Jiayin Group (NASDAQ:JFIN) is one of the smaller fintech companies in China; it has a strong track record of growth and a very strong balance sheet. The potential for outsized returns is appealing, but JFIN might not beat the market over 5+ years in stock price alone. Despite this, if management’s initiatives go as planned, my 5Y price target of $13.34 indicates price alpha. It offers moderate deep value at the moment, but its lack of a USP and service/product originality means the long-term growth narrative is weaker than I would like. Despite this, it is paying a generous dividend of 13.5% at the moment, and because of this, I think it has to be rated a Buy, as this acts as both security against volatility and significantly increases the total return prospects.

Operational Analysis

Jiayin is a fintech platform based in China. Primarily, it connects individual investors with borrowers through secure digital connections on an online platform. It is a significant player in Chinese fintech.

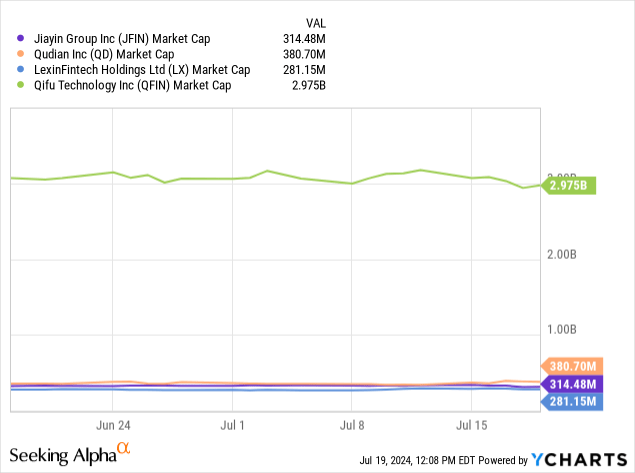

The company’s business model revolves heavily around loan facilitation, and its offering serves to streamline this process. The company is a micro-cap, with a market cap of $310.24M, but it evidences that it is committed to high standards. For example, by integrating AI for intelligent search and risk assessment, the company is investing in long-term customer satisfaction. As of the latest reports, Jiayin has partnerships with 71 financial institutions and is in discussions with an additional 36 institutions as of the end of 2023.

JFIN also offers:

- Financial guarantee services

- Borrower referral services

- Risk management solutions

- Technological empowerment

The company has also begun to expand into international markets, which I believe could be core to its long-term growth story. In Indonesia, the company reported a significant growth in user registrations and loan facilitation volumes. It is also making steady progress in Nigeria, with increasing loan volumes and new borrowers. Furthermore, the company is exploring opportunities in Mexico, with rapid growth already in its local business entity there for lending capabilities.

While I think the company has a strong offering, it operates in a notably competitive Chinese and also international fintech market. Particularly within China, its main direct competitors are as follows:

- Qudian (QD): a leading provider of small consumer credit products in China; it targets the youth, and it also leverages big data and AI like JFIN.

- Lexin (LX): another significant player in the online consumer finance sector in China; it also focuses on leveraging technology.

- Qifu (QFIN): offers a comprehensive suite of financial services, leveraging technology to optimize the user experience; it is another formidable Chinese fintech competitor.

QFIN is the largest competitor to JFIN; it operates a leading Credit-Tech platform in China, including services such as digital revolving lines of credit, credit assessment, collections, and guarantee services. The company has strong relationships with 157 financial institutions and has connected with 235.3M customers—this extensive network and its larger market cap make it dominant compared to JFIN, and I do think QFIN poses a significant long-term inhibitor to outsized growth for JFIN. However, investors are unlikely to capitalize on the high outsized growth I think is available in JFIN from QFIN, partially because it has already expanded significantly and also because its valuation is much less appealing, which I will discuss in more detail below.

Financial & Valuation Analysis

To begin with, what is most notable to me about JFIN is that management owns most of the stock. Dinggui Yan, the founder, chairman, and CEO, owns 51% of JFIN as of December 2023’s SC 13G/A SEC filing. Furthermore, it is likely that management owns 70%+ of the company in total, in my estimation, which indicates that the executive interests are highly correlated with bolstering shareholder value and the stock price.

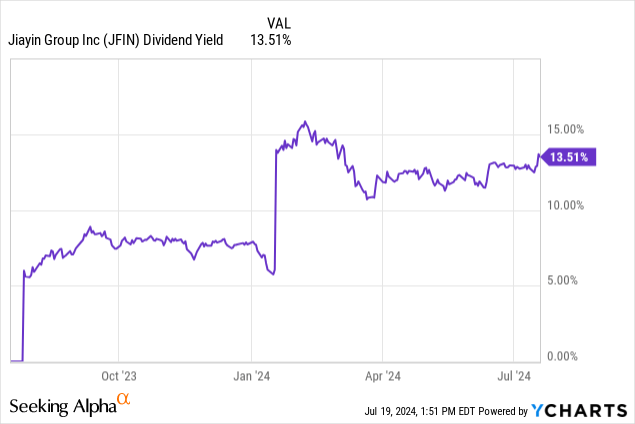

This being said, a lot of the benefits are accruing to management at the moment through the dividend yield, which is a very generous 13.5%. In my opinion, this represents some short-term interests from management, and I would likely be even more bullish if this dividend was reduced and the company reinvested effectively in strategic efforts to increase long-term profitability and drive up the price of the stock. However, such a high dividend yield is something new potential shareholders will not complain about in the interim as they monitor the firm’s ongoing fundamental growth prospects and valuation.

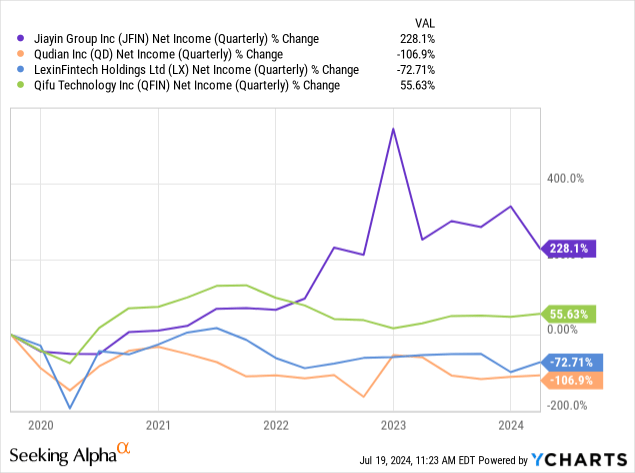

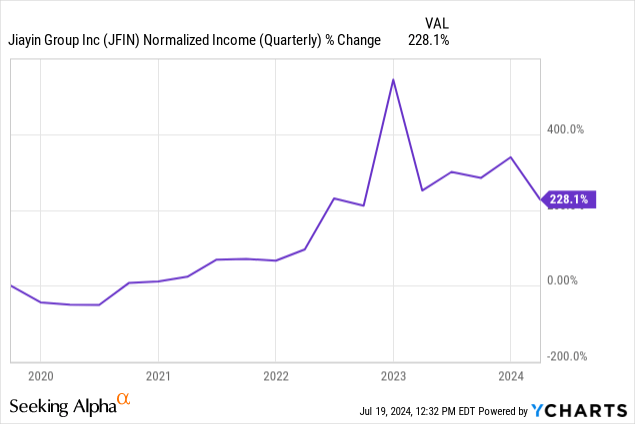

One can also be notably bullish about JFIN because it has delivered much higher net income growth over the past 5 years compared to its major direct competitors:

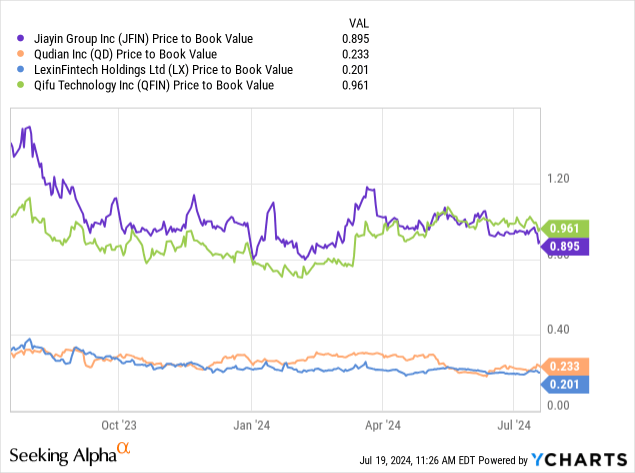

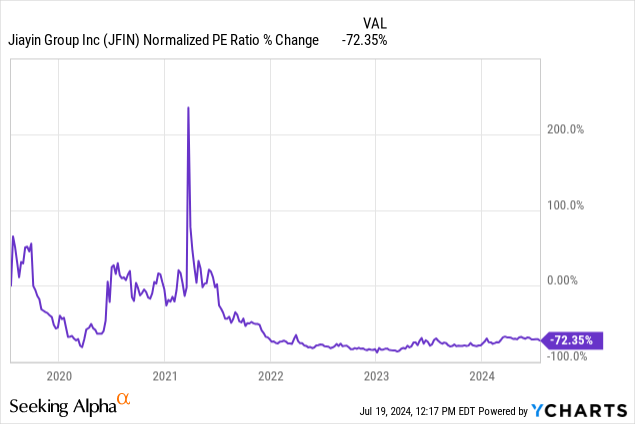

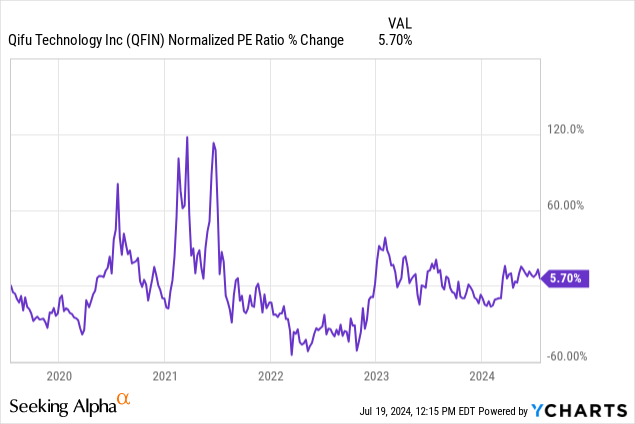

JFIN notably has a very low valuation, with a TTM price-to-book ratio of 0.9 and a TTM price-to-sales ratio of 0.39, indicating deep value. This is not unusual for such small companies operating in its field, but what is notable is its significant long-term net income expansion juxtaposed against the 1Y contraction in the price-to-book ratio. The value opportunity can be further elucidated in the 5Y contraction of 72.35% in JFIN’s normalized PE ratio over 5 years (Chart 2).

As I mentioned in my operational analysis, the value opportunity in QFIN is less pronounced right now, which is made evident in the following chart. Compare it with the chart above, and you can begin to see why I favor JFIN at the moment due to its much smaller market cap, indicating larger growth potential, and also the fact that its valuation is much more appealing compared to historically.

Investors will also be pleased to note that JFIN’s enterprise value is less than its market cap, a result of low debt levels and a high amount of cash on the balance sheet. Its equity-to-asset ratio is a reasonable 0.49, and its debt-to-equity ratio, including lease obligations, is an incredibly low 0.02. Furthermore, its cash-to-debt ratio, including lease obligations, is 11.36. JFIN has total cash and ST investments of $78.7M and no typical long-term or short-term debt. In my opinion, this is another reason to be bullish about JFIN, and I believe the company is managed well by studying its capital structure. At this stage of the company (it was founded in 2011), the low debt is a big green flag.

Since its IPO, JFIN has had a normalized PE ratio of 2 as a median. I think it is reasonable for the company to achieve this again over the next 5 years as a result of the current strength in growth. The company has reported a substantial 5Y CAGR in normalized income of 26.53%. However, this has been negatively impacted by a recent drop since 2023. This has largely been a result of macroeconomic weakness in China, including a rise in expenses related to financial guarantee services and other increased costs, as reported in Q4 2023. This has already begun to improve in Q1 2024, where the company reported a decrease of only 2.4% in net income YoY, compared to 31.1% YoY in Q4 2023. In my opinion, while there is likely to be some volatility moving forward, and it is largely unpredictable when the company and the Chinese macroeconomy will be more favorable for JFIN, my analysis and research tells me that a 5Y future EPS CAGR of about 15% is achievable for the company, which allows for some periods of weakness and competitive restraint, whilst also favorably viewing the company’s Chinese domestic and international growth opportunities. As a result, the stock could be worth $13.34 in July 2029, as the current EPS without NRI is $3.36, and it may appreciate at an EPS CAGR of 15% over 5 years to an EPS without NRI of $6.67, with the PE ratio expanding to 2. If this result comes to fruition, the stock will achieve a stock price CAGR of 17.64% over 5 years from the present price of $5.92.

Risk Analysis

I mentioned the competitive risk in my operational analysis above, particularly from QFIN, and I think this is notable. In addition to the inhibition that this larger competitor could cause, there is also the volatility that comes with investing in micro-cap companies. As JFIN is not highly established, technological advancements and perhaps larger players than QFIN, such as Tencent (OTCPK:TCEHY), that decide to venture into the fintech market that JFIN operates in could significantly disrupt JFIN’s future plans. In addition, black swan events can significantly disrupt micro-cap companies more so than large-caps—as a result, I think risk mitigation through strategic portfolio weighting, if exposed to JFIN, is critical. This is also the chance for high outsized returns if JFIN becomes very successful over the next few years and picks up more traction in China as well as abroad. However, this is largely speculative, and I think, based on the valuation and conservative growth estimates, one should not be surprised if JFIN does not beat the market considerably in price alone.

To stress the competition threat from larger technology companies, Tencent’s WeBank and Ant Financial also operate in the field—these companies have access to vast amounts of consumer data and the capability for economies of scale. JFIN has not chosen a niche part of the market, and it is not the “only” company offering such services. As a result of this market saturation, the outsized potential of this micro-cap is less probable than one would hope. The company is also prone to more risks as it is smaller and has less infrastructure, including rising cyber threats, which it may not be fully prepared for as AI-led threats become more prominent. In addition, the Chinese regulatory landscape is difficult, and the company will also have to navigate regulatory constraints in overseas territories. I think there is a large amount of potential constraint that is latent and could surface later related to complexity in international operations, and as such, I expect some strains on cash flow and profitability while it navigates new territories. Again, in other words, I think there is a high likelihood of this investment continuing to grow, but there are certain latent negative catalysts, which means it is not improbable that it will not beat the market in price CAGR alone. I do believe there are better, less speculative bets in more original companies to invest in that also have deeper value in the micro-cap world for stock price appreciation.

High Dividend Yield

Jiayin shareholders benefit from a dividend yield of 13.5%. This is primary to why my rating for JFIN is a Buy for total return. This dividend was initiated recently, and it is paid on a quarterly basis.

It is worth noting that dividends paid by Chinese companies to non-resident shareholders are subject to a withholding tax of 10%. However, U.S. investors can claim a foreign tax credit for the taxes paid to foreign governments, such as the 10% withholding tax on dividends from China. This, therefore, allows investors in JFIN to avoid double taxation, another reason why JFIN is a Buy.

Investors who buy into JFIN now should remember that the dividend yield is not guaranteed to stay so high and that it acts as a lever of security against volatility in the stock price. In addition, if the company appreciates in value as I expect over the long term, the dividend yield on cost could still be very high for JFIN over 5 to 10 years, even if the company decides to reduce the dividend yield to 7% or 8%.

Conclusion

JFIN offers moderate deep value right now, as well as historically strong long-term growth rates despite a current contraction in normalized income. As a result of the better valuation compared to historically and the dividend yield of 13.5%, I think it has to be considered a Buy, but it might not beat the market in stock price CAGR alone, despite my optimistic bull-case 5Y price target. Competitive constraints, lack of originality, no substantial moat, and no distinct USP could all inhibit price alpha. Despite my assessment here on a pure growth front, I do think the business is operated well by management, and I think it will continue to achieve good growth over the long term.

Read the full article here