Introduction

With a 152% year-to-date gain, Carvana’s (NYSE:CVNA) stock is among the best-performing in 2024. Although it faced difficulties after the pandemic, it managed to survive through the challenging economic times. It now takes the lead in the used automobile market and has a lot of potential to capitalize on the enormous market for old cars. The growth story, in my opinion, is only getting started because Carvana has distinguished itself from its peers and still has a lot of room to grow.

Turnaround Story

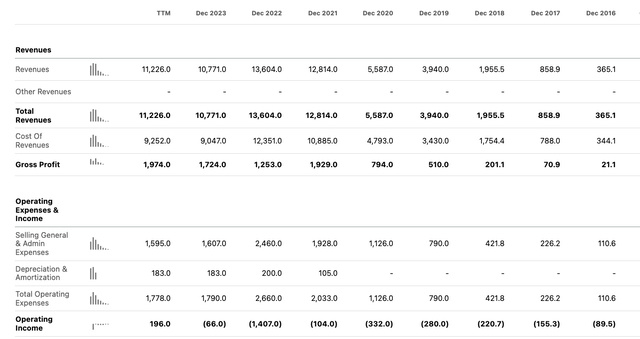

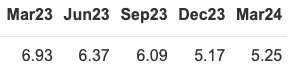

Carvana was founded in 2012. Before the COVID-19 pandemic, it was seen as a market disruptor in the used car industry because consumers preferred its ease of use. Before the pandemic, Carvana operated at a loss. During the pandemic, the company prospered because of the at-home economy, and it reduced its loss to about 100 million (see exhibit below). However, rising inflation later caused used car prices to rise sharply, and the Fed’s high-rate policy completely restricted the expansion of the used car industry.

Carvana obtained a significant amount of debt in May 2022 to acquire ADESA, a wholesale used automobile company. The market viewed it as a risky bet at the time due to over-expansion during the peak, but in retrospect, I believe it was a wise decision, which I will go into more detail about later.

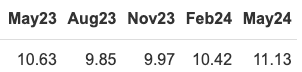

Financials (Seeking Alpha)

Due to a sharp increase in inflation in 2022, the demand for used cars collapsed, and Carvana’s growth significantly slowed in H1 2022. The company chose to liquidate excess inventory immediately. As a result, its loss increased to $1.4 billion (see exhibit above) in 2022. Thus, the market worried that Carvana wouldn’t be able to endure in the new, high-rate environment. That’s why its stock tanked to as low as $3.72 (12/27/2022).

For the previous two years, the company has been focusing on cost efficiency. Now, the ADESA’s acquisition synergy becomes apparent. Carvana successfully increased its operating efficiency and profit margins. Thus, its stock had a strong bounce in the second half of 2023. The question is if its momentum should continue in 2024 and beyond. My answer is yes, and I shall discuss as follows.

Price Chart (Seeking Alpha)

Acquisition of ADESA to Enhance Cost Structure

To fight the high inflation and high-rate environment, Carvana improved its competitive position through a variety of cost-minimization strategies. For example, it significantly cut shipping costs and delivery times by converting ADESA’s wholesale facility to its warehouse and reconditioning facilities.

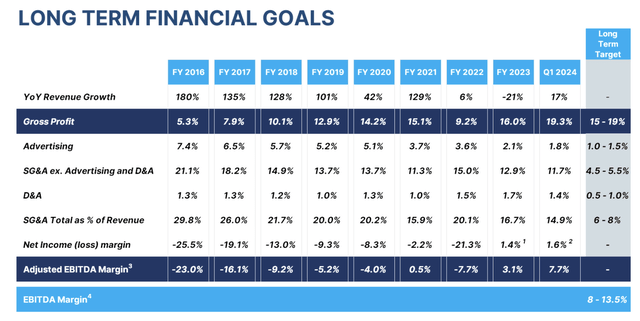

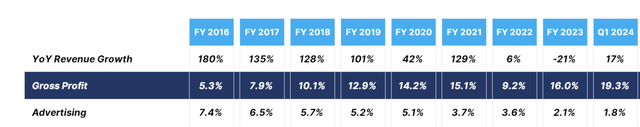

Before the acquisition, Carvana was a pureplay e-commerce platform and ADESA was the second-largest wholesale used card company in the United States. By acquiring ADESA, Carvana was able to establish itself as a dominant player in the used car industry and increase the facility’s usage rate by using it as the warehouse for its retail operations. Its SG&A as a proportion of total sales has decreased by 1000 basis points since 2016 (see exhibit below).

Margins (Carvana)

The Used Car Sector Is Impacted Unequally by Inflation

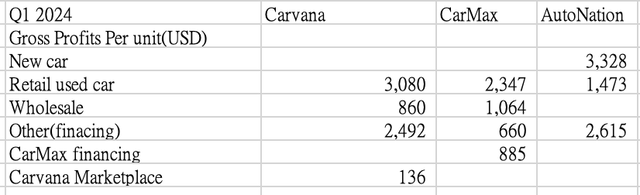

Unlike traditional dealerships such as CarMax (NYSE:KMX) and AutoNation (NYSE:AN), Carvana operates on an online-only model. This approach eliminates the need for customers to interact with salespeople, streamlining the car-buying process. As a result, Carvana has a unique advantage in cross-selling vehicle loans during transactions. Consequently, a larger portion of Carvana’s revenue is derived from originating vehicle loans compared to traditional dealerships.

Gross Profits Per unit Breakdown (Carvana, CarMax, AutoNation, edited by author)

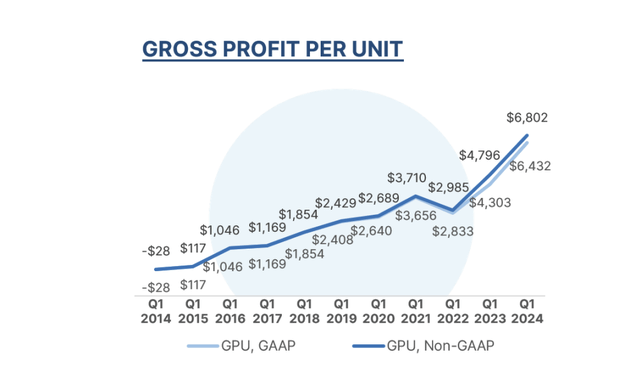

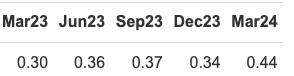

High interest rates and elevated used car prices have reduced affordability in the used car market. This has led to a contraction in overall demand. However, this contraction has primarily affected discretionary purchases, leaving a core market of consumers who need vehicles for essential purposes like commuting to work or school. These necessity-driven buyers are more willing to accept higher prices and financing costs. Consequently, despite challenging market conditions, Carvana has seen an increase in its loan margins during 2023-2024, as rising interest rates have allowed the company to charge higher premiums on its financing options. That is the core factor contributing to its ongoing growth in gross profits per unit after 2023 (see exhibit below). The only decline in 2022 occurred when Carvana decided to sell off excessive inventory immediately in response to the Fed’s decision to hike interest rates in H2 2022.

Gross Profit per unit (Carvana)

Competitive Advantage

For investors, what matters is that this transformation not only strengthens Carvana’s financials but also increases its competitiveness in the market.

It currently has the fastest inventory turnover rate among its competitors and a gross margin that leads the industry.

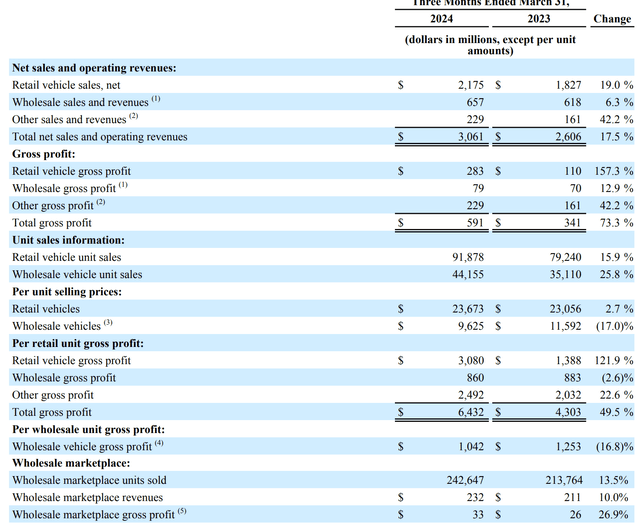

Profit Margins

Carvana has eclipsed CarMax and AutoNation, with a 19.3% gross margin in Q1 2024. Additionally, it has been increasing its operating margin; it now stands at 4.38%, surpassing CarMax and reducing the gap with AutoNation. A higher gross margin and operating margin indicate that the traditional dealership models or the omnichannel models are not as competitive in the used automobile market as they once were.

Gross Margin (Carvana) (Guru) Operating Margin (Carvana) (Guru)

Gross Margin (CarMax) (Guru) Operating Margin (CarMax) (Guru)

Gross Margin (AutoNation) (Guru) Operating Margin (AutoNation) (Guru)

Carvana reduced costs in a couple of ways. First, it used online channels to buy cars directly from customers. Second, it increased profits by selling more auto loans. These strategies helped lower inventory costs and boost earnings. Third, through several initiatives, it also decreased costs.

Retail Non-Vehicle Cost of Sales per Unit vs. FY 2021 (Carvana)

A few details about cost optimization are quoted below.

We have reduced retail reconditioning and inbound transport costs per unit by ~$900 over the past 12 months through a combination of insourcing, staffing normalization, process standardization, proprietary software development, and logistics efficiencies.

We have also made ~$600 of per unit improvements in just the last two quarters as we continue to focus on operating efficiency in Step 2.

Our progress has driven a total cost reduction of ~$400 per unit since FY 2021, which was our previous high water mark on Retail GPU.

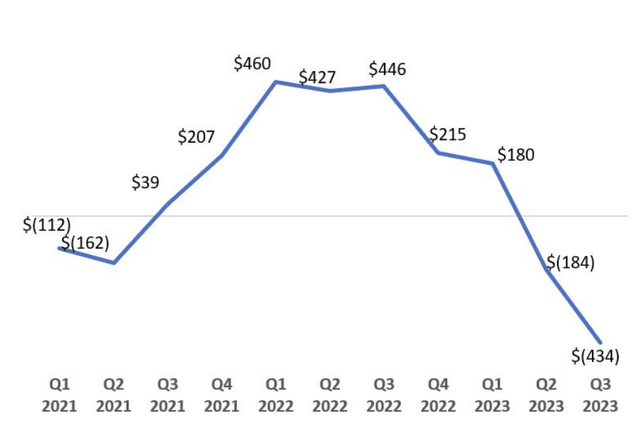

In Q1 2024, Carvana realized a $3,080 gross profit per retail vehicle (see exhibit below) and a $2,492 per unit from other sources, primarily financing. These number significantly surpasses CarMax’s figures of $2,347 and $1,545 respectively.

Operating Metrics (Carvana)

Inventory Turnover

One of the most crucial indicators of a used automobile dealership’s competitiveness is inventory turnover. Dealerships buy automobiles from other dealerships, retail customers, or wholesale channels rather than making the cars themselves. Because used cars lose value with every day and mile driven, the company’s capability to convert inventory into cash thus dictates how best to employ its cash on hand.

In Q1, 2024, Carvana’s inventory turnover ratio exceeded that of its used car competitors, including AutoNation and CarMax, reaching 2.14x in Q1 2024 and showing an upward trend.

Inventory turnover (Carvana) (Guru) Inventory turnover (CarMax) (Guru) Inventory turnover (AutoNation) (Guru)

Carvana’s achievement of the industry’s highest inventory turnover suggests that it can more efficiently convert inventory into sales, allowing for more competitive pricing while maintaining healthy profit margins.

Additionally, contrary to CarMax, which holds loans on its balance sheet, Carvana securitized the auto loan, serving as a fintech platform to provide financing receivables for banks and other partners like Ally Financial (NYSE:ALLY). Carvana’s cash situation and scalability are also enhanced by this. Thus, Carvana has a higher asset turnover rate than CarMax.

Asset turnover rate (Carvana) (Guru)

Asset turnover rate (CarMax) (Guru)

Valuation

Market Share and Growth Potential

Currently, Carvana holds a 1% market share in the used automobile sector.

The used car market remains highly fragmented, with the vast majority of sales conducted through a network of thousands of independent local dealerships scattered across the country. Further, industry e-commerce titans like Amazon (NYSE:AMZN) have shown no interest in getting into this space. This presents great expansion opportunities for Carvana, as it now holds leading margins and turnover rates.

Carvana grew from 0% to 1% of the market in ten years. I can therefore see that Carvana can acquire shares far more quickly than it did over the last ten years provided it can maintain the current inventory turnover and margin-leading position.

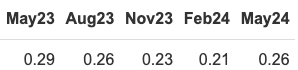

Following ADESA’s acquisition, Carvana currently has 2.9x-5.6x unutilized capacity in terms of production, logistical network, and customer service. As a result, this offers a solid foundation for growth once demand grows.

Capacity (Carvana)

Carvana was able to grow at triple digits between 2016 and 2021 and beat rivals in Q1 2024. One of the reasons is that, in contrast to local dealerships with constrained inventory, Carvana offers customers a nationwide inventory selection.

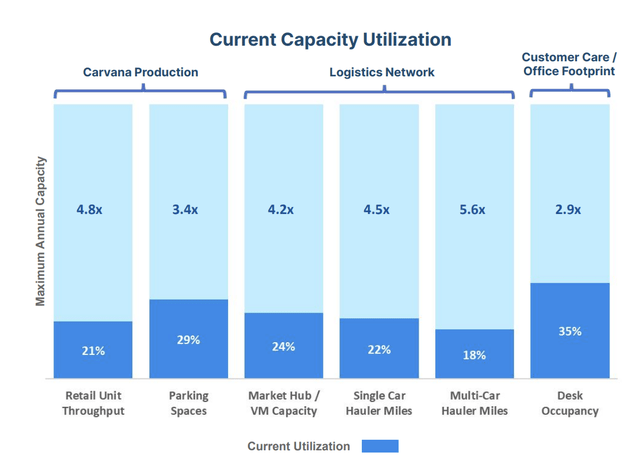

Ads expense% (Carvana)

The price difference of a used automobile can range between 20% and 11% among states, or roughly $4942 and $2718, according to iSeeCars. Carvana’s nationwide inventory is tempting to clients searching for deals because it costs a maximum of $1999 for delivery across states.

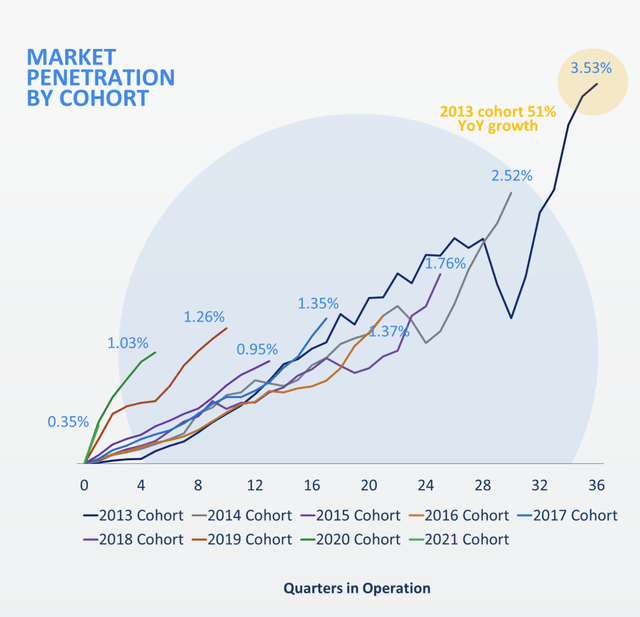

According to the most recent data available, after 36 months of operation, the oldest cohort of Carvana attained 3.5% penetration in 2021, or around 1% per 12 months.

Penetration by cohort (Carvana)

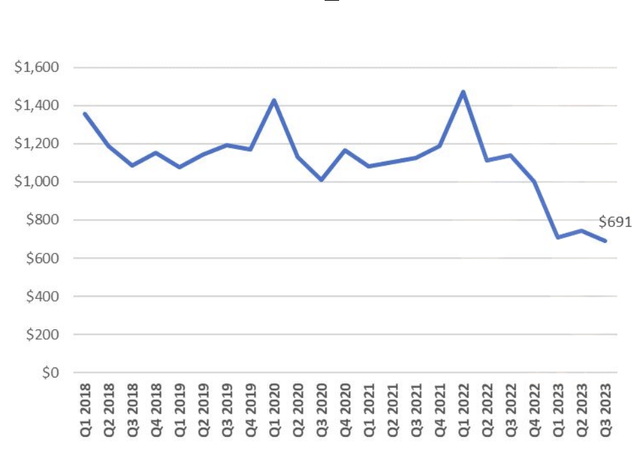

Before the pandemic, the company spent $1000-$1400 per unit (see chart below) on ads to grow. In Q1 2024, it grew again but reduced ad spending to $700 per unit. Ads expenses dropped from 7.4% of sales in 2016 to 2.1% in 2023. This shows Carvana can keep growing by increasing ad spend.

Ads spending per unit (Carvana)

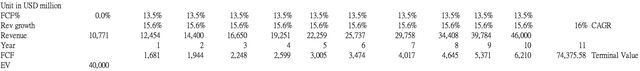

Hence, over the following ten years, I predict that Carvana will gain 5% of the market (0.5% per year or a 15.6% CAGR). I also selected the 13.5% long-term free cash margin based on management’s long-term estimate because they have shown great execution capability.

Stock Volatility and Beta

In terms of calculating WACC, it’s crucial to remember that Carvana ought to now have a lower WACC given the decreased solvency risk.

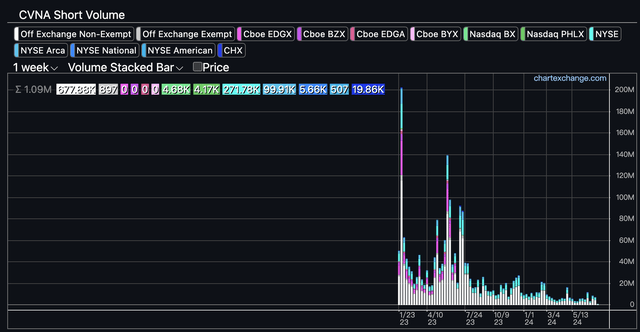

Compared to its used car peers CarMax and AutoNation, which have stock betas of 1.69x and 1.21x, respectively, Carvana has a stock beta of 3.37x during five years. This is because Carvana was run at a loss with subpar metrics in the past. Its debt load is an additional factor. Because many short sellers think the company will default on its debt, short selling increases the volatility of the stock. According to Benzinga data, the stock short ratio is 23% as of right now. However, the short interest volume declined as the company improved its fundamentals.

Short Volume (Chartexchange.com)

Carvana has successfully negotiated lower interest costs with its lenders in 2023. This, coupled with improved operating indicators and higher margins, has significantly strengthened Carvana’s overall financial position. As a result, debt holders now perceive Carvana as a lower solvency risk.

It is reasonable to predict that Carvana’s stock will be less volatile compared to the past. As a result, I choose a WACC of 11.6%. Along with the long-term terminal growth rate of 3% assumption, and net debt of $4.6 billion, I ended up with an equity value of $35.3 billion, or $166.8 per share, or a 23% upside.

FCF model (Author)

Risk Assessment

Macro Risk

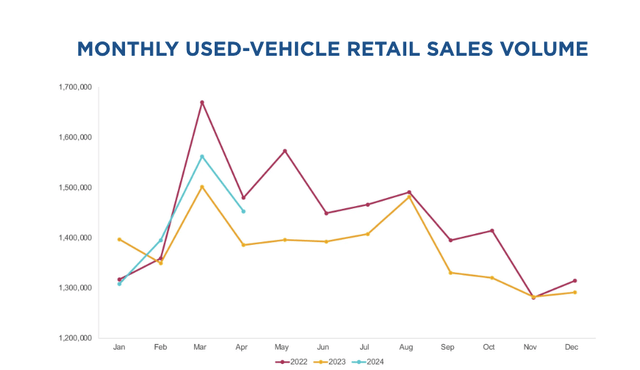

vAuto data showed that used car sales return to growth in 2024. This may indicate that the used automobile market bottomed in 2023 as the US economy continued to grow in 2024.

Used Car retail sales volume (vAuto)

Carvana has proven its robust business model by boosting profitability to counteract a drop in unit sales. Carvana was in better condition than its contemporaries, even in the current market. So, even in the event of a hard landing, I believe Carvana is in a stronger position.

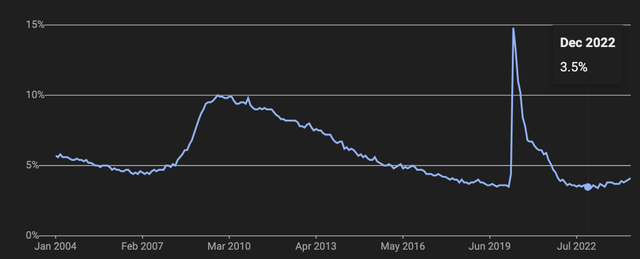

However, recent data from Visa’s earnings report suggests that US consumer spending may slow down in Q3 2024. Additionally, the US unemployment rate has quietly risen to above 4%. There is a risk that the US economy could further contract in H2 2024 due to the Fed’s restrictive interest rates.

US unemployment rate (Google)

Carvana’s earnings are heavily impacted by its transaction volume. Its huge capacity could cause operational deleverage. My valuation is also based on a long-term growth story. A sudden cooldown in the US economy could pose a downside risk to the stock.

If the Fed follows through on its promise to lower interest rates, it could generally increase demand for used cars, benefiting Carvana. However, this could also potentially hurt its loan margin. Furthermore, if the Fed lowers rates because the US economy is heading for a hard landing, there is a significant downside scenario to consider. Carvana’s solvency could be at risk if the company is unable to securitize its loan receivable or refinance its debt under such circumstances.

Company-specific risk

Carvana currently holds only 1% of the market, and its oldest customer cohort has only achieved 3.5% penetration, indicating low brand recognition. Due to the generally weak network effect, Carvana may face increased pressure when trying to expand penetration in its oldest cohorts. This scenario might require Carvana to increase its advertising spend, and investors should closely monitor its viability. Additionally, as Carvana heavily relies on internet traffic, it faces cybersecurity risks. Being a transaction platform, a cyberattack could lead to severe operational issues. Investors should also keep a close eye on this risk.

Conclusion

Carvana has become the market leader in the used automobile area following the difficult circumstances of 2023. Given Carvana’s improved operational metrics, growing market share, and potential for further expansion in a fragmented market, the company appears well-positioned for future growth. While risks remain, particularly regarding debt management, the potential upside currently outweighs the downside risks. Thus, in my opinion, Carvana presents an attractive investment opportunity for investors.

Read the full article here