The last inflation-related measure PCE met expectations

Market participants didn’t show fear of the PCE before the reveal and were right. We had a bit of a rally in the aftermath. I believe the consensus is that inflation is coming down, albeit extremely slowly. Or at the very least, it is no longer threatening to get hotter now that we had that cool April. With that notion, there is less fear of tightening and a certainty that the Fed will lower rates later this year. The market loves clarity, and because the table is set, we’ve had indexes that have stayed at the highs. As a result, we had just a 5% sell-off that lasted what felt like an instant. The VIX is at post-pandemic lows, meaning there is relatively little demand for hedging downside risk.

Friday’s May employment data brings some uncertainty

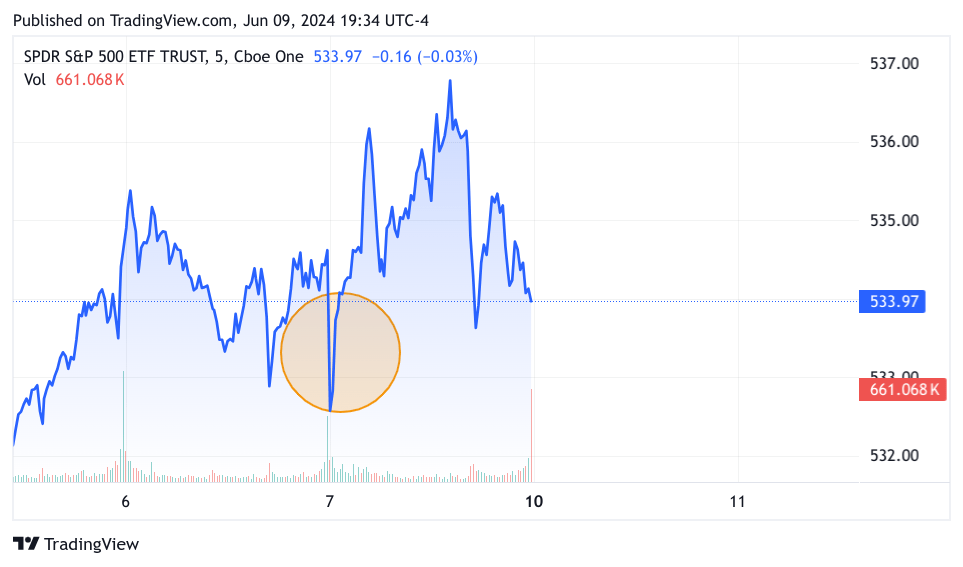

Before the reveal, the chatter Friday morning was that employment for May could be as low as 140K. Other economic data for May showed some cooling, it would follow that employment would come in lower than last month. April had 175K jobs and a 3.9% unemployment rate, adding to the expectation that if not lower than not much higher. The consensus as I recall was 190 thousand, and instead, we see 277,000 jobs for May, with 4% unemployment. I think the behavior of the market on Friday gives us a hint about how Monday and Tuesday will play out leading up to Wednesday. Today I am using the S&P 500 ETF it is the 5-day chart, but I shifted it over to focus just on June 6 and 7.

TradingView

When the news first hit the market, the futures dropped sharply, and the market fell hard at the open. The reason, of course, is that such a jump in employment means that the economy is not cooling off. What happened immediately afterward was a strong jump, probably because we want inflation to come down without hurting the economy. This is quite a trick, but Powell has been trying to pull that off. Over time, the pop diminished until the S&P 500 closed down but nearly even with the day before. Perhaps the higher unemployment percentage and other measures underneath the headline numbers showed some countervailing weakness that brought down the bulls. I believe this indecisive result, will serve to add enough opaqueness that tomorrow and Tuesday will result in selling.

Let’s add a likely sell-off in Nvidia (NVDA) to the mix

I can’t say with 100% certainty, but it isn’t unusual for a stock post-split to sell off a bit first. Why? I think a lot of people got excited by the split and bought shares pre-split. Now that they and perhaps some investors that owned NVDA for a while can trim some shares off more gradually. Eventually, others will come in and buy NVDA and take it to new highs, for now, it makes sense that NVDA consolidates all the gains it has made. In just 12 trading days NVDA has gained an astounding 23% give or take. This is even more astounding given its already gargantuan market cap, that 23ish percent leap at one point took it to $3T, that’s 3000 Billion dollars in market value. It closed this Friday at 2.9741T in market capitalization. Please don’t come at me with why $NVDA is worth every penny, I will agree with you. I do know that nothing goes up in a straight line, and with that kind of gain, I would think that many would be tempted to let go of a few shares post-split. I would also argue that those who practice good portfolio management would not let any position grow above a certain level, be it 5%, 7%, or 10%. There’s a point to singling out NVDA, NVDA is the single giant motor of the bull market right now. The rest of the “Super Six” pale in comparison to it, they are gleefully paying NVDA 10s of billions for its marvelous chips. If NVDA drops even 5% or 3%, I think the rest of the techs follow suit. So again, just temporarily, NVDA takes a pause, and a bit of a dip to add to the selling.

What are we up against? Will CPI and Powell’s FOMC statement take the market down further?

I wish I knew! We are in a quiet period, so there is no Fedspeak. There are still questions about how many cuts we will have this year. As the year has gone on, the expectations about multiple cuts this year have gotten to be fewer, and starting later. Depending on the data, Powell could give us an idea about how the Fed is looking at inflation, and that could reignite a rally or continued selling. I frankly am not thinking that far ahead. I think Monday and Tuesday will give us a sell-off, so let’s make ready for that possibility and worry about Wednesday when it happens. If we do get hot numbers for the CPI, Powell will have to address that in his presentation at 2 pm.

To summarize…

Let’s review what we have, we have a level of the VIX that displays no expectation of volatility, in other words, market participants are very complacent. We have the accepted wisdom that at some point this year the Fed will be cutting rates, and there is zero chance that the Fed will be raising rates. Market participants love the visibility afforded by the signals Fed Chair Powell has been giving. Also, we have come off of a successful Q1 earnings season, and we have the same expectations for Q2. We have all this positivity, until Friday’s May Employment results, I think this sets up the possibility that perhaps the CPI comes in hot. I am not predicting that CPI will be hot, only that the possibility is now in the air. Not only that, but by happenstance we have two consequential Macroeconomic data points that each alone can move the market. Now, together with one at 830 am and the other at 2 pm, I believe has the potential for some selling that is significant enough to call for hedging the market. As a side note, if the selling is deep enough, it could “inoculate” whatever bad news if any is in store for us on Wednesday. So the idea would be to do some hedging Monday morning and close them out Tuesday afternoon. If there is bad news on Wednesday, you can either look for bargains among the wreckage or put hedges back on. You can do both.

I was already net short via put options going into Friday’s Employment report

It happened organically really, I observed Lululemon’s (LULU) earnings report and thought it was of low quality at the open I got long Puts at the 310 strike well under the opening of 337. I thought the excitement was well overdone, it turned out to be a very quick trade as I was up 60% almost immediately. This got me thinking that there was a lot of froth in the market, so when LULU rebounded a bit, I went in for a second swipe. In addition, I got puts on eBay Inc. (EBAY) Etsy, Inc. (ETSY) and a few other names that, I thought, were overpriced, I even got Puts on the 3X QQQ ETF (TQQQ) because I decided that whatever the number was, the expectations became so low that it had to disappoint even if it came in at consensus. The moment the market opened, I closed out all my hedges and came out ok. Well, all my hedges but for Boeing (BA) I have Puts at 185, it’s trading at 190 now. Why? Because they finally launched a rocket 4 years too late? It’s still leaking helium in space, and they are still producing planes at a snail’s pace. I also have VIX calls at the 12.5 strike, and it is out of the money. The VIX is at a ridiculous level in my opinion, it just is. Tomorrow I will be putting on similar hedges for the Nasdaq-100, and also the Russell this time. With the VIX so low, options are cheap, and I will cast about for stocks that, I think, are toppy. I will also think about what stocks would be negatively affected by higher rates, and get on the short side via Puts there as well.

I hope this helps. This is just me thinking out loud about the short term and putting it down on paper. I don’t intend to sell any investments, I might add, if I see some stocks at lower prices, perhaps NVDA if it sells off enough. No one should read this and get the idea that you should sell your investments. As far as my long-term outlook, I am very bullish. It may take longer, but inflation will come down, perhaps at a slower rate than what the Fed would like. So far, the current Federal Funds Rate set by the Fed does not seem to be hurting the economy. The truth is, 4.5% on the 10-year rate is fine, even 5% is not the end of the world. The economy just has to adjust to the true cost of credit and will be better for it.

Good luck everyone

Read the full article here