Coming out of the pandemic, airlines saw golden times ahead as demand for air travel surged and due to a shortage of airplanes as well as pilots the supply of seats was constrained, pushing air fares higher. Fast forward to 2024 and things are looking difficult. In fact, things are looking so different and are changing so unexpectedly that Lufthansa (OTCQX:DLAKF) (OTCQX:DLAKY) had to revise its full-year guidance. In this report, I will be discussing the dynamics and the downward revision for Lufthansa Group shares. I will also be revisiting my price target and rating for Lufthansa stock.

Lufthansa Group: Plagued By Margin Compression

The margin pressure that Lufthansa faces is not necessarily unique to Lufthansa. Coming out of the pandemic, there was a shortage of airline pilots as well as aircraft, and that drove up prices. That boosted airline profits and in order to continue growing capacity and benefit from the golden times for airlines, many airlines offered juicy pay packages for airlines. After all, the demand for air travel was so strong that costs could be passed through to the consumer.

However, with due to the situation in Ukraine, we saw an energy crisis unfold that led to many employees looking for higher wages, pushing labor costs even higher. Perhaps that was one push too far in the cost structure for many airlines. There are two reasons for that. The first one is that more airlines have been bringing capacity online, but with higher cost connected and with supply-demand recovering, the upside to fares is diminishing and even turning negative. So, we have higher costs and lower fares. Add to the fact that the Eurozone faced a recession that it just exited, and we see additional pressure on air travel demand, further depressing air fares. Especially, Germany’s economy has had significant challenges getting out of the recession and with that in mind, it might not come as a surprise that the Lufthansa Group has lowered its full-year guidance.

A Big Trim To The Guidance For Lufthansa

For the second quarter, Lufthansa had initially guided for a year-over-year decline in adjusted EBIT and FY2024 adjusted EBIT had been reduced by €500 million to €2.2 billion. In Lufthansa’s latest adjustment, the company now expects adjusted EBIT to be between €1.4 billion and €1.8 billion, which would bring the total trim to the guidance to between €900 million and €1.3 billion. So, we could be seeing full-year profit being half of what the company initially expected.

What is rather interesting is that Lufthansa Technik, Lufthansa Cargo and the other passenger airlines excluding Lufthansa will see stable to slightly higher results, while it is primarily the result of Lufthansa’s airline operations that are significantly lower. The company is facing softer pricing on Asia routes, inefficiencies and a shortage of airplanes causing inefficiencies in the system. On a preliminary basis, we already observed that Q2 Adjusted EBIT for the group tumbled from €1.1 billion to €686 million and specific to Lufthansa there are concerns that the airline will not generate a profit for the year.

A strike at the start of the year has not helped Lufthansa, and the economic situation in Germany is also not providing any form of support. Sports events are normally seen as a boost for airlines in the hosting country. However, while not specifically mentioned, it could very well be the case that the hosting of the Euro 2024 had a counterproductive effect as we also are seeing with Air France-KLM and Delta Air Lines in Paris as the city will host the Olympics. So, I would say it is not all that surprising that if the bottom falls out that it happens at Lufthansa.

The New Stock Price Target For Lufthansa

|

Year |

Current |

Previous |

Change |

|

2024 |

$ 4,632.3 |

$ 4,956.5 |

-7% |

|

2025 |

$ 5,347.2 |

$ 5,481.7 |

-2% |

|

2026 |

$ 5,586.9 |

$ 5,730.4 |

-3% |

|

Total |

$ 15,566.36 |

$ 16,168.54 |

-4% |

Implementing the most recent analyst estimates shows that EBITDA estimates have come down by 7% for 2024 and also in the years after we see that analysts are less upbeat, so the aircraft shortage as well as the current softness in air fares has a bit of a ripple effect. Between 2024 and 2026, the EBITDA estimate has now come down by 4% to $15.6 billion.

|

Year |

Current |

Previous |

Change |

|

2024 |

$962.7 |

1569.3 |

-39% |

|

2025 |

$1779.5 |

1857.6 |

-4% |

|

2026 |

$1215.0 |

1812.6 |

-33% |

|

Total |

$ 3,957.25 |

$ 5,239.5 |

-24% |

The free cash flow estimates are even worse with a 39% downward revision this year and 24% overall, which might be caused by the fact that Lufthansa had aligned itself for a better pricing and capacity environment, and it is now not achieving either and while adding costs is easy, taking cost out of the system is significantly more challenging.

The Aerospace Forum

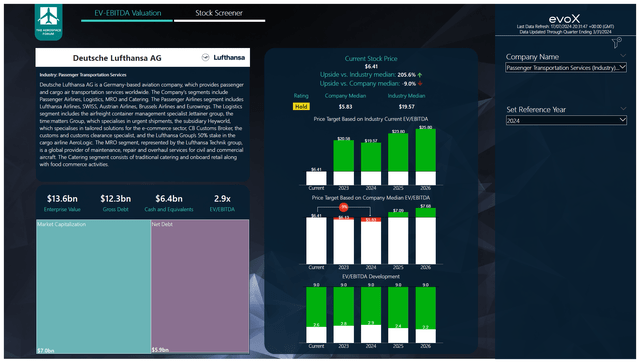

I implemented the numbers into my model, and we see that Lufthansa stock is not looking attractive. There is a hold rating because the company trades at a discount compared to peers. However, when we look at the stock price target using the company median EV/EBITDA, we see that the company is overvalued for 2024 with a $5.83 price target down from $6.79 previously. So, the downward revision has a significant impact on the valuation of the stock. I am keeping my rating on hold for now, but I would perfectly understand if investors would at this point sell their Lufthansa shares for the simple reason that uncertainty is increasing and there might be more rewarding investment opportunities. Looking at aerospace stock picks instead of airlines already provides safer investment opportunities.

Conclusion: Lufthansa Stock Is Significantly Less Attractive

This year already looked like it would become a difficult one for Lufthansa due to the strikes early in the year and while I already expected some softness on the Asia bound routes, I have to say that the downward revision to the guidance is significantly worse than I expected. Effectively, Lufthansa has cut its guidance for the year in half, and it shows that things are significantly more challenging than the company had anticipated. What we are looking at now is the company simply saying, “we were wrong”. Getting cost out of the system is going to be challenging, and I don’t believe that we are going to see unit revenues jump. So with that in mind, I don’t consider Lufthansa stock to be attractive and mark it a hold and I could even understand if shareholders sell at this point to free up cash for other investing opportunities.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here