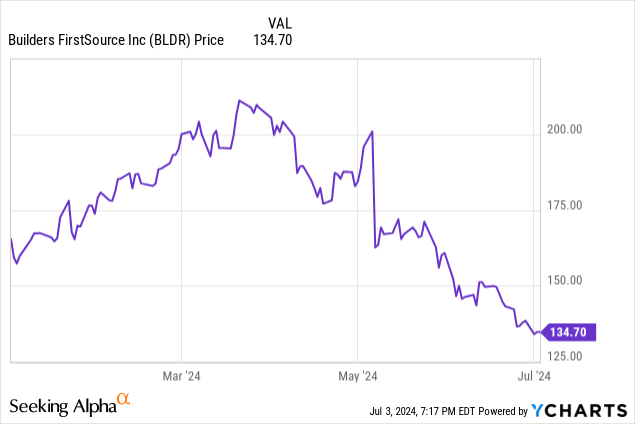

Builders FirstSource (NYSE:BLDR) has been absolutely clobbered this year. The first quarter earnings were disappointing, to say the least. The company is testing new lows for the year regularly, and as you can see, they are far down from the 52-week highs.

Today, we’ll be taking a look at the company, not as it was a couple of months ago when they were rightly beaten down on the most recent earnings, but as they look right now, a much cheaper company and still a profitable one.

We’ll try to figure out if the company as it exists is starting to dip into a modest value range, and if it is worth considering for investors looking for exposure in building material suppliers.

Looking at Builders FirstSource’s Balance Sheet

| Cash and Equivalents | $697 million |

| Total Current Assets | $3.94 billion |

| Total Assets | $11.17 billion |

| Total Current Liabilities | $1.78 billion |

| Long-Term Debt | $3.7 billion |

| Total Liabilities | $6.21 billion |

| Shareholder Equity | $4.95 billion |

(source: most recent 10-Q from SEC)

For a profitable company, Builders FirstSource has a fair bit of cash on hand, and while they’ve got a lot of long-term debt, they have more assets than liabilities. That’s good news, at least a bit.

With the shareholder equity what it is, the price/book value of the stock is hovering around 3.30. Not exactly a bargain, but still a far better prospect than what it was at the start of the year.

Understanding Builders FirstSource

Builders FirstSource manufactures and supplies building materials and offers construction services. The company features 570 locations in 43 states, and sport operations in 48 of the top 50 metropolitan statistical areas.

One of the market leaders in building products, they reported in 2023 that the top 10 customers accounted for 14.7% of their overall business, doing business with companies like D.R. Horton (DHI), Lennar (LEN) and Toll Brothers (TOL).

That’s not to say that the major builders they do business with are the only ones of import. Builders FirstSource offers services and supplies right down the line, from local and regional homebuilders right down to the contractors.

Builders FirstSource divides its business into four categories on offer: lumber and lumber sheet goods, manufactured products, windows, doors and millwork, and specialty building product and services.

The goal, one that isn’t being realized yet, is to try to grow its higher margin value-added products like trusses. Anything to improve margins would be a good thing, as would anything that substantially grows revenue.

The Risks

While Builders FirstSource is profitable, and brings in a fair bit of revenue, there are still a lot of potential roadblocks that one needs to be aware of in this risky business of theirs.

The economy is a big one. Builders FirstSource is highly dependent on new home and multifamily construction, and that construction depends heavily on the US economy and credit markets.

Even then, Builders FirstSource is in a very competitive business, and the building product industry tends to be very cyclical in nature. They work hard to stay competitive, and well they better, as the alternative is to start losing business to a meaningful alternative.

The most interesting concern, I think, is a warning that a shift toward smaller houses could force the company to scramble to try to meet the demands for what the market wants. That isn’t just a concern that a change in economic conditions could force homebuilders to downsize what they are producing, rather it could be that the market is no longer demanding homes in the size that Builders FirstSource’s business is designed to provide equipment and services for.

Looking at the Earnings

| 2021 | 2022 | 2023 | Q1 2024 | |

| Net Sales | $19.9 billion | $22.7 billion | $17.1 billion | $3.9 billion |

| Gross Margin | $5.8 billion | $7.7 billion | $6.0 billion | $1.3 billion |

| Net Income | $1.7 billion | $2.7 billion | $1.5 billion | $259 million |

| diluted EPS | $8.48 | $16.82 | $11.94 | $2.10 |

(source: 10-K from SEC)

As you can see, the company isn’t exactly growing by leaps and bounds, but rather sees its net sales relatively stable, and that’s in a good year. Fiscal Year 2023 was rough, though at the very least, Builders FirstSource’s earnings per share stayed relatively strong.

Earnings estimates for the next couple of years show things not changing too much. Fiscal year 2024 has Builders FirstSource earning $12.71 per share, with $17.7 billion in revenue. Fiscal year 2025 grows slightly on both counts, offering $13.96 earnings per share and $18.6 billion in revenue.

Fiscal year 2023’s earnings give us a P/E ratio of 11.22, and if the estimates for 2024 stand the test of time, that would bring in a P/E ratio of 10.54. That puts us in the ballpark of a value stock, though it isn’t exactly cheap, especially trading at a premium to book value like it does.

One thing that could make things more enticing is if the company paid dividends. Sad to say they don’t, and with the long-term debt being what it is, it is likely that the company will need to be responsible in paying that down quite a bit before returning anything to shareholders becomes a distinct possibility.

Conclusion

While Builders FirstSource isn’t the screaming sell it was a few months ago, I think it is still a bit too pricey to recommend jumping in. I’m not sure how much more downside the company has in it, but if it starts to approach the $110 range, so long as nothing else about the business changes, it may start to look appealing as a way to add exposure to the building product industry.

Right now, I’m going to put the company at a “be sensible” hold. If you got cold feet and bailing out months ago, you’re probably thanking your lucky stars. If you believe in the company and decide to wait it out, it’s not a terrible idea at these levels, so long as you’re comfortable with the remaining risk that is inherent to the business.

Read the full article here