When it comes to investment in the international stock market, one of the first options that comes to mind is the developed markets outside the U.S. The WisdomTree International Hedged Quality Dividend Growth Fund (NYSEARCA:IHDG) offers an investment vehicle to gain exposure to these markets while hedging the portfolio against fluctuations in exchange rates, mirroring the stocks’ returns in local currencies.

This hedge has been an important component of IHDG’s outperformance relative to other ETFs covering developed markets ex. U.S. that do not apply this strategy. This outperformance is not only related to total returns but also lower volatility, as fund price changes can be exacerbated by moves in foreign currencies versus the U.S. dollar, particularly in more risk-averse circumstances.

That said, despite modest growth and structural challenges in developed markets, lower valuation compared to those in the U.S. offers a good opportunity for diversification particularly through IHDG or other ETFs in the peer group.

ETF Description & Highlights

IHDG is an exchange-traded fund that offers investors access to developed markets worldwide, except the U.S. and Canada, with a focus on companies that pay dividends and have a growth profile. This ETF also hedges the portfolio against the fluctuation between the U.S. dollar and foreign currencies.

IHDG follows the WisdomTree International Quality Dividend Growth Index, which applies a number of screens to constitute the index. Eligible stocks must have a market capitalization of at least $1 billion and an earnings yield greater than the dividend yield in order to filter out companies whose earnings cannot support their dividends.

The remaining stocks are weighted following a rule-based approach with three measures: 50% weight for medium-term earning growth forecast, 25% weight for historical ROE 3-year average, and 25% weight for historical ROA 3-year average.

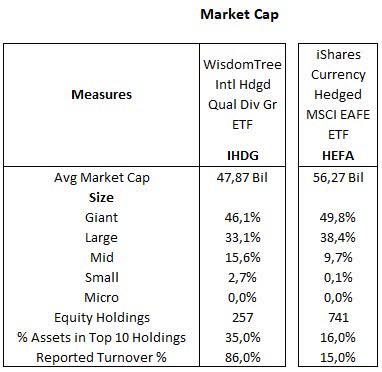

As a result, IHDG’s stock composition is concentrated on nearly 250 companies, with an average market cap of $47.8 billion and nearly 79% of total assets composed of mega and large caps. On a relative basis, IHDG’s portfolio is more concentrated than another ETF, the iShares Currency Hedged MSCI EAFE (HEFA), which also focuses on international developed markets, follows the stock composition of the MSCI EAFE Index, and is hedged against U.S. dollar fluctuation, but has a portfolio of 741 companies, almost three times of IHDG.

IHDG’s top ten holdings (Industria De Diseno Textil, ASML, Lvmh Louis Vuitton, AstraZeneca, Novartis, Novo Nordisk, Roche, DHL, UBS AG, and GSK) represent roughly 35% of total assets, with five companies from the healthcare sector.

Morningstar, consolidated by the author

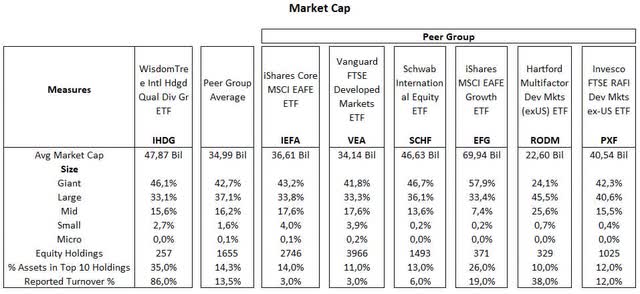

The table below compares IHDG with other developed markets ex-U.S. ETFs. The first two (IEFA and VEA) are quite diversified, exceeding 2.5 K holdings. Meanwhile, EFG, from iShares, has a growth profile, and RODM is a multifactor ETF. Completing the list, PXF is based on an RAFI index with a fundamentally driven approach.

Morningstar, consolidated by the author

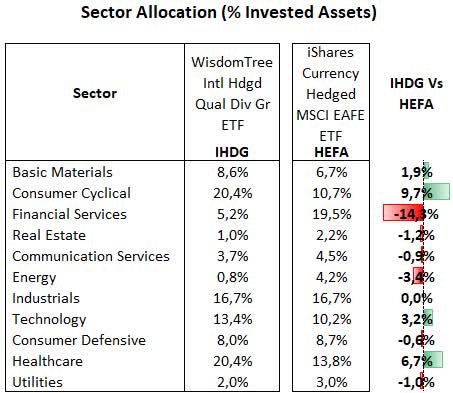

From a sector allocation perspective, IHDG’s largest allocations are to the consumer cyclical and healthcare sectors, with 20.4% of total equities each, followed by industrials with 16.7%, technology 13.4%, basic materials 8.6%, consumer defensive 8.0%, financials 5.2%, communication services 3.7%, utilities 2.0%, real estate 1.0%, and energy 0.8%. Relative to the HEFA, the iShares Currency Hedged MSCI EAFE ETF, also hedged and focused on international developed markets, IHDG is primarily overweight in consumer cyclical (+9.7%), healthcare (+6.7%), and technology (+3.2%), while underweight in financials (-14.3%), and energy (-3.4%).

Morningstar, consolidated by the author

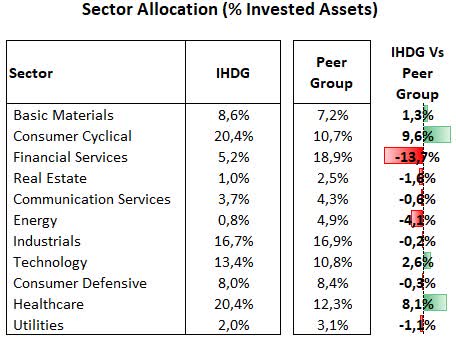

A comparison to the peer group of developed markets ex-U.S. ETFs shows a similar trend, with IHDG being overweight in consumer cyclical (+9.6%) and healthcare (+8.1%), while underweight in financials (-13.7%), and energy (-4.1%).

Morningstar, consolidated by the author

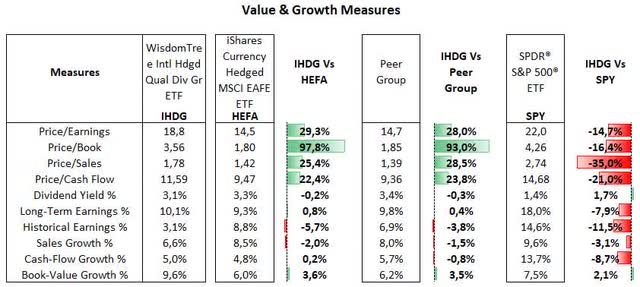

The overweight allocation to consumer cyclical and healthcare combined with an underweight stance in financials and energy is reflected in the IHDG’s valuation, as consumer cyclical and healthcare stocks typically trade at a premium compared to financial and energy counterparts. Thus, as expected, IHDG’s price/earnings of 18.8x is significantly higher than HEFA and the peer group’s valuations of nearly 14.5x.

The same goes for other valuation measures. As shown below, IHDG’s price/book and price/sales ratios are also higher than those of HEFA and the peer group. An explanation for that is HIDG’s parent index (WisdomTree International Quality Dividend Growth Index) methodology, which uses earnings growth forecast as one of the metrics to select and weigh stocks in the index, as stocks with higher earnings growth are expected to trade at a premium relative to the overall market.

Compared to the S&P 500 index, represented by the SPDR S&P 500 ETF (SPY), however, IHDG is undervalued by nearly 15%, as U.S. stocks typically trade at a premium, driven by the strength of the U.S. economy compared to the other developed markets that have shown weaker economic fundamentals over time, broadly speaking.

Morningstar, consolidated by the author

Outperformance Over Unhedged ETFs

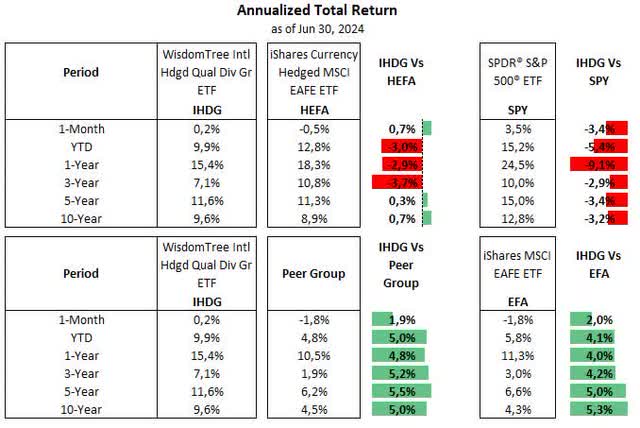

IHDG’s total return has been relatively in line with HEFA, over the long run. However, it has lagged in shorter time frames, heavily driven by its underperformance year to date. Meanwhile, despite positive absolute returns, both ETFs have not been able to keep pace with the S&P 500, as U.S. stock indexes have surged in recent years, boosted by large-cap companies.

On the other hand, IHDG has outperformed the peer group in all time frames and also the unhedged version of HEFA, the well-known iShares MSCI EAFE ETF (EFA), evidencing that hedging the portfolio has been an efficient strategy over the past ten years.

Morningstar, consolidated by the author

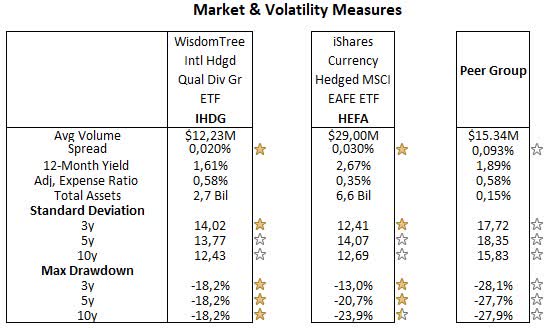

Hedging against currency fluctuations has shown another positive effect, the reduction in volatility. Below, we can see that IHDG and HEFA’s standard deviations and maximum drawdowns have been significantly lower than the peer group, which is composed of ETFs that have not implemented currency hedging in their strategies.

Morningstar, consolidated by the author

In summary, while hedging has been a core contribution to IHDG’s outperformance compared to its unhedged peers, its returns have been far below those of broader U.S. indexes, such as the S&P 500.

Despite that, international development markets should be seen as an option for diversification, where we have higher exposure to sectors like consumer cyclical, industrials and healthcare, and trading at lower valuations compared to the U.S. stock market. Meanwhile, investors must consider current challenges, such as demographics and political uncertainties in key countries in Europe, that can lead to subdued growth in the region and affect the local stock market.

Read the full article here