Introduction

Boring businesses can be some of the best businesses to own. Convenience stores, funeral homes, aerospace parts, and even solid waste have been some weird (but highly profitable) industries where investors can find great businesses that generate strong free cash flow and have long runways for growth.

One such company I think fits this bill is Republic Services (NYSE:RSG), which is the second largest waste services provider in North America, after Waste Management (WM). With a huge network of landfills and transfer stations, connected by its routes, the company has a dominant presence in the waste management industry; an industry that’s largely built on scale and route density. The large players like Waste Management and Waste Connections (WCN), which I previously covered here, have a collective market share of about 40% in North America. Beyond that, the industry is largely fragmented with several small operators who make up the remaining 60%. With nearly $15 billion in revenues each year, the company serves 13 million customers with a 94% retention rate doing 5 million daily pick-ups. The company has just under 250 transfer stations, 75 recycling centers and 17k trucks.

Investment Thesis

My investment thesis on Republic Services revolves around a few main points. Firstly, the company is a compounder growing free cash flows at high-single digits with organic sales growth of mid-single digits. Secondly, the operating leverage created by the company’s technology and AI from better pricing/surcharge opportunities, cross-selling, cost savings and efficiency has a lot more room to drive margin expansion. Lastly, the company’s differentiated strategy focused on creating a truly circular economy for plastics through its Polymer Centers and Blue Polymers partnerships creates a strong first-mover advantage (within solid waste) with strong returns and accretive margins.

Potential For Margin Improvement

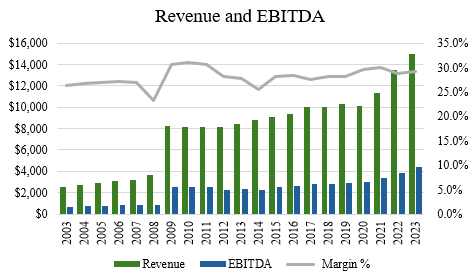

Republic Services has been a steady compounder over time. Over the last decade, the company has grown revenue at a 5.9% CAGR and EBITDA at a 6.5% CAGR (source: S&P Capital IQ). While this is decent growth on its own, compared to a peer like Waste Connections, which has grown its top and bottom line at 13.8% and 13.0%, respectively, the company’s historical growth rate is slightly below that of its peers.

Author, based on data from S&P Capital IQ

As per the company’s financial statements, about a third of the company’s cost of goods sold is comprised of labor, 20% is transfer and disposal, 15% is maintenance and repair, and 8% is fuel, with the remaining being other. While the company can’t do much on labor, fuel is an area the company is focusing on. This allows it to recover the change in fuel cost with a small lag of a couple of months. Essentially, what this means is as fuel costs increase, the company adds revenue and cost at the same dollar amount resulting in margin headwind. Conversely, as fuel cost decreases the company sees a margin tailwind. Per management, the company estimates that for every 10 cent change in the price of diesel, this equates to a $13 million impact to both revenue and expenses (source: S&P Capital IQ).

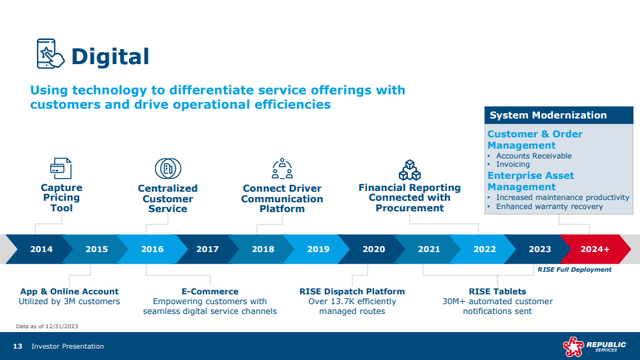

While Republic Services’ growth is below the historical peer group, the company is making efforts to change that by advancing the use of technology, which should create a pricing and margin opportunity over time. In digital, the company is planning to implement digital tools for its customers (e.g., waste tracking) that should increase customer stickiness. It also helps to differentiate itself from the rest of the competition that doesn’t offer it.

In addition to this, Republic is implementing advanced technology in collection routes. The technology utilizes cameras to identify overfill containers and contamination recycling containers. The company anticipates generating about $60 million in incremental revenue from this, and to date has already achieved $30 million of annual benefit.

Within the RISE digital platform, the company anticipates driving approximately $100 million of total annual earnings contribution, of which about $65 million has already been realized to date. In my view, these small, but wise, organic investments should be a positive margin driver over time and help improve small things for the company which enhance their operations (in this case better safety and optimizing routes). With RISE In particular, the company plans to deploy a new system in the back half of the year using a phased approach, which is estimated to result in an additional $20 million in cost savings by 2026.

Investor Presentation

Differentiated Strategy

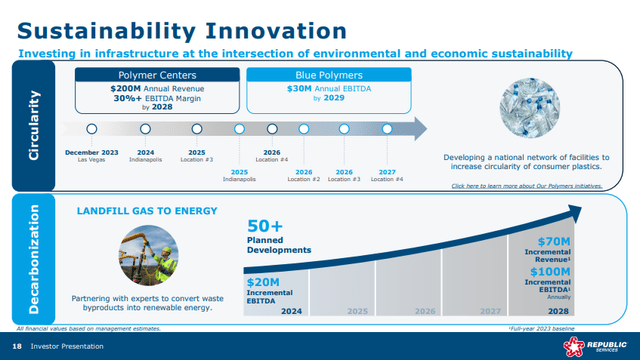

One thing I like about Republic is that it seems to be forward thinking, when comes to thinking about its focus on the circular economy. Its approach to renewable natural gas and recycling is a partnership model. For example, just last month in June, the company announced a renewable natural gas plant partnership with Archaea Energy. This will take the form of a joint venture (Lightning Renewables) that will bring approximately 40 landfill gas-to-renewable natural gas plants online in the coming years.

Other examples of this include Republic developing a national network of facilities “polymer centers” to increase circularity of consumer plastics. These polymer centers are expected to generate $200 million in annual revenue and 30%+ EBITDA Margin by 2028. Blue Polymers, which is a joint venture, is expected to generate $30 million in annual EBITDA by 2029.

Investor Presentation

Additionally, the company also has initiatives in decarbonization. In a JV with BP, the company is investing so that it can build over 50 landfill gas to energy facilities, which are expected to generate $20 million of incremental EBITDA this year. By 2028, the company expects to generate $70 million of incremental revenue and $100 million of incremental EBITDA annually. These are just a few of the many investments that Republic has made in innovation and infrastructure that are focused on circularity and environmental sustainability. In my view, this bodes well for the company’s image to customers, who are becoming increasingly focused on ESG initiatives. Importantly, these projects are all expected to be profitable for the company, so investors can be sure that management hasn’t made these investments without strong consideration into the profitability, feasibility, and economic viability of them all.

Balanced Approach to Capital Allocation

Like other publicly traded waste management companies, Republic Services has a balanced approach to M&A. This includes return of capital through buybacks and dividends as well as organic growth initiatives and tuck-in acquisitions.

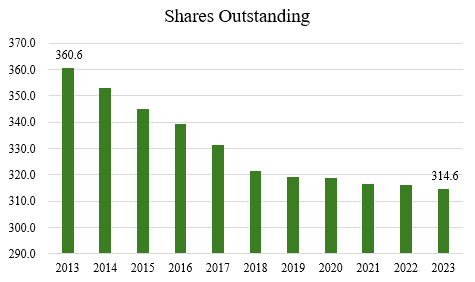

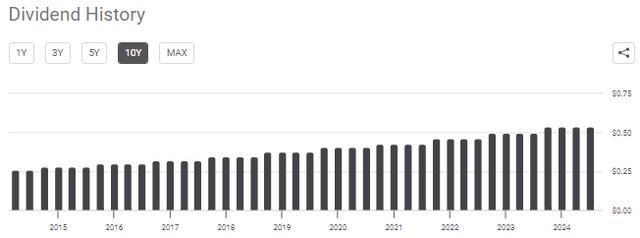

With respect to buybacks, in the last ten years, the company’s share count has gone from 361 million shares outstanding to 315 million shares outstanding, a 13% decrease (source: S&P Capital IQ). And on dividends, the company has doubled its quarterly dividend over the last decade, with the quarterly dividend increasing from $0.26 per quarter to $0.54.

Author, based on data from S&P Capital IQ Seeking Alpha

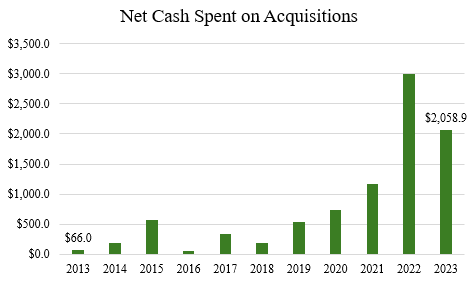

On M&A, this is where it gets a bit harder to forecast, as management doesn’t provide specific targets each year. Rather, they take into account the valuations and measure that up against the fit of the acquisitions, Republic’s balance sheet and capital needs, and other strategic considerations. Over the last three years, the company has spent over $5.5 billion in M&A, so the last few years have looked a bit ‘outsized’ in terms of what’s typical. On the earnings call, management noted that the pipeline is building, but that they are on pause until 2025 once they have a more solid foundation to integrate companies in (such that they can maximize the synergies from those deals). Guidance is for ‘at least $500 million of investment in value-creating acquisitions in 2024’.

Author, based on data from S&P Capital IQ

Outside of M&A, organic investments are still a big part of spend. Republic plans to invest about $160 million through 2027 in blue polymer and the company plans to spend about $40 million per blue polymer facility (or about $160 total for the four facilities over the next few years).

From a balance sheet perspective, total debt was $13.1 billion and total liquidity was $2.8 billion as of the most recent quarter. With a market capitalization of $62.6 billion and cash of $91.6 million, the company has a Debt to EV ratio of 21%, which is in line with the company’s investment grade rating of A- by Fitch and BBB+ by S&P with stable outlook (source: Bloomberg). Overall, the debt is high with a leverage ratio of 2.8x, but in my view, given the predictable nature of the business and CPI-indexed cash flows, I think this is warranted. When we consider that 2024 is shaping up to be a year for lower M&A, this should allow the company to deleverage the balance sheet somewhat, as evidenced by a 0.1 turn reduction in leverage, quarter over quarter.

Valuation and Wrap Up

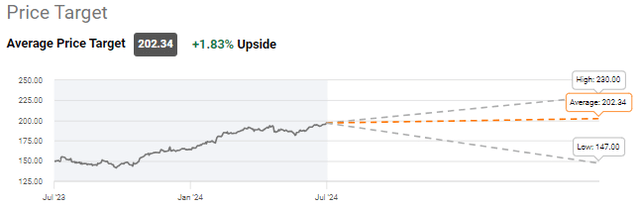

Based on the 21 sellside analysts who cover the stock, there are 9 ‘buy’ ratings, 11 ‘hold’ ratings, 1 ‘sell’ rating. In aggregating the price targets, the analysts have an average price target of $202.34 with a high of $230.00 and a low of $142.00. From the current price to the average price target one year out, this implies about 1.8% upside, not including the current dividend of 54 cents a quarter for a 1.1% yield. Given less than 3% upside potential, it seems that shares of Republic Services are likely overvlalued, based on analysts’ targets.

Seeking Alpha

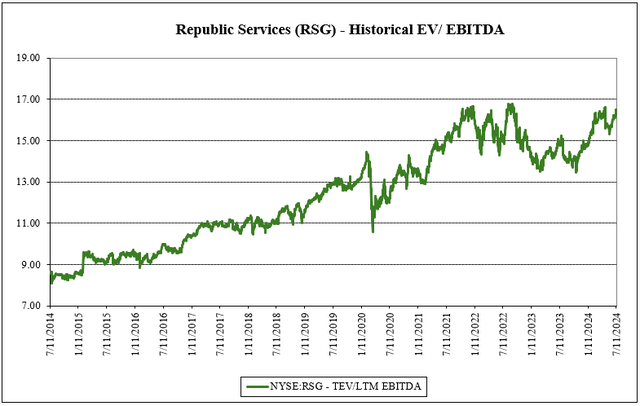

When looking at the valuation of Republic Services, the company’s historical EV/EBITDA chart makes you think you were looking at the company’s stock chart, not the valuation. With the stock trading at practically the highest valuation it’s ever traded at, is there any value here?

Author, based on data from S&P Capital IQ Author, based on data from S&P Capital IQ

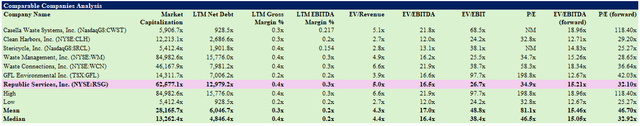

In my view, I think there’s a number of reasons why Republic deserves its valuation. At 15.2x EV/EBITDA, the company is still trading at a discount to other solid waste peers, who collectively have an average multiple of 15.6x EV/EBITDA (source: S&P Capital IQ). In my view, while Republic may have a slightly worse balance sheet compared to a Waste Management or Waste Connections, the company has more margin expansion potential.

As for the risks to the investment thesis, the key ones would be that inflation moderates and the company’s CPI-indexed cash flows aren’t able to grow at the rate they once did. Another risk is that as the company gets larger, they will need to make more acquisitions than they did before to meaningfully move the needle (law of large numbers). While the first risk is definitely a headwind, there’s still a huge untapped opportunity with nearly 60% of the industry being small operators outside of the majors, providing a long runway for M&A.

Overall, I’m taking a long-term view with Republic Services. In my view, this is the type of company you add once and tuck away for several years and let compounding do the work. Republic has always traded at a discount to its peers but with potential for margin improvement, technological investments, and a differentiated strategy in recycling, I like the company’s long-term prospects. As such, I see value in the company’s shares, even with the stock at 52-week highs, so I’d be a buyer on any weakness in the share price.

Read the full article here