Vanguard Industrials Index Fund ETF Shares (NYSEARCA:VIS) is one of the top performers in the industrials sector, beating the S&P 500 in the last twelve months. Although the sector’s valuations are high, I believe valuations alone couldn’t hinder the uptrend unless it is supported by macro factors and the broader stock market volatility. Moreover, industrial companies continue to beat expectations with strong financial growth. In the first quarter, 84% of the industrial companies topped expectations while the market fundamentals and outlook hints at the continuation of the financial growth in the following quarters of 2024 and 2025. Overall, VIS appears to be one of the best options to capitalize on the potential gains in the industrials sector.

Broader Trends Support Industrials Uptrend

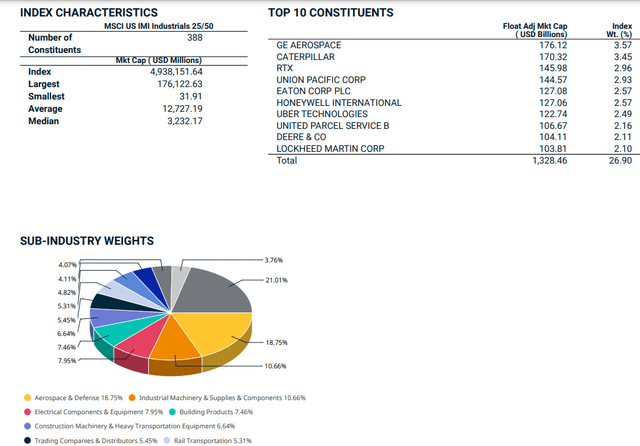

The MSCI US IMI Industrials 25/50 index (msci.com)

The industrials is one of the most diversified sectors, with more than a dozen industries. The MSCI US IMI Industrials 25/50 index, which is designed to offer coverage of small, mid and large cap industrial companies in the US equity universe, tracks the performance of 388 companies. The aerospace & defense industry represents the highest weight of 18% in its portfolio while industrial machinery, electrical equipment, construction products, and construction machinery industries ranked second, third and fourth in its portfolio based on their weight. There are a number of other key industries in the sector, such as air freight & logistics, trading & distributors companies and rail transportation.

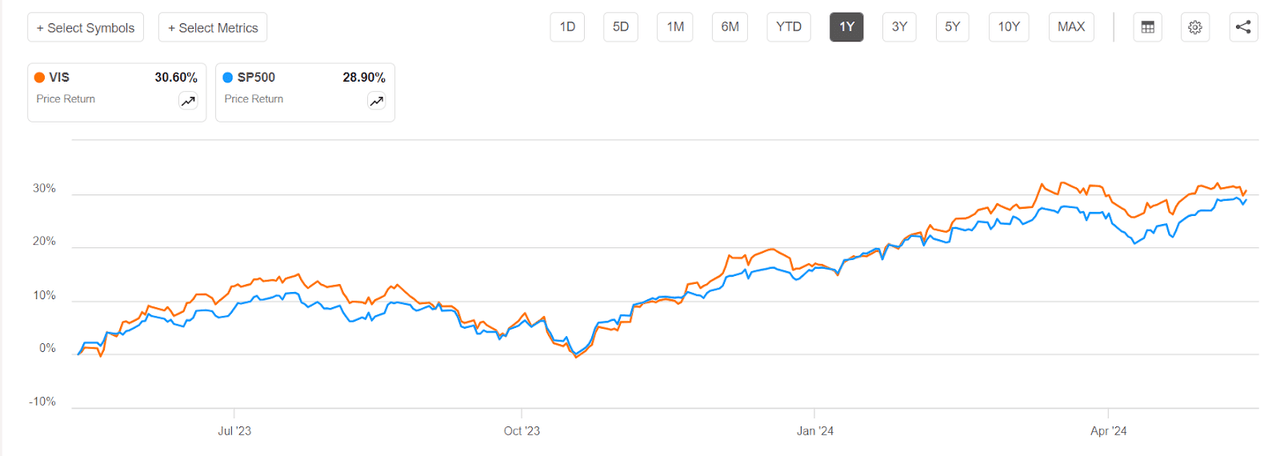

VIS Vs S&P 500 (Seeking Alpha)

The industrials sector is cyclical in nature due to its correlation with economic conditions. The sector generally performs well in robust economic growth conditions while recession brings challenges. The sector performed exceptionally in the past three years as economic growth remained robust despite volatility brought in by the Fed rate hikes, which is clearly reflected in the Vanguard Industrials Index Fund ETF Shares performance compared to the broader market index. Over the last twelve months, the industrials sector outperformed the broader stock market index because investors are getting bullish on the short and long term interest rate and economic outlook.

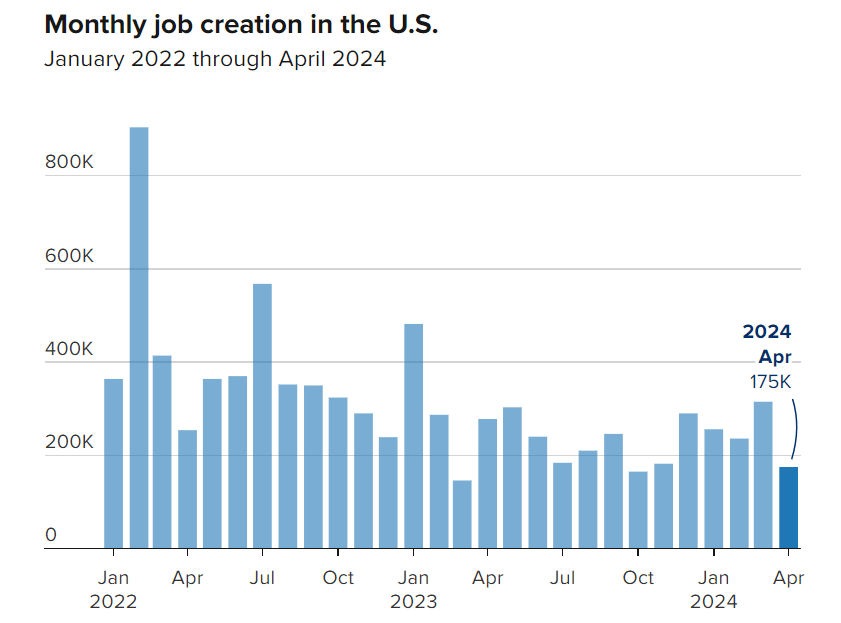

Monthly job data (CNBC)

The biggest reason for the bullishness is cooling inflation and slowing job market growth. Inflation in the US fell to around 3.4% last month from a high of 9% in June 2022 while the country added only 175K jobs compared to above 300K in previous months and 278K in the year ago period. As both indicators suggest that the Fed is close to achieving its objectives, hopes are high about the rate cuts to begin in the second half of 2024, which is likely to fuel growth and help materialize the pent-up demand.

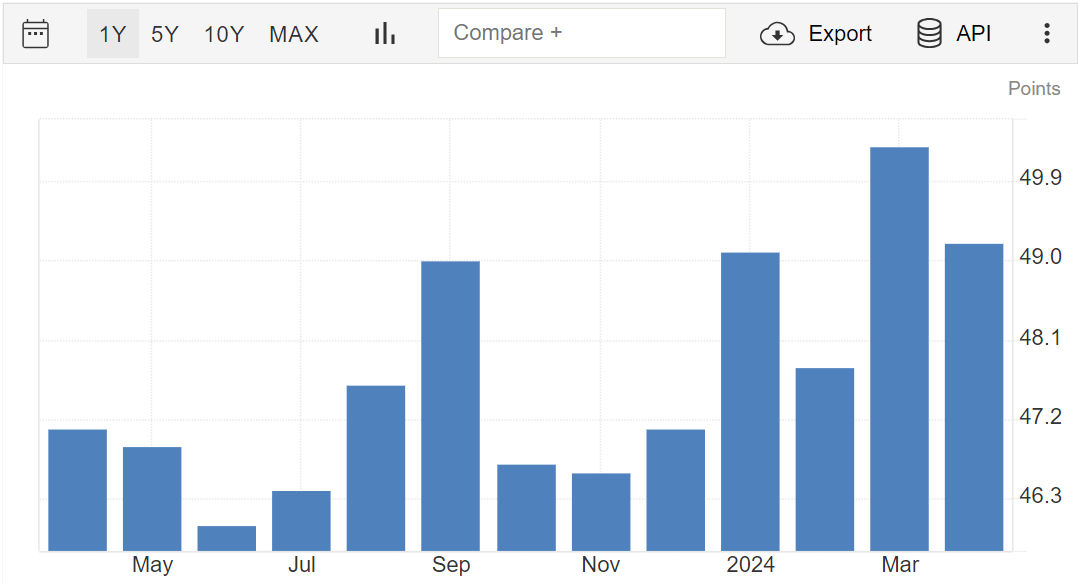

ISM Manufacturing PMI (tradingeconomics.com))

In fact, business activities in manufacturing, construction, building, and infrastructure industries have already improved in the past few months due to declining credit deterioration risk and economic stability. Although the ISM Manufacturing PMI is still in the contraction phase, it has improved significantly since the beginning of 2024 compared to the past year. The index is likely to come out of the contraction phase in the coming quarters because the US GDP is expected to increase by 3.5% in the second quarter with expectations for further acceleration after rate cuts later in 2024.

Why Vanguard Industrials Index Fund ETF Shares is a solid Pick

There are a number of reasons to consider Vanguard Industrials Index Fund ETF Shares, including its low expense ratio, strong share price momentum and solid liquidity. However, the most important reason is its portfolio diversification factor. VIS is one of the most diversified ETFs with a position in nearly 388 companies across dozens industries. Diversification lowers the risk factor attached with a single industry or stock investment. VIS tracks the performance of industrial companies in the MSCI USA Investable Market Index (IMI) 20/50 using a full replication technique.

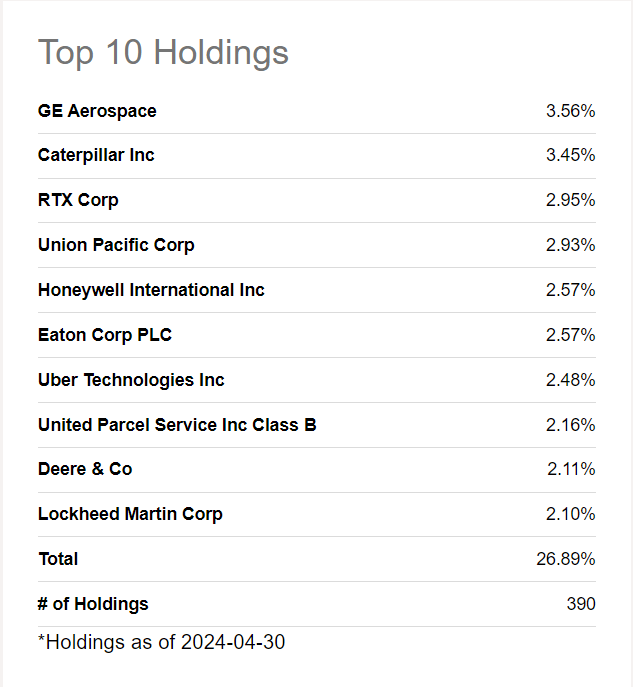

VIS portfolio top 10 holdings (Seeking Alpha)

Its top stock holdings include well-established large-caps from various industries, such as GE Aerospace (GE), Caterpillar (CAT)(CATR:CA), RTX Corporation (RTX)(RTX:CA), Union Pacific (UNP), Honeywell International (HON)(HON:CA), Eaton (ETN), Uber Technologies (UBER)(UBER:CA), Deere & Co (DE) and Lockheed Martin (LMT). All of these companies are currently trading around all-time highs because of their robust growth performance and solid outlook. For instance, GE’s share price rallied more than 100% in the last twelve months to an all-time high of $170, supported by its revenue and order growth. In the latest quarter, its revenue of $16.1 billion increased 11.0% year over year and total orders of $20.1 billion surged 14%. Wall Street expects GE to produce a whopping 44% earnings growth for the full year, with expectations for the extension of the growth trend in the following years. A significant growth in free cash flows also enables the company to invest in growth opportunities while returning cash to shareholders.

The construction machinery manufacturer Caterpillar, the second-largest holding in VIS portfolio, also recently hit an all-time high of $382 per share. Its shares are up 66% in the last twelve months, thanks to a double-digit growth. In the March quarter, its revenue of $853 million increased by 11% year over year while profit of $169 million grew 13% compared with the past year period. RTX, the third-largest stock holding in the VIS portfolio, is also currently trading around its all-time high. It is an aerospace & defense company with robust revenue and earnings growth momentum. The company generated 12% sales growth in the first quarter with a record backlog of $202 billion. Overall, the industrial growth trends are with an average annual earnings growth rate of 10.9%.

Quant Rating and Valuation

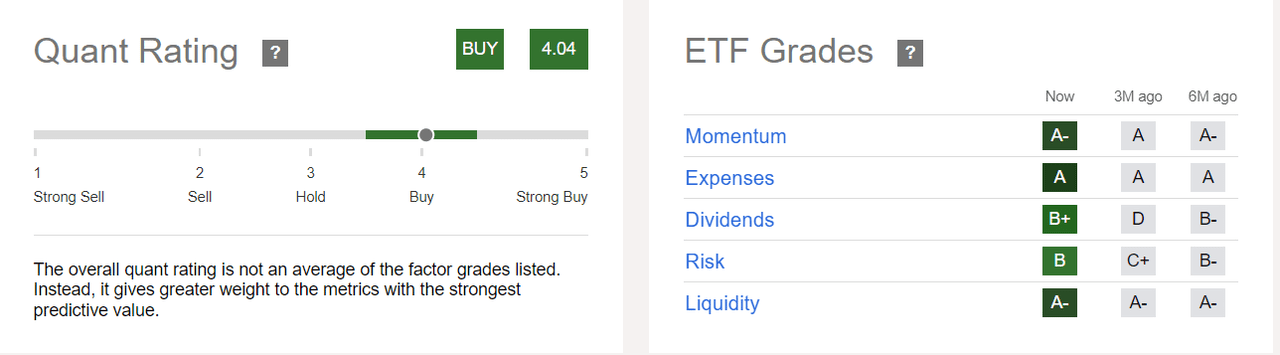

VIS quant rating (Seeking Alpha)

Quant analysis is one of the best ways to eliminate emotions because it focuses only on critical data. SA’s quant rating vindicates my stance about VIS. The ETF received a buy rating with a quant score of 4.04, supported by high grades on all five factors. A negative A score on momentum indicates that the ETF has a strong share upside momentum. Fundamental factors, such as earnings growth and improving market dynamic, also back the extension of the upside momentum. Its expense ratio of 0.10 is significantly low compared to the median of all ETFs of 0.48% while a positive B score on the dividend factors suggests that dividend growth is safe. The risk factor is low due to diversification while high trading volume and $5.51 billion in assets under management helped it earn a negative A score on liquidity.

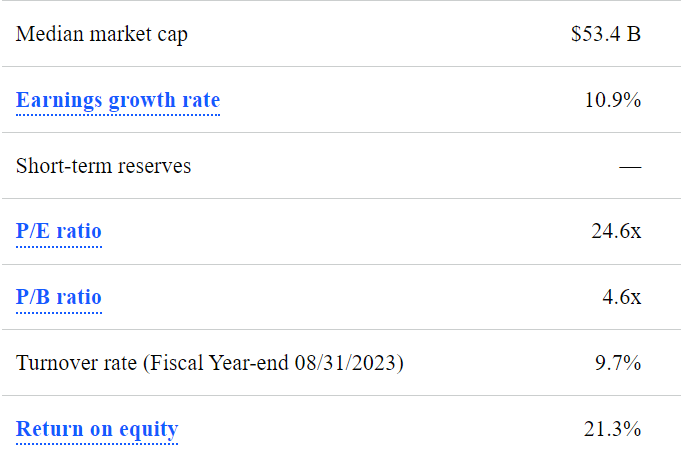

VIS portfolio key metrics (Seeking Alpha)

On the negative side, the ETF appears to be slightly overvalued trading around 24x earnings compared to its historical average of 18x to 20x and the S&P 500’s sector median of 21x. Its PE increased because a large number of its portfolio holdings experienced robust share price gains in the last twelve months. For instance, GE received an F grade on valuation because its shares are trading 44x earnings and 6x book value. Similarly, RTX is trading around 42x earnings while Uber is trading above 100x earnings.

Peer Analysis

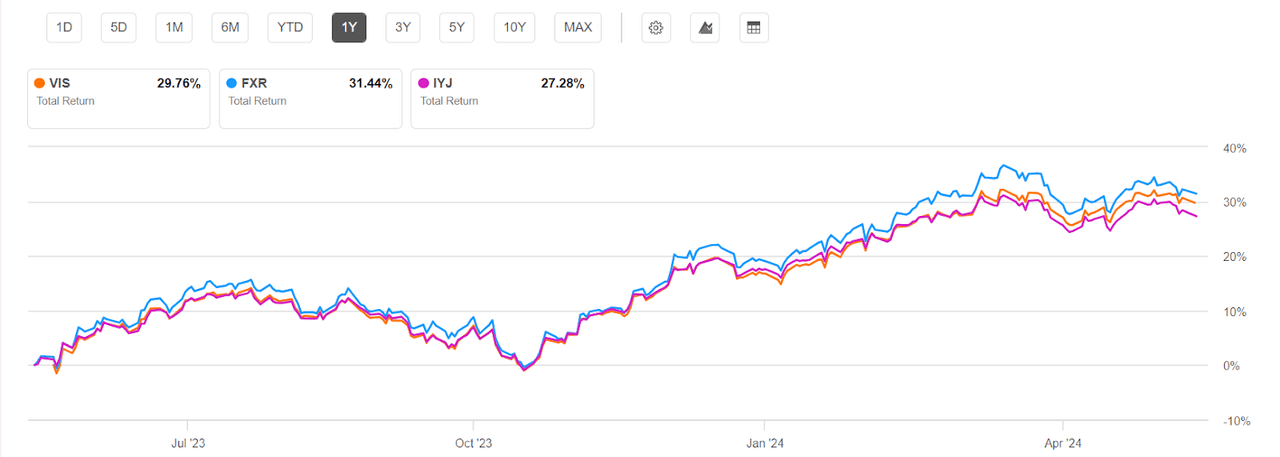

VIS and peers share price performance (Seeking Alpha)

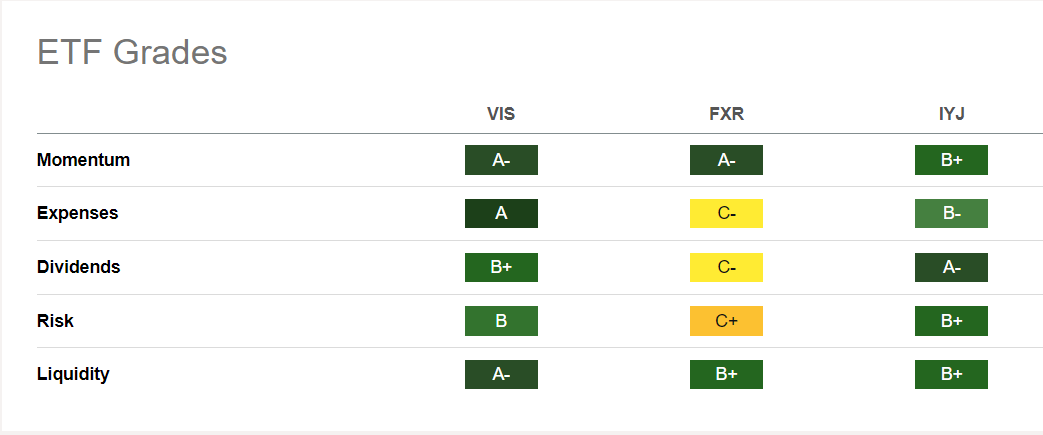

Vanguard Industrials Index Fund ETF Shares closest peers include First Trust Industrials/Producer Durables AlphaDEX® Fund ETF (FXR) and iShares U.S. Industrials ETF (IYJ). The solid total returns from all three ETFs in the past twelve months is a reflection of investor confidence in market fundamentals and corporate performance. However, I favour VIS over its peers due to various reasons, including its low expense ratio, high liquidity and high dividend yield.

Quants analysis of VIS and it peers (Seeking Alpha)

VIS also appears to be a better ETF to buy based on the Seeking Alpha quant rating. FXR has a higher expense ratio of 0.61% while its dividend yield is around 0.70%. Moreover, the risk factor is high due to its high standard deviation and volatility. IYJ appears to be a better ETF than FXR based on quant ratings. However, VIS has received higher grades on the share price momentum, expense and liquidity factors. Moreover, VIS has one of the most diversified portfolios compared to FXR’s 134 stock holdings and IYJ’s 191.

Risk Factors to Watch

Although industrial companies have a history of generating sustainable growth over the long term, the sector is exposed to numerous risk factors. The biggest risk factor could be the economic health of the United States. In a scenario of higher for longer interest rates, there is a high risk of an economic slowdown, which could hinder the growth outlook of industrial companies operating in various sectors, such as construction, machinery, infrastructure and building products. As its beta stands around 1, its performance is also closely correlated to the broader stock market trends. In the case of bearish conditions, it may follow the stock market trends.

In Conclusion

Vanguard Industrials Index Fund ETF Shares appear to be a solid option in a post-rate cut scenario, given its cyclical nature and pent-up demand. Moreover, history shows that buying stocks or ETFs ahead of events can produce healthy gains for investors. Although shares of Industrials’ stocks have already surged significantly on optimism about economic and interest rate stability, there is still more upside in the short and long-term given a solid earnings growth outlook and improving macro fundamentals.

Read the full article here