I last covered Infineon (OTCQX:IFNNY) (OTCQX:IFNNF) in March; I allocated a Buy rating at the time, and since then, the stock has gained 7.90% in price. At the time, I estimated that the stock was significantly undervalued based on my discounted earnings model. However, in this analysis, I am going to assess the company’s valuation more acutely by looking in detail at its cash flows, in particular, how its high capex affects its valuation when forecasting growth in free cash flow. I consider the stock to be fairly valued at this time, which is surprising at a time of high exuberance for technology firms involved with AI. The company also has exceptional growth and profitability. For these reasons, I reiterate my Buy rating for Infineon this month.

Operations Analysis

To recap, for readers who are not familiar with the company, Infineon is a German semiconductor manufacturer specializing in markets including automotive, industrial power control, power management, and digital security solutions. As of fiscal 2023 end, its revenue by operating segment can be broken down as follows:

| Automotive | $8.8bn, 50.5% of operating revenue |

| Power & Sensor | $4.1bn, 23.3% of operating revenue |

| Green Industrial Power | $2.4bn, 13.5% of operating revenue |

| Connected Secure Systems | $2.2bn, 12.5% of operating revenue |

| Other Operating Segments | $19.2m, 0.1% of operating revenue |

Infineon is heavily invested in silicon carbide (‘SiC’) and gallium nitride (‘GaN’) technologies. These are wide-bandgap semiconductors that offer superior performance for high-power and high-efficiency applications; these semiconductors are particularly useful in the automotive and industrial sectors. The company is also expanding its presence in AI and IoT solutions; its AI capabilities are being integrated into automotive and industrial applications. Additionally, Infineon has introduced advanced packaging technologies to improve the performance and reliability of its semiconductor products.

A large part of this analysis will be related to Infineon’s capex, and at this time, Infineon is increasing its manufacturing capacity to meet growing demand. Unlike semiconductor firms like Nvidia (NVDA) and Broadcom (AVGO), which operate essentially fabless, Infineon is highly involved in the manufacturing process. It is making the following investments:

- Kulim, Malaysia: the company is investing more than €2 billion to build a new module at its Kulim site, focusing on silicon carbide and gallium nitride technologies. It is expected to be operational by the second half of 2024, creating 900 high-value jobs and generating €2 billion in additional annual revenue once fully equipped.

- Dresden, Germany: the company has begun constructing a new 300-mm “Smart Power Fab” in Dresden with an investment of ~€5 billion. This is part of the European Chips Act initiative, which aims to boost Europe’s semiconductor production capacity. The Dresden fab will start production in 2026, creating approximately 1,000 jobs.

- Batam, Indonesia: the company is doubling its packaging capacity in Indonesia by acquiring a neighboring site from PT Unisem. This expansion is expected to be operational in 2024 and should enhance the assembly and testing of automotive products.

Infineon has also acquired GaN Systems and signed a multi-year supply agreement with Resonac:

- GaN Systems: this acquisition significantly expanded its capabilities in gallium nitride technologies. The acquisition provides Infineon with a strong portfolio of GaN patents and design expertise, crucial for its success in power electronics.

- Resonac: Infineon signed a multi-year supply agreement with Resonac for silicon carbide materials. This is part of Infineon’s strategy to secure a stable supply of SiC materials to meet the growing demand for power semiconductors.

The reason I have mentioned this is that it is proof of how highly capital-intensive Infineon’s business model is, which relies on in-house production at scale. As such, the company has to expect strains on free cash flow, which significantly reduces the appeal of the firm’s valuation in a discounted cash flow model. This is why I will also be valuing the firm based on discounted earnings in my valuation discussion to come.

In my opinion, these are the four highest threat companies to Infineon in terms of competition:

| NXP Semiconductors (NXPI) | NXP is a global semiconductor manufacturer specializing in automotive, industrial, and IoT applications. It directly competes with Infineon’s automotive segment. |

| STMicroelectronics (STM) | STM provides a broad range of semiconductor solutions, including microcontrollers, power semiconductors, and sensors. Its foothold in industrial and automotive markets is significant competition for Infineon. |

| Texas Instruments (TXN) | TI is a leading semiconductor company known for analog and embedded processing products. Its strength in power management and industrial applications directly competes with Infineon in similar markets. |

| ON Semiconductor (ON) | onsemi is another leader in the semiconductor field. It focuses on energy-efficient solutions for automotive, industrial, and communications markets. It competes with Infineon in power management and imaging technologies. |

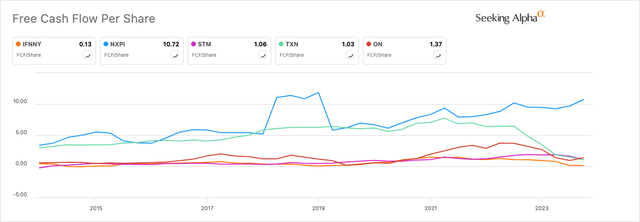

I recently covered onsemi, and I consider Infineon to be the stronger company of the two at the time of this writing. Primarily, I attribute this to Infineon’s better growth all around, but most notably in free cash flow, which at this time is negative for onsemi.

Financial Analysis

Here is a table of the fundamental financial metrics for Infineon versus the competitors I have outlined above:

| _____________________ | IFNNY | NXPI | STM | TXN | ON |

| FWD Revenue Growth 5Y Avg | 12.49% | 6.76% | 9.87% | 3.28% | 6.16% |

| FWD Diluted EPS 5Y Avg | 25.99% | 13.28% | 19.96% | 5.79% | 22.04% |

| FWD Free Cash Flow Growth 5Y Avg | 34.34% | 5.55% | 31.30% | -1.65% | 27.77% |

| TTM Net Income Margin 5Y Avg | 11.76% | 12.89% | 15.75% | 39.32% | 13.43% |

| Equity-to-Asset Ratio | 0.59 | 0.38 | 0.68 | 0.49 | 0.6 |

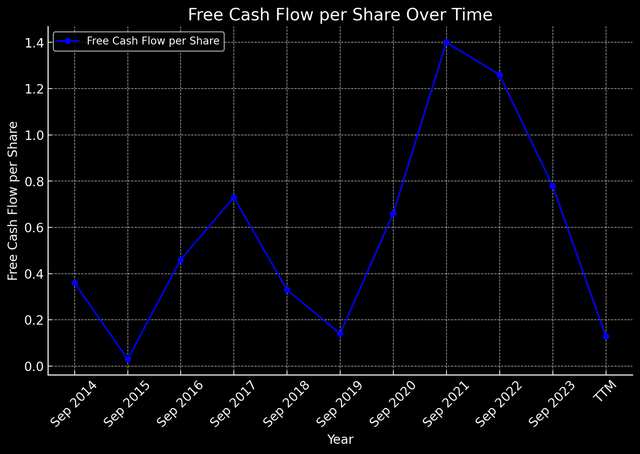

Infineon might seem to have had good free cash flow growth over the past 5 years. However, it has had periods of free cash flow weakness, including at the time of this writing. Consider the following graph, which is a history of Infineon’s free cash flow per share every year over the past decade:

Infineon Data (Author’s Graph)

As we can see, Infineon has periods of high free cash flow and periods of low free cash flow. This is the result of the fact that it has periods where it needs to make significant capital expenditures, like those I outlined in my operations analysis above. This is vital for the firm to stay competitive. Infineon is one of the weakest of the group of 5 peers I have selected for this analysis in regard to nominal free cash flow generation, but its growth in this regard has been strong over the past 5 years on average.

Author, Using Seeking Alpha

Infineon also has the weakest net income margin. However, the company has the best revenue, diluted EPS, and free cash flow growth of all 5 companies; for this reason, I believe it makes one of the most compelling semiconductor stocks on the market at the moment when paired with my assessment of its valuation. Importantly, Infineon’s balance sheet is robust, which is important because it has periods of high capex to remain competitive, meaning that this will be less affected by debt repayments than a company like Broadcom (AVGO), which has an equity-to-asset ratio of 0.4.

Valuation Analysis

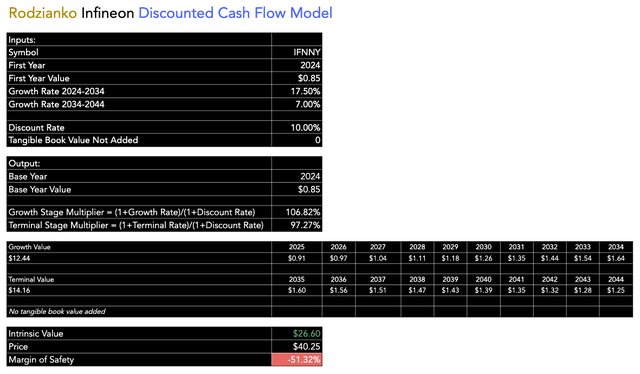

In my opinion, there are two major ways to assess the intrinsic values of companies seriously. The first is discounted cash flow analysis, which I prefer because it takes into account forecasts for what I consider “true earnings”, free cash flow. The second is discounted earnings analysis, which makes more sense in the case of Infineon because it has high capex related to its business model (manufacturing semiconductors), which causes periods of low free cash flow, distorting what would be considered intrinsic value if assessing the company at different parts of its capex cycles. For the purposes of exposition, I have performed both a discounted cash flow and a discounted earnings analysis to show readers the discrepancy. For both models, I have used a 10% discount rate, as I consider this the market standard annual return of the S&P 500 (SP500). For the DCF model, I have used a starting FCF value of $0.85, as this is the average over the past 5 annual reports. I have done this to try to ease out some of the imbalance in free cash flow across different years. I have forecasted a 17.5% FCF annual growth rate over the next 10 years, which is conservative considering the company has averaged 35% over the past 5 years. I have then used a lower 7% FCF annual growth rate for the 10 years following this. The result is a margin of safety of negative 51.32%:

Author’s Model

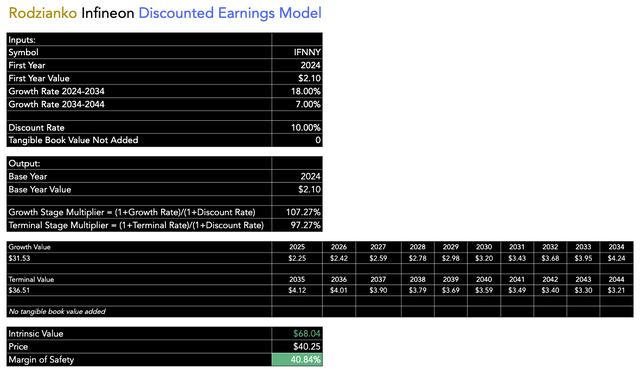

However, as I mentioned, this is not a good basis for valuing Infineon because the instability of free cash flow due to high capex distorts the value of the company in terms of future earning power. Therefore, consider Infineon instead based on my discounted earnings model. This forecasts 18% earnings growth annually for Infineon over the next 10 years and 7% annually for the 10 years after this. The result is a positive margin of safety of 40.84%:

Author’s Model

In some loose sense, both of these models cancel each other out, leading to what I deem a fair valuation for Infineon stock at this time. To further elucidate the reason for my sentiment here, consider the following table, which is a peer comparison of its major competitors based on forward P/E GAAP ratio and forward P/S ratio.

| Forward P/E GAAP Ratio | Forward P/S Ratio | |

| IFNNY | 25 | 3 |

| NXPI | 24.5 | 5.5 |

| STM | 19.5 | 2.5 |

| TXN | 38 | 11.5 |

| ON | 19 | 4.5 |

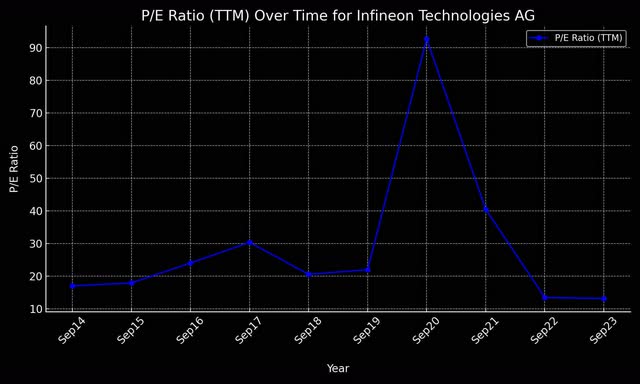

Infineon is quite richly valued based on its forward P/E GAAP ratio compared to peers, but I think this is reasonable because of how high its growth rates are at the moment. Additionally, I am taking into account its previous TTM P/E GAAP ratios compared to its present TTM P/E GAAP ratio when ascertaining that the stock is valued fairly at the time of this writing. Please note its current TTM P/E GAAP ratio is 14.5:

Author’s Graph

Risk Analysis

The semiconductor industry is highly cyclical, and the company has to be careful about how it allocates its capital, especially as it operates with a highly capital-intensive business model related to manufacturing. Therefore, it must time its periods of heavy capex carefully to also allow room for free cash flow to be generated in times of weakened demand. The company could face difficulties in remaining competitive if, during periods of low demand, it has to sacrifice crucial manufacturing plant investments because it forecasts its operating cash flow will be lower in future years. This capital intensity presents significant challenges unless the company has a well-established and unique competitive moat. Infineon faces several significant competitors, which limits its ability to claim a unique infrastructure advantage. The one semiconductor company that has developed such a moat would be TSMC (TSM), although it doesn’t compete directly with Infineon.

Infineon must also make sure it stays technologically relevant. Even if it is unlikely for it to develop a moat as significant as that of TSMC, it needs to at least make sure that it retains top talent and allocates its capital to infrastructure build-outs strategically. A failure in efficiency at its new manufacturing modules in Malaysia, Indonesia, and Germany could result in a decreased return on capital employed, reducing the total profitability of the company and, in turn, reducing investor sentiment.

Key Elements

Infineon is expanding its manufacturing infrastructure, including three new modules in Malaysia, Germany, and Indonesia. It has also recently acquired GaN Systems and entered a multi-year supply deal with Resonac, which may contribute to capex for integration and support purposes. This demonstrates the high capital intensity associated with its business model.

Infineon has the highest growth rates amongst its five major competitors right now. However, it has low free cash flow generation relatively, but its stronger balance sheet provides some relief to this.

Infineon is significantly overvalued based on my DCF model, but significantly undervalued based on my DE model. This cancels out to what I deem a relatively fair valuation at this time, which is further supported in my valuation peer analysis and assessment of Infineon’s historical TTM P/E GAAP ratios.

As the semiconductor industry is highly cyclical, Infineon needs to be careful in how it allocates its capital to preserve free cash flow during times of weakened demand. It is managing high capex, cyclical demand, and high levels of infrastructure-dependent innovation industry-wide. This contributes to a difficult environment for Infineon to remain competitive over the long term.

Conclusion

I consider Infineon one of the best semiconductor stocks to own in the world right now, primarily a result of what I consider a fair valuation. It has also demonstrated the highest fundamental growth over the last 5 years of its major competitors, strengthening my sentiment that the stock is positioned to deliver significant alpha both against the S&P 500 and Infineon’s area of the semiconductor industry.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here