable assets which reduces operating expenses over time.

Competitors

One of IOT’s primary competitors is Trimble (TRMB). This company has a broader suite of offerings and is currently generating more revenue on a TTM than Samsara. They also offer solutions for logistics companies, specifically under their “Transportation” segment. They conveniently disaggregate both their revenue and operating income by both segment and geography. In FY2023, their EBIT margin in the transportation segment was 17.57%.

TRMB’s geographic revenue splits are very different than IOT as they only generate 64.08% of their top line in North America compared to who gets 87.68% of their revenue from the U.S. alone. I believe that this is bullish for IOT as the recent push towards nearshoring and reshoring manufacturing should boost domestic logistics industries and in turn the number of firms who need vehicle telematics offerings like Samsara.

Across three different websites IOT ranked higher in every single category (sources: softwareadvice.com, Compare Samsara vs. Trimble TMS (Formerly TMW Systems) | G2, and capterra.com). From ease of use and functionality to the quality of the GPS and driver management systems, IOT is clearly the superior product. This will factor into my valuation when projecting future operating margins. The quality of the product determines the premium that firms are able to charge, and it is clear as day that IOT offers superior transportation and logistics solutions.

Discounted Cash Flow Model

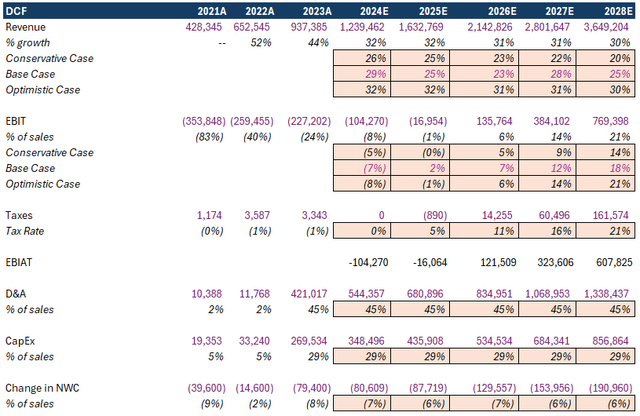

In order to value IOT I built a DCF model with three scenarios: a conservative, base, and optimistic case. For the base case I used consensus estimates from analysts to determine revenue growth. As of now, IOT is expected to grow the top line at a 19.71% CAGR from FY2025-FY2029. This seems realistic to me given the vast array of use cases and the expected improvements in the artificial intelligence space over the remainder of the decade.

Computing an operating margin was a more difficult task considering this was negative in the last full year of data (-26.68%). IOT is currently guiding for a non-GAAP operating margin of 3% in FY2025. They adjust operating income to exclude SBC, lease modifications, impairment, and legal settlements. While SBC is a non-cash expense, it is dilutive to shareholders and therefore I believe it should be included in this calculation. Since FY2022 they have averaged $214mn in SBC, which is an incredibly high figure (24.5% in the TTM ending in May). Since this expense is incredibly difficult to forecast, I am simply going to use the median to adjust this year’s non-GAAP operating income figure.

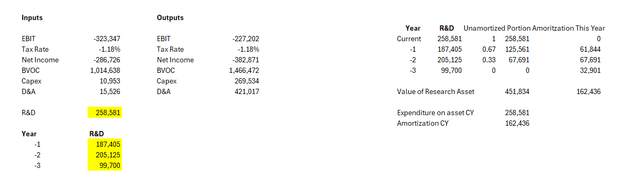

If we take the median revenue figure ($1.209bn) for FY2025, this gives us a non-GAAP operating income figure of $36.27mn. Adjusting this for the SBC expense gives us a GAAP operating loss of $177.73mn (-14.6% operating margin). This represents a 10% improvement YoY but still a year in which they are losing money. While share based compensation represents an expense, I believe that research and development for many technology companies should be a capital expense. Therefore I have taken the liberty of converting IOTs FY2024 R&D expense into a capital expenditure and in turn an asset on the balance sheet.

R&D Capitalization (Aswath Damodaran)

This process will amortize 1/3 of each of the previous three years R&D expenses in the current year and also gives us a value for the research asset. Samsara, as evidenced in the above section, has been able to create a host of useful products and is constantly innovating in order to better serve their customers. R&D is a necessary expense and should, if done correctly, pay dividends in the future. I believe in IOTs management and their decision making, therefore I believe capitalizing R&D is the most effective way to value this company moving forward.

The adjustment to operating income caused the operating margin to improve by 7.93%, a substantial boost. If we apply this to the estimate for FY2025, we arrive at an operating margin of -6.73%. Given the positive trend here, I think it is safe to assume that IOT will reach operating profitability by FY2026. I applied a 2% operating margin this year, around a 9% improvement from FY2025. For the final year of the DCF I referenced TRMB’s 17.57% operating margin mentioned earlier. I view this as a solid base case scenario considering IOT offers an objectively superior value proposition and higher customer approval ratings.

DCF (Author)

After discounting these projected future cash flows back to the present using the weighted average cost of capital as a discount rate, I found the optimistic scenario to be an implied share price of $43.01, which is 17.65% higher than what shares are currently trading at. Both the base and optimistic cases showed some potential downside which stems from the fact that this company is simply trading at very high multiples relative to current revenue and operating metrics.

I love a great value play, but sometimes you have to be willing to pay a premium to acquire a good company before it becomes a great one. I believe that is the point in IOTs growth story we are at. Investors have bid up the price to reflect growth prospects, and now it is on management to deliver upon these expectations.

Risks

The primary risk to IOT and my future growth expectations for the company is increasing competition. As of right now there is relatively limited competition, but due to the size of the industry there are sure to be companies operating in adjacent verticals who will become interested in taking market share away from Samsara.

Another slightly unnerving development is the sizeable amount of insider shares that have been sold over the past 2 years. Since 2022 there has been approximately 79 million shares solder by insiders. This is relatively unusual for a company that is experiencing high growth like Samsara, but it is unclear exactly why insiders have sold so many shares. In all likelihood it could be a measure taken to diversify executives portfolios in the event shares sell off significantly for any reason. Therefore I do not believe this poses a massive risk to shareholders.

Takeaways

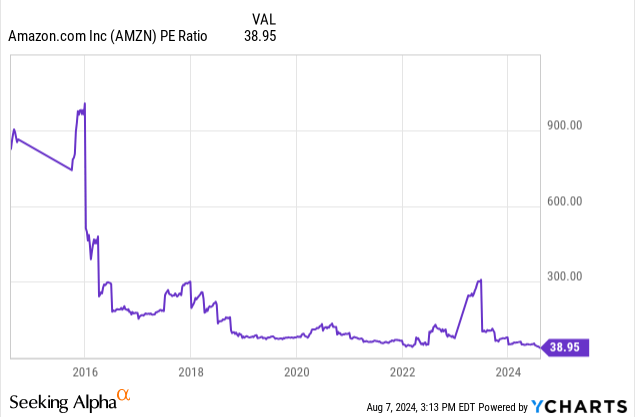

While IOT is certainly not a cheap stock today, I do not believe that shares of this company are going to go on sale anytime soon considering the explosive growth projected over the coming years. If you had avoided Amazon over the past decade due to its high P/E multiple you would have missed out on the astronomical share price gains over that period.

AMZN P/E (Y Charts)

Great companies tend to be expensive, and IOT is no exception. While there may be dip buying opportunities in the future, I believe now is a good a time as any to initiate a position if you are willing to hold over the long term. This is not a short term trade and it will take time for IOT to grow into its lofty valuation (as it did for Amazon over the past 20 years). I am initiating a buy rating on this stock ahead of earnings with a price target of $43 per share.

Read the full article here