Casgevy’s Rollout: A Genetic Leap or Stumble?

I last visited CRISPR Therapeutics (NASDAQ:CRSP) in January. Recall that CRISPR’s Casgevy is a gene therapy product targeting transfusion-dependent beta-thalassemia [TDT] and sickle cell disease [SCD]. Casgevy was approved in the U.S. in December 2023. It provides SCD patients with a “potentially curative” therapeutic. The company, however, faces competition from another gene therapy product, Lyfgenia, that was approved the same day as Casgevy and is marketed by bluebird bio (BLUE). Despite these important scientific advancements, my January analysis expressed concern regarding the “operational hurdles, competitive pressures, overvaluation, and uncertain long-term prospects” that burden CRISPR Therapeutics. Subsequently, my recommendation was “sell,” and CRSP is down 13% since.

The initial commercial rollout of gene therapies like Casgevy and Lyfgenia is unlike that of small-molecule drugs. The companies must first establish “authorized treatment centers.” In their Q1 report, CRISPR provided some insights into Casgevy’s marketization. “More than 25 authorized treatment centers” have been established “globally,” setting the stage for gene therapy utilization. “Multiple patients have already had cells collected,” indicating their intention to undergo CRISPR’s $2.2 million treatment.

In assessing the perceptions surrounding potentially curative gene therapies for conditions like SCD, they are most certainly mixed and nuanced. For example, the long-term benefits and risks of gene therapy remain a major unknown in the early innings (Cleveland Clinic). With that being said, despite some recent advancements in sickle cell disease, the lifespan of SCD patients remains limited (ASH). In general, the treatment recommendations favor gene therapy for adult patients who are experiencing significant complications from the disease (ASH), despite standard therapies like hydroxyurea. Currently, it does not appear that gene therapy will be widely used in children.

Q1 Earnings

Taking a closer look at their Q1 earnings, CRISPR’s $504K revenue missed by $26 million. I don’t see the miss as relevant, as rolling out gene therapy requires time and strategy. Revenue estimates for Q2 are $14.24 million. This is a more reasonable estimate, as we should have some patients initiating treatment. CRISPR is making progress in its efforts to reduce expenses. R&D expenses, for example, dropped from $99.9 million in Q1 ’23 to $76.17 million in Q1 ’24. Notably, CRISPR shares Casgevy-related costs with its partner, Vertex Pharmaceutics (VRTX). In Q1, CRISPR reported $47 million in collaboration expenses. This was slightly higher than the same period last year. General and administrative expenses were slightly lower, coming in at $17.95 million. When excluding a one-time $100 million milestone payment recorded in Q1 ’23, CRISPR’s net loss was reasonably improved in Q1 ’24, at $116.59 million. Common shares outstanding rose from ~78 million to ~81 million, representing only minor dilution.

Financial Health

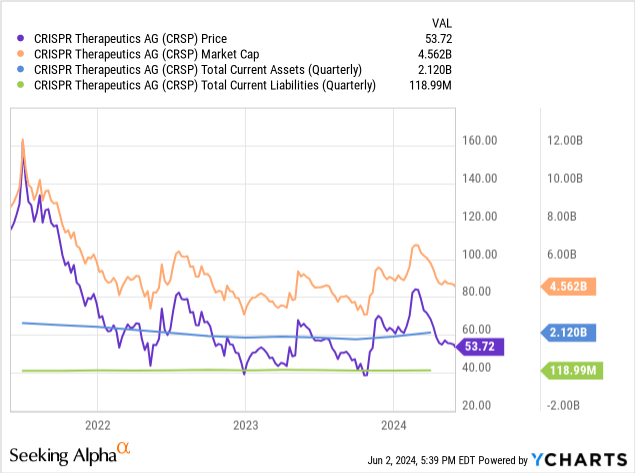

As of March 31, CRISPR’s cash and cash equivalents totaled $707.4 million. Marketable securities were $1.4 billion. Total current assets equal $2.119 billion, while total current liabilities were just $118.99 million. As such, CRISPR appears well-funded to handle the significant short-term costs associated with the complex rollout of Casgevy. CRISPR does not appear to have any significant debts on its balance sheet.

As CRISPR is not yet profitable, I will estimate a cash runway based on historical data. I will utilize their net loss from Q1 ($116.59 million) to represent cash burn, as I believe this is the most representative figure. When we divide their most liquid assets (cash and marketable securities) by their quarterly cash burn, it comes out to ~4.5 years of cash runway. There are some limitations to my estimate, especially as it is historical. For instance, CRISPR figures to have an increase in revenue as Casgevy infusions commence.

Risk/Reward Analysis and Investment Recommendation

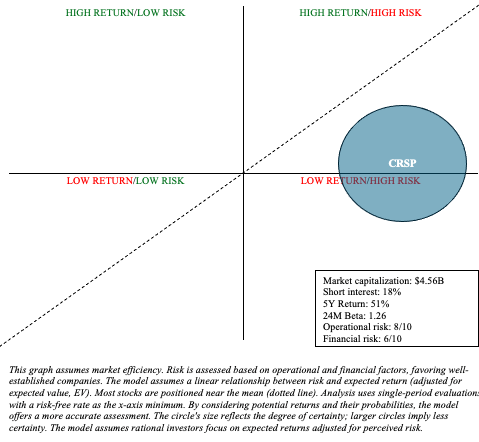

CRSP is fraught with (long-term) operational and financial uncertainty when it comes to risk and reward assessment. I represented the high level of uncertainty by adjusting the size of CRSP’s circle within my risk/reward quadrant, as shown below.

Author’s visual representation

The treatment landscape for SCD and TDT is complex and evolving. The success of potentially curative treatments like Casgevy largely hinges on long-term outcomes and patient perception. Moreover, other gene therapies, like Lyfgenia, are direct competitors to CRISPR. I continue to believe that the market for Casgevy, at least in the early years, will be markedly limited and is more likely to surprise to the downside. With that being said, CRISPR’s market capitalization, near $4.5 billion, appears to account for many of the risks discussed above. The initial excitement that drove CRISPR shares to more than $80 in February has faded due to the realities of commercializing a complex, new, uncertain, and costly treatment, amidst a weaker biotech sector sentiment. Overall, I am willing to upgrade my recommendation from “sell” to “hold” based on recent valuation adjustment and the company’s prudent management of operating expenses, which has extended their cash runway until there is more certainty about their market prospects. However, prospective and current investors need to be aware of the speculative nature of investments like CRISPR. This may be a suitable choice for a barbell portfolio. That is, one that allocates the vast majority of cash to lower-risk assets like Treasuries and broad market ETFs, with the remaining portion dedicated to potentially alpha-generating investments.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here