Investment Thesis

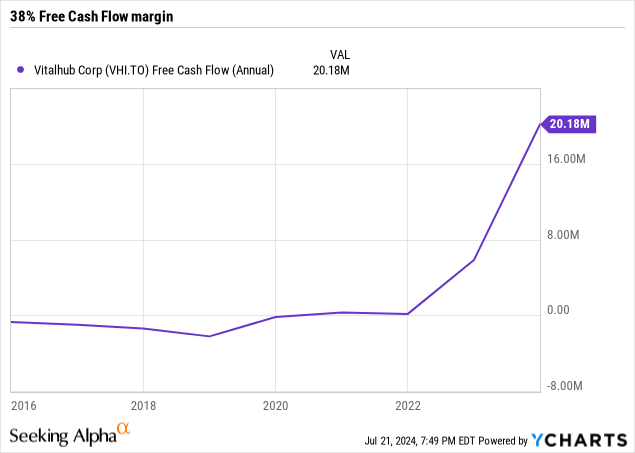

Vitalhub (TSX:VHI:CA)(OTCQX:VHIBF) is a business that offers software in the healthcare industry. This is why it has gross margins of +80%, high recurrence in its revenue and free cash flow margins of almost 40% in the last year.

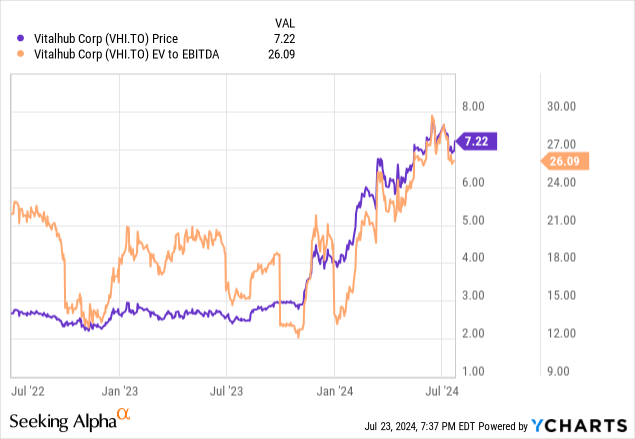

Despite this, in the last 12 months it has risen almost 200%, mainly via multiple expansion, causing it to currently seem somewhat expensive to me, which is why I think it is currently a hold until it’s at prices close to $6 CAD.

Mission-Critical Service

Vitalhub develops software with the focus of improving operational efficiency and data management in the healthcare industry specifically, turning its business model into a highly attractive one for investors and its services end up being very important for its clients. Ultimately, patient data ends up dependent on Vitalhub’s services, so you can imagine what a critical mission it solves. To give us an idea of how Vitalhub software works in practice, let’s give an example where a patient requires a consultation for a health problem:

- The patient could decide if they want to join a virtual clinic or make an appointment for an in-person visit. All this through a hospital app, developed by Vitalhub.

- Once in the consultation, the patient registers at a kiosk or with a social worker who would create their medical record, which would contain their demographic data, medication history, among other data that facilitates the work of the doctor who will treat them.

- This information would be written into the platform developed by Vitalhub, which would then be shown to the doctor and, once the consultation is over, it would be completed with the test results and other medical notes in case the patient returns in the future.

- So, Vitalhub’s mission would be to manage this registration, collection and display of data in the most efficient way possible through all areas of the clinic that require the company’s services.

Vitalhub Investor Presentation

Both Organic and Inorganic Growth

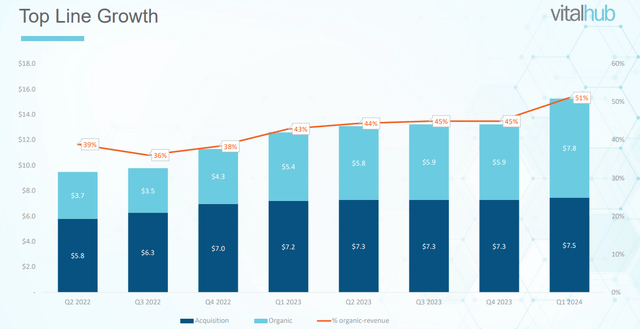

Between 2017 and 2023, Vitalhub’s revenue grew 90% annually and in the last 5 years the growth was 50% annually. According to the company itself, between 35% and 50% of this growth has been organic, and the rest has come from acquisitions, because the company has bought 18 companies since 2016, and they comment that currently see at least 400 acquisition targets.

Vitalhub Investor Presentation

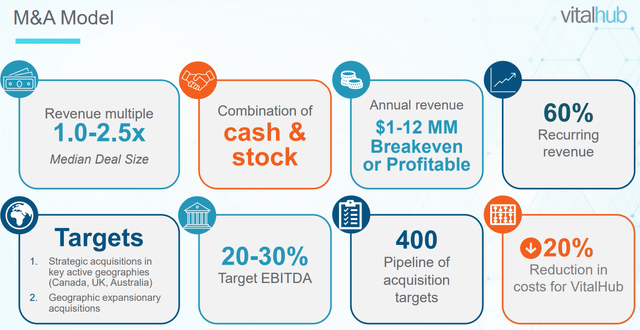

The acquisition model has well-defined objectives where they seek geographical expansion through M&A in small businesses that are in breakeven or are already profitable. Typically, due to the nature of the business model, these companies have recurring revenues and wide profit margins. Despite this, on average, Vitalhub pays between 1 and 2.5 times sales.

A less positive aspect is that the acquisitions are made with a mixture of cash and stock, which is why between 2020 and 2023 the shares outstanding increased 22% annually.

Vitalhub Investor Presentation

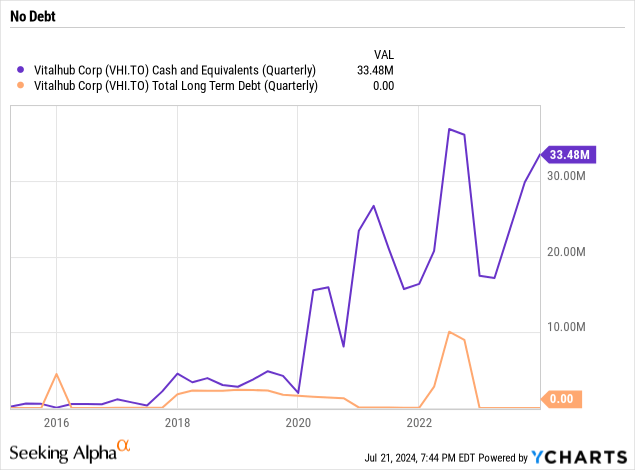

The company currently has $33 million in cash, while it has practically no debt; therefore, I would expect that the next acquisitions would be paid for in the vast majority with this same cash and that dilution wouldn’t be necessary.

This would be reinforced by the fact that Vitalhub is increasingly expanding its margins because it has reduced SG&A expenses in relation to revenue. Therefore, the business would be sufficiently profitable and generate enough cash flow to pay for the acquisitions without the need to issue shares or debt.

Currently, about 40% of revenue is converted into cash from operations and capital expenditures are minimal, which is why during FY2023 the company achieved free cash flow margins of 38% and I would expect this to remain similar.

Valuation

In the last year, Vitalhub shares have had a rally of almost 200%, causing the company to currently trade at almost 30 times EV/EBITDA. I use this valuation multiple because the company has an extremely high EBITDA-to-cash from operations conversion of 120% on average since 2021.

So, I’ll make a projection in which I will value the stock considering growth in the equation as well. In this regard, it doesn’t seem improbable to me to estimate 25% annual growth if we take into account the growth of recent years and that it’s still a small company, with a good product and a broad acquisition pipeline. Furthermore, I consider that the trend of expansion in the EBITDA margin will continue as management has mentioned previously (they have the objective of reaching EBITDA margins of 20-30%), therefore, if the multiple is 20 times EV/EBITDA (somewhat expensive), we add the $33 million in net cash to calculate the market cap and divide it between the 46.7 million shares in circulation to calculate the price per share, we would have a potential annual return of 18% five years from now.

Author’s Compilation

Personally, these assumptions wouldn’t leave me comfortable to invest in the company because it depends on perfect performance, with high growth, an expensive multiple and margin expansion. So, for me to feel comfortable, I’ll estimate 25% growth and margin expansion, but with a multiple of only 15 times EV/EBITDA.

In that case, the performance would fall somewhat short of what I usually look for. To get the 15% I’m looking for, the price should be around $6 CAD per share, that is, a drop of between 15-20% from the current price. It doesn’t seem much for a small cap, so it would be the price where I’d be willing to buy.

Author’s Compilation

Risks

One risk I see is that the company is constantly acquiring new companies. This can be an advantage because it provides growth and helps with geographic diversification, but it also adds the risk of making one or more bad acquisitions that make it difficult to fully integrate the businesses or make the investment a loss. So in this regard, we’ll depend on management to continue making good acquisitions as they have done so far. In addition, there’s always the risk that the company makes a new acquisition where they decide to issue shares and dilute the earnings per share.

Although this isn’t a specific risk for Vitalhub, we must not forget that the rapid technological evolution in the health sector means that Vitalhub must constantly innovate to maintain its competitiveness. This risk is mitigated somewhat because customers possess sensitive data within Vitalhub’s systems, so switching providers can be a time-consuming task that includes the risk of data loss in the process. Anyway, it’ll be important to monitor that Vitalhub’s software doesn’t become too obsolete.

The Bottom Line

High gross margins, recurring revenue, the critical mission it solves for its clients and the high cash generation are qualities of an excellent business model. It’s clear to me that Vitalhub is a fantastic business and I’m eager to be a shareholder, but the current price doesn’t seem ideal to me.

About $6 CAD would be a great entry price and, realistically, these types of small caps usually have no difficulty moving 10, 15 or 20% in short periods of time, so I’m willing to be patient.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here