Overview

Eagle Point Credit (NYSE:ECC) is a closed end fund that invests in equity and junior debt tranches of Collateralized Loan Obligations. CLOs may present an elevated level of risk but shareholders are rewarded for taking on this higher level of risk through a higher distribution rate. I discussed the specific risks of CLOs in my previous article titled: ‘Earn A High Yield From CLOs‘ that I recommend reading through for more context around the structure this fund follows. The fund’s objective is to generate high levels of current income and this makes it an attractive fund for investors that are looking to build a sizable income stream from their portfolio.

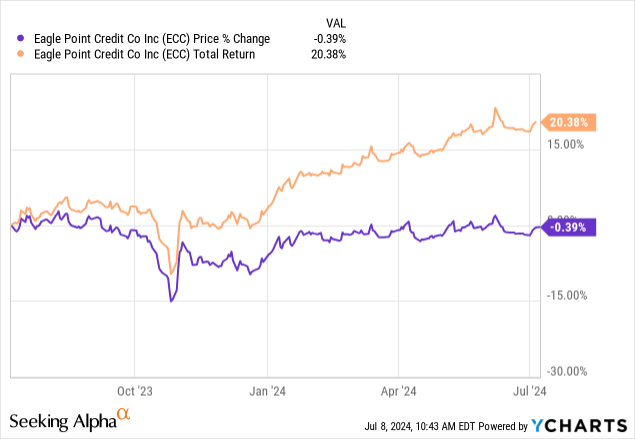

We can see that the price has remained relatively flat over the last twelve months. However, the high distribution yield of 16.5% has helped deliver a total return greater than 20% over the same time frame. The fact that the distribution is paid out on a monthly basis also adds to this appeal. I will be taking a look at the most recent earnings data to assess how stable and safe the current distribution rate is at the moment.

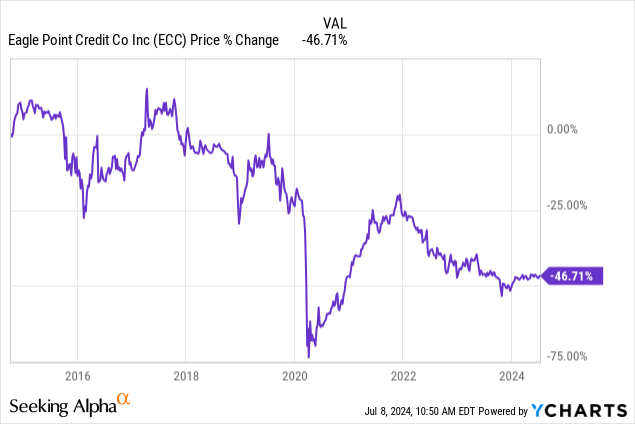

When it comes to valuation, it can be a bit challenging to know when the right time for entry is. After all, some investors may get a bit nervous when looking at the price chart alone and seeing ECC down almost 50% since inception. I wouldn’t blame some of the less risk-averse investors for staying away out of fear, but I wanted to also discuss my current thoughts on valuation and what makes this a great time for entry. There are several different macroeconomic factors here at play that have the potential to serve as a price catalyst over the next twelve months as well.

I wanted to first provide a brief overview of what ECC’s portfolio includes as well as the strategies implemented. I believe that their current portfolio would see a lot of relief and potential growth from future interest rate cuts that are on the horizon. Just for some added context, ECC has an inception dating back to 2014 and is externally managed by Eagle Point Credit Management.

Portfolio Catalyst & Risks – Interest Rate Cuts

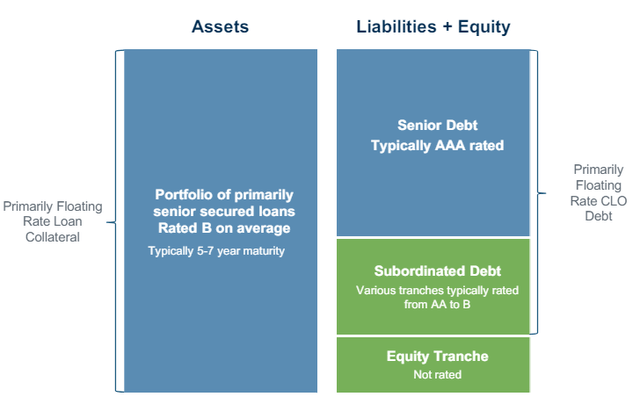

Collateralized loan obligations are a credit product that consists of a structured pool of loans that have been bundled together. Think of this structure as a totem pole, as illustrated below. The top of the totem pole is considered the least risky due to its higher level of repayment priority. Conversely, the bottom of the totem pole is the most risky since this tranche is typically paid out last. ECC operates in the riskiest tranche, which is the equity level.

Although the riskiest level, CLO equity is ultimately an attractive asset class when observed over a long period of time. For instance, the Credit Suisse Leveraged Loan index has recorded positive total returns each calendar year dating back to 1992, except for the crisis in 2008. This is a level of risk that investors must be comfortable with before considering an investment into ECC.

ECC Presentation

Another important aspect of CLOs is that these pools of debt are typically related to companies that are below investment grade rated. Referring to the same illustration above, we can see that ECC’s portfolio focuses on primary exposure to floating rate CLO debt as well. There are 1,793 underlying loan obligors as part of their portfolio, as well as 152 different equity securities within. Their current exposure to floating rate senior secured loans sits at 97.4%. A floating rate based portfolio can efficiently capitalize on this higher interest rate environment that we are in by collecting higher interest from borrowers. While this concept is great for income generation, there also lies a vulnerability for the obligors and securities held within.

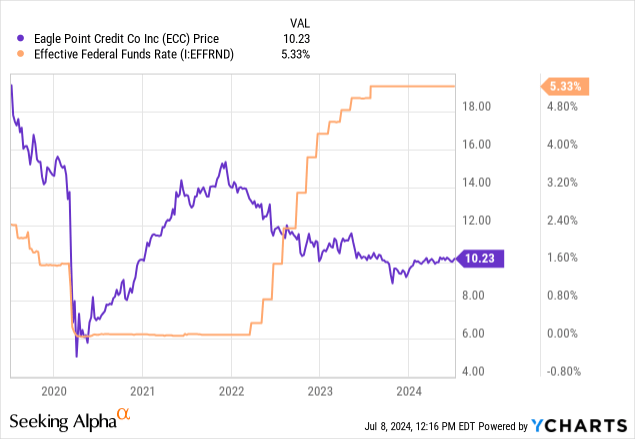

Higher interest rates can simultaneously put more strain on borrowing companies as the required cost of debt maintenance increases. The federal funds rate has sat at a decade high for almost a year now and as a result, we can see a higher amount of defaults within the CLO structure. Since the equity tranche makes up a large portion of ECC’s portfolio, this could lead to a falling share price or net asset value over time since the equity tranche is the first to absorb the losses.

It’s no coincidence that the price of ECC has recently shared an inverse relationship with the federal funds rate. We can see that when rates were cut to near zero levels in 2020, the market saw an increased volume of borrowers since acquiring debt capital was cheap. Conversely, when rates rapidly rose starting in 2022, ECC’s price started to decrease.

This same concept can be applied when looking forward as well. I believe that there are several indicators that could signal that the start of interest rate cuts may be on the horizon. The Fed has consistently kept interest rates unchanged over the last several meetings and explained that they are awaiting more economic data to roll in around inflation, the labor market, and consumer spending. The current inflation level has slowly ticked down over the last two months and we shall see if this trend continues when the latest report is released on July 11th. In addition, the latest unemployment rate now sits at 4.1% and has steadily increased for about a year straight now. Lastly, the US Presidential election is happening at the end of 2024 and this can create elevated levels of uncertainty in the market. The combination of these things can be ideal conditions to incentivize the Fed to begin cutting rates as a way to stimulate the economy.

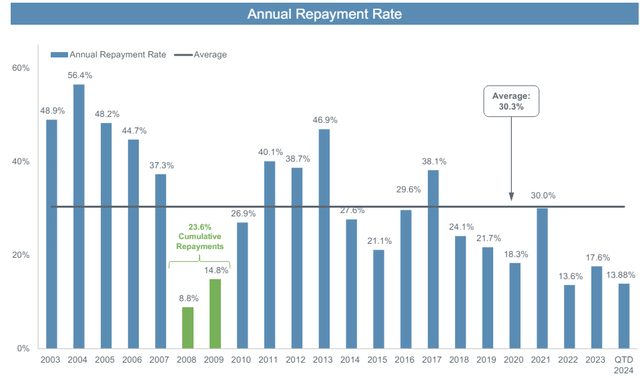

Interest rate cuts could serve as a catalyst for price and NAV growth. As the environment for borrowing becomes more attractive, we could possibly see high volumes of borrowers. This would potentially unlock a lot more deals for ECC that management can use to continue growing their overall portfolio. Similar to the price movement mentioned before, we could also see ECC’s price start to appreciate as they take advantage of this increased borrower volume. This idea is also conceptualized when looking at the annual repayment rates. Notice how the annual repayment rates rose significantly in 2021 as rates were at near zero levels but also started to decrease over 2022 as rates began increasing.

ECC Presentation

This shows that interest rate cuts can also provide a sufficient level of relief for existing borrowers within ECC’s portfolio. As interest rates get cut, the required amount of cash allocated towards debt maintenance would decrease, assuming the borrower was on a floating rate basis. This means that ECC’s portfolio quality could end up yielding better results and faster repayments in a lower rate environment. Faster repayments means that ECC would gain access to more capital to then put towards new investments that could fuel growth going forward.

Financials

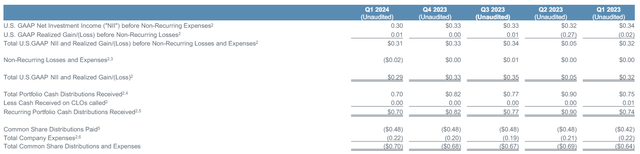

Referencing the most recent Q1 earnings report, recurring cash amounted to $0.70 per share while total NII and realized gains amounted to $0.29 per share. These were decreases over Q4 totals of both recurring cash and NII and realized gains, totaling $0.82 and $0.33 per share respectively. However, the decrease was attributed to the fact that there were higher loan prepayments in Q4 of the prior year. This means that there were fewer active loans in their portfolio that were contributing to the net investment income through interest payments.

ECC Presentation

However, this was offset by approximately $131M that was deployed into new capital investments that can contribute to overall portfolio growth. I believe that ECC will continue to prioritize new investments as they continue to sell off positions that were purchased at attractive levels over the last two years. Additionally, despite there being a drop in NII realized gains and recurring cash, ECC saw an increase in total gross income from a combination of its exposure to CLO equity and CLO debt.

CLO equity brought in investment income totaling $30.84M for the quarter and income from CLO debt brought in $4.89M. Including all other avenues, Total gross income landed at $40.80M, which was a large increase over the $31.92M for Q1 of 2023. I anticipate these numbers to increase as interest rates are cut. Interest rate cuts may introduce a bunch of new opportunities and deals that will hit the market as borrowing conditions ultimately become more attractive and affordable.

As the volume of opportunities increases, this would increase the likelihood that the current distribution rate can be sustained. The net investment income, realized gains, and recurring cash levels could certainly be negatively impacted from lower rates, as ECC would ultimately bring in less income through its exposure to floating rate loans. At the moment though, the distribution is well maintained and long term shareholders continue to be rewarded through supplementals.

Dividend

As of the latest declared monthly dividend of $0.14 per share, the current dividend yield sits at 16.5%. Cash flow has been so strong that ECC has also announced monthly supplementals through September of this year, totaling $0.02 per share for each month between now and then. If we break the base distribution out to a quarterly view, we get a quarterly base distribution total of $0.42 per share. Adding in the supplemental distributions takes the total quarterly payout to $0.48 per share. Recurring cash flows of $0.70 per share for the quarter covers this distribution, which means that the distribution is covered by about 145%.

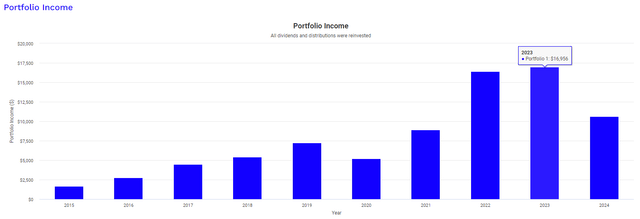

The annual payout amounts for ECC can vary based on performance but that doesn’t mean that this isn’t a great choice for income compounding. This is assisted by ECC’s dividend reinvestment policy that helps reinvest distributions at a slight discount to NAV. The latest annual report explains how the company allows distributions to be reinvested at a discount up to five percent of the market price, if the market price exceeds the NAV per share. I cannot confirm if all brokerages allow for this but I do know for sure that Fidelity is capable of reinvesting distributions at the stated discount.

To help visualize the income growth here, I ran a back test with Portfolio Visualizer. This graph assumes an original investment of $10,000 at the start of 2015 and also assumes a fixed monthly contribution of $500 per month. This calculation also includes all dividends being reinvested at market price throughout the entire holding period. In 2015 your dividend income would have totaled $1,645. This total would have grown to $16.956 in 2023 and we can really see the large spike in income once rates started to get hiked in 2022. We can also see the opposite happen in 2020, as rates were cut to near zero levels and ECC’s distribution took a slight dip.

Portfolio Visualizer

Something worth mentioning here is that the majority of the distribution received here is classified as ordinary dividends. Ordinary dividends have less favorable tax consequences compared to the qualified dividends you’d receive from traditional dividend growth stocks. Therefore, ECC may be best utilized in a tax advantaged account based on your personal situation.

Valuation

In terms of valuation, ECC does currently trade at a premium to NAV of about 12.7%. This means that the previously mentioned dividend reinvestment discount applies at the moment. For reference, this is a bit of a higher premium than the 10.7% the price traded at when I last covered ECC. However, we can see that the price traded at a much larger 30% premium to NAV earlier in the year around the start of May. Additionally, this current premium sits above the average three year premium to NAV of about 9.3% which means that ECC is relatively expensive here.

CEF Data

However, I maintain my buy rating because I do believe interest rate cuts will ultimately boost valuations within their portfolio and increase the amount of deals that ECC can pursue to grow their portfolio. As stated from their latest earnings call, the higher rates have caused some additional loans to default. As a result, lower interest rates can provide their portfolio a bit of relief and ultimately increase the quality of investments within, as it gives borrowers a bit more breathing room.

During the first quarter, we saw only six leverage loan defaults. As of quarter end, the trailing 12 month default rate declined to 1.14%, which is well below the historic average of 2.7%. While the default rate may increase from these levels as the year progresses, we also continue to believe research desks are significantly overestimating the near-term default risk as many of the underlying loan borrowers in our CLOs have continued to see revenue and EBITDA growth, which helps to offset the impact of higher rates. – Tom Majewski, CEO

Therefore, I plan to continue reinvesting my distributions and may possibly add on any price drop opportunities. The premium could increase as the portfolio continues to grow. Even if the premium doesn’t increase, I plan to add on any drops in premium to NAV to continue growing my distribution income.

Takeaway

In conclusion, I maintain my buy rating on ECC as management continues to invest in the growth of their portfolio. As prepayments start to increase, this could indicate the high quality underwriting abilities of the management. Even though the price currently trades at a premium to NAV, I still see value here as ECC can be a strong compounder of income. The dividend reinvestment discount benefit is a huge plus for long term holders since the price currently trades at a premium. Future interest rate cuts may serve as a catalyst for growth as they increase the volume of borrowers looking for debt capital. At the same time, interest rate cuts could also provide relief for their portfolio of investments and increase the overall quality. Despite CLOs maintaining a higher level of risk, the performance over long periods of time still remains an attractive asset class.

Read the full article here