CVS Health Corporation (NYSE:CVS) is well-known for its CVS pharmacy retail stores. It also has CVS Caremark, which is a pharmacy benefits manager, Oak Street Health, which is a primary care company, and Aetna, which is one of the largest health insurance providers. This stock plunged after the company reported Q1 2024 results and it made me want to take a fresh look at this stock because the valuation has changed so much in such a short time.

The situation with CVS reminds me of when Target (TGT) shares plunged late last year to around $100 after reporting results that disappointed investors. Target shares ended up surging and almost doubled in value when they went over $180 per share in April (although it is off that level now). It’s clear that investors tend to overdo enthusiasm to the upside when things are going well, and it is also clear that stocks can go below fair value when investors are overly negative. With that in mind, let’s take a closer look at what appears to be an ideal buying opportunity in CVS:

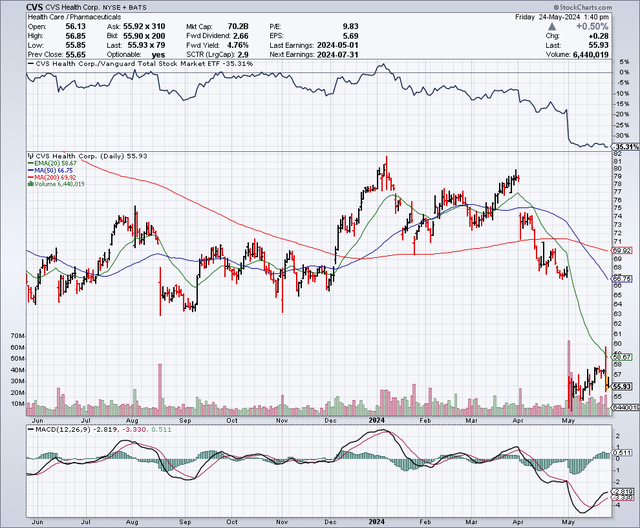

The Chart

As the chart below shows, this stock plunged after earnings were reported in early May 2024. This stock was even trading at around $80 per share in April and after the earnings plunge, it is down to about $55 per share. The 50-day moving average is $67.14 and the 200-day moving average is $70. This stock is now deeply oversold and I believe it is due for a rebound for both technical and fundamental reasons.

Stockchart.com

For additional perspective from a longer-term viewpoint, let’s look at the chart below which goes back to around 2012. As shown below, this stock topped out twice at just over $110 per share. This occurred in 2015 and in 2022. So, the next time this stock goes over $110 per share, it might be time to sell. The stock is trading for about half that level now, and it appears very undervalued.

What is notable to me on this chart is the 200-week simple moving average, which is represented by the brown trendline. Since 2012, CVS shares never went below this trendline, until now. It did basically touch this trendline in 2020 and came close to it a couple of other times. Over all these years, and each time, it was a buying opportunity. With the stock now solidly below this trendline, you could either view this as a “this time it’s different” view and assume the company is “broken”, or you could see this as a broken stock that has potentially given us an exceptional buying opportunity, which has not occurred in over a decade. I don’t think the CVS business model is broken or so different now than it was when it traded at much higher levels. This is one reason why I view this plunge as excessive and an ideal buying opportunity.

Finviz.com

Earnings Estimates And The Balance Sheet

Analysts expect CVS to earn $6.99 per share in 2024, on revenues of nearly $369 billion. For 2025, earnings are expected to rise to $8.03 per share, with revenues coming in at about $388 billion. For 2026, analysts expect a significant increase in both earnings and revenues with earnings estimates at $8.83 per share and revenues reaching nearly $411 billion. These estimates imply a price to earnings ratio of just 8 times the estimates for 2024, and around 6.5 times estimates for 2026. This is very undervalued when you consider the S&P 500 Index (SPY) is trading for about 22 times earnings. It is also very undervalued when compared to other major retailers and health insurance companies.

As for the balance sheet, CVS has nearly $82 billion in debt and just over $13 billion in cash. I prefer to invest in companies with very strong balance sheets, but when I look at financial strength, it is also important to consider whether or not the business model is cyclical or not. Since CVS is not in the type of business that sees big ups and downs (like a car manufacturer, or home builder might see), I am willing to be more lenient when it comes to balance sheet debt. I also make sure the level of revenues is commensurate with the level of debt, and again, with the level of revenues this company has, I am comfortable with the balance sheet. Credit rating agency, “AM Best” rates the Aetna division as excellent and since that is one of the most important parts of this business, it is reassuring as well.

Speaking of the balance sheet, on May 23, 2024, a report came out suggesting that CVS was looking for a private equity investor to help expand its Oak Street Health primary care division. CVS acquired Oak Street Health in 2023, for about $10.6 billion, which added to the debt load at CVS. Shortly after this report came out, I noticed the stock took another leg down on what was already a very bad day for the stock market in general. But, even though the reaction from the market seems to be negative for now, I am glad to see that CVS is not planning to add more debt in order to expand this division.

Valuation

Walgreens Boots Alliance (WBA) has a similarly low price to earnings valuation when compared to CVS. It is also trading near 52-week lows. Investors are clearly down on the retail pharmacy sector, due to pricing pressures, rising labor costs and tough comparisons from when Covid was bringing just about everyone in for regular vaccinations. I think as we get further past Covid, the comps will be much smoother and easier to beat. This could help to improve sentiment for the valuation of all retail pharmacy stocks.

As for the valuation of CVS when compared to other major health insurance companies, this stock looks deeply undervalued as it owns Aetna, one of the largest health insurance companies in the industry. For example, UnitedHealth Group (UNH) which has also seen its stock recently come under pressure, is trading for about 19 times earnings. Also, this stock only yields about 1.45%. CVS offers a yield of about 4.63% (just about triple the yield of UnitedHealth Group), and a price to earnings ratio that is less than half of the price to earnings ratio for UnitedHealth Group. Based on this, CVS shares look deeply undervalued and have a lot of room for multiple expansion.

With retail pharmacy stocks out of favor and trading at or near 52-week lows, that is definitely weighing on CVS shares, but this sector might be due for a rebound. When looking at the valuation of the health insurance sector, it seems that CVS has been punished too harshly by the market since it owns Aetna and should at least get a blended valuation that is maybe not as high as UnitedHealth Group, but not almost as low as other retail pharmacy stocks.

CVS Has A Unique Ecosystem Which Provides Growth Potential

One major growth driver that I don’t believe the market is giving CVS enough credit for is the unique healthcare ecosystem which includes the Caremark pharmacy benefits manager, the over 9,000 retail pharmacy stores, the Aetna insurance division and Oak Street Health primary care clinics which it plans to expand. In totality, this collection of healthcare businesses gives CVS unique abilities to be involved in every aspect of a patient’s healthcare, from diagnosis, to providing medications to processing medical claims and providing insurance for millions of Americans. The Oak Street Health primary care clinics are poised to expand in the future and potentially expand profit margins.

This ecosystem of healthcare companies helps CVS to lower expenses, increase efficiencies and possibly do so while expanding profits margins for the entire range of healthcare companies it owns. Most importantly, having this full range of healthcare businesses could improve the healthcare experience for patients and drive growth because CVS is increasingly a unique “one stop shop” for healthcare. In this investor presentation, CVS has guided for long term growth rates of 6% and as shown below, there are a number of growth drivers that the company expects will benefit future results including improved margins with Medicare Advantage starting in 2025:

CVSHealth.com

Medicare Advantage Is A Headwind In 2024, But A Growth Driver In 2025 And Beyond

The Medicare Advantage market has caused headwinds in terms of reduced profits for health insurance companies (like Aetna) this year in large part because more seniors are getting healthcare issues treated now, and had not sought care as much during the pandemic years. However, even though this has impacted the share price of CVS and the other big players in this space, this is likely to just be a speed bump for anyone with a longer term view. The increase in health care claims from this segment is expected to moderate after this year, and the Medicare Advantage market is expected to provide stronger profit margins in 2025, and beyond. Some analysts are seeing an opportunity in the recent selloff in health insurance stocks as a buying opportunity because there is strong long term growth potential. This is detailed in this Seeking Alpha article which states:

“We believe Managed Care is structurally well positioned to drive sustainably attractive long-term growth, margin expansion and multiple expansion beyond historical levels,” Baird analyst Michael Ha wrote.

The Dividend And Share Buybacks

In the first quarter of 2024, CVS completed a share buyback worth around $3 billion. This is a meaningful buyback, especially since CVS has a market capitalization of about $67 billion. Share buybacks can be an additional growth driver since a reduced share count can boost future earnings.

CVS pays a quarterly dividend of $0.665 per share. This provides a yield of about 4.63%. Ten years ago, the quarterly dividend was just around $0.275. This shows the dividend has more than doubled in the past ten years. On an annual basis, the dividend from CVS totals $2.66 per share. This is way below the earnings estimates, and therefore it suggests a payout ratio of just around 31%. This means there is plenty of room for future dividend increases.

What I Like About CVS

As the saying goes “buy what you know”, and I know CVS since I shop at their retail stores and I have had various vaccinations at the pharmacy. I do order a lot of items from Amazon (AMZN), but there are many times when I just want or need to go to a CVS store.

I like the valuation of CVS with a yield that can compete with money market funds, which yield just around 5%. If I park my cash in a money market account, I will get just about the same yield, and money market yields are expected to plunge when the Federal Reserve likely lower rates in the future; but with CVS I get a generous yield that I can lock-in and potentially also get significant upside from future share price appreciation.

CVS is the “go to” place for many Americans whenever they need a vaccine of any kind. This helps to drive traffic into the store. There are new Covid variants and there are concerns about a spike in cases. A summer spike in Covid cases could increase demand for Covid and the flu shots, as well as RSV, in the Fall.

I also like that the healthcare business provides a steady and solid revenue stream, and that CVS has a history of profitability. As the population grows and as more people age and live longer lives, this could benefit CVS in the long-run. In addition, the health insurance business and pharmacy business is relatively recession-resistant and that is a positive to consider.

Potential Downside Risks

There’s always pressure on health insurance companies to lower rates and increase benefits, and pharmacies also have to deal with pricing pressures. Retail pharmacies are also seeing increased competition from the likes of Amazon and other companies. However, I think there is room for growth for online and retail store pharmacies and demand exists for both as well.

With this being an election year, there could be increased pressure and rhetoric on lowering drug costs and reducing the cost of health insurance. This could be another downside risk factor that weighs on this stock through the November election cycle.

In Summary

While the market currently seems to be focused on the negatives, I see many positive reasons to buy this major pullback in the stock. CVS shares are oversold and have not been trading with such a high dividend yield and such a low price to earnings multiple in many years. The company is guiding for 6% growth and this seems realistic as it can be driven by aging demographics and population growth. I expect that in the not too distant future, investors will realize this stock does not deserve to be trading for a single digit PE ratio. I also believe investors will want to buy this stock for the yield it provides when the Federal Reserve starts lowering rates, and this could push the stock higher. This company is a very important part of the healthcare system and it deserves more credit for having built an ecosystem that is not easy to replicate or available elsewhere.

Sentiment is clearly negative, but as we know, sentiment can change, sometimes even fairly quickly. There are signs that the economy is weakening, and that could mean investors will take a fresh look at more defensive industries like healthcare, and especially at stocks that can provide a high yield like CVS does. If a recession hits, interest rates will plunge and that makes high dividend stocks even more attractive.

I just recently bought a small position. My plan is to buy more shares over the next few weeks and months, and collect the dividend while waiting for a rebound in this stock.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Read the full article here