Introduction

MTY Food Group (TSX:MTY:CA) (OTCPK:MTYFF) owns a portfolio quick-service, fast-casual, and casual dining restaurants, operating under several banners. Since my initiation of coverage on the name in December 2023, I noted several challenges MTY is facing including margin erosion and the fact that the company was paying higher multiples for bigger acquisitions. With the 17.6% decline since my HOLD rating, I’ve warmed up to shares and now view the stock’s recent weakness as a buying opportunity. In this article, I’ll analyze the latest Q1 results, provide an update to my thesis, and explain why I would be a buyer of shares of MTY today.

Company Overview

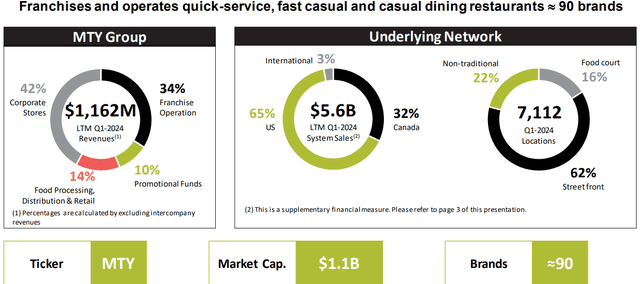

MTY Food Group owns a portfolio of franchise brands that include quick-service, fast-casual, and casual dining restaurants. Historically, the company has grown through acquisition acquiring small chains of franchises in a roll-up strategy. From its first restaurant in 1979, the company now has a portfolio of 90 brands under its umbrella. By geography, 65% of sales are generated from the United States, 32% from Canada, and 3% are derived internationally.

Investor Presentation

Throughout its history, MTY has been somewhat of a serial acquirer, acquiring several brands, including mmmuffins, Mr. Sub, Thaï Express, Tiki-Ming, Country Style, and Yogen Früz. The largest ones included its 2016 acquisition of Kahala brands (acquired 2800 stores in a $300 million deal to expand into the United States), Papa Murphy’s (2019 deal for $190 million), and Wetzel’s Pretzels (2022 acquisition for $207 million).

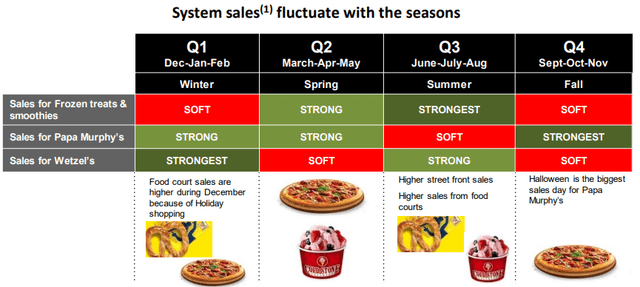

A key characteristic I like about MTY’s business is that many of the deals they’ve done to expand their categories has removed much of the seasonality of the company’s business. For example, when it isn’t hot enough for frozen treats in the winter season, sales for pizza and pretzels have their strongest periods. So while system sales of the individual categories fluctuate with the seasons, MTY as a whole has mitigated some of the seasonality of the business to do well regardless of the environment. Moreover, this also helps to ensure margins from quarter to quarter don’t fluctuate as much and that the company can maintain consistent profitability through the calendar year.

Investor Presentation

Background

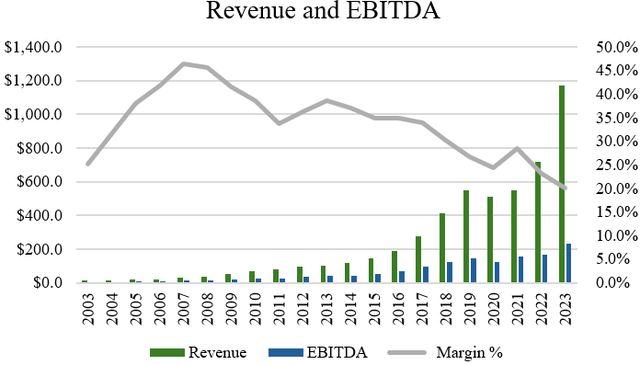

When looking at the company’s financials, MTY Food group has had a strong record of consistently growing revenues and EBITDA. For example, in the last twenty years, the company has compounded revenues and EBITDA at a 26.0% and 24.6% CAGR. Even within the last ten years, MTY has still managed to put up impressive CAGRs at 27.7% and 19.6% for revenues and EBITDA, respectively.

Author, based on data from S&P Capital IQ

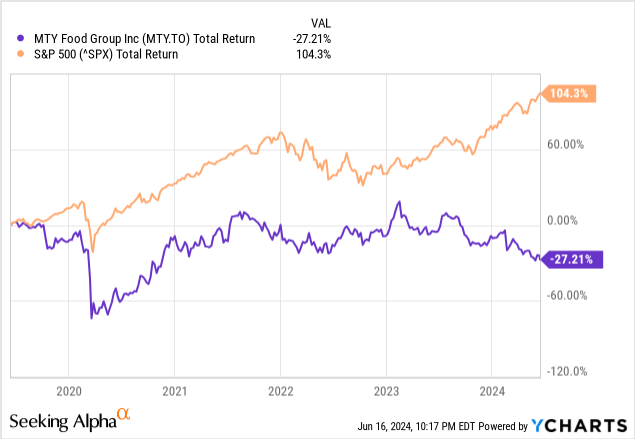

However, when observing recent share price performance, MTY Food group has underperformed by a wide margin. In the last five years, the company has delivered a total return of -27%, inclusive of the dividends paid over that time period. Compared to the S&P500’s total return of +104% over this time period, shares of MTY have underperformed significantly.

Recent Results

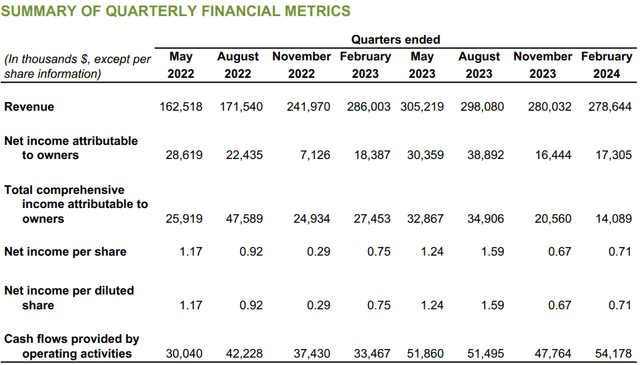

One of the big issues facing MTY today has been a weaker consumer. During the company’s most recent quarter, while management noted that weather played a role, Q1 results have shown a poorer demand environment given the challenges at play in the broader economy. With accelerated declines in same store sales growth across the board, wage inflation in key markets like California, and more fierce competition from MTY’s peers, earnings per share missed expectations by 1 cent coming in at $0.82. Revenue came in 3% lower than Q1 last year at $278.6 million in the first quarter, mostly attributable to reduced systems sales, meaning lower recurring revenue.

Quarterly Results (Company Filings)

With respect to the consumer, it seems that more and more households are concerned about persistent inflation, which has meant that consumer sentiment was down for a third straight month as the University of Michigan’s consumer sentiment index, dropped to 65.6 for the month of June from a final reading of 69.1 in May. The data seems to indicate that consumers seem to be taking a more cautious approach to spending and are curbing back discretionary purchases.

In my view, given that the latest consumer sentiment data are not included in Q2 results, my expectation is that things are likely to worsen for MTY somewhat in the next few quarters (or at least for Q2’24). So while some of the weakness was partially attributable to more severe weather in winter (particularly for the Cold Stone banner), it seems like a fair bet to say that the environment should stay tough a little while longer, at least for the first half of calendar 2024.

From a margin perspective, adjusted EBITDA came in at $59.2mm, for a margin of 21.3% compared to 22.0% last quarter. Part of the reason for the price decline is the combination of minimum wage pressures at a time when there is little appetite from consumers from price hikes in fast-food restaurants. While MTY has invested in new ERP implementation and has taken measures to cut costs, margins have still been under pressures. There’s also a cap of $50 million a year on the distributions to shareholders, that includes dividends and share buybacks. De-leveraging is a bigger focus for the company, where the company has been making good progress. At quarter end, MTY had a leverage ratio of 2.6x compared to 3.4x two years ago.

Valuation

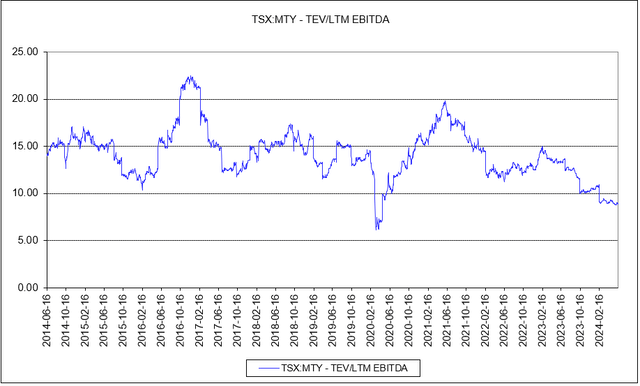

When looking at the valuation for MTY Food Group, the company trades for 8.8x EV/EBITDA. With the forward multiple also at 8.8x, analysts aren’t expecting any EBITDA growth in 2024. Compared to the last time I valued it at 10.2x EBITDA, the company’s valuation has become cheaper and is much cheaper than its historical ten-year average multiple of 14.1x EV/EBITDA. In fact, the only time MTY’s shares have been cheaper was during the COVID-19 crash in early 2020 (source: S&P Capital IQ).

Author, based on data from S&P Capital IQ

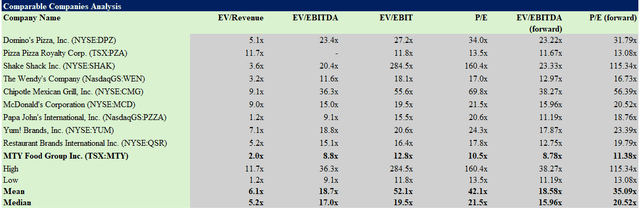

Compared to its peers, MTY is also trading at a discount when analyzing its relative valuation. Using forward EV/EBITDA and P/E multiples for Canadian franchisors like Pizza Pizza Royalty (PZA:CA) and Restaurant Brands (QSR:CA), as well as several single-banner franchisors, we can see that MTY is trading at roughly half the valuation of the average multiple of the peer group.

Author, based on data from S&P Capital IQ

While a discount is likely warranted as MTY’s portfolio of brands isn’t as well recognized and don’t have the cache that the other peers have to garner pricing power, the disconnect is too wide in my view. Thus, with better EBITDA margins and better balance sheet (comparably lower Net Debt/EBITDA ratio), I believe MTY’s valuation should be higher, closer to 12.0x EBITDA, about one standard deviation lower than the historical average multiple.

Conclusion

To summarize, while most of the challenges MTY faced in Q4 still persisted in Q1, the main reason I’m upgrading my rating from a HOLD to a BUY is because of the valuation. So even though I acknowledge that the company is facing some headwinds with margins and competitive pressures in a challenging economic environment, these issues are likely temporary and the share price weakness has created a buying opportunity for long-term investors. MTY’s track record speaks for itself. It’s built up a successful business of acquiring several fast-food and quick service restaurant brands and has best in class EBITDA margins while maintaining adequate leverage. With shares trading at severely depressed multiples compared to the peer group and compared to peers, the valuation is finally cheap enough in my view to warrant a position today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here