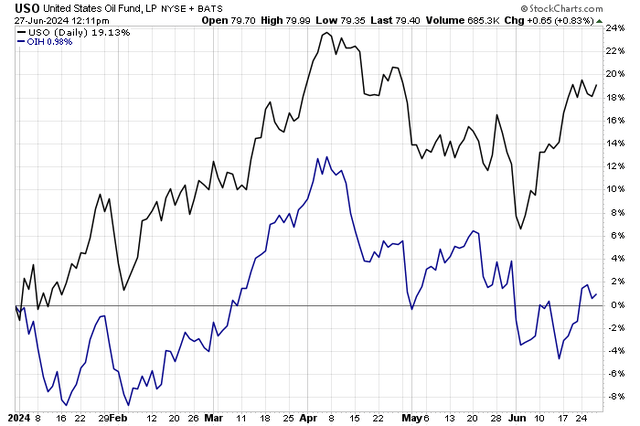

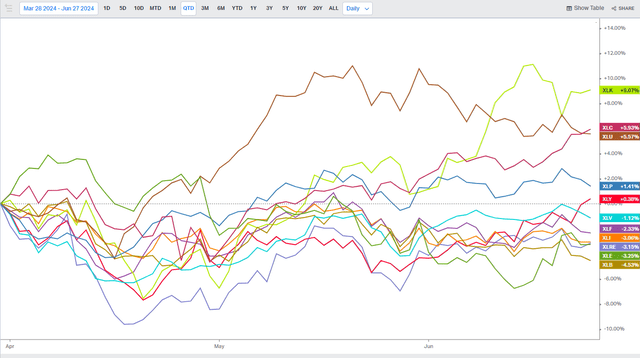

Oil prices have been marching higher as the summer driving season gets into full swing. While both WTI and Brent are in rally mode, Energy-sector stocks are lagging. For the second quarter, the Energy SPDR Select Sector ETF (XLE) is poised to print a negative return. So too are shares of oil and gas companies in the services niche of the energy space.

I reiterate a hold rating on the VanEck Oil Services ETF (NYSEARCA:OIH). I see the fund as reasonably valued, but its momentum continues to run soft ahead of a somewhat bearish seasonal stretch. Since I last reported on OIH, shares are about flat compared to an S&P 500 total return of more than 20%.

OIH ETF Underperforming the SPX & Crude Oil ETF

Stockcharts.com

Energy Sector Red in Q2

Koyfin Charts

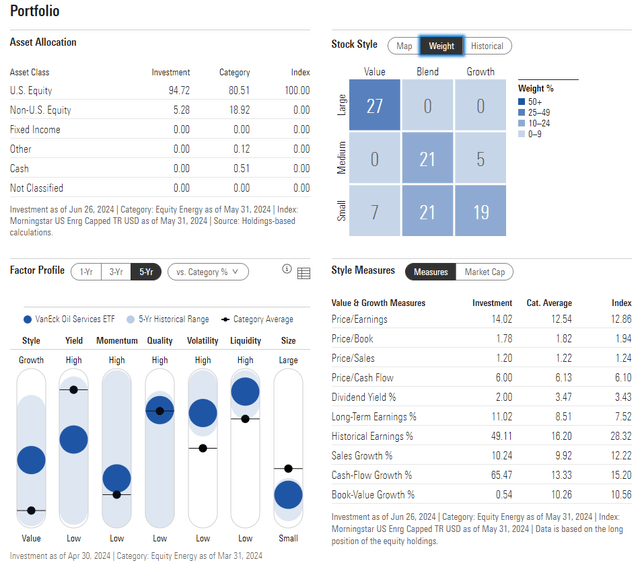

According to the issuer, OIH seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS US Listed Oil Services 25 Index, which follows the overall performance of US-listed companies involved in oil services to the upstream oil sector, which include oil equipment, oil services, or oil drilling. The index comprises the most liquid companies in the industry based on market capitalization and trading volume, and will generally own the largest oil drillers and oil services companies. The ETF may hold both US and foreign shares.

OIH has lost assets in the past seven months. Total assets under management is now just $1.8 billion compared with more than $2 billion last November. The fund features a reasonable annual expense ratio of just 0.30% while its trailing 12-month dividend yield is about on par with that of the SPX at 1.36% as of June 26, 2024.

Seeking Alpha rates OIH well when it comes to its share-price momentum trends, but I will highlight a differentiated stance later in the article. The ETF is also considered risky given its high historical standard deviation trends and a portfolio that is concentrated in just a few major oil & gas services stocks. Still, liquidity metrics are healthy given the fund’s average daily volume which is north of 350,000 shares, and a median 30-day bid/ask spread of seven basis points.

Digging into the fund’s fundamentals, the 1-star, Neutral-rated ETF by Morningstar has mixed exposure across the style box. The plurality of OIH is considered large-cap value, but there’s ample SMID cap access, which is a risk should economic conditions deteriorate over the coming quarters. OIH has also turned a bit more expensive compared to the price-to-earnings ratio from Q4 2023. Its 14.0x earnings multiple is reasonable given a long-term EPS growth rate above 11%, resulting in a decent PEG of 1.27, below that of the S&P 500.

OIH: Portfolio & Factor Profiles

Morningstar

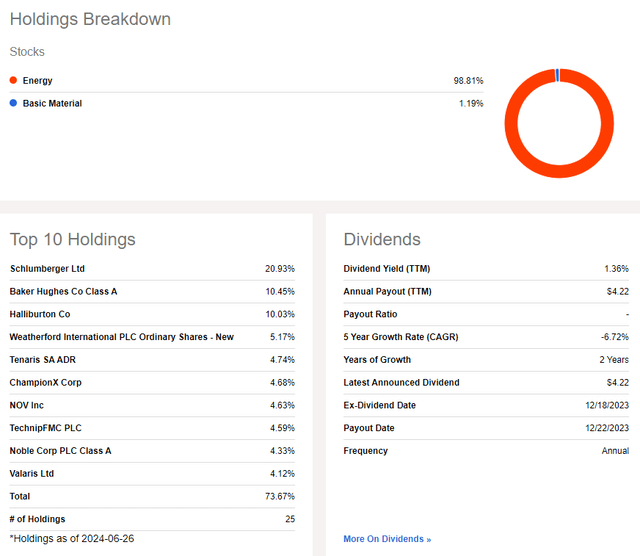

Prospective investors should be aware of OIH’s elevated exposure to three stocks: SLB (SLB) (formerly Schlumberger), Baker Hughes (BKR), and Halliburton (HAL). These names are highly sensitive to price changes in oil. Overall, the top 10 positions account for almost three-quarters of OIH.

OIH: A Concentrated Allocation

Seeking Alpha

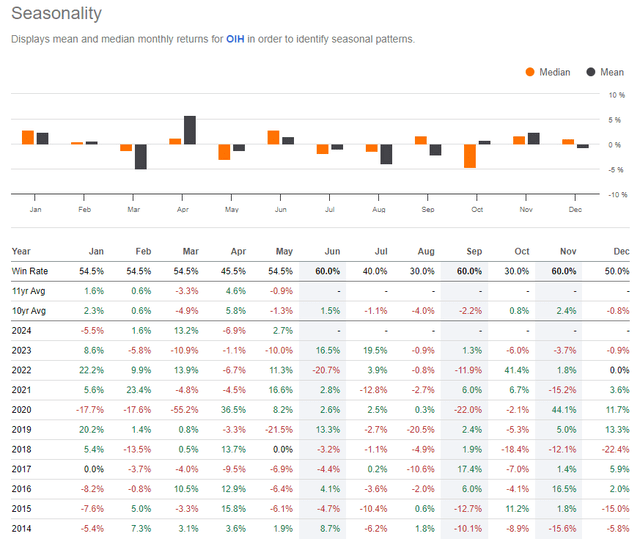

While an active hurricane season is likely in store, the July through October period has historically been a weak stretch for OIH. The start of the second half can feature volatility, so prospective investors should be particularly careful when spotting entry points. But let’s assess the chart situation to see where there could be a favorable buying zone.

OIH: Bearish July-September Seasonals

Seeking Alpha

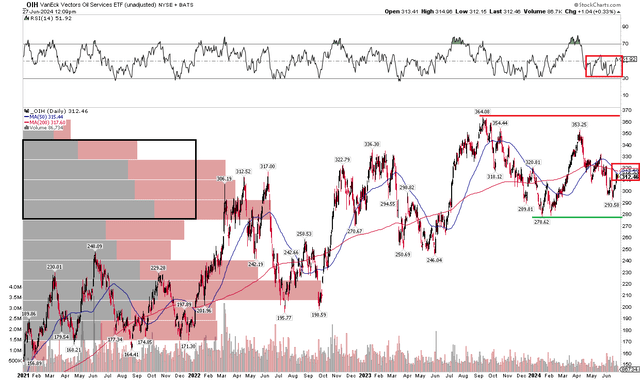

The Technical Take

Along with a steeper valuation today, OIH’s technical chart has turned less impressive. Notice in the graph below that a broad uptrend was in place from the second half of 2020 through much of the third quarter of last year. But the Energy ETF failed to notch a new high on a rally attempt during the first few months of 2024. I see an emerging trading range with resistance in the mid-$300s and support in the high $200s.

Also take a look at the long-term 200-day moving average – it’s now negatively sloped after many quarters of trending up. That tells me that the bears are grabbing hold of the primary trend. And with a high amount of volume by price in the $280 to $340 zone, that only serves as further evidence of a price consolidation. Moreover, the RSI momentum oscillator at the top of the graphs shows soft momentum trends throughout the second quarter.

Overall, OIH’s chart is less than impressive considering the broader market’s advance this year.

OIH: An Emerging Trading Range

Stockcharts.com

The Bottom Line

I reiterate a hold rating on OIH. The fund has actually turned a touch more expensive while technical momentum trends are not all that encouraging as we enter a dicey seasonal stretch.

Read the full article here