Strong Earnings Results Coming out of 2Q24 and Strong Share Price Reaction; Downgrading to HOLD on Valuation

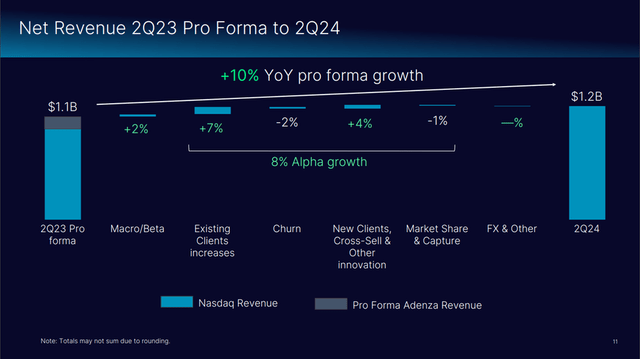

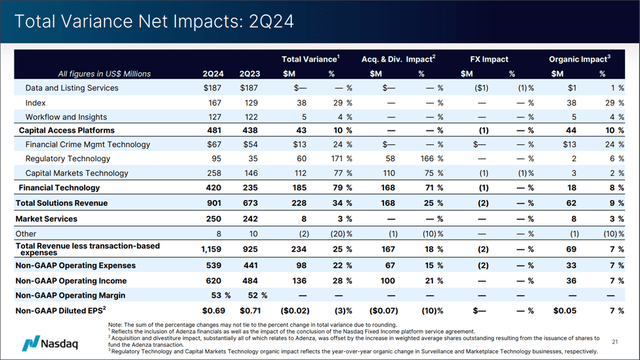

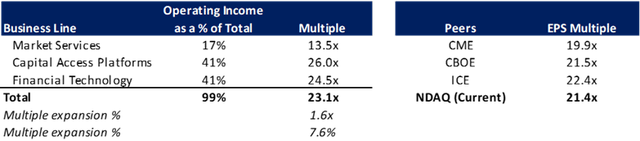

On Thursday, July 25, Nasdaq reported strong 2Q24 earnings results, putting up EPS of $0.69 vs. the consensus expectations of $0.64. Revenue was particularly strong, coming in at $1.16bn (+25% Y/Y), beating consensus estimates by $27.3mn (3%). On the expense front, Nasdaq reported adjusted operating expenses of $539mn (+22% Y/Y), translating into an adjusted operating margin of 53.5%, up 120 bps Y/Y). In addition to solid operating results, Nasdaq announced that it paid down $174 million in commercial paper in the quarter and returned $196 million to shareholders via $138 million in dividends and $58 million in share repurchases. In summary, Nasdaq’s 2Q24 earnings results were very impressive and exceeded most people’s expectations. Not surprisingly, given the strong results, Nasdaq’s share price has risen 7% since the day before the earnings announcement as the market is beginning to give the company credit for its business mix shift and potential for rapid deleveraging. As I noted in my initiation report (Nasdaq: Operating Leverage Embedded Given Revenue Mix; Multiple Expansion Is Warranted) Nasdaq’s business model is geared for meaningful operating margin expansion over the medium term and the shift in its business mix over this timeframe continues to warrant multiple expansion (though currently less so than when I first wrote on the company). Additionally, I continue to believe that the recent announcement by TXSE Group to launch a stock exchange headquartered in Dallas, Texas is likely not cause for major concern at Nasdaq given the business mix shift I previously mentioned. However, this recent run has closed the multiple gaps meaningfully, and now I only see ~8% multiple expansion for the exchange. As such, I am downgrading the shares to HOLD from STRONG BUY.

Nasdaq 2Q24 Earnings Presentation

Positives from the Quarter

There were several positives coming out of Nasdaq’s 2Q24 results. First, organic growth rates across a number of Nasdaq’s business lines were very strong. Nasdaq’s Index business put up organic growth of 29% Y/Y vs. its medium-term outlook of mid-to-high single digits, the combined Adenza businesses reported growth of 30% Y/Y vs. the medium-term outlook of low to mid-teens and Financial Crime Management Technology showed organic growth of 24% Y/Y, in line with its medium-term outlook of mid-20s. Across all of Nasdaq’s Solutions Businesses, organic growth in the quarter was 9% Y/Y, within the medium-term outlook range of 8-11%. In addition, to the strong growth in the businesses mentioned above, Nasdaq reported that it was making solid progress in against its cross-sell opportunities following the closing of the Adenza acquisition in 4Q23, reporting 4 cross-sells during 2Q24. Nasdaq also announced that it signed a new Tier 1 bank client within its Financial Crime Management Technology business. Finally, NDAQ stated that the integration of Adenza was proceeding ahead of schedule as it has already actioned 70% of the $80 million in expense synergies from the acquisition, 6 months ahead of its planned timing.

Nasdaq 2Q24 Earnings Presentation

Negatives of the Quarter

In terms of areas of relative weakness in Nasdaq’s results, Data and Listings business remained under pressure due to the soft IPO environment and the impact of delisting activity in 2023. However, CEO Adena Friedman was cautiously optimistic on the earnings call, suggesting that the IPO market was beginning to open up and suggested that 1H25 could see stronger activity in the market. Additionally, the Capital Markets Technology business put up revenue growth of 1% in the quarter vs. medium-term expectations of 4%; however, Nasdaq attributed this to difficult comps relative to last year due to the impact of a large implementation fee in 2023 and noted that the headwind from that tougher comp should abate by 4Q24. Finally, the Workflow and Insights business remained softer, showing organic growth of 4% Y/Y vs. medium-term expectations of 10%, which management attributed to headwinds in the Corporate Solutions business due to the impact of delisting in 2023.

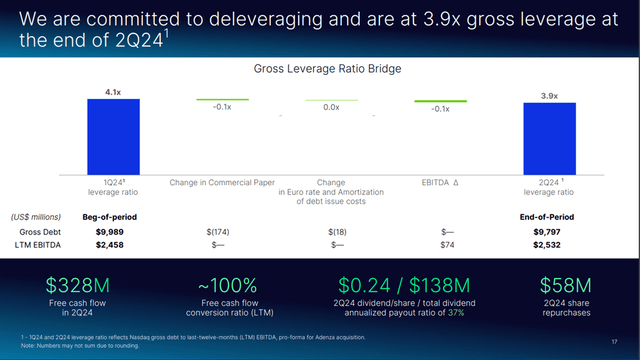

Deleveraging Occurring Ahead of Schedule, Share Repurchases Resume

Given the strong free cash flow generation in the quarter of $460 million, Nasdaq was able to pay down $174 million of Commercial Paper in 2Q24, which brought gross debt levels at the end of the period to $9,797 million. Given LTM EBITDA of $2,532 billion, Nasdaq’s gross leverage ratio ended the quarter at 3.9x, which is ~2-5 months ahead of Nasdaq’s plan of achieving a gross leverage ratio below 4.0x within 9-12 months of the Adenza acquisition close. Additionally, Nasdaq resumed share repurchase activity during the quarter, buying back $58 million of stock during 2Q, which was ahead of my expectations for share repurchases to resume during 3Q24. In terms of capital allocation priorities going forward, Nasdaq continues to prioritize debt paydowns, with the ultimate goal of achieving a leverage ratio below 3.3x (which I believe can be achieved by the end of 2025) and will also remain opportunistic on share repurchases.

Nasdaq 2Q24 Earnings Presentation

Guidance and Commentary for the Remainder of 2024

During the 2Q24 earnings conference call, Nasdaq provided guidance/commentary across a number of revenue, expense, and capital management lines. In terms of the Capital Access Platforms businesses, Nasdaq noted that it anticipates this business to exceed its medium-term growth outlook range as the Index business is expected to come in above the range, the Workflow and Insights business is expected to come in below the range and Data and Listings are expected to be roughly flat Y/Y. The Capital Markets Technology business is expected to put up growth for 2024 in line with Nasdaq’s medium-term outlook, with more normalized growth in the back half of the year. On the expense front, Nasdaq tweaked its expense guidance higher (due to revenue outperformance and related incentive compensation increases) to a range of $2.145bn-$2.185bn from $2.125bn-$2.185bn previously and made no updates to its tax rate guidance of 24.5-26.5% for the full year. Finally, on the capital allocation front, Nasdaq noted that it remains focused on deleveraging while remaining opportunistic with respect to share repurchases.

Thoma Bravo Exits 50% of Its Stake and Nasdaq Repurchases an Additional 1.2 Million Shares

Following the strong 2Q24 earnings release, Nasdaq announced that it was launching a secondary offering of 41.6 million shares owned by Thoma Bravo, equivalent to ~50% of Thoma Bravo’s stake in Nasdaq. Additionally, Nasdaq announced that it was repurchasing 1.2 million additional shares from Thoma Bravo, conditioned on the secondary offering. The secondary offering closed on July 29 and reduced Thoma’s stake in Nasdaq to 7.4% (42.8 million shares). I view the announcement as a positive as it removed a substantial overhang on Nasdaq’s stock and further, proved that Nasdaq was committed to opportunistically repurchasing shares, as the company had noted was one of its capital management priorities.

Continue to View the Company Very Favorably, Downgrading to HOLD as Valuation Approaching Fair Value

Following the 2Q24 results, I continue to view Nasdaq’s business model very favorably. The company has again demonstrated its ability to quickly and effectively integrate acquisitions and rapidly delever, even ahead of its stated plans. I continue to believe the company will exceed its targeted timing for full deleveraging and believe the company has some tailwinds in its integrated business as it realizes the synergies following the Adenza acquisition. However, given the recent run-up in share price following the 2Q results, I am downgrading the shares to HOLD as I currently see less than 10% upside to the company’s multiple. Given the future business mix of the combined company, I think a fair EPS multiple is closer to 23x vs the current 21.4x 2025 EPS (~8% upside).

Seeking Alpha EPS estimates for peer group and analyst estimates

Read the full article here