VAALCO Energy (NYSE:EGY) reported the second quarter results. The accounting for the Svenska acquisition resulted in a one-time gain of nearly $20 million reported for the second quarter. This is known as a gain in purchase. Supposedly the acquisition is just so good that the company is forced to report a gain on the purchase. Along with that came the news that the SEC reserves were roughly a couple of million barrels better than expected for the acquisition.

Along with this was a surprise announcement that the initial results in the Canadian well campaign came in with a higher than expected 70% oil production. This acreage was purchased several years ago as basically dry gas production. As technology has advanced, the acreage is now a long way from those days. As a result, Canada showed more oil production for the company.

The last article noted how the company was operating in some riskier areas that allowed for low prices and a fast payback of the purchase price. The net result of this is that the management keeps a hefty cash balance along with no long-term debt as a way to manage at least some of the risk of doing business.

In Egypt, for example, the government received a back payment of roughly $8 million (in July after the quarter close) while admitting to the company they owed roughly another $50 million. When the debts go back this far and that high relative to the size of the company, then a lot of cash is needed to manage the situation.

In Egypt, the Company received written confirmation from EGPC that $51.7 million was recognized in their June Accounts Payable as owed to Company for our Merged Concession effective date adjustment, from which they will offset $11.2 million to satisfy any obligation of VAALCO or its subsidiaries in connection with the TransGlobe combination. This allowance of $11.2 million is fully covered in the 30th June 2024 Balance Sheet. Having this confirmation from EGPC is an important step in the process of getting this paid.”

This quote from the earnings press release demonstrates that this company is having as much “fun” collecting its receivables in Egypt as its predecessor from the government.

Second Quarter Production

Thanks to the acquisition, the second quarter production demonstrated decent growth over the second quarter of the previous fiscal year.

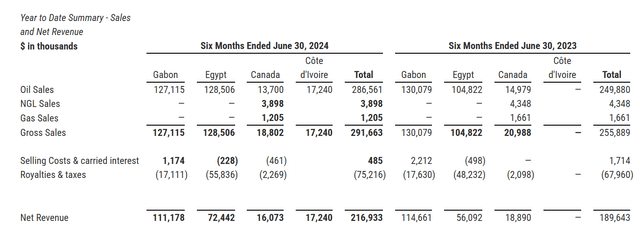

VAALCO Energy Second Quarter YTD 2024, Sales Comparison (VAALCO Energy Second Quarter 2024, Earnings Press Release)

The Côte d’Ivoire acquisition provided much of the YTD gain over the previous fiscal year. Currently, management is planning a drilling campaign in Gabon next year that would influence production there. But until then, it is natural production declines that rule the comparison.

Egypt is benefitting from a new production agreement that encourages the development of higher cost production in older fields that the company owns. The downside to this is that the Egyptian government is a really slow payer, as noted before. This is the other area of the business that provided a material part of the sales gains when compared to the previous fiscal year.

Probably the biggest surprise is that in Canada, the company is having surprising success in raising the percentage of oil produced. The progress does not show in the sales figures shown above just yet. But if it continues (and that is likely), there are going to be some very good comparisons ahead.

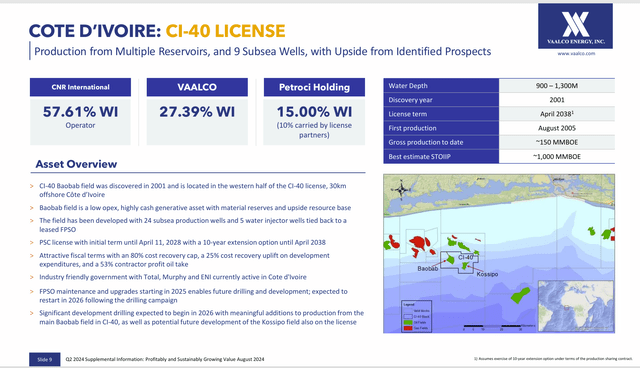

For the rest of the fiscal year, the acquisition made in the Côte d’Ivoire area will expand the growth shown for the current fiscal year. However, that production is going offline next year as the FPSO needs maintenance for about one year. At this stage, the maintenance is being planned, and various arrangements are being made. Costs have not yet been revealed. However, this company has the cash to handle its share of repairs and probably do the planned Gabon well drilling campaign as well.

The rest of the fiscal year is likely to be a cash building process. Therefore, when the challenges of next year arrive, this management will meet those challenges with a big cash balance.

Svenska Acquisition

One of the things that will likely hold the stock back for the time being is the knowledge that along with the Svenska acquisition comes a next year-long repair and upgrade. Mr. Market tends to look forward, and he sees an absence of the production now being reported. Even though there are a number of ways for the company to make up for that production loss, Mr. Market has a tendency to assume the worst.

VAALCO Energy Overview Of Svenska Acquisition (VAALCO Energy Second Quarter 2024, Earnings Conference Call Slides)

Once the Gabon drilling campaign is underway, and some results come in while Egypt continues to show production growth, then maybe the stock price will get moving. But it could well be a few months of “treading water” until that movement happens.

It is still a very positive acquisition for the company.

Summary

The company showed production growth thanks to the recent acquisition. However, the stock price may not move much until the FPSO is repaired and operating again in 2026. Then, of course, the market will be excited about a sizable production jump once the field is producing again.

What will help next year is the continued growth of other businesses, with the Gabon offshore drilling campaign probably offering the best chance to more than offset the production loss when the FPSO stops producing for a year.

In the meantime, this company has a big cash balance with no long-term debt. The recent acquisition spreads the business out into yet another country. That diversification helps because the part of Africa that the company does business in has seen some instability in recent years. That causes the market to value the business accordingly.

Nonetheless, this company remains a speculative strong buy consideration for those willing to handle the risk of the company’s strategy. This company has been very successful with what it does. That big cash balance and debt free balance sheet prove it. Ultimately, the continued diversification may provide a level of safety and certainty that will enable the market to value the company business higher. In the meantime, there are far worse things than generating a lot of cash and staying away from debt.

Risk

The countries where the company does business have a fair amount of instability. A previous article covered the Gabon coup. It does not take too much of that kind of thing for the market to value the whole business accordingly. However, whoever has come to power recognizes the need for a healthy oil and gas industry (at least so far). That has allowed the industry and this company to prosper, no matter what entity is running the country.

Any upstream company has exposure to the volatility and low visibility of future commodity prices. A severe and sustained commodity price downturn could change the outlook of this company. The debt free balance sheet provides some protection against financial stress that other less financially able competitors would feel first.

It takes a special talent to do business in Africa. The people with the ability to do that are probably not as common as the usual oil and gas people. Therefore, the loss of key employees could materially damage the company’s future prospects.

Read the full article here