Not just housing, but also other core services. However, durable goods inflation is back to normal.

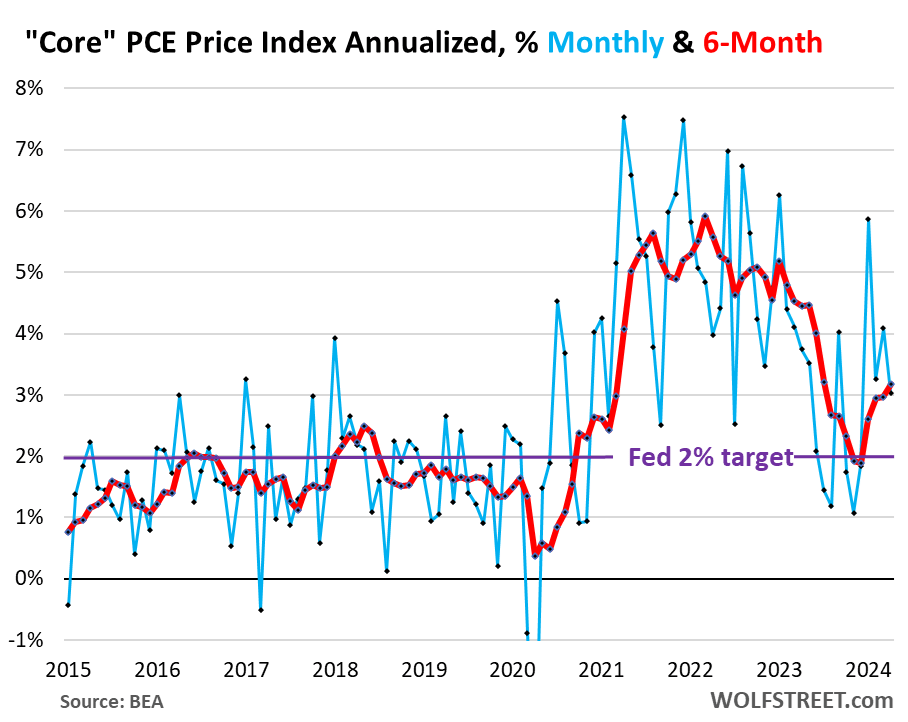

The Fed’s favored “core” PCE price index, which excludes the volatile components of food and energy, jumped by 3.0% annualized in April from March (not annualized, 0.249%), well above the Fed’s target of 2%, according to the Bureau of Economic Analysis today. But it was a smaller increase than in the prior three months, though far hotter than in late 2023 (blue in the chart).

The six-month annualized core PCE price index, which irons out most of the erratic monthly squiggles, and which Powell cites a lot, accelerated to 3.2%, the worst increase since July last year (red).

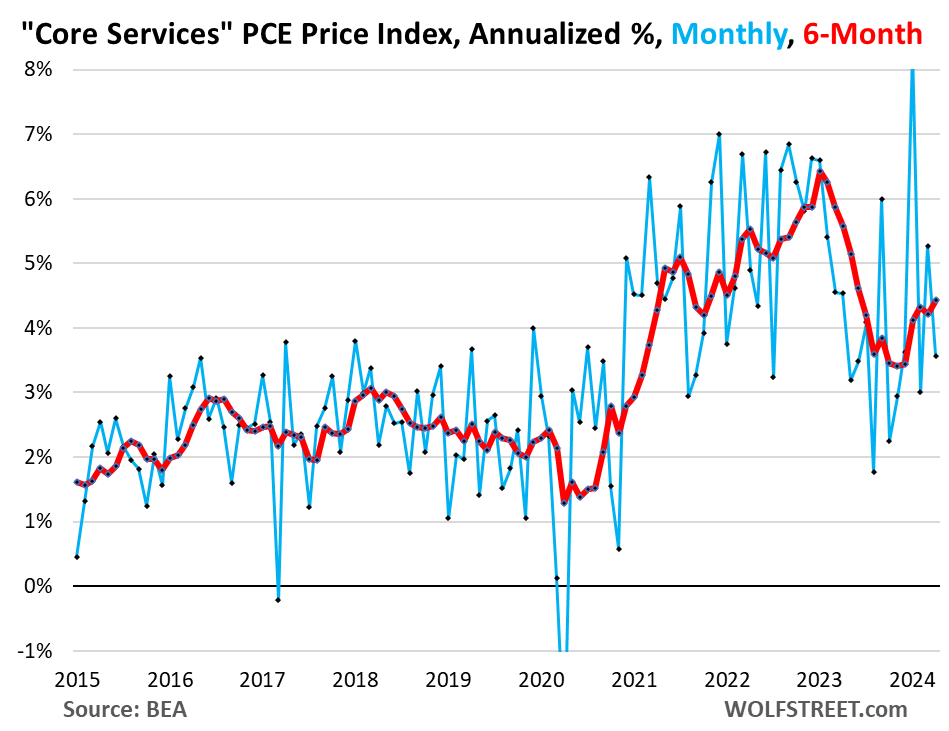

“Core Services” PCE price index, which excludes energy services, rose by 3.6% annualized in April from March (blue in the chart below).

The six-month core services PCE index jumped by 4.4% annualized, the worst increase since June last year.

Core services is where inflation has gotten entrenched, and it’s where the majority of consumer spending goes. It includes housing, healthcare, insurance, transportation services, communication services, entertainment, etc. Fed speakers have been pointing at core services incessantly.

In the month-to-month squiggles (blue), you can see how core services inflation had cooled from the peak in late 2022 (in the +7.0% range) to August 2023 (+1.8%), which had been the low point. But since then, it has re-accelerated in a disconcerting manner.

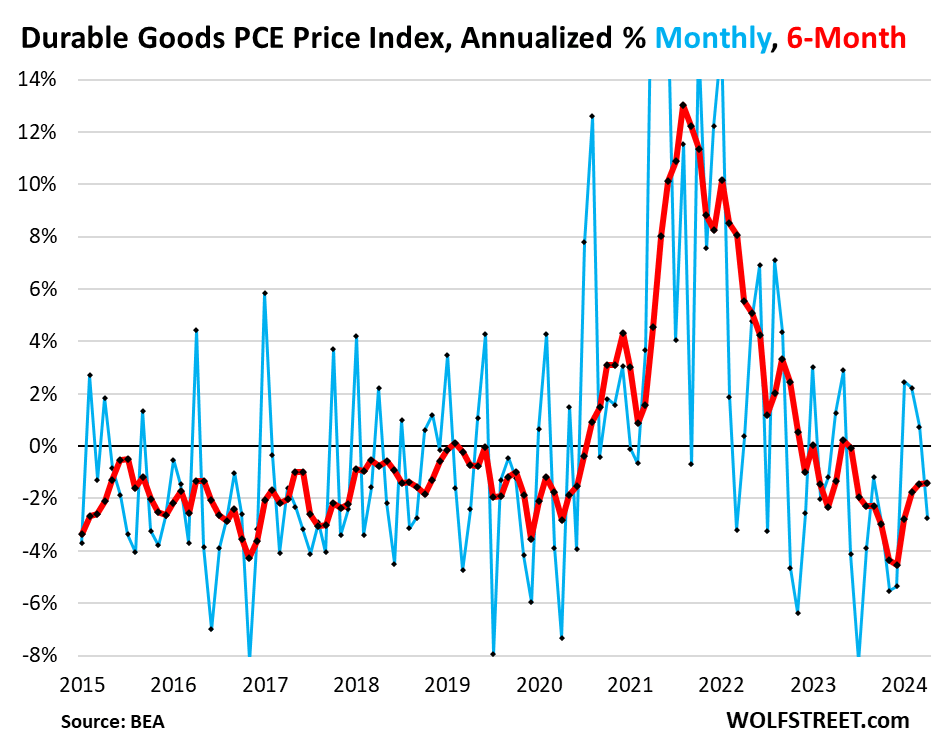

Durable goods inflation has vanished. The PCE price index for durable goods fell by 2.8% annualized in April from March (blue).

The six-month index fell by 1.4%, roughly the same as in the prior month (red). It tends to run in the slightly negative range during normal times amid manufacturing efficiencies and globalization. Durable goods include motor vehicles, appliances, electronics, furniture, etc.

So durable goods inflation is back to normal and in line with the Fed’s 2% target. The inflation problem is in services, as we’ve seen above.

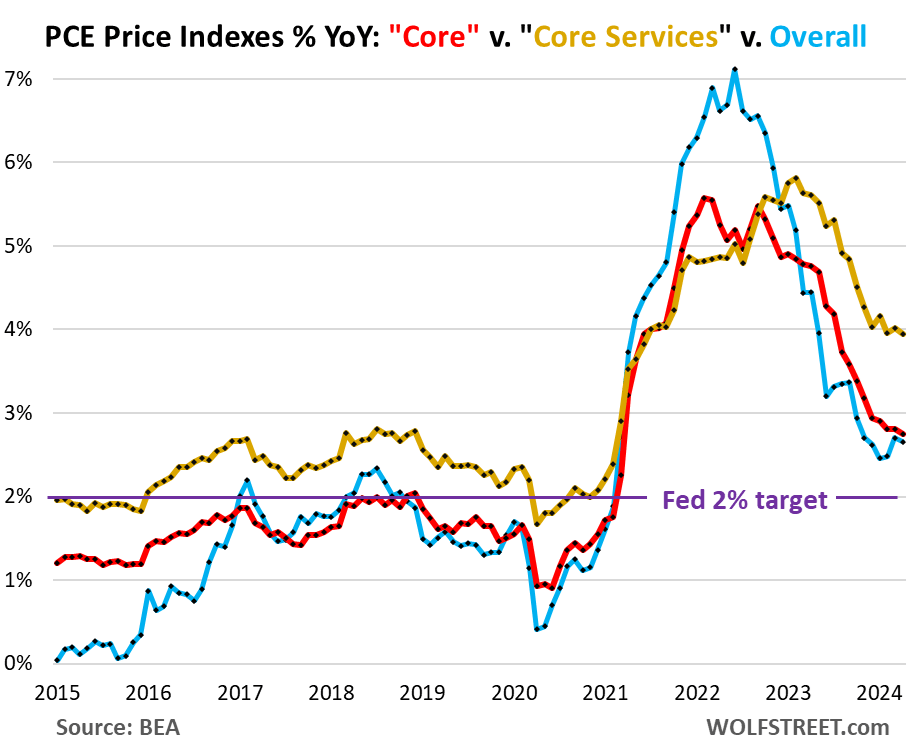

Year-over-year…

The overall PCE price index, which includes food and energy, rose by 2.7% in April from a year ago, roughly the same increase as in March (blue in the chart below).

The “core” PCE price index rose by 2.8% in April from a year ago, roughly the same increase as in the prior two months (red). The Fed’s target for this metric is 2%.

The “core services” PCE price index rose by 3.94% in April from a year ago; it barely changed over the past five months. In December, it had risen by 4.03%. As we’ve seen above, the six-month core services index has risen by over 4.2% over the past three months

Core services inflation in detail.

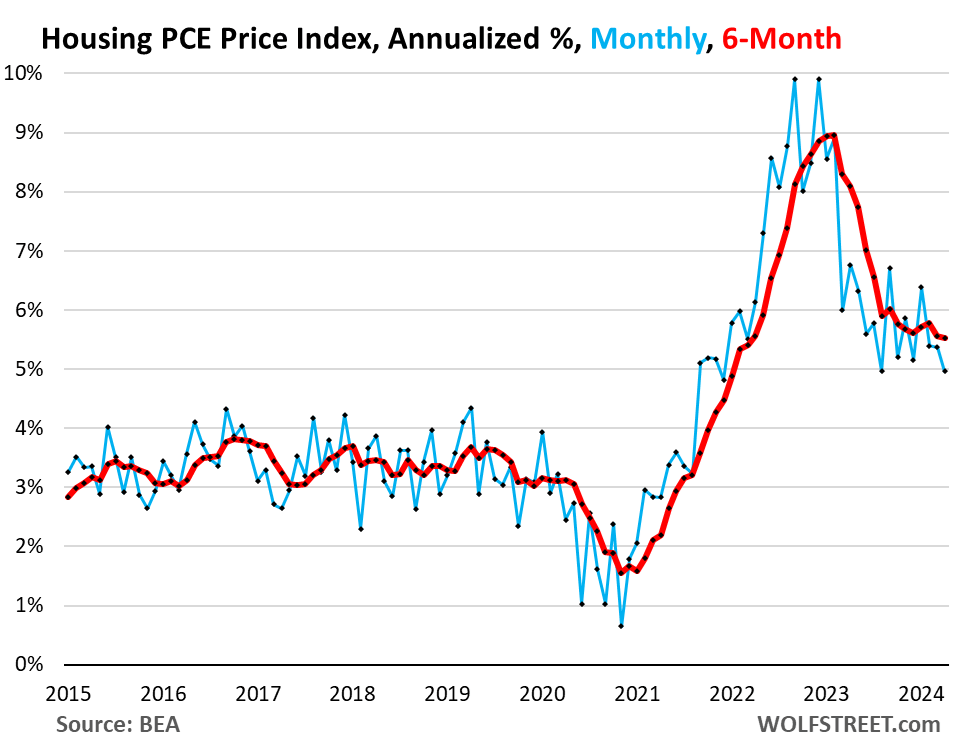

Housing PCE price index jumped by 5.0% annualized in April from March, a deceleration from prior months, but above where it had already been in August.

The six-month index jumped by 5.5% annualized, roughly the same as in the prior month. It really hasn’t significantly changed since November and remains sky-high.

The housing index includes factors for rent in tenant-occupied dwellings, imputed rent for owner-occupied housing, group housing, and rental value of farm dwellings.

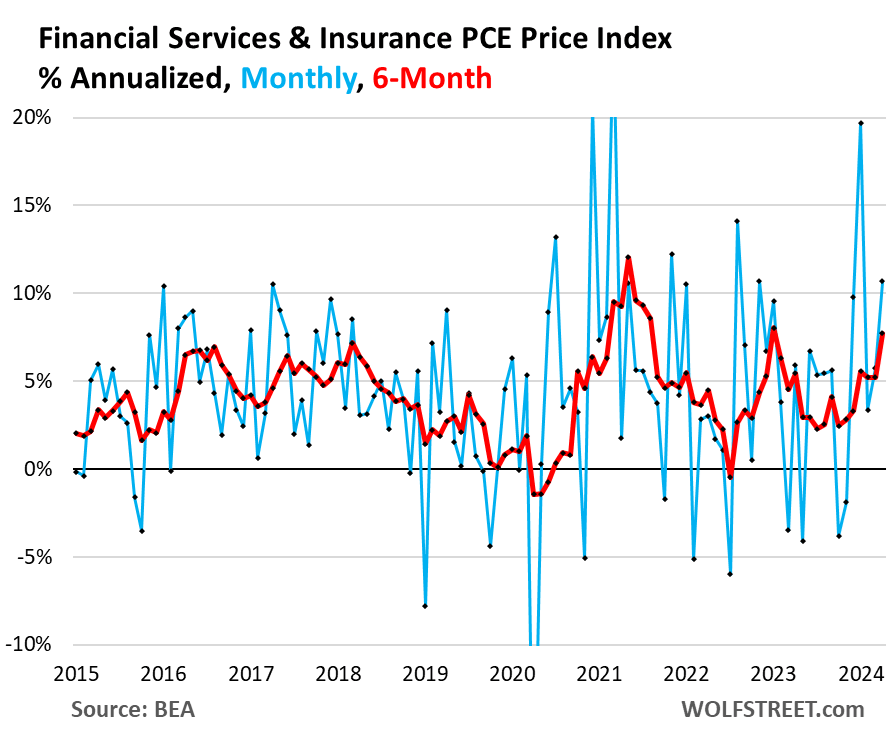

Financial services & insurance:

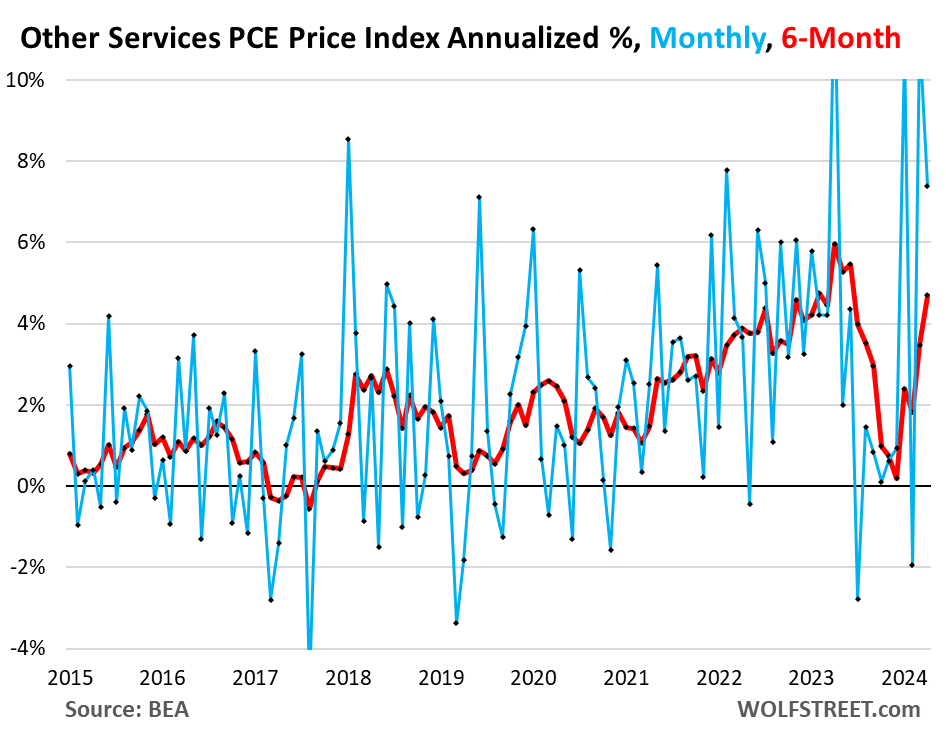

Other core services PCE price index (Broadband, cellphone, other communications; delivery; household maintenance and repair; moving and storage; education and training; legal, accounting, and tax services; dues; funeral and burial services; personal care and clothing services; social services such as homes for the elderly and rehab services, etc.):

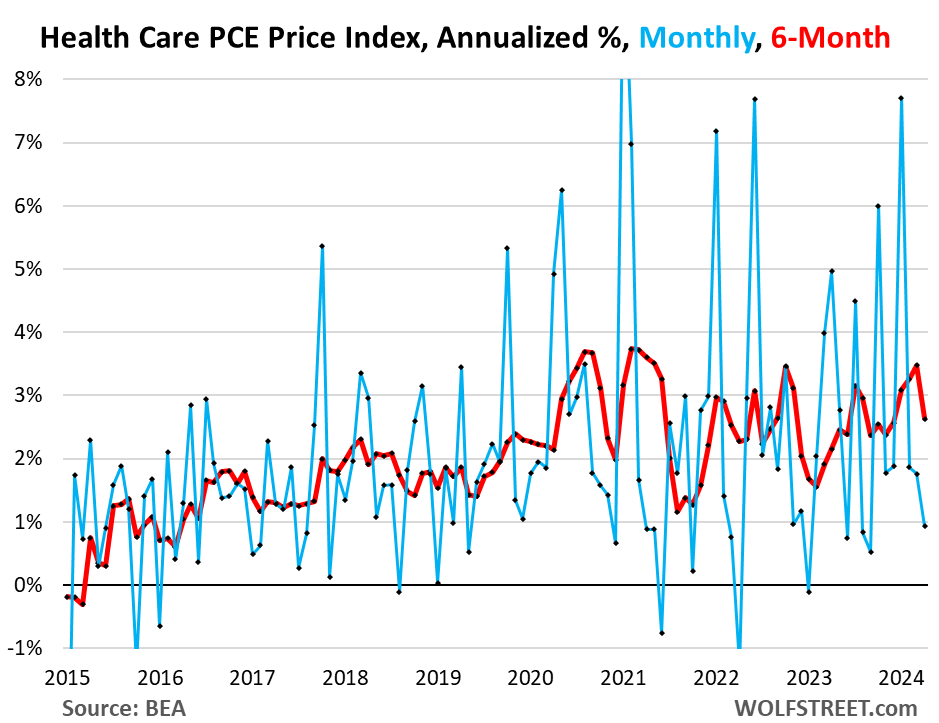

Healthcare PCE Price Index:

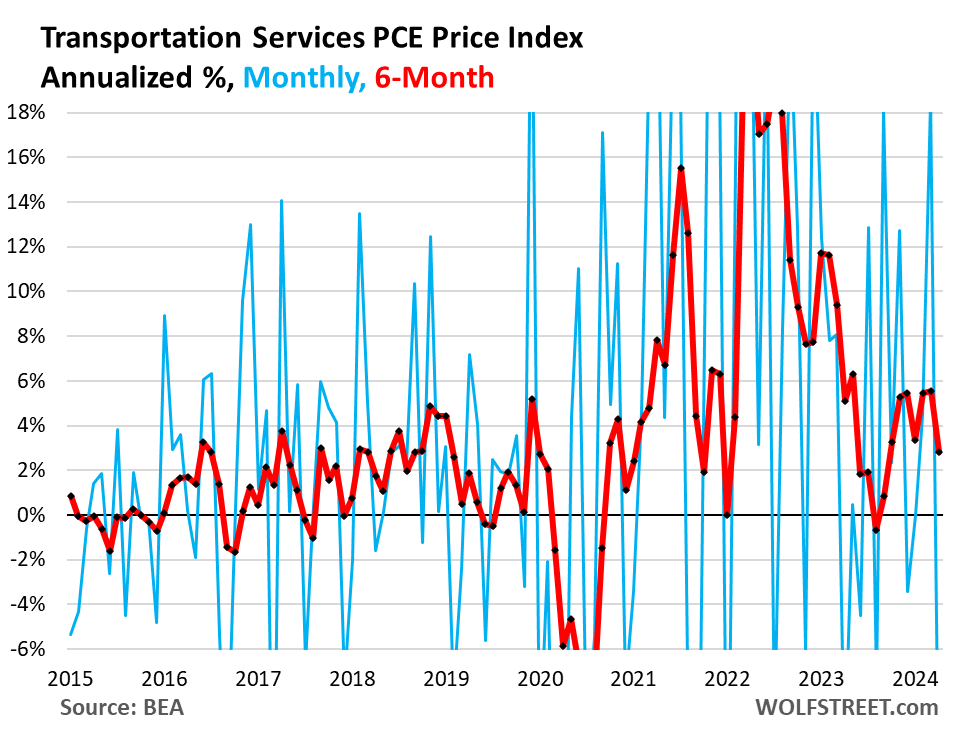

Transportation services PCE price index (motor-vehicle maintenance and repair, car rentals, parking fees, tolls, airline fares, etc.). A bit crazy-volatile month-to-month, eh?

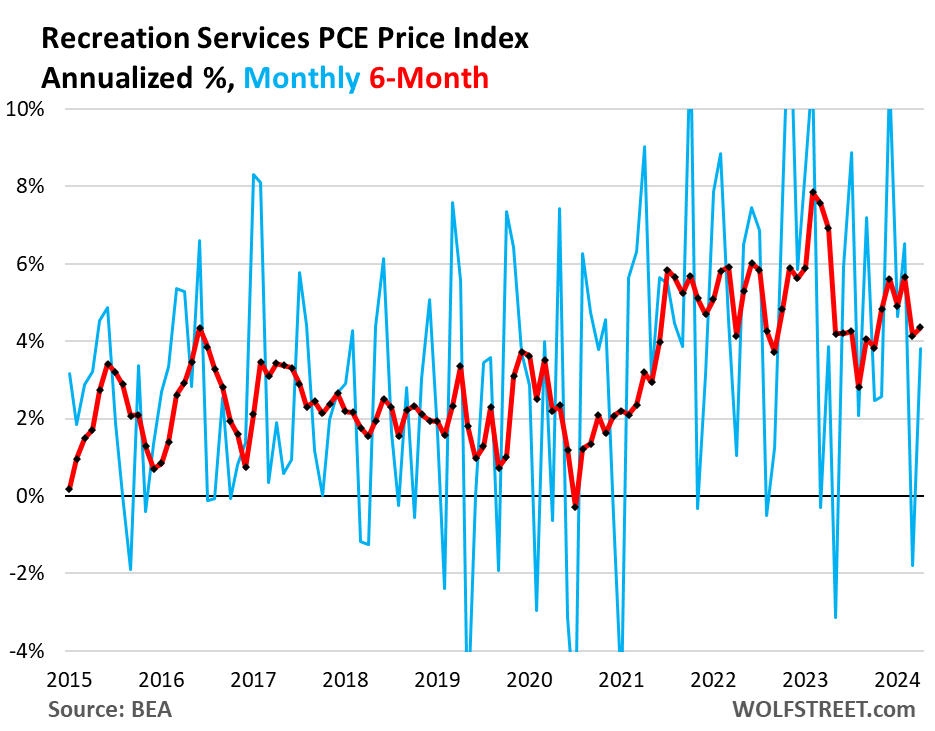

Recreation services PCE price index (cable, satellite TV & radio, streaming, concerts, sports, movies, gambling, vet services, package tours, maintenance and repair of recreational vehicles, etc.):

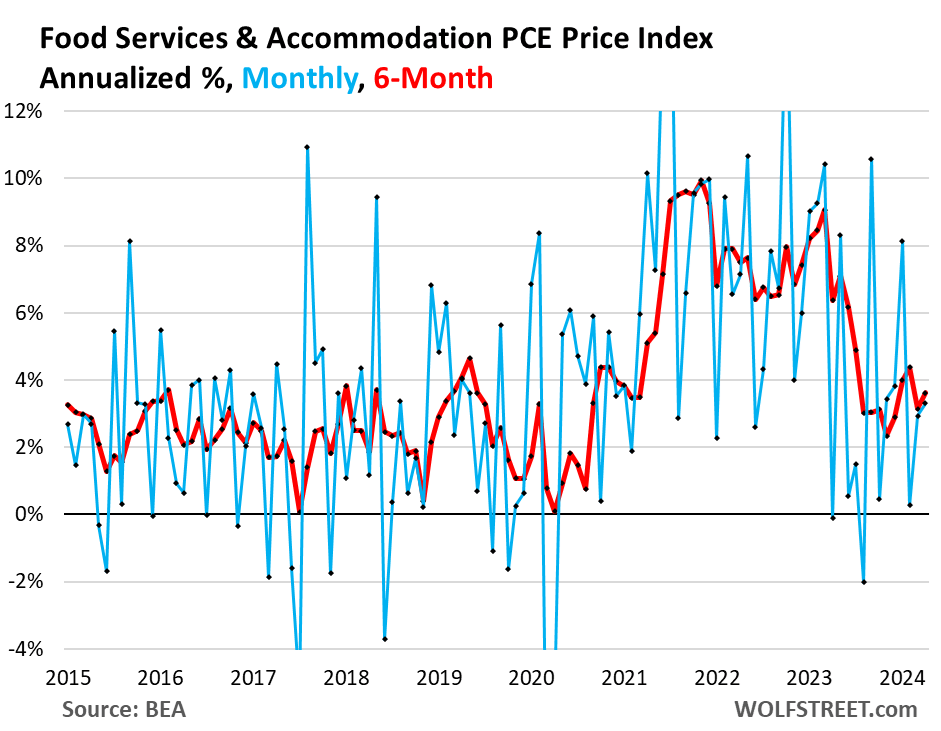

Food services & accommodation PCE price index (restaurants, hotels, motels, vacation rentals, cafeterias, cafés, delis, etc.):

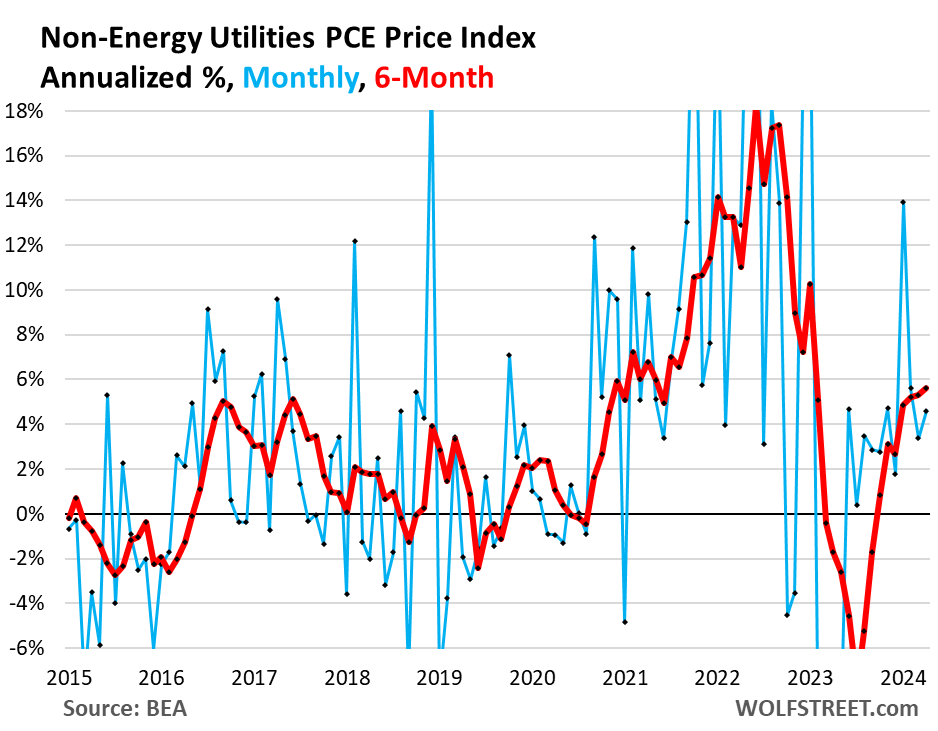

Non-energy utilities PCE price index (sewer, water supply and sanitation, trash collection):

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here