In October 2023, I covered JetBlue (NASDAQ:JBLU) for the last time with a Hold rating. While we tend to see airlines either perform extremely poorly compared to the market performance or, in exceptional cases, strongly outperform, we saw JetBlue stock up 32.2% compared to a 30.9% gain for the S&P 500. So, that hold rating was more than correct. In this report, I will be discussing whether the investment case became less or more attractive. I will include a discussion of the most recent results, a discussion of airline costs and the expectations for second quarter earnings, and provide a stock price analysis.

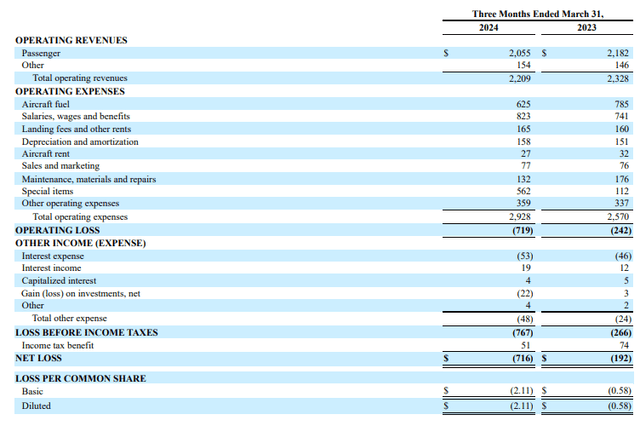

JetBlue Earnings Fall But Are Better Than Expected

JetBlue

First quarter revenues decreased 5.1% to $2.2 billion on a 2.7% reduction in capacity. Revenues were lower but came in at the low end of the 4.5 to 7.5 percent decline that the company had guided for and that was driven by capacity decline also being lower than the 3 to 4 percent guided. For JetBlue, with its alliance with American Airlines (AAL) dissolved and the Spirit Airlines (SAVE) take over off the table, it is all about managing the airline the best it can and regrowing the network where it has been weakened over the past year. The company sees $300 million in revenue initiatives to materialize this year and more revenue growth into 2025. $40 million of this has already materialized in the first quarter. While revenues are down, the Latin market remained strong. When Spirit Airlines was still an acquisition candidate, I also pointed out that the strength in the Latin America was what JetBlue was trying to protect, and we can see now why. The Latin American market was one of the highlights in the first quarter.

Total costs increased 14% and that was driven by $532 million in Spirit related costs related to the merger termination. Excluding special items, cost would have declined 3.8% but up 4% when excluding fuel costs. The $68 million increase in costs can primarily be attributed to higher salaries, as those grew $82 million due to a 14% increase in pay rates.

Driven by Spirit related costs and higher salaries, the operating loss expanded from $242 million to $719 million. Looking at revenue and cost on unit basis, we observed that the average fare remained stable at $214.39 with a 2.5% decline in revenue per available seat-mile, while unit costs excluding fuel and special items grew 7.1%.

So, there is pricing pressure as well as unfavorable costs absorption. However, JetBlue beat its own expectations on capacity and revenue while unit costs grew less than expected, driven by shifting of expenses and completing more flights than expected.

What Are Analysts Expecting For JetBlue Earnings in Q2?

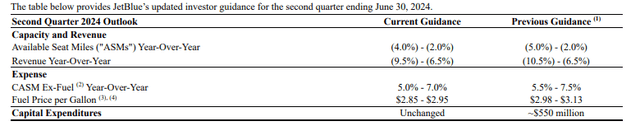

JetBlue

In May, JetBlue updated its second quarter guidance increasing the lower end of its guidance on revenue and capacity by 100 bps while unit costs growth is expected to be 50 bps less than previously guided for with a tailwind on fuel costs of 13 cents to 18 cents per gallon. So, while there is pressure on revenue and costs continue to grow year-on-year, it will all be less bad than the company initially expected.

For the second quarter, analysts are expecting an 8.2% decline in revenues to $2.40 billion and a loss per share of $0.18. Interesting to note is that over the past 90 days, all analyst revisions for JetBlue on revenues and earnings per share have been directed downward.

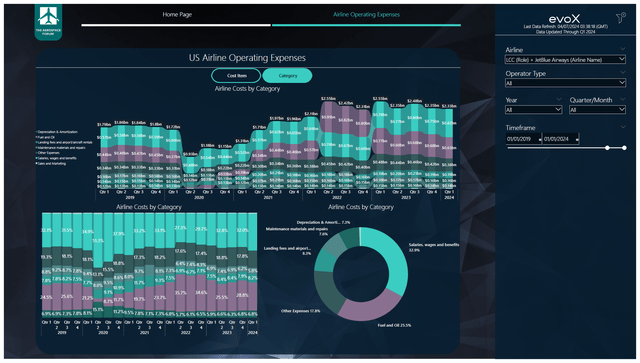

JetBlue Airline Costs: Labor Cost Inflation Is Prominent

The Aerospace Forum

I have recently developed an airline cost monitor that features airline costs for hundreds of airlines going back to the year 1990. When looking at the costs for JetBlue for the past five years, we see that salaries accounted for nearly a third of the costs over the past years, but from Q1 2019 to Q1 2024 the share of salaries in the costs has grown from 32.1% to 35.2% and by 44% in absolute terms. For JetBlue, salaries tend to be the biggest cost item, but we also see that the share in the total costs is growing and in absolute terms there also is significant growth. So, we see cost inflation that is actually rather hard to get a grip on. With softening unit revenues, that does put some question marks behind the profitability for JetBlue.

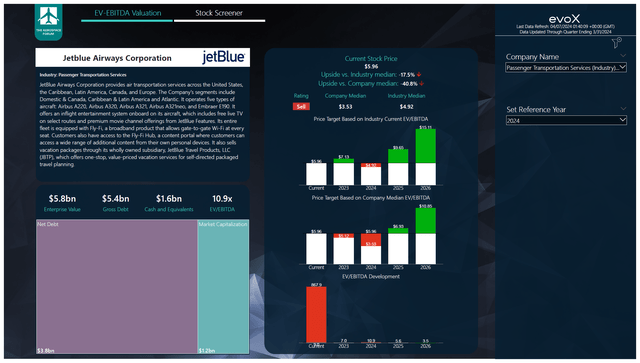

JetBlue Stock Price Analysis: No Compelling Investment Angle

The Aerospace Forum

After inserting the forward projections, which have been revised downward significantly since my last report in October, and implementing the current balance sheet data, I fail to find a compelling investment case for JetBlue. Even if we don’t consider the sky-high EV/EBITDA that is caused by the special items related to the Spirit merger agreement termination, I believe that JetBlue is not in the position to generate cash in the coming years. In my projections, I have implemented sale-and-lease back agreements for $4 billion worth of flight equipment for the years 2024 through 2026 instead of raising additional debt to maintain strong liquidity levels. Ultimately, we don’t see a very compelling angle. With respect to 2024 earnings, the stock is already overvalued, and I find the weakening market and the continued cost inflation to be too big of a risk to really pull 2025 earnings into the stock price target. As a result, I am marking the stock a sell as there is no upside for 2024 and in a tough fare and cost environment, I don’t see how JetBlue is going to generate sufficient cash flying passengers to their destinations.

Conclusion: JetBlue Experiences Significant Pressure

In the first quarter, we saw JetBlue recognizing the aftermath of the failed merger with Spirit. In the end, we see that the company, as could somewhat be expected, paid hundreds of millions of dollars to protect its lucrative Latin American market. However, overall, we see that the unit revenues are weakening despite strong close in bookings in Q1 and cost inflation continues to be prominent. To me, it doesn’t seem like JetBlue is actually able to generate cash from its business. The cash generation will come from selling aircraft and leasing them back. That is not a compelling business case, and as a result, the consensus among analysts is that JetBlue stock is a hold, and I could somewhat agree. However, considering all risks involved, I would mark the stock a sell as I believe that, even if the stock itself is a Hold, relative to JetBlue there could be more compelling investment opportunities. So, I would just sell my JetBlue stock if I owned any and either put it in an airline that has a clearer value creation path ahead or invest it in a different industry completely. Important to note, is that this is not a short idea but a name with a sell rating for the simple reason I believe there are more compelling investment opportunities elsewhere.

Read the full article here