Alexandria Real Estate Equities, Inc. (NYSE:ARE) is a well-managed real estate investment trust with an operational focus on life science real estate.

The trust has enjoyed consistent funds from operations growth in its main business over the years and has strong portfolio metrics to back up a favorable outlook for passive income investors.

Alexandria Real Estate Equities pays out just a tad more than 50% of its funds from operations, and the stock is moderately valued.

Since the life science trusts also profit from long-term, secular R&D spending tailwinds in the pharmaceutical industry, I think investors will continue to see Alexandria Real Estate Equities’ dividend grow moving forward.

My Rating History

My first coverage of Alexandria Real Estate Equities in June 2023, leading to a Buy stock classification, was that the real estate investment trust was unfairly lumped into a group of office REITs.

Since investors were very much concerned with the office market at the time, and to some extent still are today, the life science REIT made a compelling value proposition at the time.

The trust continues to earn a steady amount of funds from operations and is growing its FFO as well as dividend. The trust just last month raised its dividend again by 2.3% and the portfolio is well occupied.

Stable Portfolio, Consistent FFO Growth

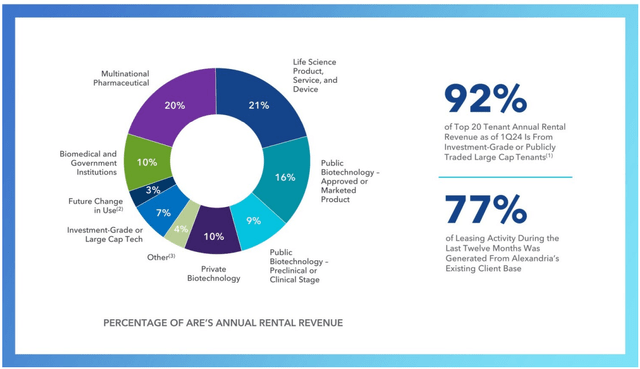

Alexandria Real Estate Equities is a real estate investment trust that leases its real estate predominantly to life science and biotechnology companies, many of which are large multinational companies.

The trust owned a real estate portfolio worth $37.5 billion and leased its properties primarily to investment-grade or large cap tenants such as Amgen, Merck, Roche, or Pfizer in the pharmaceutical industry.

Percentage Of Annual Rental Revenue (Alexandria Real Estate Equities, Inc)

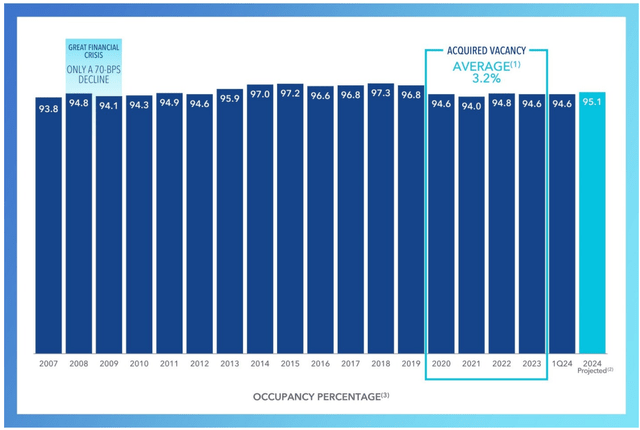

Alexandria Real Estate Equities’ portfolio is well-leased and had an occupancy of 95.1% in 1Q24, which reflected the highest occupancy percentage since 2019.

Occupancy Rates (Alexandria Real Estate Equities, Inc)

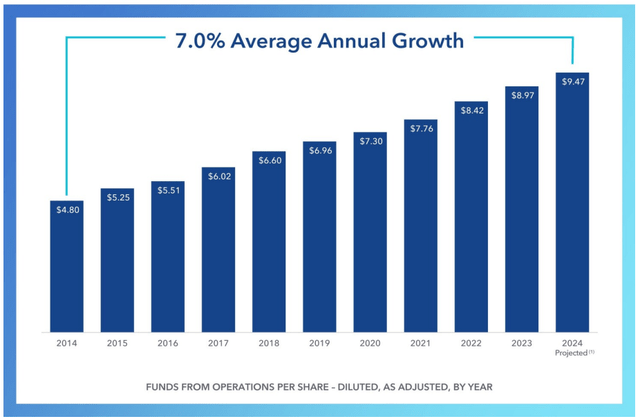

Given its portfolio of high-quality tenants, Alexandria Real Estate Equities has been able to consistently collect all of its owed rents (rent collection of 99.9% in 1Q24) and grow its funds from operations. The trust produced 7% FFO growth per annum since 2014 and the forecast is bullish also.

Funds From Operations Growth (Alexandria Real Estate Equities, Inc)

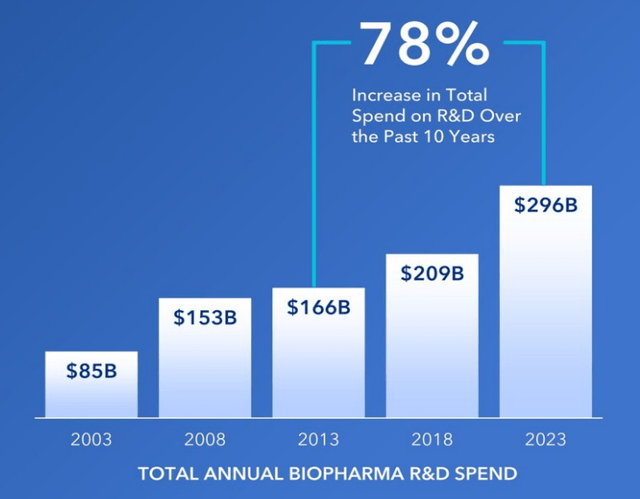

Support for Alexandria Real Estate Equities’ funds from operations growth comes from tailwinds in the pharmaceutical business, particularly R&D spending. Large pharmaceutical companies, such as Merck, Moderna or GSK, invest billions of dollars annually in order to develop new medicines.

With pharmaceutical companies spending big on R&D, Alexandria Real Estate Equities is well-positioned with its lab-focused real estate portfolio to take its share of the pie.

Total Annual Biopharma R&D Spend (Alexandria Real Estate Equities, Inc)

Dividend Coverage And Growth Are Looking Solid

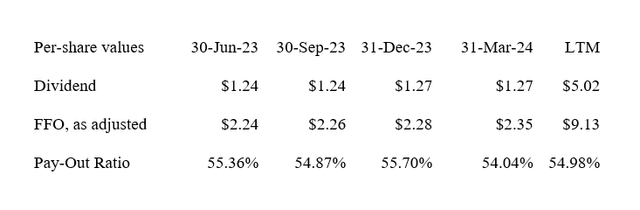

Alexandria Real Estate Equities earned $2.35 per share as funds from operations as adjusted in the first quarter, reflecting 7.3% YoY growth. The amount of FFO earned equated to a dividend pay-out ratio of 54%.

The life science REIT therefore pays out only a little bit more than half of its funds from operations (the same holds true for the twelve months dividend pay-out ratio) and Alexandria Real Estate Equities raised its dividend twice in the last year.

The most recent 2.40% dividend hike was announced in June, which is when the trust raised its dividend to $1.30 per share, or $5.20 per share per annum. The leading dividend yield, based on the new dividend pay-out of $1.30 per share per quarter, is 4.2%.

Dividend (Author Created Table Using Trust Information)

FFO Multiple

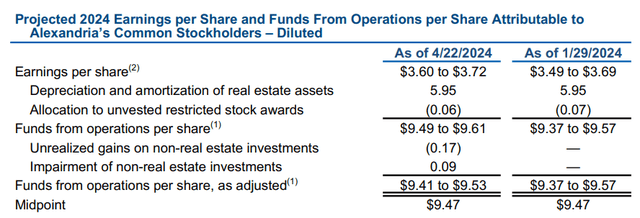

Alexandria Real Estate Equities’ run-rate 1Q24 funds from operations as adjusted are $9.40 per share. The trust foresees $9.41-9.53 per share in funds from operations which equates to an FFO multiple, at a present stock price of $124.83, of 13.2x.

Taking into account the quality of the underlying cash flows, which are derived primarily from publicly traded, investment-grade tenants, I think ARE could sell for 15.0x, or a higher, FFO multiple. This multiple would equate to an intrinsic value of $142. For me, the justification for a long position comes mainly from the fact that the trust is growing its dividend.

Funds From Operations Per Share (Alexandria Real Estate Equities, Inc)

Why The Investment Thesis Might Not Meet My Expectations

Alexandria Real Estate Equities is, as I made clear, a life science-focused real estate investment trust, and the trust has been lumped in, unfairly, with the embattled office sector in the last year or so.

This sector has some issues as hybrid work arrangements have weighed on real estate performance. For instance, the loan portfolio of Blackstone Mortgage Trust Inc. (BXMT), a large mortgage trust with big investments in the office market, has suffered quality and performance issues in 1Q24 which was a reason for me to issue a downgrade.

A weak outlook for the office market may continue to infect other real estate categories and trusts that are not active in the office market, such as Alexandria Real Estate Equities. Since the trust manages to cover its dividend with funds from operations; however, I think the dividend is quite safe.

My Conclusion

Alexandria Real Estate Equities is a well-managed real estate investment trust with an operational focus on life science real estate that profits from long-term secular R&D spending drivers in the pharmaceutical industry.

Alexandria Real Estate Equities has solid portfolio occupancy, produces a large percentage of its cash flow from investment-grade tenants in the pharmaceutical and biotechnology industries, and has a long-term record of growing its funds more operations.

To round out the value proposition, the trust pays out only a little more than half of its funds from operations and has been a solid example of shareholder-friendliness: In the last year, Alexandria Real Estate Equities raised its dividend twice and just last month raised its dividend 2.3%. The 4.2% leading dividend yield is supportable, and the stock is not outrageously expensive given its FFO and dividend trend. Buy.

Read the full article here