Introduction

About 10 years ago, I met Globant (GLOB) at an investor conference and was impressed with its business model, growth, and profitability. The need for “old economy” companies to digitize sales (front end) and internal processes (back end) to become more relevant and efficient seemed to be a large and growing market. As part of that company analysis, I came across EPAM Systems (NYSE:EPAM), a close peer and competitor that has fallen on hard times judging from the stock price correction, or has the market misjudged?

Performance

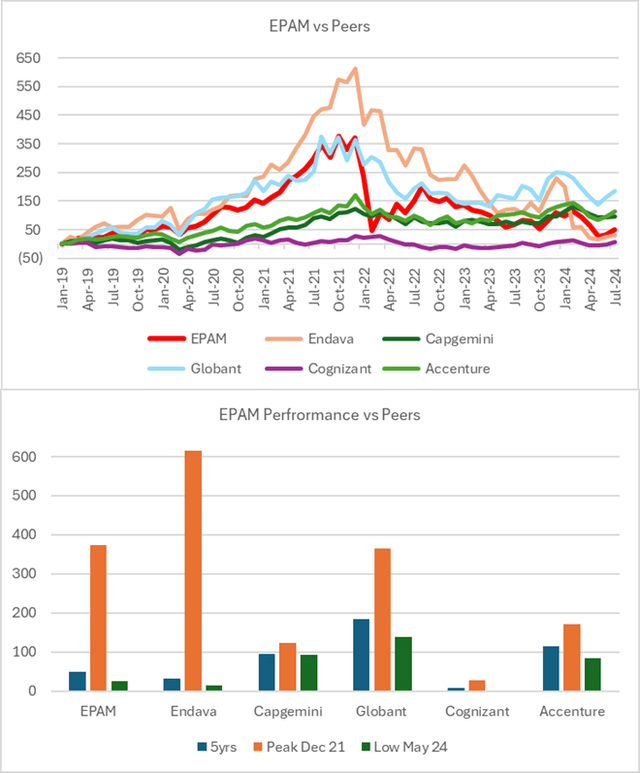

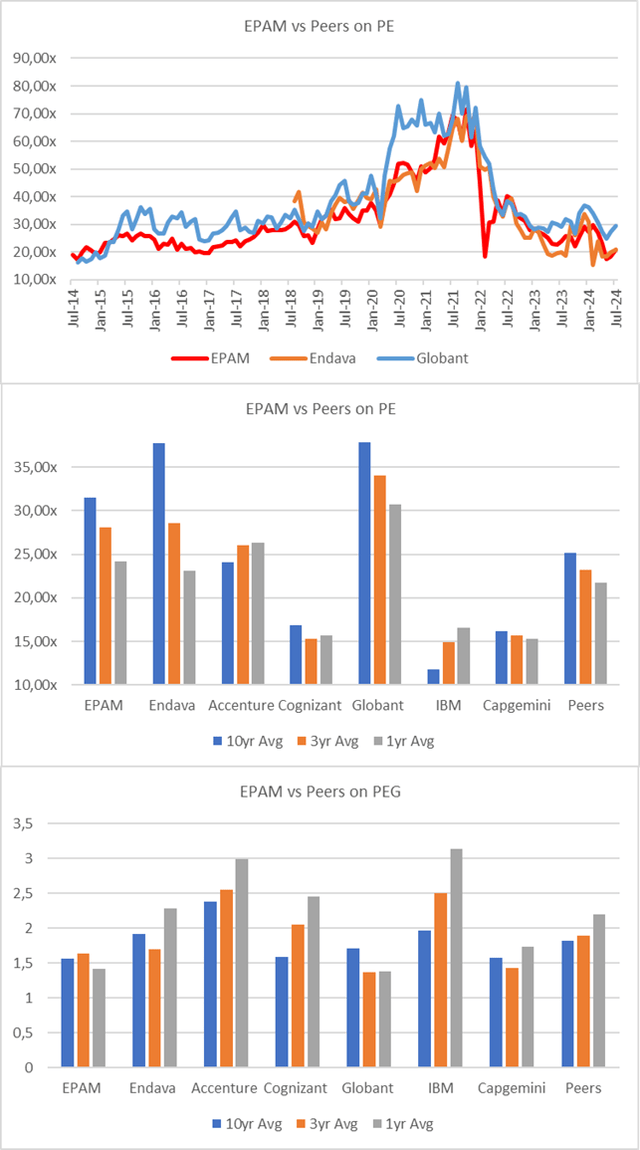

EPAM has come full circle in the last 5 years, with the stock peaking in December 2021 before the Fed rate hike cycle and Ukraine invasion drove a monster crash from US$700 to US$200 where it is now. The stock’s performance since 2022 has been damaged by a marked drop in revenue and earnings growth. EPAM´s performance has been replicated at several IT consultant stocks such as Globant and Endava (DAVA) which have also seen sharp corrections on more challenging growth.

Created by author with data from Capital IQ

The AI Growth Challenge

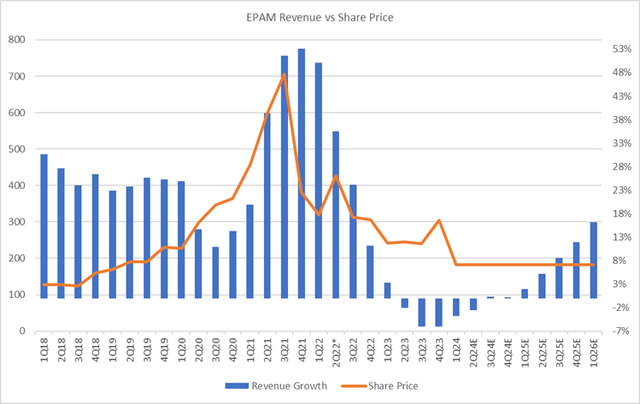

The company has been experiencing a decline in revenue since 2Q23, which is in sharp contrast with its more than 30-year history. According to consensus estimates, revenue may continue to decline through 2024 and may not surpass 10% growth until the end of 2025 and plateau at 16% in 2026. What is the root cause of this decline after so many years of high growth? Could it be the macro environment, i.e., a slower economy, inflation, etc. or is it that EPAM is not providing value and losing share? Perhaps it is all AI’s fault, as I have read in many IT company quarterly press releases, the slowdown in new business is due to companies taking time to figure out how and who can implement AI. Or can AI replace many software and IT engineering services? EPAM and most IT engineering services believe that they will be more valuable to companies that need them to select and implement AI effectively. In my view, generative AI breakthroughs are likely to cause disruptions that may lead businesses to excel, others to decline, and some to disappear. In the case of EPAM, the market is in wait-and-see mode despite its proven software engineering capabilities in digital integration and applications.

Consensus Quarterly Revenue (Created by author with data from Capital IQ)

EPAM

Consensus Estimates

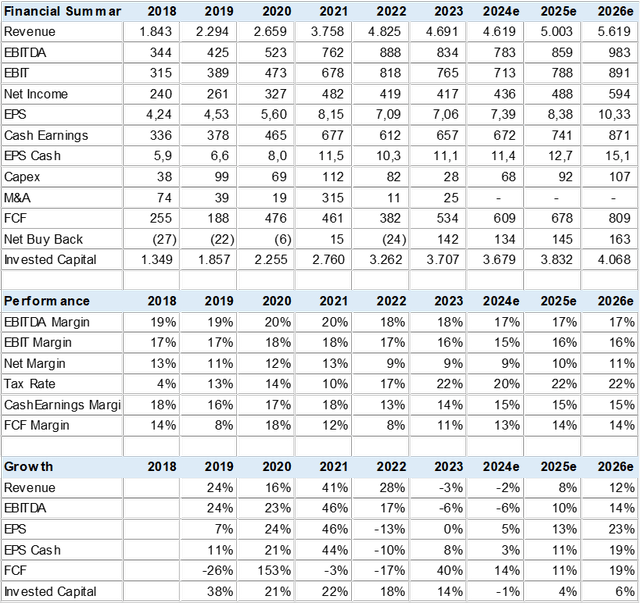

I gathered consensus estimates from 22 analysts to provide investors with growth and profitability metrics. Despite the forecasted decline in revenue, EPAM is a very profitable enterprise with low capex needs and solid margins that provide for over US$600m in free cash flow that could be used for share buybacks or M&A to improve growth. According to the analysts, EPAM may have reached a more mature phase but can still drive EPS or cash earnings (net income plus depreciation and stock-based compensation) by over 11% in 2025 and 19% in 2026.

EPAM began reducing guidance at the end of 2023 and again in the 1Q24 report, citing macro-related and client decision delays. The company also cited the continued shift away from engineering production/headcount from Eastern Europe to Latam and India as another source of contract slowdown.

Consensus Estimates (Created by author with data from Capital IQ)

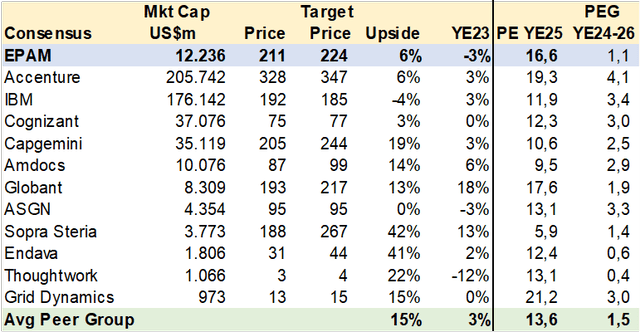

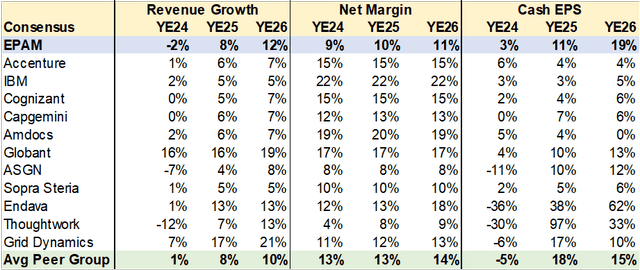

Peer Comps

EPAM compares well with many peers and competitors on valuation and earnings growth. The stock is valued at 1.1x PEG on YE25 metrics vs over 2.5x vs larger cap peers such as Accenture (ACN) and Cognizant Technology Solutions (CTSH) while revenue and earnings growth are above those more expensive names. The sector is experiencing a slowdown in 2024 and is not relegated to EPAM’s own dynamics.

Peer Comps (Created by author with data from Capital IQ)

Peer Comps (Created by author with data from Capital IQ)

Valuation

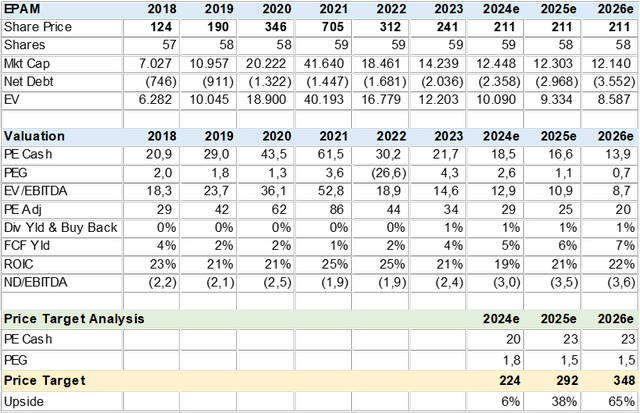

The consensus has a price target of US$224 for YE24, which backs into a target cash PE of 20x or a 1.8x PEG. This seems high when compared with its historic PEG of 1.5x that if applied to the 2025 results produces a price target of US$292 +36% upside and if the company can reach 16% revenue growth in 2026, the price target of US$348 may be attainable. The key, as mentioned earlier, is for EPAM to turn the corner on revenue/client contract growth, which is a function of macro, AI spending decisions, and EPAM´s engineering sourcing diversification toward lower-cost Latam and India.

Peer Comps (Created by author with data from Capital IQ)

Consensus Valuation (Created by author with data from Capital IQ)

Risk

EPAM may face more risk than many analysts may want to recognize. The decline in revenue may lead to lower margins as the competition pressures contract prices. The company may also be challenged to build or implement AI services for its clients that would be highly detrimental to EPAM’s viability.

Conclusion

I rate EPAM a Hold. Despite an unchallenging valuation and solid free cash flow generation, the stock is not likely to see upside until it can revert declining sales and, in my view, the medium-term risk/reward equation does not warrant a buy rating.

Read the full article here