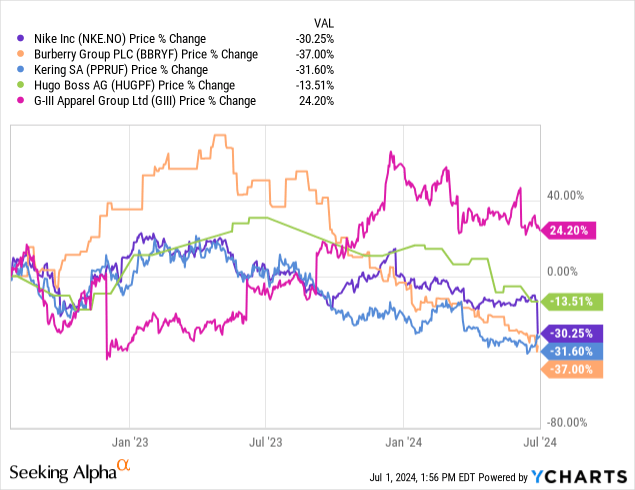

Fashion and apparel in general has been seeing some turbulence lately. To name a few, Burberry (OTCPK:BURBY) and Kering (OTCPK:PPRUF), in higher fashion, saw just as intense declines as Nike (NKE) which has lately reported issues itself, although different in nature – more to do with upstarts taking share. Hugo Boss (OTC:HUGPF)(OTCPK:BOSSY) has noticeably overperformed, although still declined particularly from peaks.

In the case of Boss and the higher end fashion stocks, the situation has been a double-effect of both declining expendable income as the economy resets and rates take their toll. Fashion stocks have also been affected by the fallout from the Chinese economy, where East Asian demand has been an important buoy for these stocks over the past cycle. Part of Hugo Boss’ relative outperformance has been the more limited APAC exposure compared to the likes of Kering, which allowed for growth. All declined on either weak/decelerating growth or guidance for weaker growth. With a pretty compressed multiple and latent earnings growth from some investments in their brick and mortar presence, we think the stock offers up a decent GARP proposition.

Earnings Comments

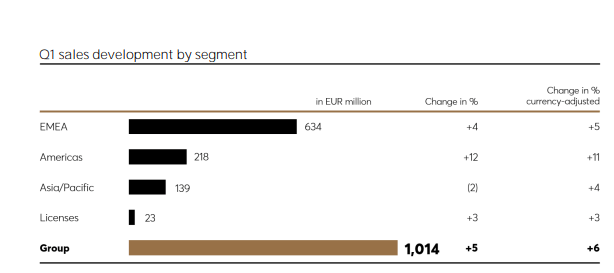

The first thing to call out are the geographies, since the Chinese exposure in this sector the market is important to track.

Geography (PR Q1)

Whereas Kering has around 35% of revenue from APAC ex-Japan, Boss has only around 14% of revenue from the ailing region, driven by the poor economic performance of China on the back of their real estate slump.

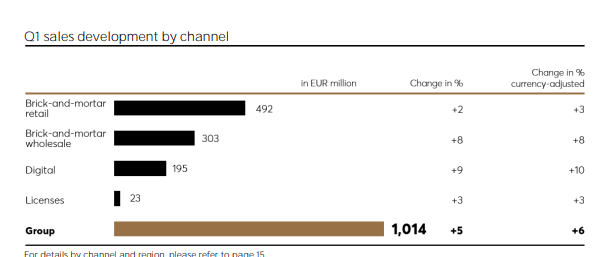

Segment (Q1 PR)

There was some investment going on into the brick and mortar retail locations. Higher payroll and rent, and all the other associated costs with expanding space, drove YoY increases in SG&A company-wide, even though components of SG&A, specifically marketing, is on the decline YoY. Admin expenses also came down as a consequence of incremental cost management. There is some latent growth to be expected here. Also, Q2 tends to be non-promotional, and the company is already baking in its current tenor of marketing expenses into guidance, which is seeing between 5-15% EBIT growth, with consequent growth in net income. Q2 topline will be tough to beat though, with Q2 2023 being a strong topline quarter – so comp effects will work against the coming quarter. But investments in retail should benefit from some operating leverage, as the bulk of improvements here have already been expended for. This is in spite of the more significant exposure to China in this segment. UK hasn’t been great either. The company fully expects volume to drive the brick and mortar retail revenues, along with space, with no further price increases planned.

Incremental improvements in logistics and sourcing are going to create incremental margin. Current Q1 run-rate gross margins are below the range of 62-64%, expected from a mix of operating leverage as investments come to fruition and calmed down freight costs YoY.

Further on marketing, the company is targeting a range of 7-8% of revenues to be spent on marketing. They are suggesting that with some major Times Square campaigns as well as another campaign with tennis start Taylor Fritz, their current 7.5% rate of marketing spend may actually be somewhat on the high side, and there is space for some dozens of bps in reduction of costs here.

Bottom Line

The news coming out of other fashion stocks has definitely been more negative. Boss is on the back of a 100 mono-branded store increase in the last 18 months, and is seeing some idiosyncratic benefit there. They have less China exposure. The higher European exposure also means less volatility, since Europe has, in general, been neither bad nor good from a macro point of view. They have also managed to win share in Europe. The US is driving growth, consistent with the superior consumer environment, and in general, they have a more confident guidance profile. It helps that they are not designer-tier in fashion either. Their fundamentals are more in line with a company like G-III (GIII), which also occupies a similar strata of the fashion market, although with its idiosyncrasies around manufacturing licenses with Hilfiger and Calvin Klein. Their performance has similarly been better than some of the higher fashion groups.

At around 10x forward PE, and with a decent growth year planned as their sales grow into their newly established space and start driving some operating leverage over indivisible expenses, it is actually quite a compelling prospect. The other stocks mentioned are significantly higher multiple, at least 14x. Our concern is just around the entire fashion sector. When looking at the impact to shareholders of Nike from upstarts like On Holding (ONON) taking sudden share over the course of only a couple of years, the risks in the sector become evident, and it becomes necessary to augur trends in the industry. Furthermore, the US driver could become derailed if the consumer there eventually becomes affected by the current rate regimes, though the US consumer is appearing rather unstoppable and the Fed unlikely to raise rates beyond this point to protect systemic elements of the financial system. It’s not uncompelling, but by no means a slam dunk on account of risks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here