High Tide Inc. (NASDAQ:HITI), the Canadian cannabis retailer behind the Canna Cabana brand, reported Q2/FY2024 results on the 13th of June after market close. The report shows slower revenue growth than previously with a stable sequential adjusted EBITDA margin, representing a solid performance when looking at underlying factors.

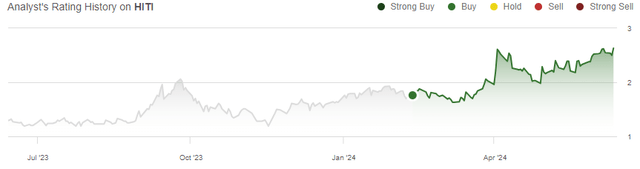

I previously wrote an article on the stock titled “High Tide: Immense Upside If Margins Can Be Lifted“. In the article, I noted High Tide’s competitive retail offering and potential private label sales as drivers for great upside with the valuation at the time, given that the near break-even profitability could be improved. Due to the highly attractive valuation, I initiated the stock at Buy in the article published on the 12th of February. Since, High Tide’s stock has returned 45%, outpacing the S&P 500’s return of 8% by a wide margin.

My Rating History on HITI (Seeking Alpha)

Q2 Report Shows Solid Performance in Seasonally Weak Quarter

High Tide’s Q2 report showed a year-over-year revenue increase of 5.2% into 124.3 million CAD, missing the estimated 127.5 million CAD by a couple of percentage points. The sales declined quarter-over-quarter due to the industry’s seasonal weakness in especially February. The adjusted EPS came in at $0.00 compared to estimates of a normalized $0.02.

In my previous article, I highlighted the importance of improved margins. The quarter came after High Tide showed a great margin improvement in Q4 and Q1, as the adjusted EBITDA margin grew to 6.6% in Q4 and to 8.1% sequentially in Q1, showing a great continued margin expansion trajectory. The reported Q2 adjusted EBITDA margin of 8.1%, consistent with Q1, is fairly good in my opinion when considering the slower sequential sales related to seasonality – I believe that the sequential stability shows great underlying profitability improvements. With seasonally stronger quarters coming up, the margin leverage looks likely to continue well.

The company’s cash flows were incredibly healthy in the quarter with $9.4 million in free cash flow from sustained operations, but partly due to a $4.8 million working capital decrease generating one-off cash flows. Excluding working capital changes, the free cash flow came in at $4.6 million, not accounting for growth-related capital expenditures, though.

While the surface financials came below expectations, I don’t see the reported quarter as weak. At the time of writing, the stock has reacted neutrally, which seems like the correct reaction to me. The quarterly report showed a solid performance in seasonal weakness and a slower industry growth. Cabana Club membership growth was good at 8% sequentially.

Recent Growth Outpaces the Industry

High Tide’s recently reported quarters have shown revenue growth very slightly above Canadian retail sales’ growth as a whole. In Q4, High Tide’s revenue growth was at 17.4% compared to Canadian retail sales’ growth of 16.7% as reported by Statistics Canada. The first quarter of FY2024 showed revenue growth of 8.5% from High Tide, again slightly outpacing nationwide sales growth of 6.9%. The second quarter now followed with a growth of 5.2% compared to Canadian retail sales growth of just 2.0% in the first two months of the quarter – April sales aren’t reported yet by Statistic Canada, but it seems like the Q1 performance showed a greater market share capture than prior quarters despite the weaker surface-level revenue growth.

The recent slowdown of growth is related to slower industry growth, but High Tide should still have great growth opportunities ahead with long-term industry growth – Statista still estimates recreational cannabis to have a CAGR of 5.4% from 2023 to 2028, and High Tide has the potential to grow its share of the market with a well-proven retail concept with growing private label sales also capturing a greater part of the value chain.

The Ontario province, responsible for 36% of Canadian cannabis retail sales in March, has doubled the allowed retail locations per company from 75 to 150 potentially allowing High Tide to capture market share greatly and capture growing revenues. In Q2, High Tide opened five new Canna Cabana stores in the province, showing rapid expansion in the market – High Tide has great potential to continue capturing market share.

Other Recent Developments

High Tide’s CFO has changed since my last article – on the 12th of April, the company announced the transition of the role from Sergio Patino to a new, already designated candidate for an undisclosed reason. The new CFO, Mayank Mahajan was revealed on the 1st of May, bringing over fifteen years of expertise in multiple industries into the company with experience in M&A and debt and equity raises among other experience. It seems that Mayank Mahajan should be able to lead High Tide’s financing well.

Private label initiatives have also strengthened with a small strategic acquisition and a regulatory change – High Tide announced the acquisition of the Queen of Bud cannabis brand for $1 million on the 15th of March, adding a name onto High Tide’s private label roster. I believe that the company is very well positioned to leverage the brand’s sales further by growing the customer base with an attractive retail network. Accelerating the private label growth for High Tide, Alberta recently allowed private label cannabis sales. The province was responsible for around 19% of Canadian retail sales in March, making the new private label sales potential notable, especially with High Tide’s high market share in the province.

The Stock Continues to Be Incredibly Undervalued

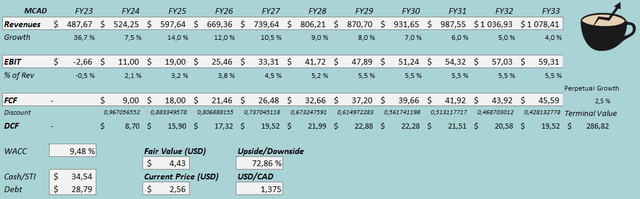

I updated my previous DCF model to account for the recent financial performance. I have adjusted upcoming growth slightly downwards due to lower industry growth and reported revenue growth, now estimating 7.5% growth in FY2024 instead of 10.0%. The new revenue estimates represent a CAGR of 8.3% from FY2023 to FY2033, down from 8.8% previously.

Due to great margin leverage from Q4 forward into Q2, I have raised my EBIT margin estimates, with the margin now ending up at an eventual 5.5% instead of 4.5% previously. I slightly adjusted the cash flow conversion downwards to represent more conservative estimates.

DCF Model (Author’s Calculation)

The estimates put High Tide’s fair value estimate at $4.43, 73% above the stock’s close price on the 13th of June – the stock still seems to have a great amount of upside after a sizable rally after my previous article. High Tide’s earnings potential is still clearly undervalued by the market, highlighted by a now higher probability of the greater margin level materializing in my opinion. The updated estimate is up from $3.54 previously due to higher margin estimates and a lower cost of capital.

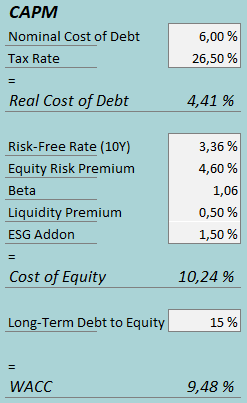

A weighted average cost of capital of 9.48% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

I continue to estimate a 6% long-term interest rate excluding lease payment interest which is accounted for in cash flow estimates. I have also kept the long-term debt-to-equity ratio at 15%.

To estimate the cost of equity, I use Canada’s 10-year bond yield of 3.36% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for Canada, updated on the 5th of January. Yahoo Finance now estimates High Tide’s beta at 1.06, down from 1.16 previously. Finally, I add a liquidity premium of 0.5% and an ESG add-on of 1.5%, creating a cost of equity of 10.24% and a WACC of 9.48%. The WACC is down from 10.01% previously.

Takeaway

High Tide reported the company’s Q2 results, showing continued growth slightly outpacing the industry. While revenue growth was weak on the surface level, the weakness is due to soft industry growth and a seasonally weak quarter. The adjusted EBITDA margin came in at 8.1%, stable sequentially, showing great margin expansion potential as upcoming quarters aren’t as weak seasonally. From Q4/FY2023 to Q2/FY2024, High Tide’s margin expansion has been above my expectations, being a hurdle to a wide undervaluation.

With still a good long-term industry growth outlook, changed regulations in Ontario and Alberta, and a strategic cannabis brand acquisition to fuel private label revenues, High Tide has incredibly good earnings growth potential in coming years. The stock continues to undervalue the growth prospects, and with the recent margin trajectory showing great promise for leveraged margins, I maintain a Buy rating for High Tide.

Read the full article here