On Friday, July 19, 2024, a glitch caused by an update from CrowdStrike (NASDAQ:CRWD) caused one of the largest IT disasters ever. Surprisingly, it appears that CrowdStrike attempted to upload a software update and instead of rolling it out in stages (which could have limited the damage), the company did a widespread update that impacted millions of computers around the world. It’s ironic that a company that is supposed to protect and maintain stability when it comes to IT systems, instead roiled it as much or even more than many of the worst ransomware attacks. I have seen a number of articles in the past couple of days that suggest this is a golden buying opportunity since CrowdStrike shares dropped more than 10% on the day this glitch occurred, and it continues to slide down. However, I have a much different opinion and I do not see a buying opportunity in this stock for a number of reasons. Let’s take a closer look at why I think it is way too early to consider buying this stock, starting with the chart:

The Chart

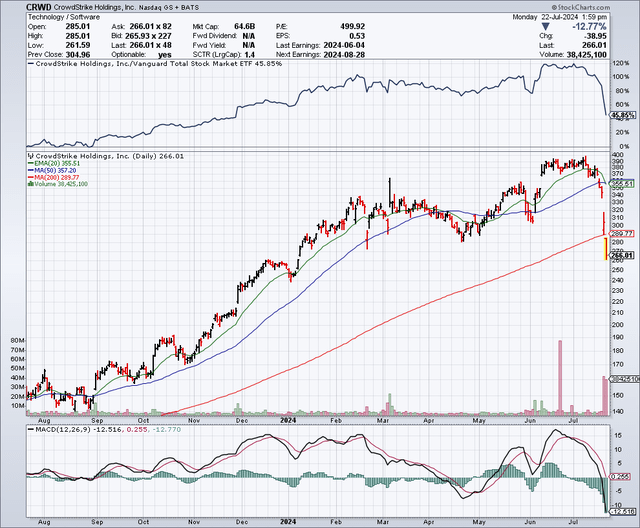

As shown in the chart below, CrowdStrike shares have experienced a tremendous rally in the past several months, rising from about $140 per share last August to nearly $400, just recently. Tech stocks have been the darlings of Wall Street for the past few months and many of them now have price to earnings ratios that have not been seen since the last tech stock bubble. After the recent pullback in this stock, it is trading for less than $270 per share. I believe more potential fallout is likely to be recognized by the financial markets in the coming days and weeks. Since the 200-day moving average has been breached, there is significant potential downside ahead in my opinion, especially because the valuation of this stock remains at nosebleed levels when you consider the fundamentals.

StockCharts.com

Like Many People Around The World, This “Glitch” Impacted Me Personally

A wide-range of industries were deeply impacted by this botched software update from CrowdStrike. Here is where I see the most pain:

1.) The Banking and Financial System:

On July 19, 2024, I was unable to place trades in one of my brokerage accounts for a few hours. Every time I tried to place a trade, I received an error message. Fortunately, I have multiple brokerage accounts with different institutions and the others worked. Finally, late in the trading day I was able to place trades in all of my accounts. I have family members and friends that work for some of the largest banks and they were unable to access customer accounts in many cases, and this issue continued for them over the weekend as many banks are open on Saturday. I was told that customers were handling this major inconvenience quite well since they generally understood it was through no fault of the banks. It is clear to me that the banks have had to hire additional IT resources in order to assist the bank staff with computer systems that were not functioning, and I believe this will lead to millions of dollars in expenses for many big banks.

2.) The Airlines:

While not being able to place trades or do banking as one would expect is inconvenient and potentially costly in terms of finances, it could be even more troublesome to those who also had flights delayed or cancelled. It seems that all of the major airlines in the United States were significantly impacted and Delta (DAL) reportedly cancelled over 1,000 flights between July 19 and 20. Flight delays and cancellations could cost the airlines many millions of dollars in revenues and also in extra expenses including employee overtime.

3.) Hospitals and Medical Care:

Many hospitals and medical practices were profoundly impacted by the CrowdStrike event and were unable to access medical information or use diagnostic tools. According to Wired, doctors and nurses went into panic mode, Quest Diagnostics (DGX) was unable to process blood work, many non-urgent surgeries were cancelled and at some facilities, even the phones would no longer work. The personal and financial impact of all these cancelled surgeries is likely to be enormous.

4.) Retailers and Shippers:

After placing some orders on Amazon (AMZN) this weekend, I received a message stating that deliveries may arrive later than expected “due to a third-party technology outage”. FedEx (FDX) and UPS (UPS) were reportedly impacted as well.

Will CrowdStrike Have To Pay Huge Damages?

Under CrowdStrike’s terms and conditions, they state there is a limitation in terms of their liability in the event of something like this happening. It appears that under these terms and conditions, CrowdStrike is trying to limit their liability by simply offering a refund to its customers. However, I do not believe this is going to work because lawyers are good at finding ways to pierce liability clauses and there usually is a way to successfully do so. Also, a company can put terms and conditions on their website, but that does not necessarily stop customers from filing lawsuits. Even though CrowdStrike might try to use the terms and conditions as a defense to any plaintiff complaints, potential lawsuits will still cost the company and it will probably make sense to settle them which will also cost money. Some very early estimates suggest that the outage caused by CrowdStrike will cost over $1 billion.

Putting legal liabilities aside, the last thing a company wants is angry customers who feel extremely let down for using software that caused significant issues and a lot of money. I feel certain that CrowdStrike is going to want to do more than offer refunds, in part because I think this will make business sense to do so and because this company has competitors that can seize this opportunity to take customers away from CrowdStrike. I see Palo Alto Networks (PANW) as a prime beneficiary of this incident, as well as Zscaler (ZS). I believe that CrowdStrike is going to potentially lose customers to other competitors due to this massive failure, and one of the first high-profile customers that it might have lost is Elon Musk who reportedly said he has deleted CrowdStrike from all his computer systems.

Why I Think It is Too Early To Buy CrowdStrike

When I hear people saying that this is a “golden” buying opportunity, on what was the first day of trading for this stock since the glitch, I think they are being way too quick to rush in and catch what could potentially be a proverbial “falling knife”. Here are my top reasons as to why it is potentially too early to buy:

1.) I want to point out that this stock was overbought (prior to the outage), just like many tech stocks and was due for a pullback anyhow. Many tech stocks have started to decline from recent highs as investors rotate into sectors that were laggards, such as small cap stocks. If this rotation continues, this stock could remain under pressure.

2.) CrowdStrike shares are now back around the same level it was earlier this year. I have to ask bullish investors and myself if this company is fundamentally worth the same as it was worth in early 2024, when it had no botched software update and zero upset customers and no potential legal liabilities from this global outage. For me the answer is clearly no. Let’s not forget that even after the stock plunged on the day of the outage, and has slid further since, this stock is still trading for nearly double the value it held in September of last year.

3.) I believe analyst downgrades and lawsuit filings are potentially coming in the days and weeks ahead. Analysts at Oppenheimer have called this incident a major blow to CrowdStrike’s reputation and other analysts expect the company to lose some customers over the incident. Elon Musk seems to be one of the first customers to bolt. I believe this incident could spark class-action lawsuits and that this will likely force CrowdStrike to offer more than just refunds.

4.) When you have a sky-high valuation, things need to be fairly perfect in order to maintain the valuation. Things are far from perfect now and yet the valuation is still in nosebleed territory. When I look at CrowdStrike, I see a $74 billion market cap for a company with just around $4 billion in revenues. Just think about the fact that some of the initial estimates are suggesting this outage has cost over $1 billion, and then it is easy to see the scale of the damage caused by a company that has just about $4 billion in revenues.

5.) When I am thinking about protecting my IT systems, the last thing I would want (if I were in charge of IT), is to be dealing with a company that caused an outage that is in many cases potentially as bad as an outage that could be caused by hackers or ransomware. I see the outage as a massive failure since CrowdStrike is supposed to keep computers from outages that can be caused by hacks and ransomware, and instead of protecting these systems from going down, their failures caused a massive glitch.

6.) I view CrowdStrike shares as being very overvalued. According to the consensus earnings and sales estimates provided by Seeking Alpha (shown below), this company is only expected to earn about $4 per share in fiscal year 2025, and sales growth is expected to moderate in the next couple of years. With this stock trading at a price to earnings ratio of about 76 times, I see significant potential downside. I believe a number of charges from this incident are going to need to be incorporated in the estimates below for 2025, and this could include the financial impact of losing customers which could slow the growth rate. I also see customer refunds as impacting the financials in the next couple of quarters, as well as potential charges for litigation. I believe CrowdStrike’s growth rates are at risk and that competitive threats are likely to accelerate with this recent failure. Growth and momentum stocks are known to plunge when and if there is a growth scare or slowdown. I believe some investors could be underestimating the potential challenges this company could face in signing new contracts, and this issue could impact the financial results over the next couple of quarters.

Earnings Estimates

|

FY |

EPS |

YoY |

PE |

Sales |

YoY |

|---|---|---|---|---|---|

| 2025 |

4.01 |

+29.78% |

76.05 |

$4.00B |

+30.90% |

| 2026 |

4.91 |

+22.56% |

62.05 |

$5.05B |

+26.15% |

| 2027 |

6.40 |

+30.26% |

47.64 |

$6.29B |

+24.64% |

How I Might Be Wrong

I have a number of concerns that drive my bearish view on this stock. First of all, is the nosebleed valuation in terms of the implied price to earnings estimates. A stock trading for double or triple the market multiple in terms of the PE ratio generally needs to be growing fast and not have the potential for a growth slowdown. I believe the current earnings estimates are now too high, because I think this company is possibly going to have to take a significant charge in the current quarter in order to cover the potential customer refunds, as well as increased legal expenses, employee overtime, possible settlements for litigation, etc.

On top of all these potential expenses, that could significantly reduce earnings for the rest of 2024, I believe the revenue growth rate of this company will slow since I expect it to lose some customers to some of its competitors. I believe the combination of higher expenses that could lower earnings, along with the potential for lower than expected revenues (from the loss of customers), is going to be a very powerful force in lowering the sky-high multiple this company holds now.

I could be wrong, and there is a chance that CrowdStrike steps up and placates its customers to a level whereby they don’t lose much business to competitors. It might take some type of financial hit in terms of refunds, but this might be manageable enough so that it is just a one time charge. If the stock market continues to rally, there is a chance this stock could go higher. This stock is deeply oversold now and it could experience a rebound for technical reasons and possibly because of short covering.

In Summary

As mentioned before, I have seen some people describing this as a golden buying opportunity, or liken this incident as being a “black eye”. But black eyes heal and can completely be gone in about 10 days and the fallout from this incident is not likely going away in 10 days, so I do not see this as just a black eye. I view CrowdStrike shares as a momentum stock that is trading with a bubble-like valuation. I think numerous risks remain and the fallout from this outage is likely to grow larger in the days ahead and put more selling pressure on this stock. I see it as being way too early to buy, and that at current valuations, this stock is a strong sell.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Read the full article here