Academy Sports and Outdoors, Inc. (NASDAQ:ASO) retails sporting goods and outdoor recreational products and accessories in the United States including clothing, firearms, ammunition, grills, and a wide range of other products. ASO had an IPO in late 2020 and seems to have been mispriced in the listing by a wide margin – the stock has compounded at a CAGR of 46% since the IPO, appreciating by a total amount of 300%. The company also pays out a dividend with a currently small yield of 0.82% as much of ASO’s cash flows are spent on fueling future growth.

The company reported its Q1/FY2024 results on the 11th of June in pre-market hours. The stock initially reacted neutrally in pre-market trading as ASO’s financials continued to perform at an expectedly soft level, but the reaction since turned negative.

Stock Chart From IPO (Seeking Alpha)

Q1 Financials Show Continued Weakness in Demand

ASO reported the company’s Q1 results on the 11th of June, with revenues declining by -1.4% year-over-year into $1364.2 million as comparable store sales declined by -5.7%. The revenues continued to show weakness as macroeconomic pressures currently weigh on customer decisions. For the quarter, the adjusted EPS came in at $1.08.

The quarter slightly missed Wall Street analysts’ estimates – revenues had a miss of $20 million, and the EPS missed by $0.14. I believe that the miss is still moderate and shouldn’t worry investors, especially considering the macroeconomic turbulence that has already caused financial declines for ASO previously.

Despite the quarter missing analysts estimates slightly, ASO reaffirmed the FY2024 guidance originally given with Q4 results, expecting revenue growth of -1.5% to 3.0% in the year along with net income of $455-530 million as weakness in comparable sales is expected to continue. The EPS for the year was jacked up slightly due to lower dilution expected than previously. The guidance still expects gradual improvements in the rest of FY2024.

I see the quarter as a solid financial continuation in an industry that’s challenged by pressure on the consumer. Earnings still continued at an overall healthy level despite missing analyst estimates. Some caution is recommended for expecting the FY2024 guidance as comparable sales weakness continued in Q1, though.

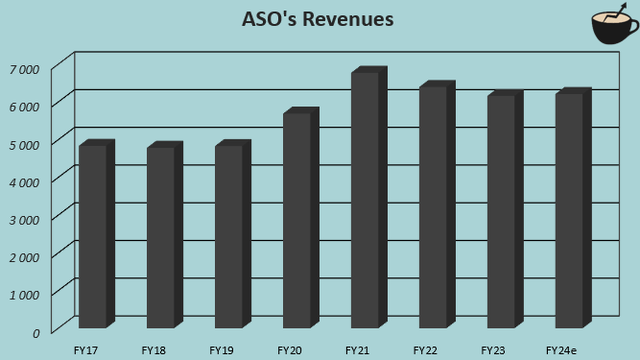

Pandemic Boost Turned Into Macroeconomic Pressure

ASO’s revenues saw significant growth during the Covid pandemic due to a boost in industry demand – in FY2020 and FY2021 revenue growth reached high teens, but the growth has now turned into consistent declines back even with slight growth aid by constantly opened stores. The final quarter of FY2023 showed signs of improvement, but in Q1 the growth went back into negative territory.

It also seems that the growth has been further pressured by macroeconomic worries. ASO’s competitor Sportsman’s Warehouse (SPWH), which I recently wrote an article on, has experienced significant issues with incredibly weak same-store sales continuing in Q1 with the company relating the performance partly to macroeconomic pressures. Weak demand has been seen especially in firearms and ammunition as AMMO (POWW) and Vista Outdoor’s (VSTO) ammunition segment sales have continued to struggle. It seems that currently, ASO’s revenues are at a more sustainable level after the pandemic, with even some demand rebound potential in some of the company’s offering.

Author’s Calculation Using Seeking Alpha Data

The boosted revenues during the Covid pandemic have also aided margins massively and raises a question about ASO’s sustainable margin level – prior to the pandemic in FY2019, the company only posted an operating margin of 3.8%. The pandemic’s demand peak elevated the margin into 13.4% in FY2021. The elevation in recent years has been mainly driven by gross margin elevation from 29.6% in FY2019 into 34.3% in the latest fiscal year, as ASO has been able to push through higher pricing with a good reception from customers so far. The gross margin elevation is contrary to competitor Sportsman’s Warehouse which has experienced a decline in the gross margin from the pre-pandemic level. ASO targets a long-term adjusted EBIT margin of 13.5% up from 11.9% in FY2023, but investors should take the target with caution.

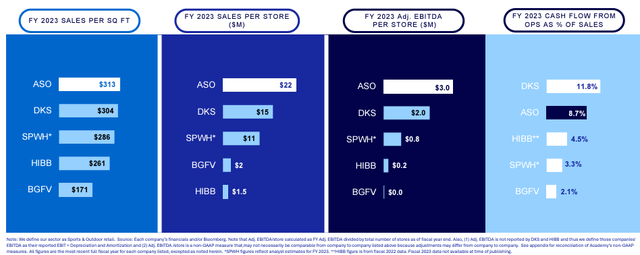

ASO March 2024 Investor Presentation

ASO does boast about industry-leading store economics, showing the greatest sales per square foot of the publicly traded peers despite a significantly larger average store size compared to the peers – I believe that the margin level shouldn’t fall anywhere near pre-pandemic levels, but could see some pressure in the future.

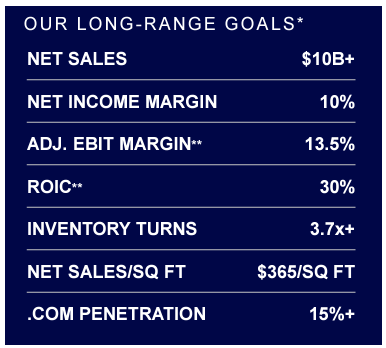

A Return to Great Growth is Targeted

The company continues to have quite ambitious growth plans over the long term, identifying potential for 800 stores nationwide compared to the current 284 after Q1. In the next five years, ASO plans to open 160 to 180 new stores, accelerating growth from 14 new stores opened in FY2023. The long-term financial goals are also significant. ASO targets for sales of $10 billion, a growth of 62% from FY2023 revenues. The ROIC is targeted at a slightly higher level than was achieved in FY2023, and seems likely to be achieved through an improved scale.

ASO March 2024 Investor Presentation

The targeted growth takes up a significant amount of capital – in FY2023, ASO spent $207.8 million on capital expenditures, and increasing inventories and decreasing payables have worsened cash flows as well with store growth tying up capital in the past three years. ASO does have a healthy return on capital of 12.0% and a return on equity of 29.0%, though, making the investments worthwhile in my opinion. Many of the new stores are targeted to serve a smaller market and are planned to be smaller than ASO’s typically quite large store size.

Valuation Has Good Upside

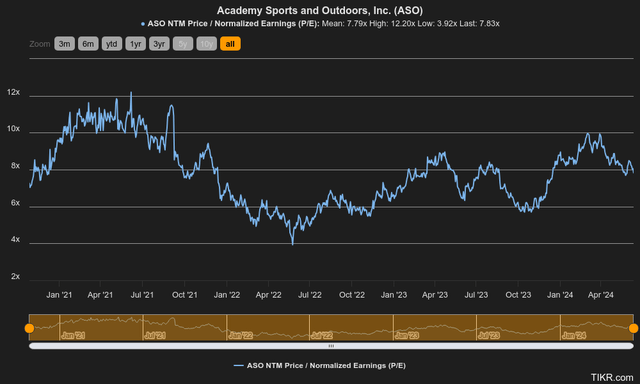

Despite the great stock appreciation, ASO still trades at quite a cheap level – the forward P/E of 7.8 is at the stock’s post-IPO average level and seems to price in quite weak growth in the future.

Historical Forward P/E (TIKR)

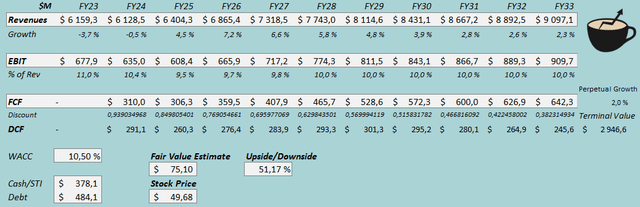

To estimate a fair value for the stock, I constructed a discounted cash flow [DCF] model as usual. In the model, I estimate a growth elevation from FY2025 forward as macroeconomic pressures relieve and as new store openings contribute better to revenues – I estimate a growth of 4.5% in FY2025, and a sequential acceleration into 7.2% in FY2026. Afterwards, I estimate a gradual slowdown into perpetual growth of 2%, representing a CAGR of 4.0% from FY2023 to FY2033. The growth estimates are below ASO’s target, but in my opinion justifiably so with not enough proof of profitable growth shown yet with the new targets.

For the margins, I estimate some continued pressure to account for a bearish scenario – I estimate the margin to fall to 9.5% in FY2025, but to climb back into 10.0% in coming years. ASO’s estimated growth should take up quite a good amount of capital, making cash flows weaker in upcoming years but stronger as the growth slows down.

DCF Model (Author’s Calculation)

The estimates put ASO’s fair value estimate at $75.10, 51% above the stock price at the time of writing. It seems that current macroeconomic pressures have created quite an attractive opportunity to buy into potential future growth at a cheap level of a 7.8 P/E.

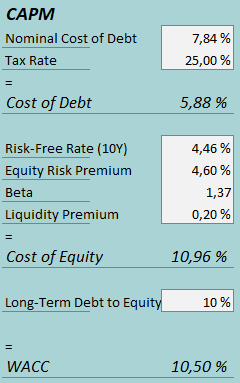

A weighted average cost of capital of 10.50% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q1, ASO had $9.5 million in interest expenses, making the company’s interest rate 7.84% with the current amount of interest-bearing debt. I estimate a continued modest amount of debt with a long-term debt-to-equity ratio of 10%. To estimate the cost of equity, I use the United States’ 10-year bond yield of 4.46% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, updated on the 5th of January. Yahoo Finance estimates ASO’s beta at 1.37. Finally, I add a liquidity premium of 0.2%, creating a cost of equity of 10.96% and a WACC of 10.50%.

Takeaway

ASO reported Q1 results, missing analysts’ estimates slightly, as macroeconomic pressured continued to weigh on comparable store sales. Still, earnings continued at a great level, and the reaffirmed FY2024 guidance shows some hope of sequential improvements. The company’s longer-term history shows a slowdown from pandemic-time earnings, but incredibly stronger margins than prior to the pandemic as ASO’s store economics lead peers in the industry. The company also targets significant growth in the future with accelerated store openings. While I estimate growth and margins more conservatively than ASO targets, the stock still has significant upside with the current valuation – I recommend caution about ASO’s FY2024 guidance and longer-term margin level, but initiate Academy Sports and Outdoors at Buy.

Read the full article here