New York Community Bank Second Quarter Earnings Review:

New York Community Bank (NYSE:NYCB) reported a Q2 with a headline adjusted earnings loss of $1.05/share. This was much wider than the ~$.45/share loss expected. I’ll go through the numbers in what, I think, is the order of importance.

Deposits:

Deposits grew 5.6%. For a bank that people viewed as teetering on potential insolvency, deposit growth is huge. This growth might have come with a cost, which I’ll get to later, but had we seen deposit bleeds, the solvency question would have been harder to put to bed.

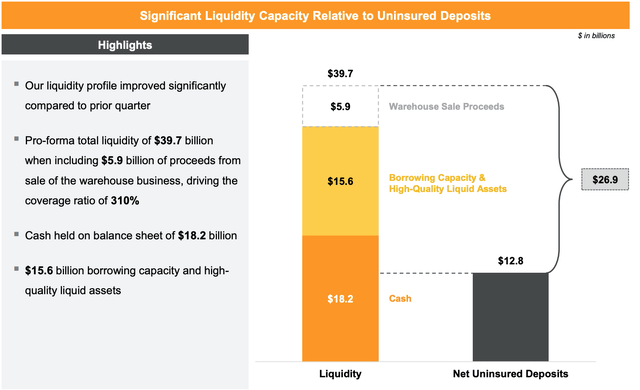

This deposit growth helps liquidity, which post the just closed asset sale is almost $40 billion versus uninsured deposits of $12.8 billion. With the asset sale, cash is almost double uninsured deposits. Moreover cash and securities is 24% of total assets, slightly above the average of banks with $50-100 billion of assets.

NYCB Liquidity Profile (NYCB Q2 Earnings Presentation)

Loan Portfolio Quality:

Provisions for credit losses were bad at $390 million, versus expectations of $193 million. The company mainly blamed the office loan portfolio, where it reviewed more loans and had to downgrade more. The good news is that there are only $500 million office loan that need to be reviewed. We shouldn’t see anywhere near the magnitude of provisions from the office portfolio. The bad news is that there are still $7 billion of multifamily loans to review and $3.7 billion of non-office CRE loans to review.

Year to date, there have been $705 million of provisions for credit losses and $430 million of charge offs. $349 million of those charge offs occurred in Q2 and the bulk of them were in the office portfolio as well. The total number of non-performing loans is now $1.944 billion. That brings NPL’s to 2.61% of total loans, a high number but not devastating. Allowances are $1.326 billion, about 68%. That assumes a pretty severe loss rate for NPL’s.

The company guided to $900 million to $1 billion of provisions for credit losses for the full year. That’s up from last quarter’s guide of $750-800 million for the year. I’ll note that last quarter’s guide was based on new management only having about six weeks to review the loan portfolio. Management stated on the conference call that they feel better about the current estimate. Perhaps they will have to increase provisions again, but my guess is this Q will be the end of the increased provisions, particularly if rates start coming down.

Cost of Funds:

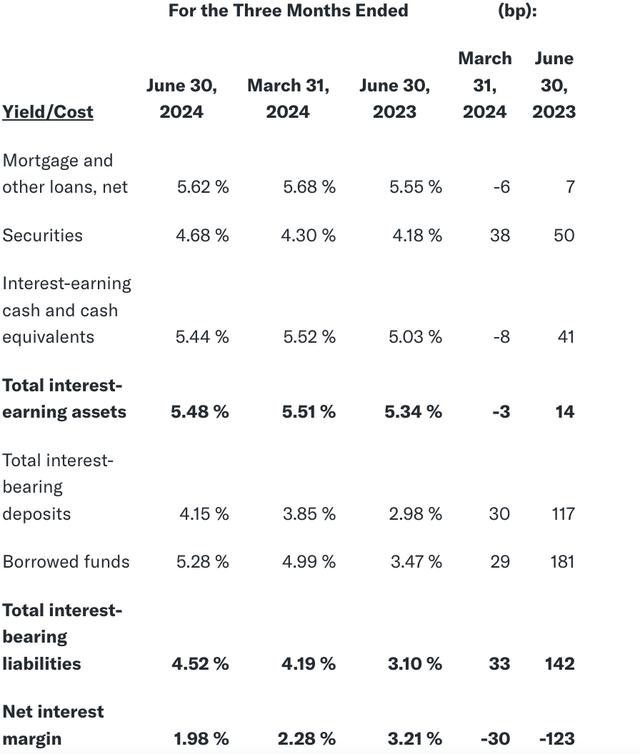

As I mentioned above, the higher deposit numbers were good, but they came at a price: a higher-than-expected cost of funds, largely high-interest rate CDs, and some higher-yielding savings accounts.

NYCB Asset Yield vs Capital Costs (NYCB Q2 Earnings Presentation)

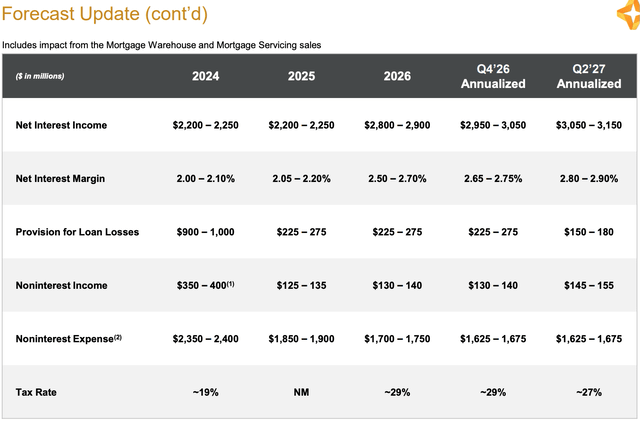

The company brought the full-year guide for NIM down from 2.20-2.30% to 2.00-2.10%. That 20 bps is worth about $160-170 million of pre-tax interest income. Combine that with fewer assets due to the asset sale, and NII was lowered from $2.4-2.45 billion for the full year to $2.2-2.25 billion.

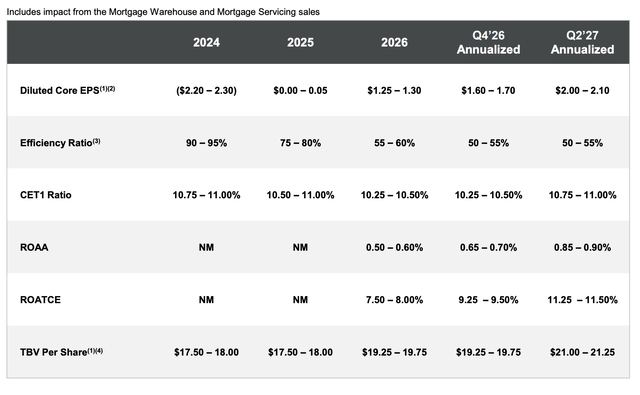

The lower NII and uptick in provisions is leading to higher than previously guided loss per share of $2.20-2.30 vs Q1’s full-year loss estimate of $1.50-1.65. The company also reduced the earnings forecast for next year from ~$1 to flat and reduced 2026’s earnings estimate to $1.25-1.30 from $1.65 midpoint. See the new estimates below.

NYCB Guidance 1 (NYCB Q2 Earnings Presentation) NYCB Guidance Table 2 (NYCB Q2 Earnings Presentation)

While I don’t think anyone would regard this earnings announcement and the revised guidance as I get excited about the near-term earnings power of this company, it is being valued as a solvency story rather than an earnings story.

Most comments I have seen on SA articles about NYCB have been predicting doom and gloom for the bank. Many have suggested that the Mnuchin and his team would have to pony up more money to save the bank from insolvency. Not even counting the sale of MSR’s (mortgage servicing rights) for $1.4 billion announced today (a $200 million gain from book value) and the potential sale of another $2-5 billion of additional assets, even a high provision for loan loss and high charge off quarter like this one does not indicate looming insolvency or liquidity problems. Liquidity is very strong and CET1 around 11% is fine. I certainly don’t see where the regulators would worry about this bank’s solvency.

More losses and charge offs will come out of the CRE portfolio. The company has already guided to over $500 million more over the rest of this year and next year. Perhaps this number will go up if the NYC economy rolls over. The good news, and my point all along, is that the bank has the liquidity and overall interest earnings power to cover these losses. The net income picture for this bank won’t clear up for about another 18 months. That stinks. I get it. If it were trading at tangible book value, I wouldn’t own it. However, at $10.30/share (as of this writing), it’s at less than 60% of expected tangible book value at year end. A bank that generates low double-digit ROE’s trades around tangible book value, if not a slightly premium.

How much of a discount to tangible book value should one apply to a bank that is cleaning up its balance sheet now but will be looking at recovering ROE’s eighteen months from now? A return to tangible book from a 40% discount over two years implies 29% IRR. The discount is over 60% and earnings recovery could be evident in 18 months instead of two years. Plus, tangible book value should grow. 29% or better IRR over two years sounds pretty good to me for an enterprise where the risks are pretty well known.

Risks:

On the subject of risk, the biggest risks here are something creeping up that spooks depositors, worse than expected loan performance leading to higher allowances, worse than expected losses from non-performing loans leading to higher charge-offs, further NIM compression, and higher, more-burdensome regulatory issues.

Of the risks listed above, the highest likelihood one is higher allowances for loan losses. Commercial real estate feels like death right now. The company is working its way through the portfolio and will be done with the bulk of its review this quarter. They did not seem overly concerned with what is left, but that could change. That said, losses that put the bank’s solvency at risk seem very unlikely, and the bank remains valued as if solvency rather than future earnings power is the main issue.

Conclusion:

NYCB is a classic value play. The downside seems quantifiable and acceptable, while little probability is being of recovery is being priced. While I expect continued noise in numbers and volatility in the stock, the risk/reward here is very favorable.

Read the full article here