Note:

Tidewater Inc. (NYSE:TDW) has been covered by me previously, so investors should view this article as an update to my earlier publications on the company.

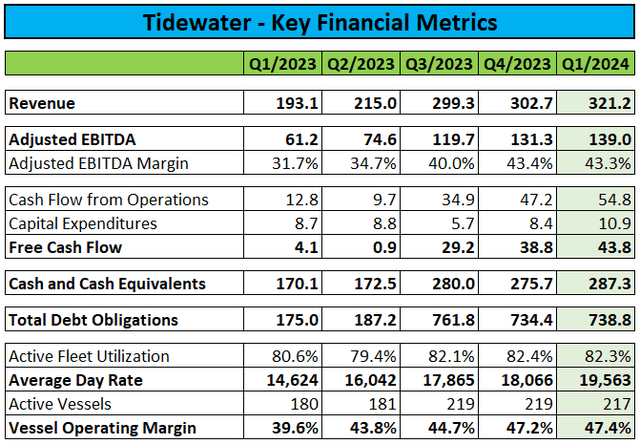

Last month, leading offshore support vessel and services provider Tidewater Inc. or “Tidewater” reported a strong Q1/2024 quarter with both revenues and profitability ahead of consensus estimates as utilization and dayrates exceeded internal expectations:

Company Press Releases / Regulatory Filings

In addition, free cash flow of $43.8 million reached a new recovery high.

During Q1, the company utilized an aggregate $32.0 in cash for share repurchases. Subsequent to quarter-end, Tidewater spent another $12.5 million on additional buybacks, as outlined in more detail by management on the conference call:

During the quarter, we repurchased $3.5 million of shares on the open market, and subsequent to the end of the first quarter, we repurchased an additional $12.5 million of shares on the open market. In addition to the open market repurchases, we used $28.5 million of cash to buy shares from employees so that they can then pay the associated tax benefit with the vesting of their equity compensation in lieu of those employees just issuing those shares into the open market. So year-to-date, we’ve used $44.5 million of cash to reduce the share count by about 492,000 shares.

We remain opportunistic on share repurchases and will continue to weigh the merits of share repurchases against other capital allocation opportunities, both relative to our view of the intrinsic value of the shares and against other capital allocation opportunities that may present themselves. We continue to pursue acquisitions, but thus far share repurchases have been the most value-added use of capital.

The company also increased its share repurchase program by $18.1 million, thus resulting in total available buyback capacity of $50.1 million.

Tidewater ended the quarter with $287.3 million in cash and cash equivalents and $738.8 million in debt.

On the conference call, management discussed potential near-term changes to the company’s capital structure which should result in increased shareholder capital returns going forward:

Our current debt capital structure is reaching a point at which we believe there is an opportunity for us to evaluate steps to establish a long-term debt capital structure more appropriate for a cyclical business and to allow for additional shareholder return capacity. Irrespective of the complexion and flexibility of our capital structure, the guiding principles of our capital allocation philosophy will remain consistent.

We will remain rigorous in evaluating the relevant merits of each opportunity we look at to pursue the most value accretive uses of our capital. In addition, we will remain mindful of our balance sheet maintaining a clear line of sight to a net cash position in about six quarters for any capital allocation decision we make.

For my part, I would expect Tidewater to refinance the majority of its credit facilities through the issuance of unsecured bonds with considerably less restrictive covenants.

Tidewater’s average dayrate of $19,563 was up by another 8.3% sequentially with leading edge dayrates exceeding $30,000:

During the first quarter, leading edge day rate momentum continued to improve nicely to $30,641 per day. We entered into 19 term contracts during the quarter with an average duration of about nine months. We anticipate that we will continue to see continued improvement in leading-edge day rates as we progress through the year, given the persistent tightness in vessel supply and increasing chartering activity as we approach the busier quarters of the year.

However, vessel operating margin (the company’s equivalent to gross margin) of $47.4% improved just slightly over Q4/2023 due to a number of issues:

- higher operating costs following the transfer of several vessels to Australia

- increased drydock and mobilization days

- higher crew training costs

Management also reiterated full-year guidance but warned of a weaker-than-expected second quarter performance (emphasis added by author) which should be made up for by a materially improved second half:

We remain confident that we can achieve average day rate to improve by approximately $4,000 per day on a year-over-year basis.

Looking through the remainder of 2024, we reiterate our full year guidance of $1.4 billion to $1.45 billion of revenue and a 52% gross margin.

As we progress through the year, we now anticipate revenue to increase slightly in the second quarter due to better than anticipated revenue performance in Q1 and to the pull forward of some drydocks, the mobilization of a few vessels, and some unplanned maintenance in the second quarter.

We still anticipate a meaningful step up in revenue in the third quarter and continued strength into the fourth quarter. Similarly, we anticipate relatively flat gross margins in Q2 due to the factors previously described, but expect about 7 percentage points of margin expansion in Q3 and maintain our expectation of Q4 gross margin exit rate of 56% in the fourth quarter, setting us up well for continued margin expansion as we enter what is expected to be an even stronger market in 2025.

At the time of the earnings release in early May, 74% of available days for 2024 had been contracted, thus resulting in $930 million in backlog for the remainder of the year.

On the call, management also addressed the current situation in the Middle East following Saudi Aramco’s recent decision to suspend contracts of 22 jackup rigs:

In the Middle East, with the recent news in Saudi Arabia, we may see some short-term demand slowdown specifically related to work in the Kingdom. However, we continue to see significant demand requirements from other countries in the region, as well as from the contractors supporting projects already ongoing in the kingdom that we expect will more than offset any near-term slowdown that we may experience from a rig count reduction in Saudi Arabia.

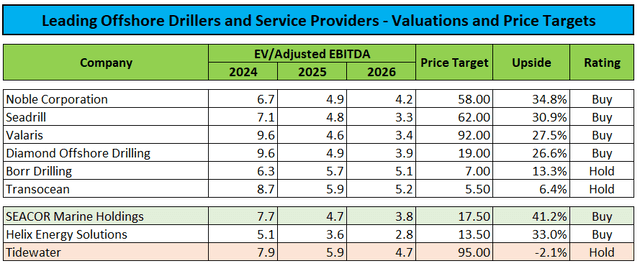

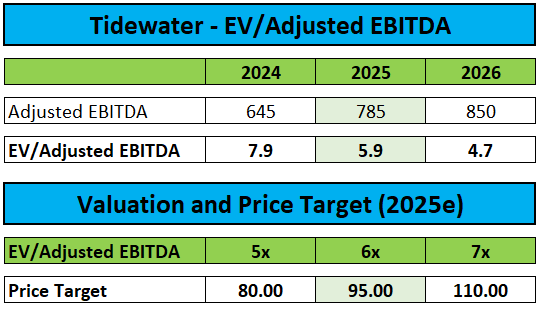

In short, Tidewater is doing well, and the industry outlook remains constructive. However, valuation remains a concern, particularly when compared to closest U.S. exchange-listed competitor SEACOR Marine Holdings or “SEACOR Marine” (SMHI):

Author’s Estimates

Please note also that in contrast to Tidewater, SEACOR Marine expenses all maintenance and drydocking costs rather than capitalizing parts of them on the balance sheet, which understates the company’s margins and profitability relative to Tidewater.

However, SEACOR Marine has started the year on a weak note and continues to lag behind in terms of profitability and cash generation.

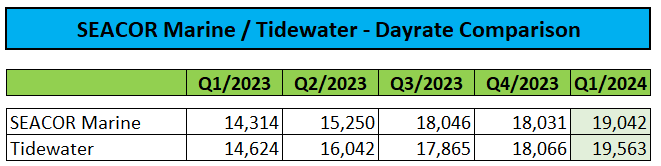

On the flip side, the companies’ year-over-year dayrate trajectory has been similar, with both Tidewater and SEACOR Marine showing an encouraging 33% increase:

Company Press Releases

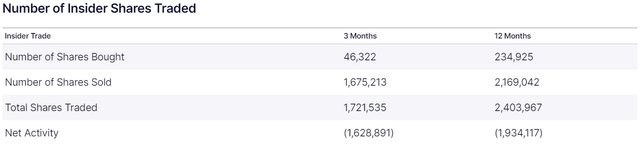

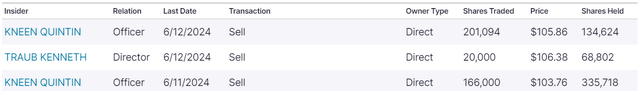

Apparently, Tidewater insiders have also noticed the company’s premium valuation and sold large numbers of shares into the open market in recent months:

Nasdaq.com

Last week’s index inclusion news was met with further insider selling:

Nasdaq.com

With shares trading close to my $95 price target, I am reiterating my “Hold” rating on the stock:

Author’s Estimates

Bottom Line

Tidewater reported strong first quarter results and affirmed full-year expectations. However, management warned of a mediocre Q2 performance, which should be made up for by a materially improved second half.

While industry conditions remain constructive, the company’s valuation in combination with recent insider selling is a cause for concern.

Consequently, investors looking for exposure to the offshore oil service industry should rather consider an investment in smaller peer SEACOR Marine Holdings, specialty services provider Helix Energy Solutions (HLX) or leading offshore drillers like Noble Corp. (NE), Seadrill (SDRL) or Valaris (VAL).

Read the full article here