Investment Thesis

Fortinet (NASDAQ:FTNT) is set to report their Q2 FY24 earnings next week on Tuesday, August 6th, after markets close for business.

Markets will be looking for additional clarifications on Fortinet’s progress with its SASE products this quarter as well. But more importantly, the focus will be back on the Sunnyvale, CA-headquartered company’s Secure Networking business, which includes their networking and security operating system, FortiOS, that powers their network firewall appliances, VPNs, and other security infrastructure, which is sold to over 700k customers.

The clock is ticking for Fortinet’s management, who have been vocal about growth returning to the company’s security platform in the back half of 2024.

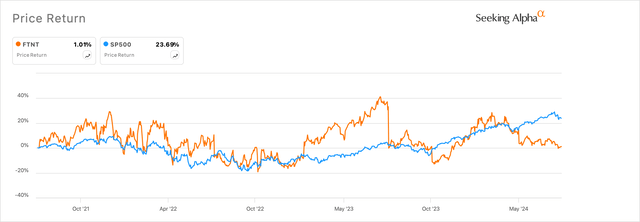

So far, markets appear to be skeptical of the return to normalized growth levels, with the stock now entering its third year of staying range-bound.

Exhibit A: Fortinet’s much-awaited return to normalized growth still eludes the company as illustrated by market’s perception of its stock. (Seeking Alpha)

I have been previously bullish on the company’s return to normalcy after customer spending slowed down on the platform in the past few years, since I believed the company would be able to take advantage of the spend ramp seen in the broader cybersecurity industry.

But I will be downgrading my view on Fortinet as it enters its Q2 earnings next week due to the slower-than-anticipated recovery.

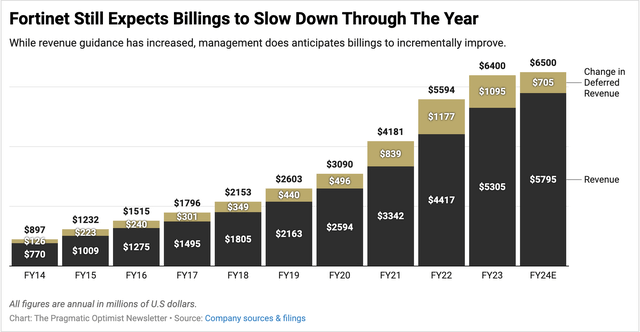

Billings Deceleration Has Defied Upgrades in Revenue Guidance

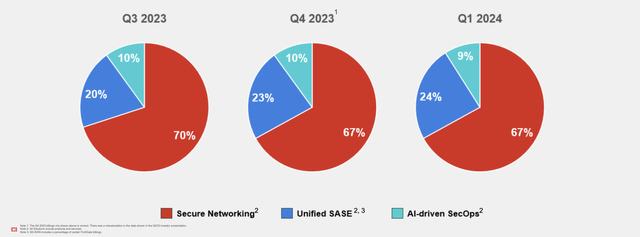

I covered Fortinet in April of this year, and I was bullish about the momentum the company had demonstrated in their FortiSASE product. The company had previously reported that their Unified SASE product platform, Fortinet’s answer to the single-vendor SASE solution gap that encompasses solutions such as firewalls, SD-WAN, Secure Web Gateway, CASB (Cloud Access Services Broker), Data Loss Prevention, ZTNA (Zero Trust Network Access), and cloud security solutions, had accounted for 23% of Fortinet’s total billings in the final quarter of 2023. This was 23% of the total billings that Unified SASE accounted for in Q3.

Exhibit B: SASE’s contribution of Fortinet’s total billings in the past three sequential quarters (Investor Presentation, Fortinet)

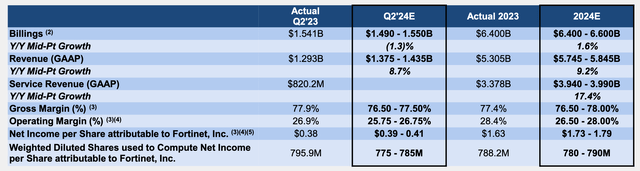

In Q1 this year, Fortinet reported Unified SASE now accounted for 24% of total billings in Q1, which implied a 1% expansion in SASE contributions to total billings. But what has me concerned now is that the contribution from their Secure Networking products and even their emerging AI SecOps product segments is falling, indicating some slowdown in billings. This was also visible in the management’s guidance, where they indicated that they would be expecting total billings of $6.4-6.6 billion, unchanged from their expectations at the start of the year.

Exhibit C: Fortinet’s revenue trends with slowing billing trends (Company filings)

Management’s guidance on total billings and revenue for FY24 translates to depressed expectations for deferred revenue, the invoiced amount that is collected upfront but is not yet recognized as revenue.

This is important to note, in my opinion, because deferred revenue indicates the future revenue that Fortinet has already collected but will be recognizing over time. According to annual filings, Fortinet usually recognizes ~50% of deferred revenue in the next twelve months on a rolling basis. A slowdown in billings and the eventual deferred revenue point to some slowdown, which I anticipate in the next twelve months, unless management revises their outlook for the upcoming Q2 earnings next week.

What changed my opinion about the billing slowdown was that Fortinet had multiple conferences to showcase their customer base or explain details about their customer deal pipeline, but that seemed to be lacking, unlike previous conferences. At both the BofA GTC and J.P. Morgan TMT conferences, management did not provide specific details about customer deals, unlike the “8-figure deal” and customer pipeline expansions that management had talked about at Morgan Stanley’s TMT conference.

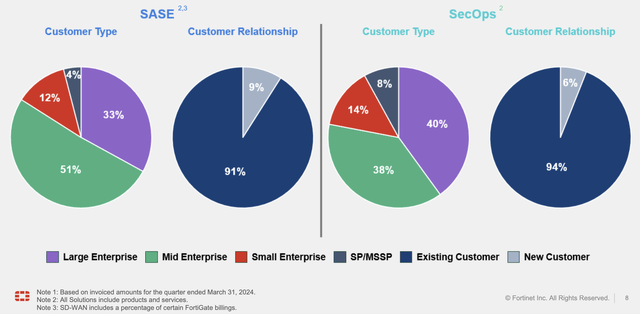

In Fortinet’s case, I believe it is important for management to highlight customer wins, especially large deals or even sales pipeline progress, since over half of their customer base is usually the SME cohort.

Exhibit D: Fortinet’s customers is primarily skewed towards small and medium-sized enterprises. (Investor Presentation, Fortinet)

In the past, management has focused on expanding their customer base to include the less price-sensitive large enterprise customers. This will be crucial because some of Fortinet’s peers that directly compete in the SME space have been known to offer products at competitive pricing. For example, Cisco recently launched a competitively priced firewall product refresh targeted at SMEs.

If management fails to upgrade their billings guidance, it would indicate the company is having trouble attracting new customers, and the stock could see some more pressure.

This became especially crucial after one of Fortinet’s peers, Check Point (NASDAQ:CHKP), mentioned on their earnings call that they were seeing “a significant improvement in the demand” for firewall products with “no significant change” in the average selling price for these products. Plus, management will also have to explain how the slowdown impacts their margins, which appear to be at the tip of turning lower based on their projections for this year.

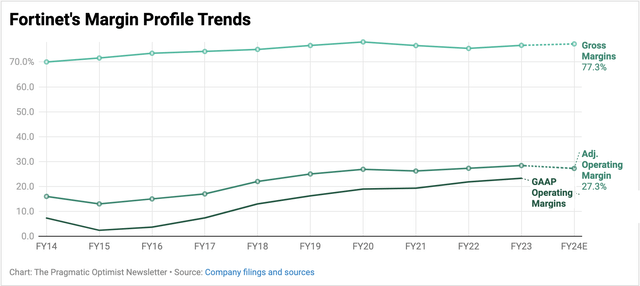

Exhibit E: Fortinet’s adjusted operating margins appear to be topping off based on management expectations (Company filings)

Fortinet will have a thin line to walk on this call to manage expectations of its core Secure Networking business, which includes firewalls as well as their Unified SASE business.

Valuation Models Point to Fair Value Range For Fortinet

In Q1, Fortinet’s management updated their FY24 guidance, raising expectations for revenue to grow 9.2% at the midpoint of their $5.745–5.845 billion revenue guidance range, up from the 8.7% y/y increase they were initially expecting in FY24 sales. This is led by an expansion in service revenue, which comes from the sale of subscription services for their FortiGuard and FortiCare services.

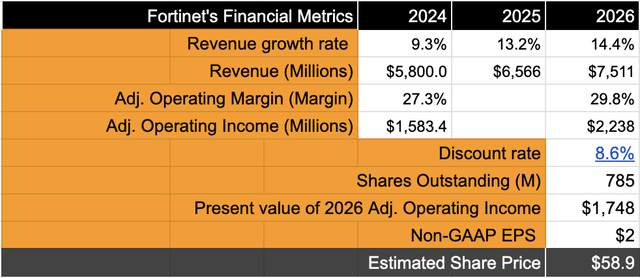

However, with Billings guidance remaining unchanged, I anticipate revenue growth may extend into next year unless management can counter my opinion in the upcoming Q2 earnings. My updated outlook implies a ~12.3% CAGR growth rate in Fortinet’s sales through FY26.

Exhibit F: Fortinet’s management raised revenue guidance but kept its billings guidance unchanged. (Investor Presentation, Fortinet)

Management also tightened the lower end of their margins for both gross margins and operating margins on an adjusted basis, as seen in Exhibit E above. My expectations for adjusted operating income remain in the lower teens, growing at ~14% CAGR over the same investment horizon. This growth rate in adjusted earnings would now imply a forward valuation multiple of 26–27x, which indicates the stock is priced in at the moment, as shown in Exhibit F below. My model assumes a discount rate of 8.6%.

Exhibit G: Fortinet’s valuation now indicates stock is priced in for FY24. (Author)

Five Other Factors To Consider in Fortinet’s Q2 Earnings

- For Q2, markets expect Fortinet to grow its earnings by 7% to 41 cents a share on sales worth $1.4 billion, growing 8.5% y/y.

- For FY24, consensus estimates peg the company to report earnings of $1.76 per share on sales of $5.79 billion, growing 9.2% y/y. These expectations are approximately in line with management’s own FY24 projections.

- I would also be interested in learning about any additional tailwinds from CrowdStrike’s (NASDAQ:CRWD) security outage incident last week. I do not expect to have any significant impact on revenue or billings yet, but if there is any immediate impact, it would be seen in the company’s sales pipeline.

- Moreover, with Fortinet’s competitors launching products that are competitively priced, it would be interesting to note if Fortinet is seeing any threat from Fortinet’s peers. Alternatively, management may also indicate these threats subtly in weaknesses that can be seen in their SMB segment.

- Fortinet recently acquired Lacework, a cloud security startup and rival to Wiz. I would be interested in seeing any potential impact on revenues, which would be a tailwind to the organic revenue growth Fortinet sees this year. Lacework reportedly had an ARR of ~100 million per last known estimates.

Takeaway

With Q2 almost under its belt, Fortinet will have to convince investors that it is primed to benefit from accelerated growth in the back half of FY24, just as it had been saying in the previous two quarters. The focus this quarter will be more on billings growth than progress on SASE or other products, and any signs of any headwinds seen in their billings number will put pressure on the company’s stock.

I have now downgraded my outlook on Fortinet, staying neutral on the company and recommending a Hold rating.

Read the full article here