Introduction

I had a ‘Strong Buy’ thesis about Google (NASDAQ:GOOG) in early March. I can praise myself for this call as the stock gained 30% since my recommendation, compared to modest 2.6% gain from the S&P 500. The company continues demonstrating strong growth momentum in digital advertising and cloud. These industries are expected to demonstrate strong long-term growth, which means that my bullish stance is sound. Google reinvests its substantial profits in new ventures and has a great potential to dominate in the autonomous driving industry, which can grow into a $400 billion monster, according to McKinsey. The valuation is still very attractive, and I am inclined to reiterate ‘Strong Buy’ for GOOGL.

Fundamental analysis

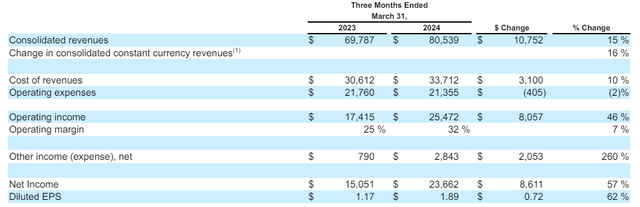

Google generated $80.54 billion revenue in Q1 2024, which is a solid 15.4% increase YoY. Revenue grew notably faster than expenses, meaning that profitability improved significantly. The operating margin improved from 25% to 32% on a YoY basis, allowing the diluted EPS to increase by 62%.

Q1 10-Q report

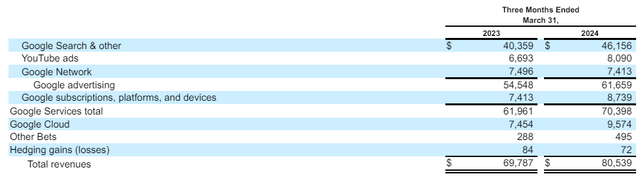

Revenue Q1 increase was of high quality because all segments demonstrated robust growth, meaning that the company did not rely on a sole growth driver. This diversified performance indicates broad health of the business and resilience against external fluctuations, proving my bullish thesis. I want to emphasize Google Cloud’s 28.4% YoY revenue growth, outpacing the industry by more than seven percentage points.

Q1 10-Q report

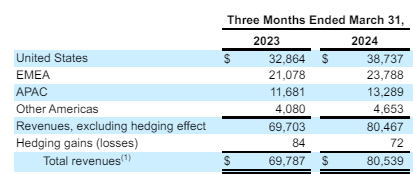

Strong growth was demonstrated not only across all business segments, but also across all geographies. This indicates strength of Google’s business model, which successfully works across different legislations, cultures, and markets. Another strong point supporting my bullish stance.

Q1 10-Q report

To summarize Q1 results, Google delivered stellar revenue growth of high quality. The company’s financial discipline allowed to substantially improve profitability.

Digital advertising is Google’s largest revenue stream, and the company’s cash cow ensuring exceptional profitability. Therefore, it is crucial to understand future prospects of the industry. According to the source, digital advertising is in good shape and total spending growth outlook for 2024 was recently upgraded from 8.4% to 9.2%. Google’s advertising revenue grew by 13% in Q1, significantly ahead of the forecast for the entire industry. According to Grand View Research, the global digital advertising market is expected to demonstrate a 15.5% CAGR by 2030. This implies that industry trends for Google’s key income stream are quite positive.

Google’s second largest revenue stream is Google Cloud, representing almost 12% of the total Q1 revenue. The industry is extremely hot with two other cloud giants, Amazon (AMZN) and Microsoft (MSFT) boosting their cloud and data center spending amid the AI battle. Google also has ambitious plans and is ready to spend aggressively on AI. My confidence is backed by strength of Google Cloud.

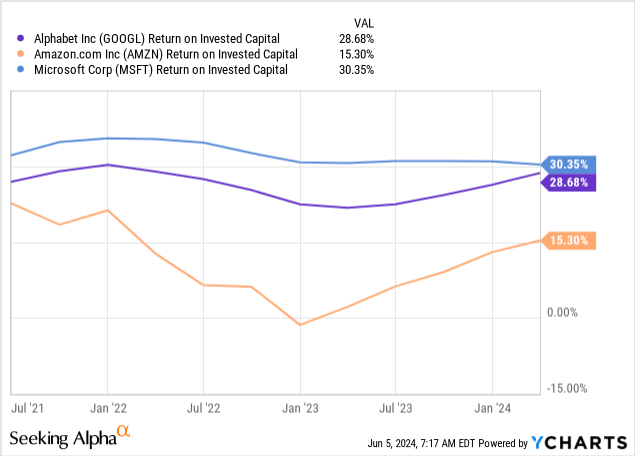

Bears might say that Google Cloud is miles away from AWS and Azure in terms of market share, which is true. However, as I mentioned earlier, it is growing faster than the industry and its market share almost doubled between 2017 and 2023. Such an aggressive market share expansion is strong evidence that the management is doing the right job in this direction. Moreover, Google’s historical ROIC is much higher compared to Amazon and the gap with Microsoft is closing rapidly.

Therefore, I think that Google is one of the key beneficiaries of the accelerated cloud and AI transition. According to Precedence Research, cloud infrastructure market size is expected to expand at a CAGR of 12.1% from 2023 to 2032. Another solid tailwind for Google and strong reason to remain bullish about Google.

Waymo’s website

The company also continues investing in new ventures outside digital ads and cloud. Technology for autonomous taxis called Waymo appears to be the most promising, in my opinion. The service is already available in some parts of large cities like Los Angeles, San Francisco, and Phoenix. Later this year, the company also plans to launch its services in Austin. McKinsey forecasts that autonomous driving could create $300 billion to $400 billion in revenue by 2035. As an industry pioneer and Google’s massive financial and human capital, the company is poised to capture significant portion of this industry in future. Capturing at least 15% of a $400 billion market will mean $60 billion in additional annual revenue. Considering Google’s TTM P/S ratio of around 7, $60 billion of additional revenue means extra $420 billion to the market cap. The level of uncertainty is extremely high, so I am not factoring it in my valuation below. However, I just want to emphasize vast potential of this business over the long-term.

Valuation analysis

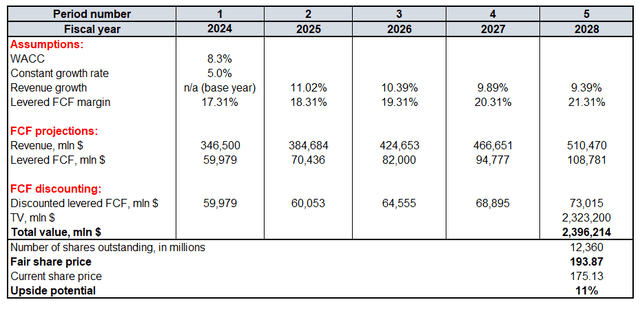

After notable rallies occurring within relatively short timeframes, there is a possibility that the share price went above its fair value. To check this out, I am running a discounted cash flow (‘DCF’) model with an 8.3% WACC.

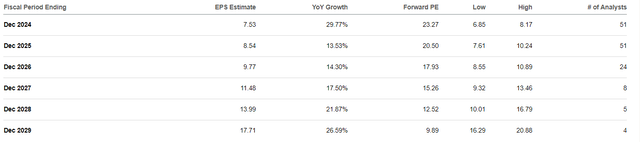

Revenue 2024-2026 is a consensus of more than 20 Wall Street analysts, which appears to be a representative and reliable sample. For 2027-2028 I incorporate a slight revenue deceleration, as comparative numbers expand. Considering Google’s fundamental strength and consistent reinvestments in growth, I think that a 5% constant growth rate is fair for terminal value (‘TV’) calculation.

SA

Google’s TTM levered FCF margin is 17.31%, it will be my assumption for FY 2024. For the years 2025-2028 I forecast 100 basis points yearly expansion. I am optimistic about FCF expansion potential because consensus outlook for the EPS is quite optimistic. According to Seeking Alpha, there are 12.36 billion GOOGL outstanding shares.

Calculated by the author

The upside potential is 11%, according to my calculations. Google’s fair share price is around $194, meaning that current $175 price per share is attractive.

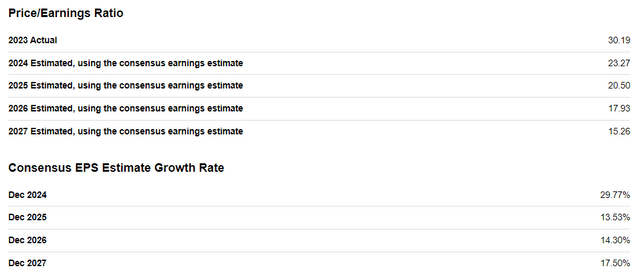

Peer valuation analysis for Google looks like an impossible task because the company’s positions in digital advertising and search engines is unparalleled, meaning that there are no peers. However, looking at forward projections for the P/E ratio is quite useful.

SA

According to the above screenshot, GOOGL’s P/E ratio is projected to shrink to almost 15 within the next few years. This looks like an unrealistically low P/E ratio for a company like Google. Therefore, I believe that the P/E ratio also shows the stock’s undervaluation.

Mitigating factors

Pressure from antitrust authorities seem to be intensifying. In late March there was information that the U.S. technological giants including Google face new probes under new EU digital laws, which could potentially lead to big fines. According to yesterday’s news, the U.S. Congress has requested to probe tech companies hiding antitrust evidence. All these probes and investigations might lead to substantial fines and penalties. Moreover, Google faces reputational risks in case the company’s behavior is proven to be misconduct.

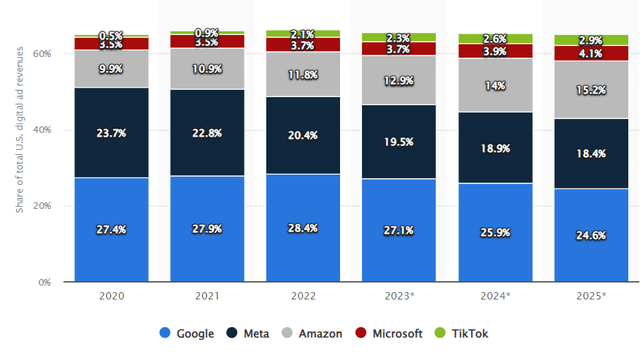

Statista

Google continues dominating in the global digital advertising market. However, the competition is intensifying, particularly from Amazon. According to Statista’s forecast, Google’s digital advertising market share is expected to shrink by around 250 basis points. At the same time, Amazon’s market share is expected to expand from 12.9% to 15.2%. According to the above chart, Google is expected to remain the undisputed number one player in the industry, but investors should be aware of intensifying competition from AMZN.

Conclusion

Google is strong across all revenue streams and geographies. Relying on a wide variety of revenue growth drivers means there is great potential to sustain aggressive trajectory over several years ahead. There is great potential for Waymo to dominate in an industry that will be worth hundreds of billions of dollars over the long term. The valuation is still very attractive, meaning that GOOGL’s ‘Strong Buy’ rating is well-deserved.

Read the full article here