Celsius Holdings (NASDAQ:CELH) has been one of the best-performing stocks in the market since the pandemic, as the company has taken the energy drinks industry by storm.

I’ve been a bull for quite some time and Celsius has rewarded me handsomely, but I recently exited my position entirely.

Let’s dive into why.

Revisiting My Bullish Thesis

I started covering Celsius Holdings in July 2023, with a Buy rating, claiming the company is a formidable rival to Monster Beverage (MNST). In the following articles, I discussed the company’s extraordinary execution and encouraged investors to pull the trigger on several occasions, including multiple unjustified selloffs.

The investment thesis was quite simple. With the help of PepsiCo’s (PEP) unparalleled distribution, Celsius had a clear path for significant revenue growth, without major capital investments and with a very attractive margin profile. The company was already in the process of 40%+ revenue growth combined with a significant operational leverage opportunity.

All that came at a PEG that was below 1x, and a sales multiple that was close to that of Monster Beverage, despite Celsius’ much higher expected growth.

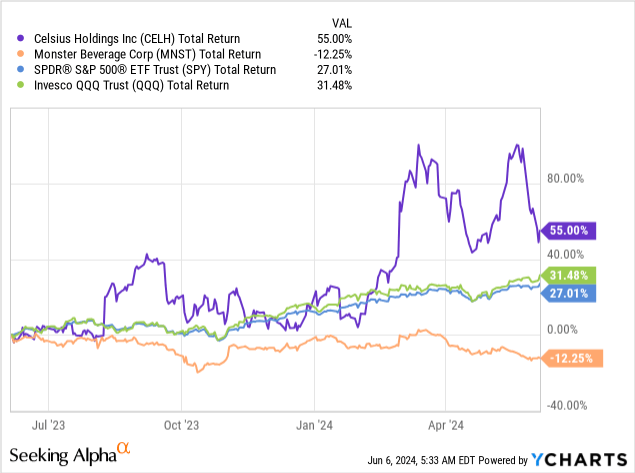

Since my first article and over the past year, Celsius is up 55%, much more than the market, even after the ~22% decline from the top.

In March of this year, I said investors should realign their positions in light of the stock surge, as it became increasingly clear that Celsius is no longer an under-the-radar disruptor.

After reaching a double-digit market share and the stock almost tripling from its 2022 lows, investors piled into Celsius. The company’s valuation started reflecting very high expectations, and the consensus seemed to believe Celsius would continue to grow by 40% annually for three more years.

When the stock surpassed $90 after that March article, I decided to exit my position.

That said, even today, as the stock trades back in the $74 range, I’m still reluctant to buy, and as we’ll discuss, I am downgrading it to a Hold.

Recent Results Show Faster-Than-Expected Deceleration

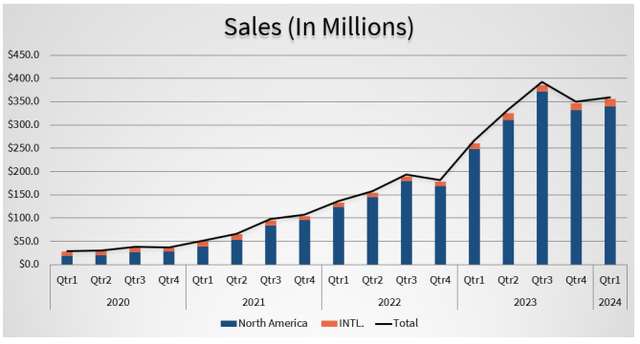

Celsius had revenues of $355 million in the quarter, of which more than 95% were in North America. Revenue growth decelerated from 95% in Q4’23 to 37% in Q1’24, as this was the first quarter to overlap a full quarter of the Pepsi partnership.

Revenues missed estimates by $34 million. Management attributed some of the miss to a $20 million impact from a change in PepsiCo’s inventory policy.

As the partnership matures, PepsiCo is optimizing its buildout and needs to hold less inventory on hand. It’s yet to be determined if this is a one-time impact or something that will affect results throughout the year.

Celsius Holdings Q1’24 Presentation

Before the Q1 results, analysts were expecting revenues of $1.83 billion in 2024, reflecting 37% growth. Following the revenue miss, consensus estimates are now down to $1.7 billion, or 30% growth.

Nielsen data from the beginning of the year also show a significant slowdown. From what I’ve been able to find, February volumes were up 82% with a 4.1% price increase. Then decelerated to 71% in March and 63% in April.

According to a recent Morgan Stanley report, volume growth declined to 39% with a 7.2% price decrease in the week that ended on May 18, resulting in a long-time-not-seen market share loss.

Low Predictability, High Consensus Estimates, Health Questions

Following the bearish numbers from Morgan Stanley, Celsius went through a sharp selloff, now down over 20% since the report. In my view, there was no reason for the stock to recover back to above $90 even before the Morgan Stanley announcement.

Three main reasons led me to change my stance on Celsius as it reached an elevated valuation. Predictability, inflated estimates, and arising health questions.

Starting with predictability. As a relatively young energy drink company, there aren’t too many cornerstones we can rely on to predict its performance from quarter to quarter. We do get Nielsen data, but we’re seeing there’s a detachment between Nielsen and total revenues, as Celsius non-tracked channels became larger. In addition, there are contracts with the end-point sellers that provide some kind of floor, but still, it’s much harder to predict energy drink sales compared to something like a subscription-based business, and that generally requires some kind of discount.

Second, health questions. If you follow Celsius’ marketing, you can see that the company promotes its drinks as a product that is good for people who work out. In fact, gyms are a big distribution channel for Celsius. Additionally, it is marketed as a sugar-free relatively healthy energy drink. Recently, more and more incidents are being reported on people who suffer health problems from drinking too much of an energy drink, as severe as death. Just as a reference point, the average Celsius can have more than 3x the caffeine in an espresso capsule. I’m no doctor, but that doesn’t sound too healthy.

Lastly, I’m struggling to make sense of current consensus estimates. As it currently stands, analysts expect revenue growth to accelerate from 30% this year to 34% in 2025, despite the much larger baseline. The way I see it, the only way this happens is if Celsius’ international expansion progresses way faster than that of its rivals, or if its spring resets, which will be reflected in the second-quarter results, show that Q1 was a low point for the year.

For Celsius, Growth Is More Important Than Margins

This brings me to a very important point about Celsius. In my view, the only way the stock works at the current valuation is if the growth story continues at ~30% for several years. Despite that, I’m already seeing several analysts changing their tone, calling Celsius an EPS growth story, rather than a market-share taker.

Here’s the problem:

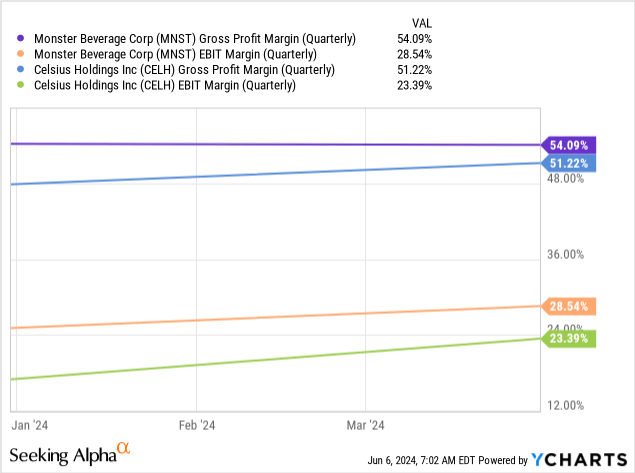

Despite being only fifth the size of Monster in terms of sales, Celsius is already approaching its industry-leading margins, with operating margins of 23.7%, and gross margins of 51.2%. This is a result of the company’s impressive efficiency, as well as its reliance on PepsiCo’s distribution.

We already know PepsiCo renegotiated some parts of the deal, which should result in at least some form of margin loss. In addition, we can understand that Celsius’ margin expansion potential isn’t close to being as significant as its revenue opportunity.

At a 68x P/E, Celsius is first and foremost a topline growth story, and as we discussed, expectations on that front are very high.

Valuation & Updated Monster Comparison

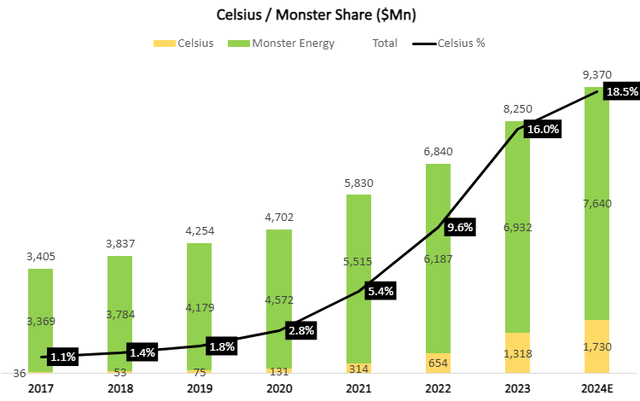

In Q1’24, Celsius outgrew Monster by more than 25 points. As a result, Celsius revenues as a percentage of Monster’s energy segments reached an all-time high, at 16.2%.

Based on current consensus estimates, Celsius is expected to reach 18.5% in 2024, meaning it will exit the year in the 20% range.

Created and calculated by the author using data from the company’s financial reports and consensus estimates; Monster Energy numbers don’t include revenues derived from Monster Beverage’s non-energy businesses.

I don’t think I’m breaking any news by saying that Celsius’ much faster growth rate, combined with its attractive margin profile, demands a significant premium over Monster.

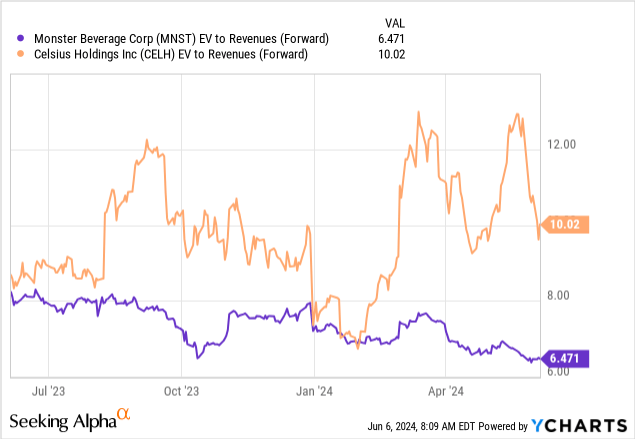

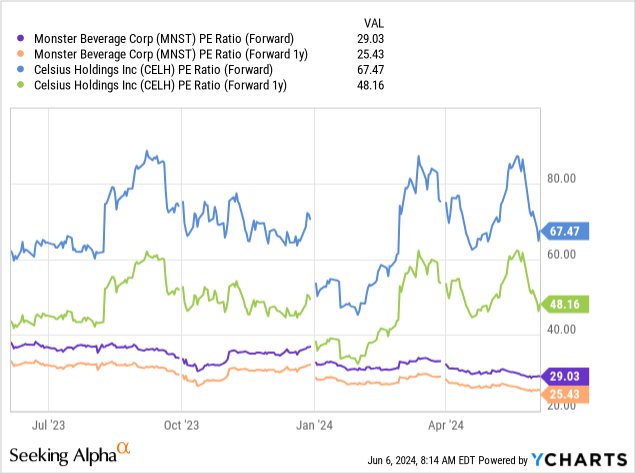

However, as we can see, there were times over the past year when this premium wasn’t that big:

For example, back in July, when I initiated coverage, the premium in EV / Sales was around 10%. Today, this premium stands at 53%.

Similarly, if we look at the companies’ P/E, we can see that the forward 1Y multiple was pretty close back in July, and now Celsius’ is close to being twice as high.

So, Celsius is gaining scale and improving margins, but its growth is significantly slowing down, and yet the premium over Monster is historically high.

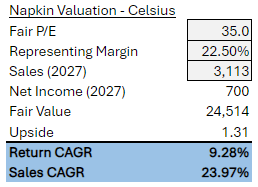

In my last article, I showed my napkin valuation for a $74 price target, which is exactly where the stock is today. However, I need to adjust my assumptions, as it seems unlikely that Celsius will achieve a 30% sales CAGR between 2023 and 2027.

Created and calculated by the author.

Maintaining the same 35x exit multiple, reducing the sales CAGR to 24%, and increasing the margin target from 20.0% to 22.5%, I now see a 9.3% annual return from current levels, compared to the 12% I saw before.

In my view, this is not enough potential return. To achieve the targeted 12% annual return we discussed, we’ll need the stock to go down to $68.

Conclusion

Celsius was an under-the-radar growth story that took the energy drink industry by storm. For quite a long time, the stock didn’t reflect the company’s growth trajectory and its margin potential.

Today, Celsius is seeing growth decelerate faster than Wall Street expected at the beginning of the year, and recent Nielsen data showed a short period of market share losses.

At a 68x P/E and already very high margins, the stock will only work if Celsius achieves a significant top-line surprise, which will be hard to do considering the very high expectations from the company.

Therefore, I downgrade Celsius to a Hold.

Read the full article here