Investment Action

I recommended a buy rating for Five Below, Inc. (NASDAQ:FIVE) when I wrote about it about three months ago, as I expected the business to meet its FY26 EPS target with ease. Based on my current outlook and analysis, I am downgrading to a hold rating. My key update to my thesis is that the macro pressure on consumer spending is a lot more than I had expected. This makes the near-term demand profile of FIVE very uncertain. I believe the market is extremely focused on how FIVE is going to perform in the near term, and as such, I think the best positioning an investor can take is to stay on the sidelines until we see more evidence of consumer spending recovery.

Review

The main reason for my downgrade is the uncertainty over the near-term demand profile. In particular, the negative impact of inflation has hurt consumer spending more than I initially expected. While there are some positive things to note (more on this later) and valuation has gotten to a cheap level, I think it is better to stay on the sidelines in the near term and wait for better macro improvements before turning bullish again.

Although the Feds are sending a stronger signal to cut rates in the coming months, I am not optimistic about how the current consumer spending situation is for FIVE. The reality seems to be that consumers are cutting back a lot on spending, even on necessary goods. For instance, consumers are cutting back on grocery spending (a necessity), and a key reason is the high prices. In order to combat this, retailers are cutting prices to attract consumers back to spend. This weakness was well evident in FIVE recent performances, where despite the strong start to the fiscal year (first six weeks of 1Q24, which is almost half), the quarter was dragged down significantly by the last 7 weeks to a negative performance of 2.3%.

I would remind readers that 1Q24 has the benefit of the Easter holiday, which should support demand as consumers buy gifts and whatnot. That didn’t happen this time, and I think this lends credence to my view that consumer spending is really weak. Moreover, the demand weakness for FIVE is across all geographies, which, in my view, suggests that the weakness in consumer spending is broad-based and not isolated to one or a few states.

And I think somebody even asked us on the last call if we were within the range of our guidance, and we were squarely in the middle of it. So Easter was disappointing, and then it continued into spring as well as then into May here. 1Q24 call

One of the bullish views I originally had for FIVE is that as a discount retailer, it benefits from a high inflation environment (i.e., attracts low-income customer groups, enjoys trade-down movements, etc.). However, I don’t believe this is true anymore. At the current state of things, I believe it is net negative for FIVE. While FIVE continues to see trade-down movements from its higher-income customer cohort (positive), FIVE is losing customers from its lower-income cohort, which is its core customer base (super negative). We can see this in the 1Q24 performance, where FIVE saw underperformance in the lower income demographic that more than offset the high-income strength, with management noting a particular weakness after tax refunds depleted. Moreover, while some might celebrate that FIVE still has pricing power (pricing was up 0.5% in 1Q24), the reality is that overall volume was down-the number of transactions was down by 2.8%, and units per transaction fell as well. This is in line with my view that consumers are purchasing less on an overall basis.

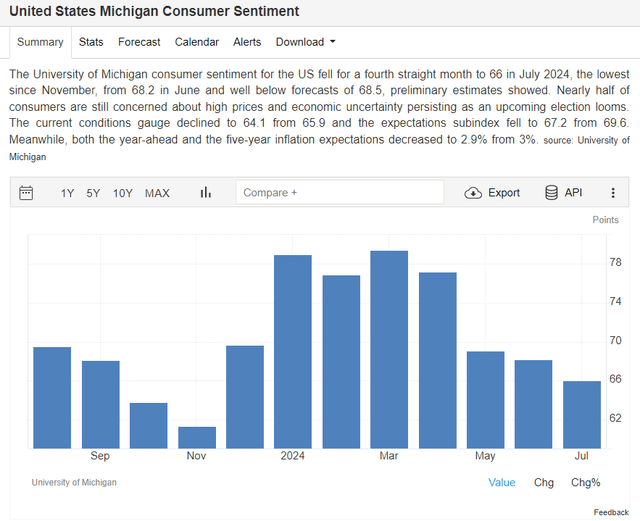

TradingEconomics

Another data point that further supports my negative view on the spending environment is that since May (the last month of FIVE’s 1Q24), the consumer confidence index has continued to fall, which suggests no positive turnaround in the spending environment. As such, with all of these negative data points, I find it hard to have confidence that FIVE will see positive demand in the coming quarters, at least for the rest of this calendar year.

On the other hand, there are positive things to note that give a little hope that FIVE could do better than I expected, and this could drive a major turnaround in fundamentals and stock sentiment, which is why FIVE still deserves a place on the watch list. Firstly, management is conducting pricing tests in ~100 stores in which it is lowering prices (primarily in their front-of-store categories) to see if this will help in demand. Suppose FIVE manages to find the “right formula.” This could help rejuvenate the volume aspect of the same-store-sales growth equation. Secondly, FIVE is about to pull the lever to turn on its promotional mode. Specifically, FIVE intends to double their marketing spend within some markets to drive awareness and transactions. Suppose this works as well; this will further contribute to volume growth. Hence, there is a chance for same-store sales to re-accelerate to positive levels.

Valuation

The other positive development about FIVE is that valuation has gotten to a very low level compared to history. At the current 18x forward PE, it is the second-lowest level it has ever dropped to (the lowest was during COVID). The way FIVE has traded over the past few months shows that the market is very focused on the near-term demand dynamics (like what is going to happen in FY24 rather than FY26, I believe), and this has forced me to change my view from a medium-term view to a short-term one. In the short term, I am leaning towards the negative side of things, where consumer spending is going to stay weak, as supported by various data points, such that major retailers are forced to cut prices to attract consumers. Therefore, same-store sales are going to stay weak, and the market is unlikely to rerate the stock any higher until there is a clear sight of consumer spending recovering (i.e., the stock stays rangebound).

Final thoughts

My recommendation is a hold rating for FIVE due to the uncertainty in near-term consumer spending. The negative impact of inflation has been much stronger than my original expectations. This weakness is reflected in FIVE’s recent performance, despite the benefit of the Easter holiday. While there are some positive aspects, such as management’s pricing tests and increased marketing spend, various data suggests continued weakness in consumer spending. While the current valuation is attractive, I think waiting on the sidelines is a better choice until there are signs of a consumer spending recovery.

Read the full article here